By Karen Langley

The Dow Jones Industrial Average's coming farewell to Exxon

Mobil Corp. is the latest sign of the waning influence of America's

struggling energy sector.

When trading begins next week, the blue-chip benchmark will

include only one energy stock: Chevron Corp., which will represent

just 2.1% of the price-weighted index, according to an S&P Dow

Jones Indices analysis.

In the broader S&P 500, the group isn't faring much better:

Its weighting has shrunk to less than 2.5%, leaving energy as the

least influential of the 11 represented industries. That is a

dramatic fall from the end of 2011, when energy stocks accounted

for 12% of the market, according to Howard Silverblatt, senior

index analyst at S&P Dow Jones Indices.

Although the removal from the Dow is largely symbolic -- much

less money tracks the 30-stock index than follows the S&P 500

-- Exxon's departure has historical significance. The company is

the longest-tenured member of the benchmark, having joined in 1928

as Standard Oil of New Jersey.

It is also a reminder of Exxon's fall from the top echelon of

American industry. As recently as 2013, Exxon was the largest U.S.

company with a market value above $415 billion. It has since shrunk

to less than $180 billion and has been eclipsed by the technology

giants such as Apple Inc., Amazon.com Inc. and Microsoft Corp. that

now drive the American economy.

"Exxon, that used to be a behemoth in the U.S. markets, and now

it's dropped out of the Dow," said Matt Hanna, portfolio manager at

Summit Global Investments. "That just goes to show how quick things

can change and how far energy has fallen as a sector."

Usually, market contrarians say a sector that is so beaten down

should be ripe for bargains. But many investors remain skeptical of

an energy rebound, pointing to muted expectations for global growth

and spotty earnings.

Energy is by far the worst-performing S&P 500 sector this

year, down 40% while the index as a whole has gained 6.6%. The

underperformance is nothing new: Energy was also the weakest

performer in 2018 and 2019.

The fortunes of energy stocks are closely tied to oil prices,

which plunged this year when the coronavirus pandemic sapped demand

for fossil fuels as producers were already struggling to manage a

glut of oil and gas. U.S. crude has dropped nearly 30% in 2020 and

is hovering just above $40 a barrel.

Subdued expectations for economic growth and increased interest

in renewable energy have all contributed to the sector's

decline.

Energy stocks are unpopular among fund managers. The net share

of respondents to August's BofA Global Fund Manager Survey who were

underweight energy was the most of any sector.

"It's very difficult for Exxon to really grow when you have low

economic growth, muted commodity prices and we're going to be

transitioning away from that main line of business into something

else," said Mr. Hanna, who said his firm holds no energy stocks in

its large-cap portfolio. "With the expectation that we're moving

away from oil, that makes a company like Exxon or the energy

complex overall just not as interesting to a lot of investors."

Exxon shares are off 41% this year, while Chevron is down 29%.

The pain is even more acute among some of the oil-field services

companies and shale drillers. Schlumberger has dropped 52%, and EOG

Resources Inc. has fallen 47%. In fact, only one company in the

S&P 500's energy sector, Cabot Oil & Gas Corp., is up for

the year.

Exxon last month posted a quarterly loss for the second straight

quarter for the first time in more than 20 years. The company has

cut thousands of jobs and slashed its capital-spending plans to

better manage its expenses during the pandemic.

Oil companies were struggling to attract investors even before

the pandemic amid concerns over climate-change regulations and

increasing competition from renewable energy. Exxon has sought to

retain investors by paying a hefty dividend, but some analysts have

questioned whether the company will be able to maintain the payout

if energy demand doesn't improve.

The company played down the significance of its removal from the

Dow.

"This action does not affect our business nor the long-term

fundamentals that support our strategy," spokesman Casey Norton

said in an email. "Our portfolio is the strongest it has been in

more than two decades, and our focus remains on creating

shareholder value by responsibly meeting the world's energy

needs."

S&P Dow Jones Indices, which manages the 30-stock benchmark,

said Monday that the changes to index were prompted by Apple's

planned 4-to-1 stock split. Along with Exxon, Pfizer Inc. and

Raytheon Technologies Corp. are departing the index, while

Salesforce.com Inc., Honeywell International Inc. and Amgen Inc.

are joining it.

Apple's stock split would have given the information-technology

sector a smaller representation in the index, and the changes will

help mitigate Apple's decision. The moves "help diversify the index

by removing overlap between companies of similar scope and adding

new types of businesses that better reflect the American economy,"

S&P Dow Jones Indices said.

Component stocks of the Dow are selected by the index committee,

a group that includes editors of The Wall Street Journal, which is

published by Dow Jones & Co., a part of News Corp.

Although Chevron has historically been smaller than Exxon, the

gap in their market caps has been narrowing. It stood at about $13

billion on Tuesday and had been as slim as $4.6 billion in March,

according to Dow Jones Market Data. Chevron's pending $5 billion

deal to buy Noble Energy Inc., an independent oil-and-gas producer,

will further narrow the divide.

In a research note Tuesday, Goldman Sachs Group Inc. analysts

attributed Chevron's outperformance relative to Exxon to a stronger

balance sheet and better earnings execution, among other

factors.

Perhaps more important for the price-weighted Dow, Chevron's

stock price is higher. It currently trades above $85 a share, while

Exxon is around $40. The only companies in the index with lower

share prices are Walgreens Boots Alliance Inc. and Pfizer, which is

also set to be removed next week.

Chevron is in the midst of its third appearance in the Dow. It

was part of the index as Standard Oil Co. of California from

February 1924 to August 1925. The company rejoined in 1930, was

replaced in 1999 and returned again in 2008. Both Exxon and Chevron

are descendants of Standard Oil Co., which was forced to break up

in 1911.

In recent years, investors have been compensated for ignoring

the energy sector, said Mark Stoeckle, chief executive and senior

portfolio manager at Adams Funds, which manages a natural-resources

fund. But because of energy's importance to the economy, he said

having some exposure makes sense.

"Nobody knows when the marketplace is going to all of a sudden

begin to reward these companies," he said. "I don't think these

companies are going to zero."

Write to Karen Langley at karen.langley@wsj.com

(END) Dow Jones Newswires

August 25, 2020 17:36 ET (21:36 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

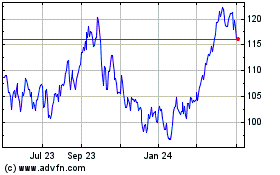

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

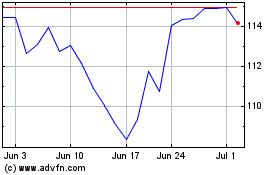

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Apr 2023 to Apr 2024