Oil Companies Brace for Twin Gulf Coast Storms

August 24 2020 - 2:15PM

Dow Jones News

By Rebecca Elliott and Collin Eaton

Oil companies have shut in roughly 58% of offshore oil

production in the Gulf of Mexico and are securing refineries and

petrochemical plants as two tropical storms barrel toward Louisiana

and Texas.

Tropical Storm Marco is expected to approach the Louisiana coast

Monday afternoon, while Tropical Storm Laura is poised to

strengthen into a hurricane Tuesday as it sweeps across the Gulf of

Mexico before nearing the Louisiana and Texas coastline late

Wednesday, according to the National Oceanic and Atmospheric

Administration.

The region is the heart of America's fuel making and chemicals

corridor, home to nearly half of the nation's refining capacity,

according to the Energy Information Administration. Roughly one

million barrels a day worth of oil output in the Gulf had been shut

off as of Sunday, according to the Bureau of Safety and

Environmental Enforcement, or around 10% of the oil produced in the

U.S.

Gulf Coast refineries, typically located in low-lying coastal

areas, are vulnerable to both wind damage that affects power grids

and prolonged flooding that can affect pumps and other ground-level

equipment. Hurricane Harvey, for example, forced roughly a quarter

of U.S. refining capacity to close in 2017 when the storm inundated

the Houston area.

Chemical facilities face similar dangers, but a temporary loss

of some petrochemical products isn't likely to affect consumers,

analysts said.

If the path of Laura, expected to be the more powerful of the

two storms, moves further into Texas, the impact on U.S. refineries

could be more significant, said Andy Lipow, an oil analyst at Lipow

Oil Associates LLC in Houston. But Mr. Lipow said he didn't expect

a significant supply disruption from either storm as inventories of

gasoline and diesel were both well above last year's levels.

Severe weather can send prices at the pump soaring, but American

drivers are unlikely to see major impacts this time around because

demand remains depressed due to Covid-19, fuel stockpiles are high

and refiners elsewhere likely could pick up any slack.

"If there is an impact from the storm, it's more likely to be

local outages, local disruption," said Patrick De Haan, head of

petroleum analysis for GasBuddy, referring to Laura. "It should not

be a pricing event."

U.S. benchmark oil was up less than 1% midday Monday, trading

around $42 a barrel. Regular gasoline prices averaged about $2.20 a

gallon, according to GasBuddy, around 15% below year-ago

prices.

U.S. fuel makers have already reduced processing this year in

light of weak demand due to the coronavirus pandemic. If the

tropical storms cause refineries to shut down in parts of

Louisiana, for example, refiners in the Houston area could easily

ramp up fuel production, said Sandy Fielden, an analyst at

financial services firm Morningstar Inc.

"There's no shortage of product," Mr. Fielden said. "It's not a

tight market."

U.S. refiners were operating at around 81% of capacity in

mid-August, down from around 96% a year earlier, according to the

EIA.

Offshore, Exxon Mobil Corp. has evacuated personnel from its one

Gulf of Mexico platform, with minimal impact to its production,

while the company's Gulf Coast refinery operations were normal,

spokesman Todd Spitler said.

"ExxonMobil is closely monitoring the storms and continues to

prepare for severe weather at offshore and coastal operations in

the Gulf of Mexico," Mr. Spitler said.

Royal Dutch Shell PLC, meanwhile, had paused production at all

but one of the nine assets it operates in the Gulf of Mexico and

evacuated nonessential personnel. Chevron Corp. also pumped the

brakes on offshore production in the region and evacuated employees

and contractors.

Colonial Pipeline Co., which ships fuels into the northeast U.S.

from the Houston area, said it was in contact with refiners and

didn't have plans to shut down any portion of its system.

Write to Rebecca Elliott at rebecca.elliott@wsj.com and Collin

Eaton at collin.eaton@wsj.com

(END) Dow Jones Newswires

August 24, 2020 14:00 ET (18:00 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

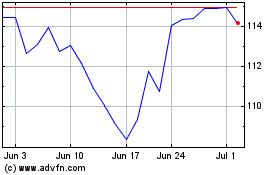

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

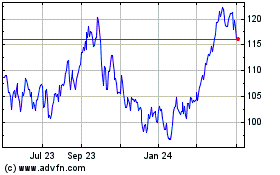

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Apr 2023 to Apr 2024