By Nick Timiraos

The Federal Reserve said it would start making loans to American

corporations, relaunching a crisis-era tool to help calm short-term

debt markets that have faced intensifying strains in recent

days.

The Fed trained its sights Tuesday on dysfunction in the $1.1

trillion market for short-term corporate IOUs called commercial

paper. Companies use commercial paper to finance their day-to-day

business operations such as payroll expenses.

While the Fed can't buy corporate debt or lend directly to

households and businesses, it can invoke emergency powers to

establish lending facilities that, in turn, extend credit.

The steps show how the Fed is repurposing its tools from the

2008 crisis to combat an unfolding economic emergency that is

entirely different. Back then, fears about the solvency of key

financial institutions spawned a crisis that fueled a broader

economic contraction.

Now the problems are in the economy, which needs the financial

system and government to tide over businesses and households forced

to hunker down to prevent the coronavirus pandemic from overloading

local health-care systems.

"What economic policy can do here is to create a safety net for

the economy, and particularly for individuals and firms that don't

have buffers, that aren't able to absorb lost wages or lost

revenues," said Nathan Sheets, a former senior official at the

Treasury Department and the Fed who is now chief economist at

investment-advisory firm PGIM Fixed Income.

Complicating that task is uncertainty everywhere: about the

length and severity of the economic downturn; about the regulatory

system's ability to handle an abrupt deleveraging; and about how

financial firms will function with remote operations and

alternative work arrangements.

"The problem with trying to create a distinction between

economic and financial crises is that it ignores the fact that the

real economy and the financial sector are inextricably linked, and

thus there is no way to have a crisis in one without it immediately

causing a crisis in the other," said Joshua Shapiro of consulting

firm MFR Inc.

In launching the Commercial Paper Funding Facility, the Fed is

trying to encourage investors to return to that market to ensure

that eligible issuers can roll over maturing obligations. The

central bank's facility will purchase three-month debt from firms

with high credit ratings. The Fed deployed a version of the tool

between 2008 and 2010, during and after the financial crisis.

"The Fed is trying to break the fear loop that corporates will

lose access to the short-term markets by committing that funding

will exist," said Alexandra Wilson-Elizondo, senior credit

portfolio manager at MacKay Shields. "It's a symbol. A healthy

commercial-paper market gives companies confidence in the term

market."

Investors who buy longer-dated debt gauge the pulse of

short-term funding markets to assess risk. Analysts and asset

managers were alarmed to see disruptions in commercial paper, in

which yields were higher than those for certain long-dated bonds.

That either meant companies were desperate for cash or that buyers

had disappeared. If short-term debt instruments are in trouble,

that could signal tough times ahead.

As an example of restored faith and a well-functioning

high-grade credit market, Exxon Mobil Corp. issued debt across

various maturities Tuesday, borrowing at a rate of around 4% on a

30-year bond.

Tuesday's announcement marked the Fed's first effort in the

current crisis that required consultation with the Treasury

Department, potentially opening the door to other joint ventures

between fiscal and monetary authorities.

To create the latest facility, the Fed had to invoke special

powers by citing "unusual and exigent circumstances" to authorize

one of its reserve banks, the New York Fed, to extend credit. In

2010, Congress required the Fed to seek approval from the Treasury

secretary before using these so-called 13(3) powers, named for the

section of its charter that allows it to set up such last-resort

programs.

Treasury Secretary Steven Mnuchin gave his approval to the

program Tuesday. The Treasury will also provide $10 billion from

its Exchange Stabilization Fund, which has around $94 billion, to

cover any Fed credit losses.

Later on Tuesday, the Fed announced another 13(3) lending

program that will enable 24 large financial institutions known as

primary dealers, which function as the Fed's exclusive

counterparties when trading in financial markets, to seek loans of

up to 90 days.

The Primary Dealer Credit Facility will essentially function as

an overnight loan facility for primary dealers, similar to how the

Fed's discount window provides a round-the-clock source of backup

funding to banks. It represents the Fed's latest bid to unclog

financial markets.

The facility will offer terms as generous as those made

available in the fall of 2008. Primary dealers will be able to

pledge a broader range of collateral than the government-backed

debt required for open-market operations, and the Fed will charge

the same 0.25% rate being made available for banks at the discount

window.

The commercial-paper market has been strained as money-market

mutual funds and other investors seek to sell commercial paper at

the same time that demand for short-term borrowing is rising from

companies that face unanticipated, virus-related funding needs.

The Fed said it would lend to commercial-paper issuers at a rate

of 2 percentage points above overnight lending rates for three

months at a time. The facility will last for at least one year.

"The terms are not easy," said Julia Coronado, a former Fed

economist and founder of the economic-advisory firm MacroPolicy

Perspectives. "It was a mild disappointment to the market."

The facility differs from the 2008 version in one important way.

While both are only open to firms with strong credit ratings, the

new facility will also allow firms that currently have strong

credit ratings but whose ratings are later downgraded by one tier

to access the facility.

In 2008, the facility took three weeks to launch, and this

change could give companies greater confidence that they will able

to access credit even if their ratings are downgraded before the

facility is fully operating.

Tuesday's announcement is one example of how policy makers in

the days and weeks ahead may need to repurpose old tools and invent

new ones to address a working-capital crunch for small and midsize

businesses and the self-employed.

Michael Feroli, chief U.S. economist at JPMorgan Chase, said one

possible scheme would allow the Fed to provide nonrecourse funding

for loans underwritten by banks to small- and midsize companies at

the Fed's primary credit rate, 0.25%.

Such loans could be limited to firms that were in good credit

standing as of the start of the year, to avoid lending to

enterprises that were distressed before the virus hit. Relying on

the banking system could reduce the administrative burden on the

central bank or the Treasury associated with underwriting tens of

thousands of borrowers.

The Fed has moved over the past two weeks to address growing

market strains at a pace that has surprised veterans of the 2008

crisis, which unfolded over many months.

On March 3, the central bank approved an emergency cut in its

benchmark federal-funds rate by a half-percentage point. On Sunday,

it slashed the rate by a full percentage point, to near zero.

The Fed also announced plans to purchase $500 billion in

Treasury securities and $200 billion in mortgage bonds to arrest

funding strains in critical markets for government debt, which are

typically havens during a crisis. And it has promised to offer

unlimited amounts of short-term loans to large banks that are

collateralized by government securities.

--Julia-Ambra Verlaine contributed to this article.

Write to Nick Timiraos at nick.timiraos@wsj.com

(END) Dow Jones Newswires

March 17, 2020 22:09 ET (02:09 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

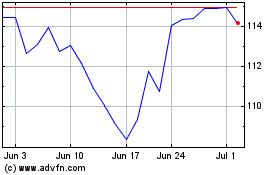

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

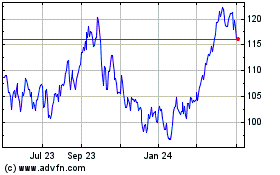

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Apr 2023 to Apr 2024