By Christopher M. Matthews and Kejal Vyas | Photographs by Oscar B. Castillo for The Wall Street Journal

GEORGETOWN, Guyana -- To mark the flow of the world's biggest

oil discovery in years, President David Granger declared a new

holiday, National Petroleum Day, on Dec. 20.

Backed by soothing Caribbean tunes in a video address to his

countrymen, Mr. Granger said oil riches would soon transform this

poor South American country, and he would put the proceeds to work

for all through a sovereign-wealth fund that prioritized investment

in education and infrastructure.

"Guyana's future is brighter with the beginning of first oil,"

the former army brigadier said in the video. "The good life for

everyone beckons."

Yet as Guyana heads into an election March 2, the almost surreal

reversal of fortune is turning out to be a source of strife for

this jungle-covered former British colony. Many here worry that the

country -- which has virtually no oil experience -- is wildly

unprepared to become the planet's new petrostate.

An oil-sharing deal with Exxon Mobil Corp. is estimated to

shower Guyana with nearly $170 billion in revenue in coming

decades, a giant windfall for a country of 780,000 people with an

annual budget of about $1.4 billion and the lowest per capita

income in South America after Bolivia.

It's also kicked off a fuss over fairness and secrecy over the

price of the contract and how it was handled. At the heart of the

debate is a renegotiated production-sharing agreement signed in

2016 by Guyana's natural resources minister -- just days before

Exxon disclosed an increased estimate for the size of its find.

Amid mounting criticism of the terms, Guyana's resources

ministry recently hired U.K. law firm Clyde & Co. to examine

the circumstances leading to the 2016 deal. It found that Exxon

pressured Guyanese officials into signing the deal in a short time

frame, "presumably because knowledge of a 'world class' discovery

could have altered the government's negotiating position,"

according to a copy of the Jan. 30 investigative report reviewed by

the Journal.

The resources minister, Raphael Trotman, a close political ally

of Mr. Granger's, agreed that Guyana might have secured better

terms with Exxon with a lengthier negotiation, but called the rush

to sign with the American oil giant necessary due to hostilities

with neighboring Venezuela, which in the past had sent naval

vessels into Guyanese waters in a dispute over the territory where

the oil was found.

"This is all new to us," Mr. Trotman said in an interview.

"We're a nation of skeptics. We've never had anything good going

our way and even the possibility of prosperity scares people."

Exxon declined to discuss whether it pressured Guyana's

government. It defended the deal as fair for a first-time producer

such as Guyana.

"It offers globally competitive terms," said Exxon spokesman

Casey Norton. "It was done at a time where there was significant

technical and financial risk."

The deal comes at a good time for Exxon, which has been

struggling to maintain its leading status among global oil

companies in recent years. Exxon expects a return of at least 30%

in Guyana, more than double the 15% return the industry regards as

the lowest necessary to justify investment.

Since first striking oil there in 2015, the Exxon-led

consortium, which also includes Hess Corp. and China National

Offshore Oil Corp., has repeatedly raised estimates for how much it

can recover, and recently upped it to more than 8 billion barrels.

The first vessel carrying Guyanese oil, which is extracted 120

miles offshore and sold directly to market, set sail last

month.

The dispute over the contract has sharpened divisions in Guyana,

which has been riven by racial tensions among its citizens, mostly

descendants of African slaves and indentured laborers from India,

since becoming fully independent from Britain in 1966. Before the

discovery of oil, the country's biggest industries were gold mining

and rice and sugar farming.

Global Witness, a London-based watchdog group that seeks to

expose what it sees as resource exploitation in poor countries,

estimated in a report this month that the deal pays Guyana some $55

billion below market value for its resources over three decades.

The group also provided documents to the Journal about the process

that led to the renegotiation.

Global Witness's report prompted a response from the People's

Progressive Party, the group of largely Indian Guyanese that had

held power for two decades before a multiethnic coalition won a

one-seat majority in the country's parliament and made Mr. Granger

president in 2015.

"We were underserved in the negotiations," said Bharrat Jagdeo,

a former president and head of the opposition party, in a public

statement after the report's release. "Guyana did not get its fair

share of the deal."

That in turn led Mr. Granger's government to accuse Global

Witness and other outsiders of interfering in the March 2

election.

"This timing cannot be seen as a coincidence and it appears as

though it is seeking to influence the electoral outcome," it said

in a response to the Global Witness report. "It is time that the

people of Guyana enjoy the right to self-determination and their

own destiny without interference of foreign influences."

Jonathan Gant, senior campaigner at Global Witness, said his

group is nonpartisan. "The Guyanese people deserve accountability

and transparency into how this deal was negotiated and in whose

interest," he said.

Despite the fallout, neither Mr. Granger's coalition nor the

main opposition party have said they want a wholesale renegotiation

of the contract with Exxon, or a halt to the gusher of money it is

about to bring. But both say other contracts signed after 2016

could be revoked and future deals, including with Exxon, will

require better terms. Both sides have also said they would evaluate

direct-cash transfers of oil proceeds to citizens as a way to

distribute the wealth.

First discovery

Guyana initially signed an exploration agreement with Exxon in

1999. While an assessment by the U.S. Geological Survey had

estimated more than 13 billion barrels of crude below the seabed,

which wraps around the shoulder of South America, Guyana logged

some 40 dry wells before Exxon made its first discovery in 2015,

according to Robert Persaud, Mr. Trotman's predecessor as natural

resources minister.

Previous governments had struggled to keep companies interested

in exploring due to hostilities with neighboring Venezuela and

Suriname, both already oil producers. Each had sent gunboats,

seeking to reclaim disputed waters from Guyana, which has no navy,

paralyzing operations for long stretches. An earlier Exxon partner,

Royal Dutch Shell PLC, pulled out in 2014, selling its shares for

$1.

Mr. Granger took office in May 2015, days before Exxon's first

find. Within three months, Venezuelan President Nicolás Maduro

issued a decree rekindling a century-old border controversy,

claiming two-thirds of Guyana. Seeking international support, Mr.

Granger turned to his oil partners, publicly arguing that major

companies from the U.S. and China would serve as a deterrent to

Venezuelan aggression. A case over the border dispute is currently

with the United Nations' International Court of Justice.

The task of renegotiating the oil deal was granted to Mr.

Trotman, a family lawyer and former speaker of parliament with

little energy experience. As co-founder of the Alliance for Change

Party, he was a vital part of the coalition that made Mr. Granger

president. Mr. Trotman said his orders from the president were to

work toward getting oil flowing as quickly as possible.

On June 23, 2016, Mr. Trotman emailed a consultant hired to

advise the government on oil and gas issues, saying Exxon had asked

for an extension of some drilling leases that were set to expire,

according to a person familiar with the matter. Mr. Trotman wrote

in the email that he saw it as an opportunity to revise some of the

terms of the 1999 agreement, which split output 50-50 with an

additional 1% royalty for the country.

The consultant sent back his thoughts on Mr. Trotman's proposed

changes on June 27, and suggested the government should get no less

than if it allowed the contract to expire and opened the field to

bidding. The consultant suggested a 10% royalty might be

appropriate.

Another adviser hired by Mr. Trotman's ministry had previously

counseled that Guyana should ask for a 15% royalty, according to

two people familiar with the matter. That adviser also suggested

Mr. Trotman work with a team of 10 or 20 experts on the

renegotiation. The ministry had only one.

Unknown to either adviser, Mr. Trotman signed a new deal with

Exxon four days later on June 27, 2016, the same day the consultant

sent back his suggestions. It kept a 50-50 production sharing

agreement from 1999 in place after Exxon takes 75% of annual output

to recoup its investments and upped Guyana's royalty to 2%. It also

included a signing bonus of $18 million.

Three days after the signing, Exxon announced that results from

a second exploratory well led it to believe it could recover as

much as 1.4 billion barrels of oil and gas from the Guyana field,

double what it had publicly revealed before the renegotiation.

The new deal wasn't made public for months. The government has

said it wanted to keep the deal quiet in the midst of its border

arbitration case with Venezuela, and that legal fees are being paid

for with the signing bonus.

The Clyde & Co. report found that Mr. Granger, the

president, chaired a meeting with an Exxon representative six days

before the new deal was signed. But three advisers to the president

told the Journal that Mr. Granger only learned of the new terms in

early 2017, when one of them suggested a contract renegotiation to

Exxon and was told by the company that a new pact, extending to

2026, had already been inked.

Representatives for Mr. Granger declined requests for comment,

and he wasn't interviewed by the law firm for the report.

Mr. Trotman said that he informed other members of the country's

cabinet.

The report, commissioned by Mr. Trotman, supported his position

that he briefed the cabinet about his intentions to renegotiate,

and cited Venezuela concerns as a key driver for the

government.

Jan Mangal, who served as petroleum adviser to Mr. Granger from

2017 to 2018, believes the government got a bad deal.

"We had all of the bargaining power and it was just given away,"

said Mr. Mangal, a former Chevron project manager and native of

Guyana.

A vocal critic of the deal, Mr. Mangal well understands it has

become divisive. One of the deal's defenders in Guyana is his

brother, Lars Mangal, who is a lead investor in one of Exxon's

largest local service providers, Guyana Shore Base Inc.

"We have completely different views and objectives," Jan Mangal

said. "It has been tough, I'm not going to pretend that has been OK

in terms of the family." The brothers say that while they respect

each other's views, their difference of opinion has led to some

tough conversations at the dinner table.

Lars Mangal, a former executive for oil field service giant

Schlumberger Ltd., said he believes his brother is missing the

forest for the trees. He said Guyana could perhaps have extracted

better concessions from Exxon, but getting oil flowing quickly was

paramount, especially because of long-term questions about global

demand for oil.

"You have to think about the macro and maximizing your potential

as early as possible," Lars Mangal said. "It's good to have debate,

don't get me wrong, but I certainly hope that my views

prevail."

Mr. Trotman was stripped of the oil portfolio in 2018 after the

government created a new energy department. He said he and the deal

he signed have been unfairly villainized by some of his

compatriots. He hopes oil money will soothe hard feelings.

"I'm a man of great faith and I believe it's going to be a true

blessing for Guyana," he said. "I expect it will bring us closer

together."

Write to Christopher M. Matthews at christopher.matthews@wsj.com

and Kejal Vyas at kejal.vyas@wsj.com

(END) Dow Jones Newswires

February 28, 2020 12:17 ET (17:17 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

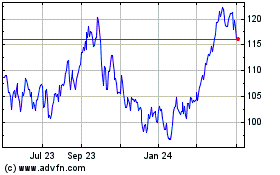

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

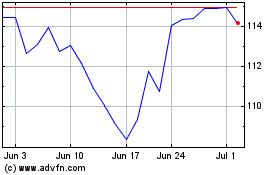

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Apr 2023 to Apr 2024