Real-Estate Companies Amass Cheaper -- but Riskier -- Short-Term Debt

July 09 2019 - 9:52AM

Dow Jones News

By Konrad Putzier

More publicly-listed real-estate companies are taking on

short-term debt, assuming additional risk to reduce their borrowing

costs.

This debt, known as commercial paper, can have terms as short as

a single night. It is a popular tool for many companies to cover

accounts payable or pay for inventory.

Real-estate investment trusts tend not to have these expenses,

but some property firms are amassing short-term obligations because

they can borrow at cheaper rates than longer-term debt. Interest

rates on commercial paper are generally a half percentage point

lower than those on bank credit facilities, according to a new

report from Fitch Ratings.

The risk, analysts say, is that property companies could be

unable to refinance this debt if lenders suddenly lose confidence,

for example in the event of a financial panic.

Because real estate can take time to sell and prices fluctuate,

property owners faced with a sudden financing shortfall are

sometimes forced into foreclosure -- one of the reasons most firms

prefer long-term mortgages.

"It would be an unforced error if there were a hiccup in the

commercial-paper availability," said Stephen Boyd, a senior

director at Fitch. "Why take that risk?"

Mr. Boyd said more REITs are issuing short-term debt in part

because the real-estate market cycle is nearing its end. "There are

fewer levers to pull off earnings growth, and this is one of them,"

he said.

While commercial paper accounts for a mere fraction of overall

real estate liabilities and the practice is not widespread, some

prominent property companies are getting involved.

In the first half of this year, Ventas Inc., Welltower Inc. and

Mid-America Apartment Communities Inc. issued commercial paper.

Ventas's vice president of investor relations, Juan Sanabria, said

commercial paper is "funding short term working capital needs and

is not a mismatch to long duration assets."

Apartment owner Equity Residential has been issuing this type of

debt since February 2015 and had $345 million outstanding at the

end of the first quarter, according to its public filings. Chief

Financial Officer Robert Garechana said the company decided to

issue commercial paper because "it just was a cheaper alternative"

to credit facilities.

It uses its $500-million program to cover short-term funding

gaps, for example between the expiration of a mortgage and the

issuance of new long-term debt, or between the purchase of one

building and the sale of another.

Mr. Garechana said he fielded questions from bond investors

about the risks of commercial paper, but most weren't concerned. He

said the company has a $2 billion credit facility, and keeps $500

million unused in case it needs to end its commercial-paper

program. "When you use it in a modest way like we do, I don't view

it as being incrementally risky, " he said.

Mall owner Simon Property Group Inc. issued its first commercial

paper in October 2014 under a program that allowed the company to

borrow up to $500 million.

The company has since increased the program to $2 billion, and

had $1.3 billion outstanding at the end of March, according to

Fitch. The weighted average interest rate on its commercial paper

was 2.58%, compared with 3.28% for its credit facilities, according

to its public filings. Simon Property didn't respond to requests

for comment.

In most cases, commercial paper accounts for less than 5% of

debt. And property firms usually have credit facilities with banks

that they could tap into if short-term debt is no longer

available.

Still, the Fitch report called commercial paper issuance a

"modest net credit-negative" for real-estate investment trusts.

While the availability of credit facilities lessens the risk, the

report notes, it doesn't eliminate it.

Using bank facilities to pay off commercial paper could mean

less money is available to use elsewhere, and concerns over

short-term debt could spill over into bond and mortgage markets,

leading to higher debt costs there as well.

Write to Konrad Putzier at konrad.putzier@wsj.com

(END) Dow Jones Newswires

July 09, 2019 09:37 ET (13:37 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

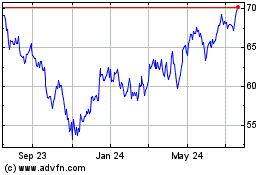

Equity Residential (NYSE:EQR)

Historical Stock Chart

From Mar 2024 to Apr 2024

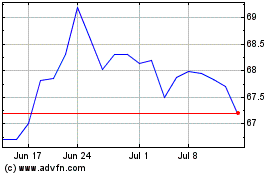

Equity Residential (NYSE:EQR)

Historical Stock Chart

From Apr 2023 to Apr 2024