UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

May 10, 2023

Commission File Number 1-15200

Equinor ASA

(Translation of registrant’s name into English)

FORUSBEEN 50, N-4035, STAVANGER, NORWAY

(Address of principal executive offices )

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

This Report on Form 6-K contains a press release issued by Equinor ASA on May 10, 2023, entitled "Equinor ASA: Minutes from the Annual General Meeting 2023".

Equinor ASA: Minutes from the Annual General Meeting 2023.

On 10 May 2023, the annual general meeting in Equinor ASA (OSE: EQNR, NYSE: EQNR) approved the annual report and accounts for Equinor ASA and the Equinor group for 2022, as proposed by the board of directors.

An ordinary dividend of US dollar ("USD") 0.30 per share and an extraordinary dividend of USD 0.60 will be distributed for the fourth quarter of 2022.

The fourth quarter 2022 dividend accrues to the shareholders as registered in Equinor's shareholder register with the Norwegian Central Securities Depository (VPS) as of expiry of 12 May 2023. Subject to ordinary settlement in VPS, this implies that the right to dividend accrues to shareholders as of 10 May 2023. The shares will be traded ex-dividend on the Oslo Stock Exchange (Oslo Børs) from and including 11 May 2023. Same dates will also apply for the dividend under the US ADR (American Depository Receipts) program. Shareholders whose shares trade on Oslo Børs will receive their dividend in Norwegian kroner ("NOK"). The NOK dividend will be communicated on 22 May 2023. The expected payment date for the dividend in NOK and in USD under the ADR program is 25 May 2023.

The general meeting authorised the board of directors to resolve dividend payments based on the company’s approved annual accounts for 2022. The authorisation is valid until the next annual general meeting, but no later than 30 June 2024.

Seven proposals from shareholders were up for voting. The shareholders' supporting statements and the board's response are available at www.equinor.com/agm. None of the shareholder proposals were adopted. Details are included in the attached minutes.

The general meeting endorsed the board's report on Corporate Governance.

The general meeting approved the board of directors' remuneration policy and endorsed the board of directors’ 2022 remuneration report.

Remuneration to the company's external auditor for 2022 was approved.

In accordance with the proposal from the nomination committee, the general meeting adopted the remuneration to the corporate assembly, effective as of 11 May 2023.

In accordance with the proposal from the nomination committee, the general meeting adopted the remuneration to the nomination committee, effective as of 11 May 2023.

The general meeting authorised the board of directors on behalf of the company to acquire Equinor shares in the market to continue the company’s share-based incentive plans for employees. The authorisation is valid until 30 June 2024. The previous authorisation, dated 11 May 2022, shall remain valid until the new authorisation is registered in the company register.

As part of the company’s share buyback program, the general meeting approved a reduction in capital through the cancellation of own shares and the redemption of shares belonging to the Norwegian State.

The general meeting authorised the board of directors on behalf of the company to acquire Equinor shares in the market. It is a precondition that the repurchased shares are subsequently annulled through a resolution by a new general meeting to reduce the company’s share capital. The authorisation is valid until the next annual general meeting, but no later than 30 June 2024.

Minutes of the AGM is enclosed.

Contact persons:

Investor relations

Bård Glad Pedersen, senior vice president Investor Relations: +47 918 01 791

Press

Sissel Rinde, vice president Media Relations: +47 412 60 584

This information is subject to the disclosure requirements pursuant to Section 5-12 the Norwegian Securities Trading Act

MINUTES OF THE ANNUAL GENERAL MEETING OF EQUINOR ASA 10 MAY 2023

The annual general meeting of Equinor ASA was held on 10 May 2023 in Equinor Business Center, Forusbeen 50, 4035 Stavanger and via Lumi AGM for digital attendance.

The chair of the board, Finn Kinserdal from the corporate assembly, the president and CEO, general counsel and the company’s auditor attended. Company secretary Marte Johanson Hanasand recorded the minutes of the meeting.

The agenda was as follows:

| 1. |

Opening of the annual general meeting

Based on a resolution from the corporate assembly, the annual general meeting was opened by Finn Kinserdal, shareholder-elected member of the corporate assembly.

|

| 2. |

Registration of represented shareholders and proxies

Overview of shareholders represented at the annual general meeting, either by personal or digital attendance, by proxy, or by advance voting, is attached in Appendix 1 to these minutes.

|

| 3. |

Election of the chair of the meeting

The general meeting adopted the following resolution:

“Finn Kinserdal, shareholder-elected member of the corporate assembly, is elected chair of the meeting.”

|

| 4. |

Approval of the notice and the agenda

The general meeting adopted the following resolution:

“The notice and proposed agenda are approved.”

|

| 5. |

Election of two persons to co-sign the minutes together with the chair of the meeting

The general meeting adopted the following resolution:

“Georg Fredrik Rabl and Fride Seljevold Methi are elected to co-sign the minutes together with the chair of the meeting.”

|

| 6. |

Approval of the annual report and accounts for Equinor ASA and the Equinor group for 2022, including the board of directors’ proposal for distribution of fourth quarter 2022 dividend

The chair of the meeting informed the general meeting that the annual report and accounts and the auditor’s report have been made available on the company’s website.

In accordance with the proposal from the board, the general meeting adopted the following resolution:

“The annual accounts and the annual report for 2022 for Equinor ASA and the Equinor group are approved. A fourth quarter 2022 ordinary dividend of USD 0.30 per share and an extraordinary dividend of USD 0.60 per share are approved to be distributed.”

|

| 7. |

Authorisation to distribute dividend based on approved annual accounts for 2022

In accordance with the proposal from the board, the general meeting adopted the following resolution:

“The general meeting of Equinor ASA hereby authorises the board of directors to resolve the payments of dividend based on the company’s approved annual accounts for 2022, cf. the Norwegian Public Limited Liability Companies Act section 8-2, second paragraph.

The board of directors shall, when using the authorisation, make its decision in accordance with the company’s approved dividend policy. The board of directors shall before each decision to approve the payment of dividends consider if the company, after the payment of dividends, will have sufficient equity and liquidity.

The authorisation shall be valid until the next annual general meeting, but no later than 30 June 2024.”

|

| 8. |

Proposal from shareholder to ban the use of fiberglass rotor blades in all new wind farms, commit to buy into existing hydropower projects and to conduct research on other energy sources such as thorium

Shareholder Roald Skjoldheim had proposed that the company ban the use of fiberglass rotor blades in all new wind farms, commits to buy into existing hydropower projects and conduct research on other energy sources such as thorium.

The shareholder’s proposal was not adopted.

|

| 9. |

Proposal from shareholders to identify and manage risks and possibilities regarding climate, and integrate these in the company’s strategy

Shareholders WWF and Greenpeace had proposed that the company identify and manage risks and possibilities regarding climate and integrate these in the company’s strategy.

The chair of the meeting read the following statement from the Ministry of Trade, Industry and Fisheries:

The state expects cf. Meld. St. 6 (2022 – 2023) - Greener and more active state ownership (white paper on the State’s direct ownership of companies) that

i) The company identifies and manages risks and opportunities relating to climate and integrates these into the company’s strategies.

ii) The company sets targets and implements measures to reduce greenhouse gas emissions in both the short and long term in line with the Paris Agreement, and reports on goal attainment. The targets shall be science-based when available.

iii) The company reports on direct and indirect greenhouse gas emissions and climate risk, and uses recognized standards for reporting greenhouse gas emissions and climate risk.

These expectations, which were presented in the white paper in October 2022 and discussed in the Storting in February 2023, are communicated to Equinor's board of directors and are followed up in the ownership dialogue the state has with the company. The state expects the board and administration to work actively with the state's expectations and to assess whether and how they should be taken into account in the company's energy transition plan and related reporting. The state voted in favor of Equinor's energy transition plan at the general meeting in 2022, i.a. based on the company being clear that the long-term value creation supports the goals of the Paris Agreement, cf. the state's statement at the annual meeting last year. It is the board's responsibility to manage the company, including setting the company's strategy, cf. the division of roles between the owner, board of directors and the general manager set out in company law, and on generally recognized principles and standards for corporate governance. The state does not consider it appropriate to adopt expectations for the company at the general meeting, but follows them up in the dialogue with the company.

The shareholders’ proposal was not adopted.

|

| 10. |

Proposal from shareholder to stop all exploration and drilling by 2025 and provide financial and technical assistance for the repair of and development of Ukraine’s energy infrastructure

Shareholder Guttorm Grundt had proposed that the company stops all exploration and drilling by 2025 and provides financial and technical assistance for the repair of and development of Ukraine’s energy infrastructure.

The shareholder’s proposal was not adopted.

|

| 11. |

Proposal from shareholder to develop a procedure for greatly improved process for responding to shareholder proposals

Shareholder Even Bakke had proposed that the company develops a procedure for greatly improved process for responding to shareholder proposals.

The shareholder’s proposal was not adopted.

|

12. |

Proposal from shareholder to end all plans for activity in the Barents Sea, adjust up the investments in renewables/low carbon solutions to 50 percent by 2025, implement CCS for Melkøya and invest in rebuilding of Ukraine

Shareholder Gro Nylander had proposed that the company ends all plans for activity in the Barents Sea, adjusts up the investments in renewables/low carbon solutions to 50 percent by 2025, implements CCS for Melkøya and invests in rebuilding of Ukraine.

The shareholders’ proposal was not adopted.

|

| 13. |

Proposal from shareholder to stop all exploration and test drilling for oil and gas, become a leading producer of renewable energy, stop plans for electrification of Melkøya and present a plan enabling Norway to become net-zero by 2050

Shareholder Bente Marie Bakke had proposed that the company stops all exploration and test drilling for oil and gas, becomes a leading producer of renewable energy, stops plans for electrification of Melkøya and presents a plan enabling Norway to become net-zero by 2050.

The shareholder’s proposal was not adopted.

|

| 14. |

Proposal from shareholder to let the results of global warming characterise its further strategy, stop all exploration for more oil and gas, phase out all production and sale of oil and gas, multiple its investment in renewable energy and CCS and become a climate-friendly company

Shareholder Gro Nylander had proposed that the company’s management let the results of global warming characterise its further strategy, stops all exploration for more oil and gas, phase out all production and sale of oil and gas, multiplies its investment in renewable energy and CCS and becomes a climate-friendly company.

The shareholders’ proposal was not adopted.

|

| 15. |

The board of directors’ report on Corporate Governance

Jon Erik Reinhardsen, chair of the board of directors, presented the board’s report on Corporate Governance. The report is included in the annual report.

In accordance with the proposal from the board, the general meeting adopted the following resolution:

“The general meeting endorses the board of directors’ report on Corporate Governance.”

|

| 16. |

The board of directors’ remuneration policy on determination of salary and other remuneration for leading personnel and remuneration report for salary and other remuneration for leading personnel

Jon Erik Reinhardsen, chair of the board of directors, presented the board’s remuneration policy on determination of salary and other remuneration for leading personnel and report for salary and other remuneration for leading personnel.

|

| 16.1 |

Approval of the board of directors’ remuneration policy on determination of salary and other remuneration for leading personnel

In accordance with the proposal from the board, the general meeting adopted the following resolution:

“The general meeting approves the board of directors’ Remuneration policy.”

|

| 16.2 |

Advisory vote of the board of directors’ remuneration report for leading personnel

In accordance with the proposal from the board, the general meeting adopted the following resolution:

“The general meeting endorses the board of directors’ 2022 Remuneration report.”

|

| 17. |

Approval of remuneration for the company’s external auditor for 2022

The general meeting adopted the following resolution:

“Remuneration to the auditor for 2022 of NOK 49,894,487 for Equinor ASA is approved.”

|

| 18. |

Determination of remuneration for the corporate assembly members

In accordance with the proposal from the nomination committee, the general meeting adopted the following resolution:

“The remuneration to the corporate assembly is adjusted effective from 11 May 2023 as follows:

From

To

Chair

NOK 137,600/annually

NOK 143,700/annually

Deputy chair NOK 72,600/annually NOK 75,800/annually

Members

NOK 51,000/annually NOK 53,250/annually

Deputy members NOK 7,340/meeting NOK 7,670/meeting”

|

| 19. |

Determination of remuneration for the nomination committee members

In accordance with the proposal from the nomination committee, the general meeting adopted the following resolution:

“The remuneration to the nomination committee is adjusted effective from 11 May 2023 as follows:

From

To

Chair

NOK 13,650/meeting

NOK 14,260/meeting

Members

NOK 10,130/meeting

NOK 10,580/meeting”

|

| 20. |

Authorisation to acquire Equinor ASA shares in the market to continue operation of the company’s share-based incentive plans for employees

In accordance with the proposal from the board, the general meeting adopted the following resolution:

“The board of directors is authorised on behalf of the company to acquire Equinor shares in the market. The authorisation may be used to acquire own shares at a total nominal value of up to NOK 27,500,000.

Shares acquired pursuant to this authorisation may only be used for sale and transfer to employees of the Equinor group as part of the group’s share saving plan and long-term incentive plan, as approved by the board of directors.

The minimum and maximum amount that may be paid per share will be NOK 50 and NOK 1,000, respectively.

The authorisation is valid until 30 June 2024. This authorisation replaces, from the time of registration in the Register of Business Enterprises, the previous authorisation to acquire own shares for the company’s share-based incentive plans for employees granted by the annual general meeting on 11 May 2022.”

|

| 21. |

Reduction in capital through the cancellation of own shares and the redemption of shares belonging to the Norwegian State

In accordance with the proposal from the board, the general meeting adopted the following resolution:

“As part of the implementation of the company’s share buy-back programme, the company’s share capital will be reduced by NOK 430,913,885.00 from NOK 7,938,675,397.50 to NOK 7,507,761,512.50. Of the total capital reduction amount:

(i) NOK 142,201,582.50 will be used to annul 56,880,633 own shares, and

(ii) NOK 288,712,302.50 will be used to redeem and annul 115,484,921 shares owned by the Norwegian State by the Ministry of Trade, Industry and Fisheries.

In addition to the capital reduction amount described in item (ii) above, the Norwegian State by the Ministry of Trade, Industry and Fisheries shall receive NOK 39,893,455,758.00, with a deduction for fourth quarter 2022 dividend of USD 0.90 per share and corresponding interest compensation. The part of the amount paid to the Norwegian State that exceeds the nominal value of the shares, shall be covered by retained earnings.

With effect from the time the capital reduction has been registered, Article 3 of the company’s Articles of Association will be amended to read as follows:

“The share capital of the company is NOK 7,507,761,512.50 divided into 3,003,104,605 shares of NOK 2.50 each.””

|

| 22. |

Authorisation to acquire Equinor ASA shares in the market for subsequent annulment

In accordance with the proposal from the board, the general meeting adopted the following resolution:

“The general meeting of Equinor ASA hereby authorises the board of directors to acquire in the market, on behalf of the company, Equinor shares with a face value of up to NOK 235,000,000.

The minimum and maximum amount that can be paid per share will be NOK 50 and NOK 1,000, respectively. Within these limits, the board of directors shall itself decide at what price and at what time such acquisition shall take place.

Own shares acquired pursuant to this authorisation may only be used for annulment through a reduction of the company’s share capital, pursuant to the Norwegian Public Limited Liability Companies Act section 12-1.

This authorisation shall be valid until the next annual general meeting, but no later than 30 June 2024.”

|

| |

*****

There were no further matters for discussion and the annual general meeting was closed.

Stavanger, 10 May 2023 |

|

|

|

_________[Signed]___________ |

_________[Signed]___________ |

_________[Signed]___________ |

Finn Kinserdal |

Georg Fredrik Rabl |

Fride Seljevold Methi |

Appendix 1: Overview of shares represented at the annual general meeting, either by personal or digital attendance, by proxy, or by advance voting.

Appendix 2: The voting results for the individual items.

Attendance Summary report

Equinor ASA |

|

|

|

|

AGM |

|

|

|

|

10 May 2023 |

|

|

|

|

|

|

|

|

|

Registered Attendees: |

59 |

|

|

|

Total Votes Represented: |

2,477,420,547 |

|

|

|

Total Accounts Represented: |

3,260 |

|

|

|

|

|

|

|

|

Total Voting Capital: |

3,111,049,146 |

|

|

|

% Total Voting Capital Represented: |

79.63% |

|

|

|

Total Capital: |

3,175,470,159 |

|

|

|

% Total Capital Represented: |

78.02% |

|

|

|

Company Own Shares: |

64,421,013 |

|

|

|

|

|

|

|

|

Sub Total: |

59 |

0 |

2,477,420,547 |

|

Capacity |

Registered Attendees |

Registered Non-Voting Attendees |

Registered Votes |

Accounts |

Shareholder |

26 |

0 |

2,127,682,631 |

26 |

Shareholder (web) |

28 |

0 |

26,787 |

28 |

3rd Party Proxy |

2 |

0 |

7,832 |

4 |

Chair of the Board WITH PROXY |

1 |

0 |

3,387,690 |

456 |

Chair of the Board WITH INSTRUCTIONS |

1 |

0 |

235,170,939 |

2448 |

ADVANCE VOTES |

1 |

0 |

111,144,668 |

297 |

Registrar for the company: |

DNB Bank ASA |

|

_______________________________ |

Signature company: |

EQUINOR ASA |

|

_______________________________ |

EQUINOR ASA GENERAL MEETING 10 MAY 2023

As scrutineer appointed for the purpose of the Poll taken at the General Meeting of the Members of the Company held on 10 May 2023, I HEREBY CERTIFY that the result of the Poll is correctly set out as follows:-

| Issued voting shares: 3,111,049,146 |

|

VOTES

FOR / FOR |

% |

VOTES

MOT / AGAINST |

% |

VOTES

AVSTÅR / ABSTAIN |

VOTES

TOTAL |

% ISSUED VOTING SHARES VOTED |

NO VOTES IN MEETING |

3 |

2,476,994,520 |

100.00 |

18,488 |

0.00 |

288,448 |

2,477,301,456 |

79.63% |

119,091 |

4 |

2,477,021,354 |

100.00 |

16,186 |

0.00 |

274,065 |

2,477,311,605 |

79.63% |

108,942 |

5 |

2,477,017,113 |

100.00 |

15,850 |

0.00 |

278,642 |

2,477,311,605 |

79.63% |

108,942 |

6 |

2,466,707,645 |

99.61 |

9,544,525 |

0.39 |

1,062,376 |

2,477,314,546 |

79.63% |

106,001 |

7 |

2,475,753,559 |

100.00 |

58,615 |

0.00 |

1,502,372 |

2,477,314,546 |

79.63% |

106,001 |

8 |

5,426,824 |

0.22 |

2,464,972,960 |

99.78 |

6,914,769 |

2,477,314,553 |

79.63% |

105,994 |

9 |

88,014,856 |

3.57 |

2,376,259,889 |

96.43 |

13,041,138 |

2,477,315,883 |

79.63% |

104,664 |

10 |

7,734,891 |

0.31 |

2,462,198,694 |

99.69 |

7,381,368 |

2,477,314,953 |

79.63% |

105,594 |

11 |

4,832,697 |

0.20 |

2,462,511,159 |

99.80 |

9,967,919 |

2,477,311,775 |

79.63% |

108,772 |

12 |

8,681,345 |

0.35 |

2,461,210,441 |

99.65 |

7,422,971 |

2,477,314,757 |

79.63% |

105,790 |

13 |

9,590,822 |

0.39 |

2,460,308,550 |

99.61 |

7,415,160 |

2,477,314,532 |

79.63% |

106,015 |

14 |

9,673,614 |

0.39 |

2,460,220,393 |

99.61 |

7,420,525 |

2,477,314,532 |

79.63% |

106,015 |

15 |

2,476,629,098 |

99.99 |

359,116 |

0.01 |

325,745 |

2,477,313,959 |

79.63% |

106,588 |

16.1 |

2,437,143,525 |

98.99 |

24,841,385 |

1.01 |

15,329,214 |

2,477,314,124 |

79.63% |

106,423 |

16.2 |

2,441,575,788 |

99.15 |

20,832,274 |

0.85 |

14,898,463 |

2,477,306,525 |

79.63% |

114,022 |

17 |

2,475,316,999 |

99.99 |

152,124 |

0.01 |

1,838,350 |

2,477,307,473 |

79.63% |

113,074 |

18 |

2,476,901,955 |

100.00 |

79,928 |

0.00 |

321,867 |

2,477,303,750 |

79.63% |

116,797 |

19 |

2,476,900,253 |

100.00 |

87,913 |

0.00 |

323,018 |

2,477,311,184 |

79.63% |

109,363 |

20 |

2,461,709,738 |

99.78 |

5,462,799 |

0.22 |

10,141,422 |

2,477,313,959 |

79.63% |

106,588 |

21 |

2,476,985,614 |

100.00 |

50,743 |

0.00 |

277,602 |

2,477,313,959 |

79.63% |

106,588 |

22 |

2,471,042,818 |

99.76 |

6,002,075 |

0.24 |

269,231 |

2,477,314,124 |

79.63% |

106,423 |

Registrar for the company: |

DNB Bank ASA |

|

[Signed]___________________________ |

Signature company: |

EQUINOR ASA |

|

[Signed]________________________ |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

EQUINOR ASA

(Registrant)

|

Dated: May 10, 2023 |

By: |

___/s/ Torgrim Reitan

Name: Torgrim Reitan

Title: Chief Financial Officer |

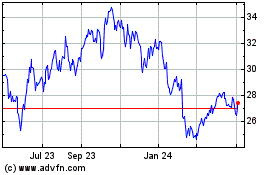

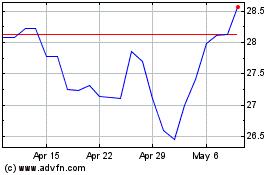

Equinor ASA (NYSE:EQNR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Equinor ASA (NYSE:EQNR)

Historical Stock Chart

From Apr 2023 to Apr 2024