Equinor Earnings Weighed by Impairments, Writedowns -- Earnings Review

February 10 2021 - 9:33AM

Dow Jones News

By Dominic Chopping

Equinor ASA reported results for the fourth quarter on

Wednesday. Here's what we watched:

NET INCOME: Equinor reported a net loss of $2.42 billion

compared with a loss of $236 million a year earlier and a $512

million profit expected in a FactSet poll.

Earnings for the quarter were weighed by impairments of $1.30

billion related to U.S. assets held for sale and a previously

announced writedown of $982 million at its Tanzania LNG

project.

REVENUE: Revenue fell 20% to $11.88 billion versus $12.74

billion expected.

WHAT WE WATCHED:

ASSET SALE: Equinor said it is selling U.S. onshore assets for

$900 million. The company said it has agreed to divest its

interests in the Bakken field in North Dakota and Montana to

Grayson Mill Energy, backed by EnCap Investments.

PRODUCTION: Equinor delivered total equity production of 2.043

million barrels of oil equivalent a day in the quarter, down from

2.198 million barrels a day for the same quarter of the prior

year.

GUIDANCE: Organic capital expenditure is estimated at an annual

average of $9 billion-$10 billion for 2021-22 while production for

2021 is estimated to be around 2% above 2020 levels.

Exploration activity in 2021 is seen at around $0.9 billion and

it still expects to deliver average annual production growth of

around 3% from 2019 to 2026.

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

February 10, 2021 09:18 ET (14:18 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

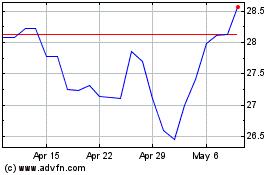

Equinor ASA (NYSE:EQNR)

Historical Stock Chart

From Mar 2024 to Apr 2024

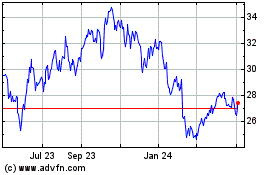

Equinor ASA (NYSE:EQNR)

Historical Stock Chart

From Apr 2023 to Apr 2024