Hot Housing Market Drives Overall Consumer Debt Higher Ahead of New Mortgage Stress Test

June 08 2021 - 5:00AM

While most consumers are ratcheting back on their credit card debt,

homebuyers have pushed new mortgage volumes to unprecedented levels

according to Equifax Canada’s most recent report on consumer credit

conditions. New mortgages are up 41.2 per cent in Q1 compared to Q1

2020 and the average limit on new mortgages grew by 20.5 per cent

to $326,930.

Overall consumer debt now stands at $2.08 trillion, up 0.62 per

cent from last quarter and up 4.78 per cent from Q1 2020. Much of

the new mortgage growth adding to the overall debt was driven by

B.C. and Ontario, which saw jumps of 59.2 per cent and 44.3 per

cent in volume respectively compared to Q1 2020.

“Low interest rates and speculation around U.S. inflation

impacting our interest rates has fueled mortgage volumes as

consumers fear future interest rate hikes,” said Rebecca Oakes, AVP

of Advanced Analytics at Equifax Canada. “Competition among

homebuyers is fierce in many markets across the country. We’ll

monitor whether the new mortgage stress test helps to cool off the

hot housing market.”

The Office of the Superintendent of Financial Institutions

(OSFI) introduced new mortgage stress test criteria in June to set

the qualifying rate on uninsured mortgages at a contracted rate

plus two percentage points or 5.25 per cent, whichever is higher,

which will limit the purchasing capacity of a lot of buyers and

might help slow down the overheated mortgage market.

Credit card debt plummets to a new low, reaching 2015

levels

Despite the increased activity in the housing market, most

Canadians are living more frugally as credit card debt has

continuously declined since the pandemic began. Credit card debt is

now at its lowest level in six years as consumers are paying off

debts more than they are spending. On average, credit card balances

dropped by 9.9 per cent in Q1 of this year compared to last year

and by 4.2 per cent compared to the last quarter of 2020.

“Lower interest rates, multiple lockdowns and higher

unemployment rates have led to changes in consumer behaviour, which

has slowed overall credit card growth during the pandemic,” said

Oakes. “While deferral programs have come to an end for most

consumers, government incentives are still in place, which has

helped consumers in paying down their credit card debt.”

The number of cards per consumer has been on a downward

trajectory since 2016. Consumers are moving away from multiple

cards and being more careful with their credit. Younger consumers

who are more likely to miss payments on credit cards have also seen

a drop in their spend-to-payment ratio. Likewise, Gen Z has managed

to reverse this ratio and are also paying off their credit card

debt.

The average consumer debt (excluding mortgages) dropped again

this quarter to $20,430, which is a year-over-year decrease of 4.2

per cent from Q1 2020.

Delinquencies continue to decline

Non-mortgage delinquencies saw a year-over-year decline of 21.8

per cent and a quarter-over-quarter decline of 4.0 per cent with

credit cards and non-bank auto loans showing the biggest drop.

The 90+ day mortgage delinquency rate dropped by 19.0 per cent

compared to Q1 2020 and by 7.4 per cent versus Q4 2020. Mortgage

delinquency rates are at an all-time low, but there are some

variations across cities and provinces. Most provinces and cities

have shown a decline in mortgage delinquencies except for Vancouver

and Fort McMurray. Vancouver showed a 14.6 per cent increase in the

90+ day mortgage delinquency rate compared to Q1 2020, while Fort

McMurray showed the biggest spike with a 38.0 per cent increase

compared to the previous year.

“The road to recovery continues to be uneven with non-mortgage

delinquency rates among younger consumers (under 35) on the rise

since last quarter, but older consumers have managed to keep their

non-mortgage delinquencies at lower levels,” added Oakes.

“Successful vaccine rollouts will be the critical factor in opening

up the economy, which will have a big impact on consumer spending

and debt management. Canadians should be preparing themselves for a

point in time, which will likely come in this calendar year, when

governments begin to rein in support mechanisms.”

Debt (excluding mortgages) & Delinquency

Rates

|

Age |

Average Debt (Q1

2021) |

Average Debt

ChangeYear-over-Year(Q1 2021 vs.

Q1 2020) |

Delinquency Rate(Q1 2021) |

Delinquency Rate

ChangeYear-over-Year(Q1 2021 vs.

Q1 2020) |

|

18-25 |

$8,476 |

-0.89 |

% |

1.42 |

% |

-24.29 |

% |

|

26-35 |

$16,369 |

-2.07 |

% |

1.49 |

% |

-21.06 |

% |

|

36-45 |

$24,219 |

-4.53 |

% |

1.18 |

% |

-23.72 |

% |

|

46-55 |

$30,578 |

-4.64 |

% |

0.89 |

% |

-22.15 |

% |

|

56-65 |

$25,875 |

-5.17 |

% |

0.79 |

% |

-20.18 |

% |

|

65+ |

$14,336 |

-4.67 |

% |

0.90 |

% |

-20.69 |

% |

|

Canada |

$20,430 |

-4.25 |

% |

1.04 |

% |

-21.85 |

% |

Major City Analysis – Debt (excluding

mortgages) & Delinquency Rates

|

City |

Average Debt(Q1 2021) |

Average Debt

ChangeYear-over-Year(Q1 2021 vs.

Q1 2020) |

Delinquency Rate(Q1 2021) |

Delinquency Rate

ChangeYear-over-Year(Q1 2021 vs.

Q1 2020) |

|

Calgary |

$25,295 |

-4.24 |

% |

1.31 |

% |

-17.02 |

% |

|

Edmonton |

$24,537 |

-4.24 |

% |

1.54 |

% |

-13.75 |

% |

|

Halifax |

$21,177 |

-4.48 |

% |

1.21 |

% |

-24.46 |

% |

|

Montreal |

$15,236 |

-5.02 |

% |

0.93 |

% |

-32.87 |

% |

|

Ottawa |

$17,970 |

-6.18 |

% |

0.96 |

% |

-18.82 |

% |

|

Toronto |

$19,020 |

-2.87 |

% |

1.26 |

% |

-17.69 |

% |

|

Vancouver |

$21,661 |

-2.95 |

% |

0.78 |

% |

-19.38 |

% |

|

St. John's |

$23,703 |

-2.95 |

% |

1.39 |

% |

-19.12 |

% |

|

Fort McMurray |

$37,757 |

-1.63 |

% |

1.71 |

% |

-17.01 |

% |

Province Analysis - Debt (excluding mortgages)

& Delinquency Rates

|

Province |

Average Debt(Q1 2021) |

Average Debt

ChangeYear-over-Year(Q1 2021 vs.

Q1 2020) |

Delinquency Rate(Q1 2021) |

Delinquency Rate

ChangeYear-over-Year(Q1 2021 vs.

Q1 2020) |

|

Ontario |

$20,295 |

-4.23 |

% |

1.00 |

% |

-19.99 |

% |

|

Quebec |

$17,566 |

-5.33 |

% |

0.71 |

% |

-35.95 |

% |

|

Nova Scotia |

$20,992 |

-3.22 |

% |

1.36 |

% |

-25.19 |

% |

|

New Brunswick |

$22,297 |

-3.66 |

% |

1.48 |

% |

-21.38 |

% |

|

PEI |

$21,826 |

-1.31 |

% |

1.03 |

% |

-17.11 |

% |

|

Newfoundland |

$22,919 |

-1.36 |

% |

1.43 |

% |

-21.22 |

% |

|

Eastern Region |

$21,868 |

-2.83 |

% |

1.39 |

% |

-22.69 |

% |

|

Alberta |

$25,404 |

-4.06 |

% |

1.46 |

% |

-14.02 |

% |

|

Manitoba |

$16,896 |

-4.52 |

% |

1.18 |

% |

-25.36 |

% |

|

Saskatchewan |

$22,677 |

-3.04 |

% |

1.36 |

% |

-19.23 |

% |

|

British Columbia |

$21,119 |

-3.20 |

% |

0.90 |

% |

-19.59 |

% |

|

Western Region |

$22,355 |

-3.68 |

% |

1.19 |

% |

-17.52 |

% |

|

Canada |

$20,430 |

-4.25 |

% |

1.04 |

% |

-21.85 |

% |

* Based on Equifax data for Q1 2021

About EquifaxAt Equifax (NYSE: EFX), we believe

knowledge drives progress. As a global data, analytics, and

technology company, we play an essential role in the global economy

by helping financial institutions, companies, employees, and

government agencies make critical decisions with greater

confidence. Our unique blend of differentiated data, analytics, and

cloud technology drives insights to power decisions to move people

forward. Headquartered in Atlanta and supported by more than 11,000

employees worldwide, Equifax operates or has investments in 25

countries in North America, Central and South America, Europe, and

the Asia Pacific region. For more information,

visit Equifax.ca and follow the company’s news on

LinkedIn.

|

Contact: |

|

|

Andrew Findlater |

Tom Carroll |

|

SELECT Public Relations |

Equifax Canada Media Relations |

|

afindlater@selectpr.ca |

MediaRelationsCanada@equifax.com |

|

(647) 444-1197 |

|

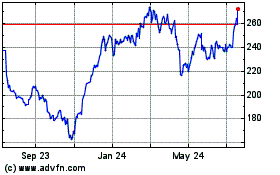

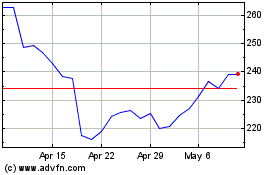

Equifax (NYSE:EFX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Equifax (NYSE:EFX)

Historical Stock Chart

From Apr 2023 to Apr 2024