Equifax Canada continues to support consumers, launches COVID + Credit Resource Centre

June 03 2020 - 6:00AM

Equifax Canada has created a COVID + Credit Resource Centre to help

consumers better understand how the pandemic may be impacting their

finances and credit. The Centre provides insights on managing

finances and steps to mitigate any negative impact on their credit

during these difficult times. Consumers concerned about deferred

payments and the potential impact on their credit scores will also

be able to find guidance and helpful information.

Specifically, consumers concerned about deferred

payments and their credit standing can refer to these resource

articles:

- Deferred payments and your credit report

- COVID + credit: your questions answered

- How to spot deferred payments on your credit report

- What factors impact my credit scores?

- What information is in a credit report?

- What is a consumer statement and should I have one?

“We recognize that the pandemic has led to widespread

uncertainty for millions of Canadians, leaving them struggling to

keep up with their bills and overwhelmed by financial decisions,”

said Carrie Russell, President of Equifax Canada. “We are committed

to helping all Canadians build credit confidence, no matter their

circumstances. Our resources help provide answers for the people

who need them."

“To ensure information is being accurately reported, it's

important for consumers to check their credit reports regularly -

especially after a deferred payment agreement has been reached with

their lenders.”

Equifax Canada recognizes the hardships people are facing and

continues to work with industry stakeholders to define data

reporting specifications, which strive to achieve these key

objectives:

- Helping to minimize negative impacts of deferred payment

programs on borrowers’ (consumer and business)

creditworthiness

- Offering support to data furnishers who may have a limited

ability to report account deferral data in accordance with the

existing reporting specifications for standard reporting of

deferrals

- Fair and accurate credit reporting practices in accordance with

regulatory requirements

- Consistent data reporting and processing by both Equifax and

TransUnion

Credit bureaus use different sources for collecting information,

and not all third parties report to both credit bureaus. This means

that the credit reports belonging to a consumer may contain

different information. It is important to regularly check credit

reports to help better understand your current credit position and

detect any inaccurate or incomplete information. Consumers

can currently obtain their free Equifax Canada credit report

instantly via the company’s website:

https://www.consumer.equifax.ca/personal/products/credit-report/.

About EquifaxEquifax is a global information

solutions company that uses unique data, innovative analytics,

technology and industry expertise to power organizations and

individuals around the world by transforming knowledge into

insights that help make more informed business and personal

decisions. Headquartered in Atlanta, Ga., Equifax operates or has

investments in 24 countries in North America, Central and South

America, Europe and the Asia Pacific region. It is a member of

Standard & Poor's (S&P) 500® Index, and its common stock is

traded on the New York Stock Exchange (NYSE) under the symbol EFX.

Equifax employs approximately 11,000 employees worldwide. For more

information, visit Equifax.ca and follow the company’s news on

LinkedIn.

Media Contacts:

| Andrew FindlaterSELECT Public

Relationsafindlater@selectpr.ca(416) 659-1197 |

Tom CarrollEquifax CanadaMediaRelationsCanada@equifax.com (416)

227-5290 |

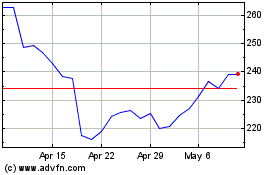

Equifax (NYSE:EFX)

Historical Stock Chart

From Mar 2024 to Apr 2024

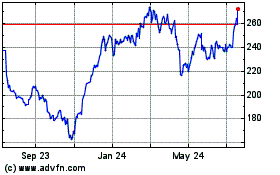

Equifax (NYSE:EFX)

Historical Stock Chart

From Apr 2023 to Apr 2024