Hedge Fund D.E. Shaw Pushes Emerson to Cut Costs, Break Up

October 15 2019 - 11:37AM

Dow Jones News

By Micah Maidenberg

D.E. Shaw Group wants Emerson Electric Co. (EMR) to reduce

expenses and split the industrial conglomerate into two, as the

company's returns have trailed those offered by peers and key

benchmarks.

Emerson has a poor record on spending, capital allocation and

governance issues, among other problems, according to a letter D.E.

Shaw sent to the company's board and released Tuesday.

"We believe that Emerson has the assets and businesses to be a

great company with a premium valuation, but the management team and

board have let shareholders down," D.E. Shaw said in its letter,

adding that it currently owns more than 1% of Emerson's stock.

Shares of Emerson rose about 2% to $68.28 in morning trading

Tuesday.

Based in St. Louis, Emerson develops a wide range of products,

operating a business focused on industrial-automation technology

and another focused on climate controls, like thermostats and

residential heating and cooling systems.

The company will evaluate proposals from D.E. Shaw, Emerson's

lead independent director, Clemens A.H. Boersig, said in a

statement Tuesday. The company has a strong record of operational

excellence and delivering returns to shareholders, the statement

said.

The investor wants Emerson to separate into two companies, with

one focused on automation and the other offering climate

technologies, according to D.E. Shaw's letter.

Emerson said earlier this month its board was leading a review

of the company's operations, approach to capital allocation and

other matters.

Total returns offered by Emerson shares have underperformed

peers by 45% over the last five years and the S&P 500 Index by

47%, D.E. Shaw said in the letter.

Emerson could save $1 billion annually through cost reductions

and efficiency gains, mostly within its automation business and

corporate headquarters, the investor said.

For example, D.E. Shaw said it believes Emerson could save $200

million by downsizing the company's aviation department, which

includes eight aircraft and a helicopter, and by reducing "excess"

corporate general and administrative costs, among other changes,

according to a presentation the investor also released Tuesday.

Other savings could come from consolidating manufacturing sites

and bolstering productivity among the company's salesforce, D.E.

Shaw said.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

October 15, 2019 11:22 ET (15:22 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

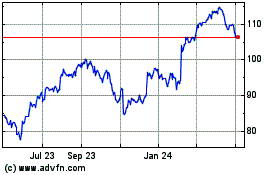

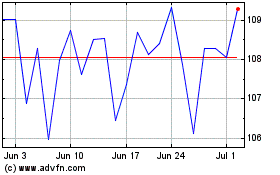

Emerson Electric (NYSE:EMR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Emerson Electric (NYSE:EMR)

Historical Stock Chart

From Apr 2023 to Apr 2024