By Elizabeth Koh

SEOUL -- Contract-manufacturing companies working to accelerate

the global availability of Covid-19 vaccines are struggling with a

shortage of their own: There aren't enough workers to meet this

year's big production push.

The talent pool is so tight that Emergent BioSolutions Inc., a

Covid-19 contractor based in Gaithersburg, Md., for AstraZeneca PLC

and Johnson & Johnson, enlisted its CEO and a half-dozen other

senior executives to pitch potential hires at a virtual career fair

in October. More than 550 people attended.

Not enough of them were swayed. More than two months later,

Emergent still has roughly 200 openings for warehouse associates,

quality-assurance analysts and even a supply-chain management

director. "Hiring and ramping up has become challenging," said Sean

Kirk, an Emergent executive vice president, who spoke at the

event.

Outsourcing companies such as Emergent make about one-sixth of

complex treatments including vaccines, but the scale and abruptness

of Covid-19 shots is likely to boost that share much higher, say

industry executives and experts. With demand dwarfing supply,

Pfizer Inc., Moderna Inc. and others are turning to contract

manufacturers for assistance in what is the largest pharmaceutical

rollout in modern history.

But those helping drugmakers need more help themselves. More

than 5,000 open jobs exist at the world's 10 largest companies that

have won Covid-19 outsourcing work, according to a Wall Street

Journal analysis of the companies' websites. The firms were ranked

by production capacity.

The labor crunch is another potential drag on a global vaccine

rollout already facing a supply backlog and requiring near-flawless

logistics. Many contract manufacturers are trying to fill roles

that often require years of experience in pharmaceutical

manufacturing or biotechnology-related degrees. They are also

struggling to hire workers willing to work overnight shifts, as

production goes round-the-clock. The jobs are likely to be

permanent.

"We are truly in unprecedented territory because of the

world-wide demand outstripping supply," said Rena Conti, a Boston

University business professor who studies biopharmaceutical supply

chains.

Many contract manufacturers were already staffing up before the

pandemic. Demand has soared for niche production of complex

medications treating diseases such as breast cancer or rheumatoid

arthritis, taken by a minority of the population. But Covid-19

vaccines have created a massive new product category where the

potential market is every person on Earth.

"I'm hard pressed to think of another event where we saw such

rapid expansion," said Gil Roth, president of the Pharma &

Biopharma Outsourcing Association, which represents contract

manufacturers in the U.S. and Europe.

World production of Covid-19 vaccines is expected to reach 6

billion doses in 2021, according to industry tracker PharmSource.

Nearly every major pharmaceutical company with a potential vaccine

candidate has enlisted contract manufacturers to help meet

production targets.

BioNTech SE, which developed with Pfizer one of the vaccines

being distributed in the West, has several publicly known deals

with contract manufacturers in Europe. Moderna, which developed

another vaccine used by Western countries, also has tapped several

contractors, including Lonza Group AG, a biopharmaceutical

manufacturing giant that produces the vaccine's key ingredient.

Catalent Inc., one of the largest contract manufacturers in the

U.S., has leaned into unusual recruiting strategies, including ads

on the radio-streaming app, Pandora, targeting people who live near

its manufacturing plants. It offers $3,000 sign-on bonuses for its

manufacturing associates willing to work overnight shifts at its

Madison, Wis., facility.

The company, based in Somerset, N.J., has hundreds of unfilled

jobs, which could directly affect how much extra production it can

allot to Covid-19 vaccines, said Bernie Clark, Catalent's vice

president of marketing and strategy. The company has signed

multiple Covid-19 vaccine contracts, including deals to produce

compounds for Moderna, AstraZeneca and Johnson & Johnson.

"To keep adding capacity and new lines, you have to have the

people to run them," Mr. Clark said.

Lonza, the Swiss contractor, is recruiting dozens of new

employees from quality-assurance managers to engineers at one of

its facilities in Switzerland, which is expected to turn out 300

million doses over the next year. Sweden's Recipharm AB, another

Moderna contractor helping with late-stage production, is hiring

about 65 workers for a plant in France, the company said.

Avid Bioservices Inc., of Tustin, Calif., which has contracts to

make components for multiple vaccine candidates, expects to recruit

about 40 new employees by next summer -- or double a typical year,

said Lorna Larson, the company's senior director in human

resources. Those workers require six months of training, detailing

how Avid handles manufacturing and assists clients. The plan is to

keep the new hires long-term, incorporating them into Avid's staff

of 234 employees, Ms. Larson said.

"The pandemic has just accelerated the fight for talent," she

said. "It really is critical right now -- and there's a lot of

competition for it."

Write to Elizabeth Koh at Elizabeth.Koh@wsj.com

(END) Dow Jones Newswires

January 04, 2021 07:57 ET (12:57 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

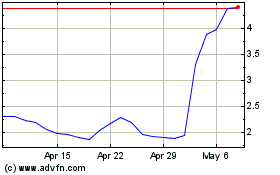

Emergent Biosolutions (NYSE:EBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Emergent Biosolutions (NYSE:EBS)

Historical Stock Chart

From Apr 2023 to Apr 2024