Eli Lilly Earnings, Halted Covid-19 Drug Trial Disappoint Investors

October 27 2020 - 2:37PM

Dow Jones News

By Peter Loftus

Eli Lilly & Co. reported lower-than-expected quarterly

earnings due to pricing pressure on top products, while the

drugmaker said it would proceed with plans to introduce a new

Covid-19 antibody treatment despite a setback in one of several

clinical studies of its uses.

The Indianapolis-based company said it would continue pursuing

U.S. authorization for an antibody drug to treat Covid-19 patients

in the early course of illness and with a mild to moderate version

of the disease. That comes after the National Institute of Allergy

and Infectious Diseases said late Monday that it would close a

study of that drug, named LY-CoV555, being testing in combination

with other treatments. The institute concluded the antibody drug

didn't provide a clinical benefit to hospitalized patients.

Eli Lilly Chief Executive David Ricks said Tuesday that the

halted study doesn't signal significant concerns for LY-CoV555's

safety. "We've learned antibodies are more likely to work early in

the disease and are less likely to be effective in later stages of

the disease," he said in an interview after the company reported

its third-quarter results.

A separate study had shown that the antibody drug reduced

hospitalization rates in people with mild to moderate Covid-19, and

this is the basis for Lilly's request for U.S. regulators to

authorize its use. Eli Lilly plans to continue testing the drug in

other studies, in patients early in the course of their disease,

and in people at risk of infection including staff and residents at

nursing homes.

Lilly shares dropped 5.6% to $133.73 in recent trading Tuesday,

which analysts attributed to investor disappointment in the

antibody study as well as third-quarter results that missed

expectations. The company lowered its profit guidance for 2020,

though it projected continued recovery in the health-care sector

despite the continuing pandemic.

The company said it expects new prescriptions for patients to

continue to recover in the U.S. Company executives also expect

general health-care activity to accelerate following a slump

earlier in the pandemic as providers shift to telehealth.

Jared Holtz, a health-care equity strategist at financial

services firm Jefferies, called the quarterly results slightly

disappointing and said the setback for the Covid-19 antibody drug

makes Lilly a less formidable player in the hunt for

treatments.

The study that the NIAID halted was testing whether adding

LY-CoV555 to standard treatment -- including the antiviral drug

remdesivir -- would improve outcomes in hospitalized Covid-19

patients versus standard treatment alone. The study was designed to

isolate the effect of the Lilly antibody.

Enrollment in the study of the drug combination had been paused

earlier this month over a potential safety concern stemming from a

difference in the clinical status between Covid-19 patients who

received the Lilly drug and those who got a placebo. An independent

board overseeing the trial that identified the disparity later said

it found no significant differences in safety outcomes between

those two sets of patients. The board instead decided to recommend

that no more trial participants be given the Lilly drug because of

"lack of clinical benefit" in hospitalized patients, according to

the NIAID.

The company Tuesday reported a third-quarter profit decline to

$1.21 billion, or $1.33 a share, from $1.25 billion, or $1.37 a

share, in the same three-month period a year earlier. On an

adjusted basis excluding certain items, Eli Lilly's profit was

$1.54 a share. Analysts polled by FactSet had forecast an adjusted

profit of $1.71 a share.

Revenue rose 5% to $5.74 billion from $5.48 billion a year

earlier, but short of the analysts' forecast of $5.88 billion.

The revenue shortfall came primarily from lower-than-expected

sales of Lilly's top drug, the diabetes treatment Trulicity. Lilly

said that although it made modest list-price increases in the U.S.,

it had lower realized prices due to changes in its estimates of

rebates and discounts for the drug. As a result, sales growth was

lower than prescription volume growth.

Overall, lower realized prices reduced sales growth by five

percentage points for the quarter, Lilly said.

--Matt Grossman contributed to this article.

Write to Peter Loftus at peter.loftus@wsj.com

(END) Dow Jones Newswires

October 27, 2020 14:22 ET (18:22 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

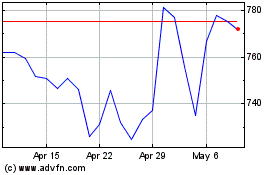

Eli Lilly (NYSE:LLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Eli Lilly (NYSE:LLY)

Historical Stock Chart

From Apr 2023 to Apr 2024