Additional Proxy Soliciting Materials (definitive) (defa14a)

March 28 2023 - 4:20PM

Edgar (US Regulatory)

Edwards Lifesciences Spring 2023 Stockholder Engagement

Cautionary Statement and Use of Non-GAAP Financial Measures 2 This presentation may include forward-looking statements, including, but not limited to, financial forecasts, that involve risks and uncertainties that could cause actual results or experience to differ materially from historical results or those anticipated. Actual future results may differ materially depending on a variety of factors, including, but not limited to, the effects of the COVID-19 pandemic, technological advances in the medical field, foreign currency exchange rates, product demand and market acceptance, the impact of competitive products and pricing, the effect of economic conditions, and other risks detailed in Edwards Lifesciences' filings with the Securities and Exchange Commission. All forward-looking statements are based on estimates and assumptions made by management of the Company as of the date of publication. Unless otherwise indicated, all figures are GAAP financial measures A reconciliation of non-GAAP historical financial measures to the most comparable GAAP measure is available at www.edwards.com The Company is not able to provide a reconciliation of future projections that exclude special items to expected reported results due to the unknown effect, timing and potential significance of special charges or gains, and management’s inability to forecast charges associated with future transactions and initiatives

We Request Your Support at the 2023 Annual Meeting of Stockholders 3 Proposal 1. FOR Election of Nine Director Nominees Proposal 2. FOR Advisory Vote to Approve Named Executive Officer Compensation Proposal 3. ONE YEAR Advisory Vote to Approve Frequency of Future Advisory Votes on Named Executive Officer Compensation Proposal 4. FOR Ratification of Appointment of Independent Registered Public Accounting Firm Proposal 5. FOR Approval of Amendment of the Certificate of Incorporation to Provide for Exculpation of Officers Proposal 6. AGAINST Stockholder Proposal Regarding Independent Board Chairman The Board asks that you vote FOR all proposals, except one that is viewed as AGAINST stockholder interests

Our Credo We will celebrate our successes, thrive on discovery, and continually expand our boundaries. We will act boldly, decisively, and with determination on behalf of people fighting cardiovascular disease. At Edwards Lifesciences, we are dedicated to providing innovative solutions for people fighting cardiovascular disease. Through our actions, we will become trusted partners with customers, colleagues, and patients – creating a community unified in its mission to improve the quality of life around the world. Our results will benefit customers, patients, employees and shareholders. 4

Edwards Lifesciences at a Glance 5 COMPANY OVERVIEW 800K+ Patients Treated with Transcatheter Therapies 85%+ Charitable employee engagement ~95% Sales from Products with #1 Global Position PATIENT-FOCUSED INNOVATION STRATEGY Lead groundbreaking standards of care through trusted relationships Leadership Singular focus on the large unmet needs of structural heart and critically ill patients Focus Pioneer breakthrough technologies with compelling evidence Innovation Create Meaningful Value by Transforming Patient Care 60%+ Millennials and Generation Z 17,000+ Global Employees 2,000+ Engineers Investment in R&D 17-18% of 2022E sales 7 Manufacturing Locations Around the World Resilient Supply Chain

Edwards Lifesciences SPSIHE S&P 500 Edwards’ Patient-Focused Innovation Strategy has Produced Sustained Sales Growth 6 $1.9 $2.0 $2.3 $2.5 $3.0 $3.4 $3.7 $4.3 $4.4 $5.2 $5.4 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023E Edwards Sales ($ in billions) $5.6 - $6.0(1) Focused on opportunities where patient demand is very large Track record of triple wins: • Improved outcomes • Enhanced quality of life • Cost effectiveness Long-term investments have yielded high-value, organic growth Edwards Sales ($ in billions) 2012-2022 Total Shareholder Return(2) 1 Guidance as of January 31, 2023 2 Capital IQ, reflecting performance from January 3, 2012 through December 30, 2022; 3 S&P Healthcare Equipment Select Industry Index (3) 522% 201% 303%

CEO Pay Element Components Corporate Performance Measures & Rationale Base Salary Cash Attract and retain qualified executives Annual Cash Incentive(1) Corporate Financial Measurement Based on underlying revenue growth, adjusted earnings per share, and adjusted free cash flow targets set at the beginning of the year Key Operating Drivers (“KODs”) KODs established by the Board each year to address specific business initiatives derived from our Strategic Imperatives and operating plans Actual achievement is measured against a number of different metrics and milestones Individual Performance Individual objectives focus on the achievement of financial measures and operational goals within each executive’s area of responsibility Long-Term Incentive Awards Stock Options (55%) Consistent with our focus on top-line growth, innovation and longer-term investment horizon and product pipeline Restricted Stock Units (20%) Promotes stability and retention of our executives over the long term Performance Based Restricted Stock Units (25%) Awards are contingent on relative total shareholder return (“TSR”) performance measured against a subset of the S&P Healthcare Equipment Select Industry Index Links compensation to our performance over a three-year period 20% 16% 35% 16% 13% 8% 13% 43% 20% 16% Compensation Design Informed by Strategy and Aligned with Key Performance Indicators 7 1 Incentive plan funding is determined by the Corporate Financial Measurement, subject to maximum funding at 175% of target, and KOD achievement, subject to maximum funding at 150% of target; individual payouts are further modified by individual performance and are capped at 200% of target 2022 CEO Target Pay Mix 92% at-risk pay 80% at-risk pay 2022 NEO Target Pay Mix Base Salary Annual Cash Incentive Stock Options PBRSUs RSUs

33% 56% 11% Tenure 33.3% 66.7% Gender Men Women Refreshed Board with a Thoughtful Leadership Structure 8 Michael A. Mussallem(1) Joined in 2000 Non-executive Chairman, Edwards Lifesciences Bernard J. Zovighian(2) 2023 Nominee CEO, Edwards Lifesciences Medical Technology Industry Experience International Executive Experience Corporate Governance Risk Management Risk Oversight Senior Leadership Innovation and Technology Corporate Responsibility Operations Management Corporate StrategyIT and Cybersecurity Regulatory and Compliance DIVERSE RANGE OF QUALIFICATIONS AND SKILLS 33.3% 33.3% 33.3% Age <5 years 5-10 years >10 years ≤60 years 61-69 years ≥70 years BALANCED AND DIVERSE BOARD 22% 78% Ethnic/Racial Diversity Ethnically/Racially Diverse Caucasian Human Capital Resources Financial Reporting Finance and Financial Industry Martha H. Marsh Lead Independent Director Joined in 2015 Retired President and CEO, Stanford Hospital & Clinics Kieran T. Gallahue Joined in 2015 Former Chairman and CEO, CareFusion Corporation Leslie S. Heisz Audit Committee Chair Joined in 2016 Former Managing Director, Lazard Frères & Co. Paul A. LaViolette Joined in 2020 Managing Partner, COO, SV Health Investors LLC Steven R. Loranger Joined in 2016 Former Chairman, President and CEO, ITT Corporation Ramona Sequeira Joined in 2020 President of US Business Unit and Global Portfolio Commercialization, Takeda Pharmaceuticals USA, Inc. Nicholas J. Valeriani Compensation & Governance Committee Chair Joined in 2014 Former CEO, West Health; Former EVP, Johnson & Johnson 1 As previously disclosed, Mr. Mussallem will retire from his position as Chief Executive Officer of Edwards at the Annual Meeting. Accordingly, if elected at the Annual Meeting, Mr. Mussallem will serve as non-executive Chairman of the Board 2 CEO effective as of 2023 Annual Meeting Bernard Zovighian has a strong track record of success, previously leading Edwards’ TMTT business; he has launched breakthrough therapies for patients and developed deep management experience

Board Recommends Vote Against the Proposal Regarding Independent Board Chairman 9 EFFECTIVE INDEPENDENT LEADERSHIP ROBUST LEAD INDEPENDENT DIRECTOR RESPONSIBILITIES Reviews and approves Board meeting agendas, time allotments and information provided to directors Serves as a liaison between the independent directors, the Chairman and other members of management Provides feedback to management from the Board’s executive sessions Coordinates independent directors’ activities, such as calling meetings Provides counsel to the Chairman and the Chief Executive Officer Engages with stockholders and other stakeholders on behalf of the Board Proposes executive sessions, Board meetings, and meetings with individual directors and members of management Collaborates with the Chairman in proposing actions to be taken by the Board • Independent directors should have the flexibility to determine the Company’s leadership structure and not be restricted to a single rigid approach • This year, the Board was able to make the thoughtful, informed decision to separate the CEO and Chair roles that would have been restricted by this proposal • The roles of CEO and Chair will be held by separate individuals • Bernard Zovighian (CEO) • Michael Mussallem (Non-executive Chairman) • Martha Marsh (Lead Independent Director) • Our leadership structure and corporate governance practices provide strong oversight and have been expanded in response to stockholder feedback • Independent directors regularly evaluate the Board’s leadership structure to ensure effective independent oversight and the best interests of stockholders • The Board previously expanded the role of the Presiding Director and, in light of the additional responsibilities, renamed the position Lead Independent Director

10 Commitment to Stockholder Engagement and Responsiveness We have consistently contacted stockholders holding >50% of outstanding stock each year since 2015 to discuss topics of interest with active participation from our Lead Independent Director 20 2 3 20 1 9 20 1 5 DISCUSSION TOPICS Governance features and stockholder rights Board oversight of human capital management and diversity Sustainability efforts and internal oversight processes Compensation program and alignment between pay and long-term performance results Board composition, evaluation, refreshment and leadership structure Formalized and enhanced responsibilities for Lead Independent Director, providing strong independent Board leadership and effective risk oversight Reduction in special meeting threshold from 25% to 15% Elimination of supermajority voting Adoption of majority voting in director elections Adoption of proxy access right Published Sustainability and EHS Reports against established frameworks Set goals related to diversity and Company culture; published EEO-1 data and relevant infographics OUTCOMES

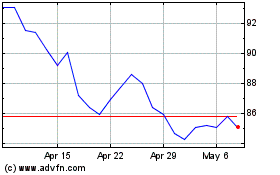

Edwards Lifesciences (NYSE:EW)

Historical Stock Chart

From Mar 2024 to Apr 2024

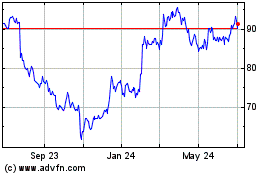

Edwards Lifesciences (NYSE:EW)

Historical Stock Chart

From Apr 2023 to Apr 2024