Amended Statement of Changes in Beneficial Ownership (4/a)

July 30 2020 - 7:47AM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

CONTINENZA JAMES V |

2. Issuer Name and Ticker or Trading Symbol

EASTMAN KODAK CO

[

KODK

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

Executive Chairman and CEO |

|

(Last)

(First)

(Middle)

C/O EASTMAN KODAK COMPANY, 343 STATE STREET |

3. Date of Earliest Transaction

(MM/DD/YYYY)

7/27/2020 |

|

(Street)

ROCHESTER, NY 14650

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

7/29/2020 |

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Stock Option (Right to Buy) | $3.03 | 7/27/2020 | | A | | 981707 | | (1) | 2/19/2026 | Common Stock, par value $.01 | 981707 | $0 | 981707 | D | |

| Stock Option (Right to Buy) | $4.53 | 7/27/2020 | | A | | 298780 | | (1) | 2/19/2026 | Common Stock, par value $.01 | 298780 | $0 | 298780 | D | |

| Stock Option (Right to Buy) | $6.03 | 7/27/2020 | | A | | 298780 | | (1) | 2/19/2026 | Common Stock, par value $.01 | 298780 | $0 | 298780 | D | |

| Stock Option (Right to Buy) | $12 | 7/27/2020 | | A | | 170733 | | (1) | 2/19/2026 | Common Stock, par value $.01 | 170733 | $0 | 170733 | D | |

| Explanation of Responses: |

| (1) | These options were previously reported by Mr. Continenza and the Form 4 is being amended to provide greater detail on the terms of the options. Following the issuance of the Company's 5.00% Secured Convertible Notes due 2021 (the "Notes"), the Board of Directors of the Company desired to protect Mr. Continenza from the economic dilution attributable to the issuance of the Notes, which affected the value of the options granted upon his becoming Executive Chairman of the Company (the "Original Grant"). The options described in this Form 4 were out-of-the-money when granted and have the same exercise prices and term as the Original Grant. The terms of this award described in this Form 4, including the exercise prices, were generally designed to put Mr. Continenza in the same economic position he would have been in had the Notes been repaid instead of converted into common stock. The award described in this Form 4 was unable to be made until additional shares were authorized to be issued under the Company's 2013 Omnibus Incentive Plan, as amended (the "Plan"), which additional shares were not approved by shareholders until May 20, 2020. These options were granted under the Plan in a transaction exempt under Rule 16b-3 and, except as otherwise provided in the award notice, 28.57% of these options vest immediately, with the remaining 71.43% vesting on the conversion of the Company's outstanding 5.00% Secured Convertible Notes due 2021. If the 5.00% Secured Convertible Notes due 2021 are not fully converted, the 71.43% remainder portion of the options will vest on a pro rata basis based on the percentage converted. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

CONTINENZA JAMES V

C/O EASTMAN KODAK COMPANY

343 STATE STREET

ROCHESTER, NY 14650 | X |

| Executive Chairman and CEO |

|

Signatures

|

| /s/ Roger W. Byrd, Attorney-in-fact for James V. Continenza | | 7/29/2020 |

| **Signature of Reporting Person | Date |

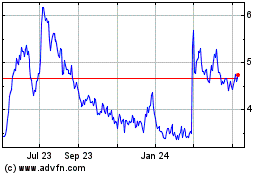

Eastman Kodak (NYSE:KODK)

Historical Stock Chart

From Mar 2024 to Apr 2024

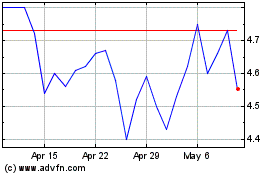

Eastman Kodak (NYSE:KODK)

Historical Stock Chart

From Apr 2023 to Apr 2024