Eagle Materials Inc. (NYSE: EXP) today reported financial

results for the third quarter of fiscal 2020 ended December 31,

2019. Notable items for the quarter are highlighted below (unless

otherwise noted, all comparisons are with the prior year’s fiscal

third quarter):

Third Quarter Fiscal 2020 Results

- Third quarter revenue of $350.2 million, up 5%

- Net loss per diluted share of $2.77, down 323%

- Asset impairments of $224.3 million related to the Oil and Gas

Proppants business were the principal factor contributing to the

net loss for the quarter

- Adjusted earnings per share of $1.51, up 22%

- Adjusted earnings per share is a non-GAAP financial measure

calculated by excluding non-routine items in the manner described

in Attachment 6

- Net loss of $114.6 million, down 299%

- Adjusted EBITDA of $118.7 million, up 6%

- Adjusted EBITDA is a non-GAAP financial measure calculated by

excluding non-routine items in the manner described in Attachment

6

Commenting on the third quarter results, Michael Haack,

President and CEO, said, “We are pleased that during the third

quarter of fiscal 2020 we capitalized on robust underlying demand

across our geographic footprint to achieve a 5% revenue

improvement. Notably, our Cement sales volume was up 7% to a record

1.4 million tons. Market demand for our Wallboard also remained

healthy, with shipments up 2%. Our operational cost-control

initiatives and continued strong operational execution also

contributed to the favorable third-quarter performance.”

Mr. Haack concluded, “The outlook for calendar 2020 is positive.

We expect demand for our building materials and construction

products will continue to be supported by several advantageous

market dynamics, including ongoing growth in jobs, high consumer

confidence and low interest rates.”

As previously announced, on November 25, 2019, Eagle entered

into a definitive agreement with Kosmos Cement Company (a joint

venture between CEMEX S.A.B. de C.V. and Buzzi Unicem S.p.A), to

purchase the Kosmos cement plant in Louisville, Kentucky, as well

as seven distribution terminals and substantial raw-material

reserves. The plant has the capacity to produce nearly 1.7 million

tons of cement annually. Eagle expects that the acquisition will

increase its U.S. annual cement capacity by approximately 25% to

more than 7.5 million tons. The purchase price is $665 million,

subject to customary post-closing adjustments. Eagle expects the

transaction to close in its fiscal 2020 fourth quarter following

the receipt of required regulatory approvals and other typical

closing conditions. Eagle intends to finance the acquisition

through a combination of cash on hand and borrowings under a new

syndicated term loan facility.

Segment Results

Heavy Materials: Cement, Concrete and Aggregates

Revenue in the Heavy Materials sector, which includes Cement,

Concrete and Aggregates, and Joint Venture and intersegment Cement

revenue, was $229.8 million, an 18% increase. Heavy Materials

operating earnings increased 19% to $57.5 million primarily because

of higher sales volume and net sales prices.

Cement revenue, including Joint Venture and intersegment

revenue, was up 12% to $183.0 million, reflecting improved net

sales prices and sales volume. The average net sales price for the

quarter increased 2% to $110.09 per ton. Cement sales volume for

the quarter was a record 1.4 million tons, up 7% versus the prior

year.

Operating earnings from Cement were $54.2 million, 15% above the

same quarter a year ago. The earnings improvement was primarily due

to higher sales volume and net sales prices.

Concrete and Aggregates revenue for the third quarter was $46.8

million, an increase of 53%. Third quarter operating earnings were

$3.3 million, a 222% increase, reflecting record Concrete sales

volume, improved Concrete and Aggregates sales prices and the

financial results of a small concrete and aggregates business that

Eagle acquired in August 2019.

Light Materials: Gypsum Wallboard and Paperboard

Revenue in the Light Materials sector, which includes Gypsum

Wallboard and Paperboard, declined 4% from the prior year, as

improved sales volume was offset by lower pricing. Gypsum Wallboard

sales volume was 669 million square feet (MMSF), up approximately

2%, while the average Gypsum Wallboard net sales price declined 8%

to $146.46 per MSF.

Paperboard sales volume for the quarter was up 8%. The average

Paperboard net sales price this quarter was $460.65 per ton, down

11%, primarily as a result of the pricing provisions in our

long-term sales agreements.

Operating earnings were $47.5 million in the sector, a decline

of 7%, due primarily to lower net sales prices and increased costs

associated with the plant expansion partially offset by improved

sales volume and lower operating costs. Operating costs during the

quarter declined primarily due to lower energy and recycled fiber

costs. In connection with the planned expansion of our papermill,

we had an extended outage during the quarter to install new

operating equipment. This outage reduced production and led to

increased costs of approximately $1.5 million during the

quarter.

Oil and Gas Proppants

Revenue in the Oil and Gas Proppants segment was $7.3 million,

down 48%, primarily reflecting a 45% decrease in Frac Sand sales

volume. The operating loss of $6.8 million during the quarter

included $3.4 million of depreciation, depletion and

amortization.

During the second half of calendar year 2019, our Frac Sand

business has been increasingly affected by a combination of reduced

drilling and completion activity and increased use of local

in-basin sand by oil field service companies and other customers

instead of northern white frac sand. These trends are expected to

continue in the near term. Consequently, in connection with the

preparation of our financial statements for the third quarter of

fiscal 2020, we recorded impairments of $217 million for long-lived

assets and $7 million of other assets.

Planned Separation of Heavy Materials and Light Materials

Businesses

As previously announced on May 30, 2019, the Company plans to

separate its Heavy Materials and Light Materials businesses into

two independent, publicly traded corporations by means of a

tax-free spin-off to Eagle shareholders. We anticipate that the

separation will be completed in the summer of calendar 2020. The

Company also continues to pursue alternatives for its Oil and Gas

Proppants business.

Details of Financial Results

We conduct one of our cement plant operations through a 50/50

joint venture, Texas Lehigh Cement Company LP (the Joint Venture).

We use the equity method of accounting for our 50% interest in the

Joint Venture. For segment reporting purposes only, we

proportionately consolidate our 50% share of the Joint Venture’s

revenue and operating earnings, which is consistent with the way

management organizes the segments within Eagle for making operating

decisions and assessing performance.

In addition, for segment reporting purposes, we report

intersegment revenue as a part of a segment’s total revenue.

Intersegment sales are eliminated on the income statement. Refer to

Attachment 3 for a reconciliation of these amounts.

About Eagle Materials Inc.

Eagle Materials Inc. manufactures and distributes Portland

Cement, Gypsum Wallboard and Recycled Gypsum Paperboard, and

Concrete, Sand and Aggregates from more than 75 facilities across

the US. Eagle’s corporate headquarters is in Dallas, Texas.

EXP’s senior management will conduct a conference call to

discuss the financial results, forward looking information and

other matters at 8:30 a.m. Eastern Time (7:30 a.m. Central Time) on

Tuesday, February 4, 2020. The conference call will be webcast

simultaneously on the EXP website, eaglematerials.com. A replay of

the webcast and the presentation will be archived on the website

for one year.

Forward-Looking Statements. This press release contains

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, Section 21E of the Securities Exchange Act

of 1934 and the Private Securities Litigation Reform Act of 1995.

Forward-looking statements may be identified by the context of the

statement and generally arise when the Company is discussing its

beliefs, estimates or expectations. These statements are not

historical facts or guarantees of future performance but instead

represent only the Company's belief at the time the statements were

made regarding future events which are subject to certain risks,

uncertainties and other factors, many of which are outside the

Company's control. Actual results and outcomes may differ

materially from what is expressed or forecast in such

forward-looking statements. The principal risks and uncertainties

that may affect the Company's actual performance include the

following: the cyclical and seasonal nature of the Company's

business; public infrastructure expenditures; adverse weather

conditions; the fact that our products are commodities and that

prices for our products are subject to material fluctuation due to

market conditions and other factors beyond our control;

availability of raw materials; changes in energy costs including,

without limitation, natural gas, coal and oil; changes in the cost

and availability of transportation; unexpected operational

difficulties, including unexpected maintenance costs, equipment

downtime and interruption of production; material nonpayment or

non-performance by any of our key customers; fluctuations in or

changes in the nature of activity in the oil and gas industry,

including fluctuations in the level of fracturing activities and

the demand for frac sand and changes in processes or substitutions

in materials used in well fracturing; inability to timely execute

announced capacity expansions; difficulties and delays in the

development of new business lines; governmental regulation and

changes in governmental and public policy (including, without

limitation, climate change regulation); possible outcomes of

pending or future litigation or arbitration proceedings; changes in

economic conditions specific to any one or more of the Company's

markets; competition; a cyber-attack or data security breach;

announced increases in capacity in the gypsum wallboard, cement and

frac sand industries; changes in the demand for residential housing

construction or commercial construction; risks related to pursuit

of acquisitions, joint ventures and other transactions; general

economic conditions; and interest rates. For example, increases in

interest rates, decreases in demand for construction materials or

increases in the cost of energy (including, without limitation,

natural gas, coal and oil) could affect the revenue and operating

earnings of our operations. In addition, changes in national or

regional economic conditions and levels of infrastructure and

construction spending could also adversely affect the Company's

result of operations. With respect to our proposed acquisition of

certain assets from Kosmos Cement Company as described in this

press release, factors, risks and uncertainties that may cause

actual events and developments to vary materially from those

anticipated in such forward-looking statements include, but are not

limited to, the inability to complete the acquisition within the

expected time frame, or at all, failure to realize expected

synergies from or other benefits of the transaction, possible

negative effects resulting from consummation of the transaction,

significant transaction or ownership transition costs, unknown

liabilities or other adverse developments affecting the assets to

be acquired and the target business, including the effect on the

target business of the same or similar factors discussed above to

which our Heavy Materials business is subject. Finally, the

proposed separation of our Heavy Materials and Light Materials

businesses into two independent, publicly traded corporations is

subject to various risks and uncertainties, and may not be

completed on the terms or timeline currently contemplated, or at

all. These and other factors are described in the Company's Annual

Report on Form 10-K for the fiscal year ended March 31, 2019 and

subsequent quarterly and annual reports upon filing. These reports

are filed with the Securities and Exchange Commission. All

forward-looking statements made herein are made as of the date

hereof, and the risk that actual results will differ materially

from expectations expressed herein will increase with the passage

of time. The Company undertakes no duty to update any

forward-looking statement to reflect future events or changes in

the Company's expectations.

Attachment 1

Statement of Consolidated Earnings

Attachment 2

Revenue and Earnings by Lines of

Business

Attachment 3

Sales Volume, Average Net Sales Prices and

Intersegment and Cement Revenue

Attachment 4

Consolidated Balance Sheets

Attachment 5

Depreciation, Depletion and Amortization

by Lines of Business

Attachment 6

Reconciliation of Non-GAAP Financial

Measures

Eagle Materials Inc.

Attachment 1

Eagle Materials Inc.

Statement of Consolidated

Earnings

(dollars in thousands, except

per share data)

(unaudited)

Quarter Ended

December 31,

Nine Months Ended

December 31,

2019

2018

2019

2018

Revenue

$

350,249

$

333,285

$

1,135,372

$

1,108,540

Cost of Goods Sold

262,735

252,864

868,023

838,554

Gross Profit

87,514

80,421

267,349

269,986

Equity in Earnings of Unconsolidated

JV

10,700

9,507

32,489

28,931

Corporate General and Administrative

Expenses

(13,794

)

(9,408

)

(48,506

)

(27,333

)

Litigation Settlements and Losses

-

-

-

(1,800

)

Impairment Losses

(224,267

)

-

(224,267

)

-

Other Non-Operating Income

825

1,292

1,967

2,291

(Loss) Earnings before Interest and Income

Taxes

(139,022

)

81,812

29,032

272,075

Interest Expense, net

(9,543

)

(7,294

)

(28,526

)

(20,743

)

(Loss) Earnings before Income Taxes

(148,565

)

74,518

506

251,332

Income Tax Benefit (Expense)

33,933

(16,803

)

(2,041

)

(54,675

)

Net (Loss) Earnings

$

(114,632

)

$

57,715

$

(1,535

)

$

196,657

(LOSS) EARNINGS PER SHARE

Basic

$

(2.77

)

$

1.25

$

(0.04

)

$

4.18

Diluted

$

(2.77

)

$

1.24

$

(0.04

)

$

4.15

AVERAGE SHARES OUTSTANDING

Basic

41,314,289

46,275,198

42,246,329

47,059,408

Diluted

41,314,289

46,495,994

42,246,329

47,403,271

Eagle Materials Inc.

Attachment 2

Eagle Materials Inc.

Revenue and Earnings by Lines

of Business

(dollars in thousands)

(unaudited)

Quarter Ended

December 31,

Nine Months Ended

December 31,

2019

2018

2019

2018

Revenue*

Heavy Materials:

Cement (Wholly Owned)

$

148,475

$

134,845

$

502,452

$

453,800

Concrete and Aggregates

46,797

30,495

141,762

110,247

195,272

165,340

644,214

564,047

Light Materials:

Gypsum Wallboard

125,070

130,954

380,454

402,978

Gypsum Paperboard

22,562

22,891

74,170

76,249

147,632

153,845

454,624

479,227

Oil and Gas Proppants

7,345

14,100

36,534

65,266

Total Revenue

$

350,249

$

333,285

$

1,135,372

$

1,108,540

Segment Operating Earnings

Heavy Materials:

Cement (Wholly Owned)

$

43,480

$

37,690

$

124,338

$

113,147

Cement (Joint Venture)

10,700

9,507

32,489

28,931

Concrete and Aggregates

3,334

1,037

15,023

10,621

57,514

48,234

171,850

152,699

Light Materials:

Gypsum Wallboard

38,484

43,543

114,872

139,694

Gypsum Paperboard

9,021

7,475

29,060

26,078

47,505

51,018

143,932

165,772

Oil and Gas Proppants

(6,805

)

(9,324

)

(15,944

)

(19,554

)

Sub-total

98,214

89,928

299,838

298,917

Corporate General and Administrative

Expense

(13,794

)

(9,408

)

(48,506

)

(27,333

)

Litigation Settlements and Losses

-

-

-

(1,800

)

Impairment Losses

(224,267

)

(224,267

)

Other Non-Operating Income

825

1,292

1,967

2,291

(Loss) Earnings before Interest and Income

Taxes

$

(139,022

)

$

81,812

$

29,032

$

272,075

*Net of Intersegment and Joint Venture

Revenue listed on Attachment 3

Eagle Materials Inc.

Attachment 3

Eagle Materials Inc.

Sales Volume, Average Net

Sales Prices and Intersegment and Cement Revenue

(unaudited)

Sales Volume

Quarter Ended

December 31,

Nine Months Ended

December 31,

2019

2018

Change

2019

2018

Change

Cement (M Tons):

Wholly Owned

1,199

1,126

+6

%

4,046

3,740

+8

%

Joint Venture

240

218

+10

%

721

672

+7

%

1,439

1,344

+7

%

4,767

4,412

+8

%

Concrete (M Cubic Yards)

357

237

+51

%

1,095

846

+29

%

Aggregates (M Tons)

749

747

0

%

2,608

2,616

0

%

Gypsum Wallboard (MMSF)

669

653

+2

%

2,010

1,992

+1

%

Paperboard (M Tons):

Internal

33

32

+3

%

99

95

+4

%

External

47

42

+12

%

148

140

+6

%

80

74

+8

%

247

235

+5

%

Frac Sand (M Tons)

200

365

-45

%

963

1,129

-15

%

Average Net Sales

Price*

Quarter Ended

December 31,

Nine Months Ended

December 31,

2019

2018

Change

2019

2018

Change

Cement (Ton)

$

110.09

$

107.54

+2

%

$

109.69

$

107.94

+2

%

Concrete (Cubic Yard)

$

112.96

$

102.94

+10

%

$

108.17

$

102.72

+5

%

Aggregates (Ton)

$

9.20

$

8.68

+6

%

$

9.36

$

9.30

+1

%

Gypsum Wallboard (MSF)

$

146.46

$

159.38

-8

%

$

148.51

$

161.63

-8

%

Paperboard (Ton)

$

460.65

$

519.29

-11

%

$

482.34

$

520.02

-7

%

*Net of freight and delivery costs billed

to customers.

Intersegment and Cement

Revenue

Quarter Ended

December 31,

Nine Months Ended

December 31,

2019

2018

2019

2018

Intersegment Revenue:

Cement

$

6,174

$

3,518

$

17,130

$

11,769

Concrete and Aggregates

350

346

1,134

1,178

Paperboard

15,251

16,747

48,190

49,799

$

21,775

$

20,611

$

66,454

$

62,746

Cement Revenue:

Wholly Owned

$

148,475

$

134,845

$

502,452

$

453,800

Joint Venture

28,382

25,369

85,775

78,112

$

176,857

$

160,214

$

588,227

$

531,912

Eagle Materials Inc.

Attachment 4

Eagle Materials Inc.

Consolidated Balance

Sheets

(dollars in thousands)

(unaudited)

December 31,

March 31,

2019

2018

2019*

ASSETS

Current Assets –

Cash and Cash Equivalents

$

126,255

$

17,060

$

8,601

Accounts and Notes Receivable, net

140,283

133,873

128,722

Inventories

234,264

251,260

275,194

Federal Income Tax Receivable

-

314

5,480

Prepaid and Other Assets

6,997

6,966

9,624

Total Current Assets

507,799

409,473

427,621

Property, Plant and Equipment, net

1,269,733

1,627,152

1,426,939

Investments in Joint Venture

71,862

61,988

64,873

Operating Lease Right of Use Asset

29,346

-

-

Notes Receivable

9,192

3,022

2,898

Goodwill and Intangibles

230,099

236,936

229,115

Other Assets

12,194

16,845

17,717

$

2,130,225

$

2,355,416

$

2,169,163

LIABILITIES AND

STOCKHOLDERS’ EQUITY

Current Liabilities –

Accounts Payable

$

65,035

$

77,611

$

80,884

Accrued Liabilities

87,690

66,921

61,949

Operating Lease Liabilities

10,601

-

-

Current Portion of Senior Notes

-

36,500

36,500

Total Current Liabilities

163,326

181,032

179,333

Long-term Liabilities

36,648

30,554

34,492

Non-current Lease Liabilities

51,939

-

-

Bank Credit Facility

585,000

245,000

310,000

4.500% Senior Unsecured Notes due 2026

345,594

344,924

345,092

Deferred Income Taxes

50,391

133,569

90,759

Stockholders’ Equity –

Preferred Stock, Par Value $0.01; None

issued

-

-

-

Common Stock, Par Value $0.01; Authorized

100,000,000 Shares; Issued and Outstanding 41,643,970; 46,238,591

and 45,117,393 Shares, respectively

416

462

451

Capital in Excess of Par Value

8,325

-

-

Accumulated Other Comprehensive Losses

(3,215

)

(3,844

)

(3,316

)

Retained Earnings

891,801

1,423,719

1,212,352

Total Stockholders’ Equity

897,327

1,420,337

1,209,487

$

2,130,225

$

2,355,416

$

2,169,163

*From audited financial statements

Eagle Materials Inc.

Attachment 5

Eagle Materials Inc.

Depreciation, Depletion and

Amortization by Lines of Business

(dollars in thousands)

(unaudited)

The following table presents

depreciation, depletion and amortization by lines of business for

the quarter and nine months ended December 31, 2019 and

2018:

Depreciation, Depletion and

Amortization

Quarter Ended

December 31,

Nine Months Ended

December 31,

2019

2018

2019

2018

Cement

$

14,189

$

13,242

$

42,275

$

38,909

Concrete and Aggregates

3,105

2,049

8,050

6,154

Gypsum Wallboard

5,050

4,978

15,149

15,009

Paperboard

2,244

2,150

6,610

6,387

Oil and Gas Proppants

3,445

6,964

11,087

24,403

Corporate and Other

578

402

1,773

1,099

$

28,611

$

29,785

$

84,944

$

91,961

Eagle Materials Inc.

Attachment 6

Eagle Materials Inc.

Reconciliation of Non-GAAP

Financial Measures

(unaudited)

(Dollars in thousands, other

than earnings per share amounts, and number of shares in

millions)

Adjusted Earnings per Diluted Share

(Adjusted EPS)

Adjusted EPS is a non-GAAP financial

measure and represents earnings per diluted share excluding the

impacts from non-routine items, such as impairment losses and

business development costs (Non-routine Items). Management uses

measures of earnings excluding the impact of Non-routine Items as a

basis for comparing operating results of the Company from period to

period and for purposes of its budgeting and planning processes.

Although management believes that Adjusted EPS is useful in

evaluating the Company’s business, this information should be

considered as supplemental in nature and is not meant to be

considered in isolation, or as a substitute for, earnings per

diluted share and the related financial information prepared in

accordance with GAAP. In addition, our presentation of Adjusted EPS

may not be the same as similarly titled measures reported by other

companies, limiting its usefulness as a comparative measure.

The following shows the calculation of

Adjusted EPS and reconciles Adjusted EPS to earnings per diluted

share in accordance with GAAP for the three months ended December

31, 2019:

Three Months Ended

December 31, 2019

Impairment Losses 1

$

224,267

Business Development Costs 2

3,367

Plant Expansion Costs 3

1,500

Non-routine Items

$

229,134

Tax Impact

(50,868

)

After-tax Impact of Non-routine Items

178,266

Diluted average shares outstanding 4

41.6

Diluted earnings per share impact from

Non-routine Items

$

4.28

1 Represents asset impairment losses

related to the Frac Sand business

2 Represents non-routine charges

associated with acquisitions and separation costs

3 Represents the impact of an outage at

the Republic Paperboard papermill associated with the planned

expansion

4 As reported diluted average shares

outstanding for the three months ended December 31, 2019 excludes

approximately 300,000 equity instruments to purchase share of

common stock as their impact would be antidilutive because Eagle’s

reported income was in a loss position during the period. When

adjusting income to the company in the period for the adjustments

described above, these shares become dilutive.

Three Months Ended December 31,

2019

Diluted EPS in accordance with generally

accepted accounting principles

$

(2.77

)

Add back: Earnings per diluted share

impact from Non-routine Items

$

4.28

Adjusted EPS

$

1.51

Eagle Materials Inc.

Attachment 6 (Continued)

EBITDA and Adjusted EBITDA

Similar to the presentation of Adjusted

EPS, we present Earnings before Interest, Taxes, Depreciation and

Amortization (EBITDA) and Adjusted EBITDA to provide more

consistent comparison of operating performance from period to

period. EBITDA is a non-GAAP financial measure that provides

supplemental information regarding the operating performance of our

business without regard to financing methods, capital structures or

historical cost basis. Adjusted EBITDA is also a non-GAAP financial

measure that further excludes the same non-routine items excluded

in the calculation of Adjusted Earnings per Diluted Share as

described above. Management uses EBITDA and Adjusted EBITDA as

alternative bases for comparing the operating performance of Eagle

from period to period, for purposes of its budgeting and planning

processes, and for purposes of monitoring compliance with specific

requirements of its credit agreement and other debt instruments.

Adjusted EBITDA may not be comparable to similarly titled measures

of other companies because other companies may not calculate

Adjusted EBITDA in the same manner. Neither EBITDA nor Adjusted

EBITDA should be considered in isolation or as an alternative to

net income, cash flow from operations or any other measure of

financial performance in accordance with GAAP.

The following shows the calculation of

EBITDA and Adjusted EBITDA and reconciles them to net (loss)

earnings in accordance with GAAP for the three months ended

December 31, 2019 and 2018.

Three Months Ended

December 31,

2019

2018

Net (Loss) Earnings

$

(114,632

)

$

57,715

Income Tax (Benefit) Expense

(33,933

)

16,803

Interest Expense

9,543

7,294

Depreciation, Depletion and

Amortization

28,611

29,785

EBITDA

(110,411

)

111,597

Impairment Losses

224,267

-

Business Development Costs

3,367

-

Plant Expansion Costs

1,500

-

Adjusted EBITDA

$

118,723

$

111,597

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200204005115/en/

For additional information, contact at

214-432-2000 Michael R. Haack Chief Executive

Officer

D. Craig Kesler Executive Vice President and Chief

Financial Officer

Robert S. Stewart Executive Vice President, Strategy,

Corporate Development and Communications

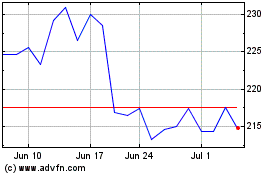

Eagle Materials (NYSE:EXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Eagle Materials (NYSE:EXP)

Historical Stock Chart

From Apr 2023 to Apr 2024