Adjusted ARR growth of 29%

year-over-year

Dynatrace (NYSE: DT), the leader in unified observability and

security, today announced financial results for the fourth quarter

and full year ended March 31, 2023.

“Dynatrace delivered a great finish to the year with strong

fourth quarter results that exceeded expectations across the board,

demonstrating the durability of our business model,” said Rick

McConnell, Chief Executive Officer. “Observability is quickly

moving from optional to mandatory as customers look to tame the

explosion of data and increased complexity that's driven by their

cloud migration and digital transformation initiatives. As we begin

fiscal 2024, we remain focused on driving innovation to meet

customers' evolving needs, managing the business prudently, and

investing thoughtfully in strategic priorities to capture the

substantial opportunities we see ahead.”

All growth rates are compared to the fourth quarter and full

year of fiscal 2022 unless otherwise noted.

Fourth Quarter Fiscal 2023 Financial Highlights:

- Total ARR of $1,247 million, Adjusted ARR growth of 29%

year-over-year

- Total Revenue of $314 million, up 27% on a constant currency

basis

- Subscription Revenue of $293 million, up 28% on a constant

currency basis

- GAAP Operating Income of $19 million and Non-GAAP Operating

Income of $78 million

- GAAP EPS of $0.27 and non-GAAP EPS of $0.31, on a dilutive

basis

Full Year Fiscal 2023 Financial Highlights:

- Total Revenue of $1,159 million, up 29% on a constant currency

basis

- Subscription Revenue of $1,083 million, up 29% on a constant

currency basis

- GAAP Operating Income of $93 million and Non-GAAP Operating

Income of $292 million

- GAAP EPS of $0.37 and non-GAAP EPS of $0.97, on a dilutive

basis

- GAAP Operating Cash Flow of $355 million and Free Cash Flow of

$333 million

Business Highlights:

- Platform Expansion: Innovations from the last quarter

include an expanded GrailTM data lakehouse and a new user

experience for Dynatrace products, both designed to enable

exploratory analytics and deliver precise answers and intelligent

automation from petabytes of unified observability and security

data. In addition, the new Dynatrace AutomationEngine and AppEngine

allow customers to automate nearly unlimited BizDevSecOps workflows

and easily build custom, compliant, and data-driven apps and

integrations.

- Analyst Recognition: The 2023 GigaOm Radar for Cloud

Observability Solutions recently named Dynatrace a "Leader" and

positioned the company as the closest of all vendors to the center

of the radar. Enterprise Management Associates (EMA) recognized

Dynatrace as one of the top ten leading security visionaries

exhibiting at the 2023 RSA Conference.

- Expanded Partnerships: In fiscal 2023, business

transacted through hyperscaler partners, including AWS, Google

Cloud, and Microsoft Azure, led to several seven-figure deals in

the fourth quarter. New business transacted through our largest

hyperscaler partner grew by more than 80% compared to last year. In

addition, we commenced the rollout of Dynatrace to DXC PlatformX

customers, with many expected to migrate within the next 12 months.

In Q4, we also saw continued expansion of our customer relationship

with a major global system integrator (GSI). In addition to using

the Dynatrace platform to power its observability practice, this

GSI also uses Dynatrace for its internal observability and digital

transformation initiatives.

Fourth Quarter 2023 Financial

Highlights

(Unaudited – In thousands,

except per share data)

Three Months Ended March

31,

2023

2022

Key Operating Metric:

Annualized recurring revenue (ARR)

$

1,246,681

$

995,121

Year-over-Year Increase

25

%

Year-over-Year Increase - constant

currency

28

%

Adjusted ARR Growth

29

%

Revenue:

Total revenue

$

314,475

$

252,585

Year-over-Year Increase

25

%

Year-over-Year Increase - constant

currency (*)

27

%

Subscription revenue

$

293,314

$

234,976

Year-over-Year Increase

25

%

Year-over-Year Increase - constant

currency (*)

28

%

GAAP Financial Measures:

GAAP operating income

$

19,431

$

17,629

GAAP operating margin

6

%

7

%

GAAP net income

$

80,293

$

929

GAAP net income per share - diluted

$

0.27

$

0.00

GAAP shares outstanding - diluted

293,917

290,339

Net cash provided by operating

activities

$

120,427

$

88,305

Non-GAAP Financial Measures:

Non-GAAP operating income (*)

$

77,935

$

57,656

Non-GAAP operating margin (*)

25

%

23

%

Non-GAAP net income (*)

$

92,459

$

48,287

Non-GAAP net income per share - diluted

(*)

$

0.31

$

0.17

Non-GAAP shares outstanding - diluted

(*)

293,917

290,339

Free Cash Flow (*)

$

114,512

$

82,378

Full Year 2023 Financial

Highlights

(Unaudited – In thousands,

except per share data)

Year Ended March 31,

2023

2022

Revenue:

Total revenue

$

1,158,530

$

929,445

Year-over-Year Increase

25

%

Year-over-Year Increase - constant

currency (*)

29

%

Subscription revenue

$

1,083,330

$

870,439

Year-over-Year Increase

24

%

Year-over-Year Increase - constant

currency (*)

29

%

GAAP Financial Measures:

GAAP operating income

$

92,811

$

81,307

GAAP operating margin

8

%

9

%

GAAP net income

$

107,959

$

52,451

GAAP net income per share - diluted

$

0.37

$

0.18

GAAP shares outstanding - diluted

291,617

290,903

Net cash provided by operating

activities

$

354,885

$

250,917

Non-GAAP Financial Measures:

Non-GAAP operating income (*)

$

291,791

$

233,766

Non-GAAP operating margin (*)

25

%

25

%

Non-GAAP net income (*)

$

282,224

$

197,502

Non-GAAP net income per share - diluted

(*)

$

0.97

$

0.68

Non-GAAP shares outstanding - diluted

(*)

291,617

290,903

Free Cash Flow (*)

333,345

233,222

* Use of Non-GAAP Financial Measures

In our earnings press releases, conference calls, slide

presentations, and webcasts, we may use or discuss non-GAAP

financial measures, as defined by Regulation G. The GAAP financial

measure most directly comparable to each non-GAAP financial measure

used or discussed, and a reconciliation of the differences between

each non-GAAP financial measure and the comparable GAAP financial

measure, are included in this press release after the consolidated

financial statements. Our earnings press releases containing such

non-GAAP reconciliations can be found in the Investor Relations

section of our website at https://ir.dynatrace.com.

Financial Outlook

Based on information available as of May 17, 2023, Dynatrace is

issuing guidance for the first quarter and full year fiscal 2024 in

the table below. This guidance is based on foreign exchange rates

as of April 28, 2023. The total foreign exchange tailwind for

fiscal 2024 is expected to be approximately $10 million on ARR and

$13 million on revenue. Growth rates for ARR, Total revenue, and

Subscription revenue are presented in constant currency to provide

better visibility into the underlying growth of the business.

All growth rates are compared to the first quarter and full year

of fiscal 2023 unless otherwise noted.

(In millions, except per share data)

First Quarter Fiscal

2024

Full Year Fiscal

2024

ARR

-

$1,475 - $1,490

As reported

-

18% - 20%

Constant currency

-

18% - 19%

Total revenue

$325 - $328

$1,388 - $1,406

As reported

22% - 23%

20% - 21%

Constant currency

22% - 23%

19% - 20%

Subscription revenue

$306 - $309

$1,311 - $1,327

As reported

23% - 24%

21% - 22%

Constant currency

23% - 24%

20% - 21%

Non-GAAP operating income

$76.5 - $78.5

$348 - $358

Non-GAAP operating margin

23.5% - 24%

25% - 25.5%

Non-GAAP net income

$64 - $66

$295 - $307

Non-GAAP net income per diluted share

$0.22

$0.98 - $1.02

Diluted weighted average shares

outstanding

296 - 297

300 - 301

Free cash flow

-

$303 - $312

Free cash flow margin

-

22%

Reconciliation of non-GAAP operating income, non-GAAP net

income, non-GAAP net income per share and free cash flow guidance

to the most directly comparable GAAP measures is not available

without unreasonable efforts on a forward-looking basis due to the

high variability, complexity and low visibility with respect to the

charges excluded from these non-GAAP measures; in particular, the

measures and effects of share-based compensation expense, employer

taxes and tax deductions specific to equity compensation awards

that are directly impacted by future hiring, turnover and retention

needs, as well as unpredictable fluctuations in our stock price. We

expect the variability of the above charges to have a significant,

and potentially unpredictable, impact on our future GAAP financial

results.

Conference Call and Webcast Information

Dynatrace will host a conference call and live webcast to

discuss its results and business outlook at 8:00 a.m. Eastern Time

today, May 17, 2023. To access the conference call from the U.S.

and Canada, dial (866) 405-1247, or internationally, dial (201)

689-8045 with event confirmation #: 13737836. The call will also be

available live via webcast on the company’s website,

ir.dynatrace.com.

An audio replay of the call will also be available until 11:59

p.m. Eastern Time on May 31, 2023, by dialing (877) 660-6853 from

the U.S. or Canada, or for international callers by dialing (201)

612-7415 and entering event confirmation #: 13737836. In addition,

an archived webcast will be available at ir.dynatrace.com.

The company has used, and intends to continue to use, the

investor relations portion of its website as a means of disclosing

material non-public information and for complying with disclosure

obligations under Regulation FD.

Non-GAAP Financial Measures & Key Metrics

In addition to disclosing financial measures prepared in

accordance with GAAP, this press release and the accompanying

tables contain certain non-GAAP financial measures.

Non-GAAP financial measures do not have any standardized meaning

and are therefore unlikely to be comparable to similarly titled

measures presented by other companies. Dynatrace considers these

non-GAAP financial measures to be important because they provide

useful indicators of its performance and liquidity measures. These

are key measures used by our management and board of directors to

understand and evaluate our core operating performance and trends,

to prepare and approve our annual budget and to develop short and

long-term operational plans. In addition, investors often use

similar measures to evaluate the performance of a company. Non-GAAP

financial measures are presented for supplemental informational

purposes only for understanding the company’s operating

performance. The non-GAAP financial measures should not be

considered a substitute for financial information presented in

accordance with GAAP, and may be different from non-GAAP financial

measures presented by other companies. The GAAP financial measure

most directly comparable to each non-GAAP financial measure used or

discussed, and a reconciliation of the differences between each

non-GAAP financial measure and the comparable GAAP financial

measure, are included in this press release after the consolidated

financial statements.

Dynatrace presents constant currency amounts for Revenue and

Annual Recurring Revenue to provide a framework for assessing how

our underlying businesses performed excluding the effect of foreign

currency rate fluctuations. Dynatrace provides this non-GAAP

financial information to aid investors in better understanding our

performance.

Annual Recurring Revenue (“ARR”) is defined as the daily

revenue of all subscription agreements that are actively generating

revenue as of the last day of the reporting period multiplied by

365. We exclude from our calculation of Total ARR any revenues

derived from month-to-month agreements and/or product usage overage

billings.

Adjusted ARR is defined as ARR excluding the impact of

foreign exchange rate fluctuations that occurred over the trailing

twelve month period. This calculation also excludes the headwind

associated with the Dynatrace® perpetual license ARR that rolled

off in the trailing twelve month period.

Adjusted ARR Growth is defined as year-over-year growth

in Adjusted ARR divided by ARR as reported.

Constant Currency amounts for ARR, Total Revenue and

Subscription Revenue are presented to provide a framework for

assessing how our underlying businesses performed excluding the

effect of foreign exchange rate fluctuations. To present this

information, current and comparative prior period results for

entities reporting in currencies other than United States dollars

are converted into United States dollars using the average exchange

rates from the comparative period rather than the actual exchange

rates in effect during the respective periods. All growth

comparisons relate to the corresponding period in the last fiscal

year.

Dollar-Based Gross Retention Rate is defined as the ARR

from all customers as of one year prior, less contraction and

customer churn, divided by the total ARR from one year prior. This

metric reflects the percentage of ARR from all customers as of the

year prior that has been retained.

Dollar-Based Net Retention Rate is defined as the

Dynatrace® ARR at the end of a reporting period for the cohort of

Dynatrace® accounts as of one year prior to the date of

calculation, divided by the Dynatrace® ARR one year prior to the

date of calculation for that same cohort. Our dollar-based net

retention rate reflects customer renewals, expansion, contraction

and churn, and excludes the benefit of Dynatrace® ARR resulting

from the conversion of Classic products to the Dynatrace® platform.

Effective the first quarter of fiscal year 2023, we began to

exclude the headwind associated with the Dynatrace perpetual

license ARR given diminishing impact of perpetual license ARR. We

believe that eliminating the perpetual license headwind results in

a dollar-based net retention rate metric that better reflects

Dynatrace’s ability to expand existing customer relationships.

Dollar-based net retention rate is presented on a constant currency

basis.

Dynatrace Customers are defined as accounts, as

identified by a unique account identifier, that generate at least

$10,000 of Dynatrace® ARR as of the reporting date. In infrequent

cases, a single large organization may comprise multiple customer

accounts when there are distinct divisions, departments or

subsidiaries that operate and make purchasing decisions

independently from the parent organization. In cases where multiple

customer accounts exist under a single organization, each customer

account is counted separately based on a mutually exclusive

accounting of ARR.

Free Cash Flow is defined as net cash provided by (used

in) operating activities less capital expenditures (reflected as

"purchase of property and equipment" in our financial

statements).

About Dynatrace

Dynatrace exists to make the world’s software work perfectly.

Our unified platform combines broad and deep observability and

continuous runtime application security with the most advanced

AIOps to provide answers and intelligent automation from data at an

enormous scale. This enables innovators to modernize and automate

cloud operations, deliver software faster and more securely, and

ensure flawless digital experiences. That is why the world’s

largest organizations trust Dynatrace® to accelerate digital

transformation.

Cautionary Language Concerning Forward-Looking

Statements

This press release includes certain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995, including Mr. McConnell's remarks and statements regarding

management’s expectations of future financial and operational

performance and operational expenditures, expected growth, and

business outlook, including our financial outlook for the first

quarter and full year of fiscal 2024. These forward-looking

statements include, but are not limited to, plans, objectives,

expectations and intentions and other statements contained in this

press release that are not historical facts and statements

identified by words such as “expects,” “anticipates,” “intends,”

“plans,” “believes,” “seeks,” “estimates” or words of similar

meaning. These forward-looking statements reflect our current views

about our plans, intentions, expectations, strategies and

prospects, which are based on the information currently available

to us and on assumptions we have made. Although we believe that our

plans, intentions, expectations, strategies and prospects as

reflected in or suggested by those forward-looking statements are

reasonable, we can give no assurance that the plans, intentions,

expectations or strategies will be attained or achieved.

Furthermore, actual results may differ materially from those

described in the forward-looking statements and will be affected by

a variety of risks and factors that are beyond our control

including, without limitation, our ability to maintain our revenue

growth rates in future periods; market adoption of our product

offerings; continued demand for, and spending on, our solutions;

our ability to innovate and develop solutions that meet customer

needs; the ability of our platform and solutions to effective

interoperate with customers’ IT infrastructures; our ability to

acquire new customers and retain and expand our relationships with

existing customers; our ability to expand our sales and marketing

capabilities; our ability to compete; our ability to maintain

successful relationships with partners; security breaches, other

security incidents and any real or perceived errors, failures,

defects or vulnerabilities in our solutions; our ability to protect

our intellectual property; the effect on our business of the

macroeconomic environment, associated global economic conditions

and geopolitical disruption; and other risks set forth under the

caption “Risk Factors” in our most recent Form 10-Q filed on

February 1, 2023 and our other SEC filings, including our Annual

Report on Form 10-K for the fiscal year ended March 31, 2023, which

we plan to file later this month. We assume no obligation to update

any forward-looking statements contained in this document as a

result of new information, future events or otherwise.

DYNATRACE, INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(In thousands, except per

share data)

Three Months Ended March

31,

Twelve Months Ended March

31,

2023

2022

2023

2022

(unaudited)

Revenue:

Subscription

$

293,314

$

234,976

$

1,083,330

$

870,439

Service

21,161

17,609

75,200

59,006

Total revenue

314,475

252,585

1,158,530

929,445

Cost of revenue:

Cost of subscription

39,052

31,245

144,445

111,646

Cost of service

16,618

12,796

62,882

45,717

Amortization of acquired technology

3,895

3,875

15,564

15,513

Total cost of revenue

59,565

47,916

222,891

172,876

Gross profit

254,910

204,669

935,639

756,569

Operating expenses:

Research and development (1)

61,502

42,833

218,349

156,342

Sales and marketing (1)

124,702

101,300

448,015

362,116

General and administrative (1)

42,546

35,368

150,031

126,622

Amortization of other intangibles

6,573

7,539

26,292

30,157

Restructuring and other

156

—

141

25

Total operating expenses

235,479

187,040

842,828

675,262

Income from operations

19,431

17,629

92,811

81,307

Interest income (expense), net

4,066

(2,234

)

(3,409

)

(10,192

)

Other income, net

2,412

1,889

565

544

Income before income taxes

25,909

17,284

89,967

71,659

Income tax benefit (expense)

54,384

(16,355

)

17,992

(19,208

)

Net income

$

80,293

$

929

$

107,959

$

52,451

Net income per share:

Basic

$

0.28

$

0.00

$

0.38

$

0.18

Diluted

$

0.27

$

0.00

$

0.37

$

0.18

Weighted average shares outstanding:

Basic

289,751

285,349

287,700

284,161

Diluted

293,917

290,339

291,617

290,903

(1) During the three months ended March 31, 2023, we began

allocating depreciation expense to operating expenses based upon

location and headcount, whereas previously it was included

primarily in general and administrative expense. This has been

retrospectively applied to the twelve months ended March 31,

2023.

SHARE-BASED

COMPENSATION

Three Months Ended March

31,

Twelve Months Ended March

31,

2023

2022

2023

2022

(unaudited)

Cost of revenue

$

4,973

$

3,321

$

18,383

$

12,863

Research and development

12,067

5,985

41,406

21,316

Sales and marketing

13,748

9,470

51,147

35,957

General and administrative

11,233

8,810

35,938

29,400

Total share-based compensation expense

$

42,021

$

27,586

$

146,874

$

99,536

DYNATRACE, INC.

CONSOLIDATED BALANCE

SHEETS

(In thousands, except share

data)

March 31,

2023

2022

Assets

Current assets:

Cash and cash equivalents

$

555,348

$

462,967

Accounts receivable, net

442,518

350,666

Deferred commissions, current

83,029

62,601

Prepaid expenses and other current

assets

37,289

72,188

Total current assets

1,118,184

948,422

Property and equipment, net

53,576

45,271

Operating lease right-of-use asset,

net

68,074

58,849

Goodwill

1,281,812

1,281,876

Other intangible assets, net

63,599

105,736

Deferred tax assets, net

79,822

28,106

Deferred commissions, non-current

86,232

63,435

Other assets

14,048

9,615

Total assets

$

2,765,347

$

2,541,310

Liabilities and shareholders'

equity

Current liabilities:

Accounts payable

$

21,953

$

22,715

Accrued expenses, current

188,380

141,556

Deferred revenue, current

811,058

688,554

Operating lease liabilities, current

15,652

12,774

Total current liabilities

1,037,043

865,599

Deferred revenue, non-current

34,423

25,783

Accrued expenses, non-current

29,212

19,409

Operating lease liabilities,

non-current

59,520

52,070

Deferred tax liabilities

280

85

Long-term debt, net

—

273,918

Total liabilities

1,160,478

1,236,864

Shareholders' equity:

Common shares, $0.001 par value,

600,000,000 shares authorized, 290,411,108 and 286,053,276 shares

issued and outstanding at March 31, 2023 and 2022, respectively

290

286

Additional paid-in capital

1,989,797

1,792,197

Accumulated deficit

(353,389

)

(461,348

)

Accumulated other comprehensive loss

(31,829

)

(26,689

)

Total shareholders' equity

1,604,869

1,304,446

Total liabilities and shareholders'

equity

$

2,765,347

$

2,541,310

DYNATRACE, INC.

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(In thousands)

Year Ended March 31,

2023

2022

Cash flows from operating

activities:

Net income

$

107,959

$

52,451

Adjustments to reconcile net income to

cash provided by operations:

Depreciation

12,541

10,638

Amortization

42,070

46,238

Share-based compensation

146,874

99,536

Loss on extinguishment of debt

5,925

—

Deferred income taxes

(53,534

)

(12,401

)

Other

988

1,486

Net change in operating assets and

liabilities:

Accounts receivable

(94,910

)

(108,848

)

Deferred commissions

(45,191

)

(29,533

)

Prepaid expenses and other assets

26,753

(8,108

)

Accounts payable and accrued expenses

58,680

35,946

Operating leases, net

1,186

1,353

Deferred revenue

145,544

162,159

Net cash provided by operating

activities

354,885

250,917

Cash flows from investing

activities:

Purchase of property and equipment

(21,540

)

(17,695

)

Acquisition of businesses, net of cash

acquired

—

(13,195

)

Net cash used in investing activities

(21,540

)

(30,890

)

Cash flows from financing

activities:

Repayment of term loans

(281,125

)

(120,000

)

Debt issuance costs

(1,949

)

—

Proceeds from employee stock purchase

plan

17,806

13,913

Proceeds from exercise of stock

options

32,939

25,489

Equity repurchases

(15

)

(66

)

Net cash used in financing activities

(232,344

)

(80,664

)

Effect of exchange rates on cash and cash

equivalents

(8,620

)

(1,358

)

Net increase in cash and cash

equivalents

92,381

138,005

Cash and cash equivalents, beginning of

year

462,967

324,962

Cash and cash equivalents, end of year

$

555,348

$

462,967

DYNATRACE, INC.

GAAP to Non-GAAP

Reconciliations

(Unaudited - In

thousands)

Three Months Ended March 31,

2023

GAAP

Share-based

compensation

Employer payroll taxes on

employee stock transactions

Amortization of other

intangibles

Restructuring &

other

Non-GAAP

Non-GAAP operating income:

Cost of revenue

$

59,565

$

(4,973

)

$

(272

)

$

(3,895

)

$

—

$

50,425

Gross profit

254,910

4,973

272

3,895

—

264,050

Gross margin

81

%

84

%

Research and development

61,502

(12,067

)

(445

)

—

—

48,990

Sales and marketing

124,702

(13,748

)

(1,143

)

—

(1,332

)

108,479

General and administrative

42,546

(11,233

)

(841

)

—

(1,826

)

28,646

Amortization of other intangibles

6,573

—

—

(6,573

)

—

—

Restructuring and other

156

—

—

—

(156

)

—

Operating income

$

19,431

$

42,021

$

2,701

$

10,468

$

3,314

$

77,935

Operating margin

6

%

25

%

Three Months Ended March 31,

2022

GAAP

Share-based

compensation

Employer payroll taxes on

employee stock transactions

Amortization of other

intangibles

Restructuring &

other

Non-GAAP

Non-GAAP operating income:

Cost of revenue

$

47,916

$

(3,321

)

$

(143

)

$

(3,875

)

$

—

$

40,577

Gross profit

204,669

3,321

143

3,875

—

212,008

Gross margin

81

%

84

%

Research and development

42,833

(5,985

)

(259

)

—

—

36,589

Sales and marketing

101,300

(9,470

)

(424

)

—

—

91,406

General and administrative

35,368

(8,810

)

(123

)

—

(78

)

26,357

Amortization of other intangibles

7,539

—

—

(7,539

)

—

—

Restructuring and other

—

—

—

—

—

—

Operating income

$

17,629

$

27,586

$

949

$

11,414

$

78

$

57,656

Operating margin

7

%

23

%

DYNATRACE, INC.

GAAP to Non-GAAP

Reconciliations

(Unaudited - In thousands,

except per share data)

Three Months Ended March

31,

2023

2022

Non-GAAP net income:

Net income

$

80,293

$

929

Income tax (benefit) expense

(54,384

)

16,355

Non-GAAP effective cash tax

10,084

(7,543

)

Interest (income) expense, net

(4,066

)

2,234

Cash received from (paid for) interest,

net

4,440

(1,826

)

Share-based compensation

42,021

27,586

Employer payroll taxes on employee stock

transactions

2,701

949

Amortization of other intangibles

6,573

7,539

Amortization of acquired technology

3,895

3,875

Transaction, restructuring, and other

3,314

78

Gain on currency translation

(2,412

)

(1,889

)

Non-GAAP net income

$

92,459

$

48,287

Share count:

Weighted-average shares outstanding -

basic

289,751

285,349

Weighted-average shares outstanding -

diluted

293,917

290,339

Shares used in non-GAAP per share

calculations:

Weighted-average shares outstanding -

basic

289,751

285,349

Weighted-average shares outstanding -

diluted

293,917

290,339

Net income per share:

Net income per share - basic

$

0.28

$

0.00

Net income per share - diluted

$

0.27

$

0.00

Non-GAAP net income per share - basic

$

0.32

$

0.17

Non-GAAP net income per share -

diluted

$

0.31

$

0.17

Three Months Ended March

31,

2023

2022

Free Cash Flow ("FCF"):

Net cash provided by operating

activities

$

120,427

$

88,305

Purchase of property and equipment

(5,915

)

(5,927

)

FCF

$

114,512

$

82,378

DYNATRACE, INC.

GAAP to Non-GAAP

Reconciliations

(Unaudited - In

thousands)

Year Ended March 31,

2023

GAAP

Share-based

compensation

Employer payroll taxes on

employee stock transactions

Amortization of other

intangibles

Restructuring &

other

Non-GAAP

Non-GAAP operating income:

Cost of revenue

$

222,891

$

(18,383

)

$

(798

)

$

(15,564

)

$

(380

)

$

187,766

Gross profit

935,639

18,383

798

15,564

380

970,764

Gross margin

81

%

84

%

Research and development (1)

218,349

(41,406

)

(1,704

)

—

—

175,239

Sales and marketing (1)

448,015

(51,147

)

(2,338

)

—

(1,332

)

393,198

General and administrative (1)

150,031

(35,938

)

(1,351

)

—

(2,206

)

110,536

Amortization of other intangibles

26,292

—

—

(26,292

)

—

—

Restructuring and other

141

—

—

—

(141

)

—

Operating income

$

92,811

$

146,874

$

6,191

$

41,856

$

4,059

$

291,791

Operating margin

8

%

25

%

(1) During the three months ended March 31, 2023, we began

allocating depreciation expense to operating expenses based upon

location and headcount, whereas previously it was included

primarily in general and administrative expense. This has been

retrospectively applied to the year ended March 31, 2023.

Year Ended March 31,

2022

GAAP

Share-based

compensation

Employer payroll taxes on

employee stock transactions

Amortization of other

intangibles

Restructuring &

other

Non-GAAP

Non-GAAP operating income:

Cost of revenue

$

172,876

$

(12,863

)

$

(1,059

)

$

(15,513

)

$

—

$

143,441

Gross profit

756,569

12,863

1,059

15,513

—

786,004

Gross margin

81

%

85

%

Research and development

156,342

(21,316

)

(1,879

)

—

—

133,147

Sales and marketing

362,116

(35,957

)

(2,305

)

—

—

323,854

General and administrative

126,622

(29,400

)

(701

)

—

(1,284

)

95,237

Amortization of other intangibles

30,157

—

—

(30,157

)

—

—

Restructuring and other

25

—

—

—

(25

)

—

Operating income

$

81,307

$

99,536

$

5,944

$

45,670

$

1,309

$

233,766

Operating margin

9

%

25

%

DYNATRACE, INC. GAAP to

Non-GAAP Reconciliations (Unaudited - In thousands, except per

share data)

Year Ended March 31,

2023

2022

Non-GAAP net income:

Net income

$

107,959

$

52,451

Income tax (benefit) expense

(17,992

)

19,208

Non-GAAP effective cash tax

(13,370

)

(27,889

)

Interest expense, net

3,409

10,192

Cash received from (paid for) interest,

net

3,803

(8,375

)

Share-based compensation

146,874

99,536

Employer payroll taxes on employee stock

transactions

6,191

5,944

Amortization of other intangibles

26,292

30,157

Amortization of acquired technology

15,564

15,513

Transaction, restructuring, and other

4,059

1,309

Gain on currency translation

(565

)

(544

)

Non-GAAP net income

$

282,224

$

197,502

Share count:

Weighted-average shares outstanding -

basic

287,700

284,161

Weighted-average shares outstanding -

diluted

291,617

290,903

Shares used in non-GAAP per share

calculations:

Weighted-average shares outstanding -

basic

287,700

284,161

Weighted-average shares outstanding -

diluted

291,617

290,903

Net income per share:

Net income per share - basic

$

0.38

$

0.18

Net income per share - diluted

$

0.37

$

0.18

Non-GAAP net income per share - basic

$

0.98

$

0.70

Non-GAAP net income per share -

diluted

$

0.97

$

0.68

Year Ended March 31,

2023

2022

Free Cash Flow ("FCF"):

Net cash provided by operating

activities

$

354,885

$

250,917

Purchase of property and equipment

(21,540

)

(17,695

)

FCF

333,345

233,222

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230517005058/en/

Investor: Noelle Faris VP, Investor Relations

Noelle.Faris@dynatrace.com

Media Relations: Jerome Stewart VP, Communications

Jerome.Stewart@dynatrace.com

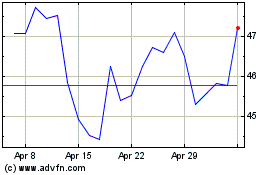

Dynatrace (NYSE:DT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dynatrace (NYSE:DT)

Historical Stock Chart

From Apr 2023 to Apr 2024