Dycom Announces Authorization of a New $150 Million Stock Repurchase Program

February 26 2025 - 7:05AM

Dycom Industries, Inc. (NYSE: DY) today announced that its Board of

Directors has authorized a new $150 million program to repurchase

shares of Dycom’s outstanding common stock. Repurchases under the

new program are authorized to be made over the next eighteen (18)

months in open market purchases or privately-negotiated

transactions, including pursuant to a Rule 10b5-1 plan. The exact

timing and amount of repurchases will depend on market conditions

and other factors. The repurchase program does not obligate Dycom

to acquire any particular amount of common stock, and may be

suspended or discontinued at any time. The new program replaces the

Company’s previous $150 million stock repurchase program of which

approximately $55.0 million remained outstanding. As of February

25, 2025, the Company had 28,979,138 shares of common stock

outstanding, excluding the dilutive effect of stock options and

unvested restricted stock.

About Dycom Industries, Inc.Dycom is a leading

provider of specialty contracting services to the

telecommunications infrastructure and utility industries throughout

the United States. These services include program management,

planning, engineering and design; aerial, underground, and wireless

construction; maintenance; and fulfillment services for

telecommunications providers. Additionally, Dycom provides

underground facility locating services for various utilities,

including telecommunications providers, as well as other

construction and maintenance services for electric and gas

utilities.

Forward Looking InformationThis press release

contains forward-looking statements as contemplated by the 1995

Private Securities Litigation Reform Act, including those related

to our stock repurchase program. Forward-looking statements are

based on management’s expectations, estimates and projections, are

made solely as of the date these statements are made, and are

subject to both known and unknown risks and uncertainties that may

cause the actual results and occurrences discussed in these

forward-looking statements to differ materially from those

referenced or implied in the forward-looking statements contained

in this press release. The most significant of these known risks

and uncertainties are described in the Company’s Form 10-K, Form

10-Q, and Form 8-K reports (including all amendments to those

reports) and include future economic conditions and trends

including the potential impacts of an inflationary economic

environment, changes to customer capital budgets and spending

priorities, the availability and cost of materials, equipment and

labor necessary to perform our work, the adequacy of the Company’s

insurance and other reserves and allowances for doubtful accounts,

whether the carrying value of the Company’s assets may be impaired,

the future impact of any acquisitions or dispositions, adjustments

and cancellations of the Company’s projects, the impact to the

Company’s backlog from project cancellations or postponements, the

impacts of pandemics and public health emergencies, the impact of

varying climate and weather conditions, the anticipated outcome of

other contingent events, including litigation or regulatory actions

involving the Company, the adequacy of our liquidity, the

availability of financing to address our financials needs, the

Company’s ability to generate sufficient cash to service its

indebtedness, the impact of restrictions imposed by the Company’s

credit agreement, and other risks and uncertainties detailed from

time to time in the Company’s filings with the Securities and

Exchange Commission. The Company does not undertake any obligation

to update its forward-looking statements.

For more information, contact:Callie Tomasso,

Vice President Investor RelationsEmail:

investorrelations@dycomind.comPhone: (561) 627-7171

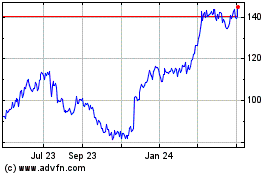

Dycom Industries (NYSE:DY)

Historical Stock Chart

From Jan 2025 to Feb 2025

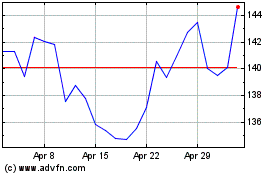

Dycom Industries (NYSE:DY)

Historical Stock Chart

From Feb 2024 to Feb 2025