UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 11-K

ANNUAL REPORT

PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Year Ended December 31, 2020

of

DUKE ENERGY

RETIREMENT SAVINGS PLAN

Commission File Number 1-32853

Issuer of Securities held pursuant to the Plan is

DUKE ENERGY CORPORATION

550 South Tryon Street

Charlotte, North Carolina 28202-1803

DUKE ENERGY

RETIREMENT SAVINGS PLAN

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

Page

|

|

Report of Independent Registered Public Accounting Firm

|

|

|

|

|

|

Financial Statements:

|

|

|

|

|

|

Statements of Net Assets Available for Benefits as of December 31, 2020 and 2019

|

|

|

|

|

|

Statement of Changes in Net Assets Available for Benefits for the Year Ended December 31, 2020

|

|

|

|

|

|

Notes to Financial Statements

|

|

|

|

|

|

Supplementary Information:

|

|

|

|

|

|

Form 5500, Schedule H, Part IV, Line 4i—Schedule of Assets (Held at End of Year) as of December 31, 2020

|

|

NOTE: All other schedules described by Section 2520.103-10 of the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974, as amended, have been omitted because they are not applicable.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Benefits Committee of Duke Energy Corporation

Charlotte, North Carolina

Opinion on the Financial Statements

We have audited the Statements of Net Assets Available for Benefits of the Duke Energy Retirement Savings Plan (the Plan) as of December 31, 2020 and 2019, and the related Statement of Changes in Net Assets Available for Benefits for the year ended December 31, 2020, and the related Notes to Financial Statements (collectively referred to as the financial statements). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2020 and 2019, and the changes in net assets available for benefits for the year ended December 31, 2020 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of Plan management. Our responsibility is to express an opinion on these financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by Plan management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Report on Supplementary Information

The supplementary information of Schedule of Assets (Held at End of Year) as of December 31, 2020 has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplementary information is the responsibility of Plan management. Our audit procedures included determining whether the supplementary information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplementary information. In forming our opinion on the supplementary information, we evaluated whether the supplementary information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under Employee Retirement Income Security Act of 1974. In our opinion, the supplementary information is fairly stated, in all material respects, in relation to the financial statements as a whole.

|

|

|

|

|

/s/ McCONNELL & JONES LLP

|

|

|

|

We have served as the Plan’s auditors since 2008.

|

|

|

|

Houston, Texas

|

|

June 25, 2021

|

DUKE ENERGY

RETIREMENT SAVINGS PLAN

Statements of Net Assets Available for Benefits

December 31, 2020 and 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(IN THOUSANDS)

|

|

|

|

|

|

|

|

|

|

|

|

2020

|

|

2019

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

|

Investments

|

|

|

|

|

|

Investments at fair value

|

|

$

|

9,211,012

|

|

|

$

|

8,480,980

|

|

|

Fully benefit-responsive investment contracts at contract value

|

|

654,584

|

|

558,862

|

|

Total investments

|

|

9,865,596

|

|

|

9,039,842

|

|

|

|

|

|

|

|

|

Receivables

|

|

|

|

|

|

Notes receivable from participants

|

|

145,707

|

|

|

145,924

|

|

|

Employer's contributions

|

|

6,096

|

|

|

4,941

|

|

|

|

|

|

|

|

|

Total receivables

|

|

151,803

|

|

|

150,865

|

|

|

|

|

|

|

|

|

Total Assets

|

|

10,017,399

|

|

|

9,190,707

|

|

|

|

|

|

|

|

|

Net assets available for benefits

|

|

$

|

10,017,399

|

|

|

$

|

9,190,707

|

|

See Notes to Financial Statements

4

DUKE ENERGY

RETIREMENT SAVINGS PLAN

Statement of Changes in Net Assets Available for Benefits

For the Year Ended December 31, 2020

|

|

|

|

|

|

|

|

(IN THOUSANDS)

|

|

|

|

|

|

Additions to net assets attributed to:

|

|

|

|

|

|

Investment income

|

|

|

Net appreciation in fair value of investments

|

$

|

1,023,328

|

|

|

Interest and dividends

|

63,551

|

|

|

Total investment income

|

1,086,879

|

|

|

|

|

|

Interest income on notes receivable from participants

|

7,538

|

|

|

|

|

|

Contributions

|

|

|

Participants

|

311,523

|

|

|

Employer

|

224,202

|

|

|

Participants’ rollover

|

21,449

|

|

|

Total contributions

|

557,174

|

|

|

|

|

|

Total additions

|

1,651,591

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Benefits paid to participants

|

827,532

|

|

|

Administrative Fees

|

7,432

|

|

|

Total deductions

|

834,964

|

|

|

|

|

|

Net increase prior to transfers

|

816,627

|

|

|

|

|

|

Transfer from REC Solar Plans

|

10,065

|

|

|

|

|

|

Net increase

|

826,692

|

|

|

Net assets available for benefits, beginning of year

|

9,190,707

|

|

|

Net assets available for benefits, end of year

|

$

|

10,017,399

|

|

See Notes to Financial Statements

5

DUKE ENERGY RETIREMENT SAVINGS PLAN

Notes to Financial Statements

December 31, 2020 and 2019

1. Description of the Plan

The following description of the Duke Energy Retirement Savings Plan (the Plan) is provided for general information purposes only. Participants should refer to the Plan document for a more complete description of the Plan’s provisions.

Participation and Purpose

The Plan is a defined contribution plan sponsored by Duke Energy Corporation (Duke Energy). Duke Energy and each of its affiliated companies that is at least 80% owned and that participate in the Plan are collectively referred to as the Participating Company. The Plan is administered by the Duke Energy Benefits Committee (Benefits Committee or Plan Administrator) and trusteed by the Fidelity Management Trust Company (Fidelity).

The purpose of the Plan is to provide an opportunity for eligible employees to enhance their long-range financial security through employee contributions, matching contributions and non-elective employer retirement or transition credit contributions, as applicable, from the Participating Company, and investment among certain investment funds, one of which provides indirect ownership in Duke Energy common stock. The Plan is, in part, an employee stock ownership plan and is subject to the applicable provisions of the Employee Retirement Income Security Act of 1974, as amended (ERISA).

Generally, employees of the Participating Company are eligible to enter and participate in the Plan if they are paid on the Participating Company’s U. S. payroll system and are non-union (unless agreed to in a collective bargaining agreement).

Contributions

Duke Energy automatically enrolls new full or part-time employees eligible for the Plan. The contributions made to the Plan on the employee’s behalf will be invested in one or more funds selected in accordance with procedures established by the Plan Administrator. The Company match is invested in the same manner as the employee contributions. If an employee chooses not to participate, Fidelity, the recordkeeper must be contacted by the employee to change the deferral rate to 0%.

Participants may elect to contribute (subject to certain limitations) in the form of pretax, Roth 401(k), and/or after-tax contributions up to 75% of eligible earnings per pay period without regard to years of service. Various provisions of the Internal Revenue Code of 1986, as amended (IRC) may limit the deferrals of some highly compensated employees. All pretax deferrals are exempt, up to the allowed maximum, from federal and most state income tax withholding in the year they are deferred, but are subject to payroll taxes. Participant deferrals are intended to satisfy the requirements of Section 401(k) of the IRC.

Duke Energy generally matches 100% of the first 6% of the employee’s eligible compensation that is contributed to the Plan in the form of pretax and/or Roth 401(k) contributions. A different matching contribution formula may apply to certain groups of employees covered by a collective bargaining agreement. Participant after-tax contributions and matching contributions are intended to satisfy the requirements of Section 401(m) of the IRC. The Participating Company also provides a non-elective employer retirement contribution of 4% of eligible compensation for employees who are not eligible to participate in a defined benefit plan. These contributions are invested in the same manner as the employee elected contributions. Beginning on January 1, 2018, the Participating Company also makes non-elective employer transition credit contributions of 3% to 5% (based on service as of December 31, 2017) of eligible compensation for certain legacy Piedmont Natural Gas Company, Inc. employees.

Participants age 50 or older by the end of the year may contribute an additional pretax and/or Roth 401(k) contribution amount over and above the IRC limits each year. For 2020, the IRC allowed participants age 50 or older to contribute up to $6,500 over and above the $19,500 pretax and/or Roth 401(k) contribution limit. Participating Company does not provide a base company match on these additional contributions.

Rollover Contributions to the Plan

Rollover contributions represent amounts recorded when participants elect to contribute amounts to their Plan accounts from other eligible, tax-qualified retirement plans or qualified individual retirement accounts. Rollover contributions of approximately $21.5 million were made to the Plan in 2020. An in-plan Roth rollover feature was added to the Plan, effective November 1, 2019.

Investments

Participants may invest their Plan accounts in any or all of the core investment funds offered in the Plan, which include stock, bond, specialty, short-term and target retirement date funds, as well as the Duke Energy Common Stock Fund. The value of an account is updated each business day. As of December 31, 2020, 21 funds were offered for investment.

The Plan offers a brokerage option, BrokerageLink, whereby participants can elect to invest up to 90% of their Plan accounts in numerous publicly traded securities (excluding Duke Energy securities) and mutual funds not offered directly by the Plan.

The Plan also offers an investment advisory service (Professional Management) program through the independent investment advice and management services provider, Financial Engines Advisors, LLC. For 2020, participants in the Professional Management program are charged an annual fee of 0.33% on their average account balance. Participants may cancel their participation in the Professional Management program at any time without penalty. Online advice is also available at no additional cost to the participant.

DUKE ENERGY RETIREMENT SAVINGS PLAN

Notes to Financial Statements

December 31, 2020 and 2019

Participant Accounts

Individual accounts are maintained for each Plan participant. Each participant’s account is credited with participant contributions, Participating Company contributions, and allocations of Plan earnings and charged with benefit payments, allocations of Plan losses, and administrative expenses. Allocations are based on participant elections and earnings and/or account balances, as defined in the Plan document.

The benefit to which a participant is entitled is the benefit that can be provided from the participant’s vested account. The selection from available investment funds is the sole responsibility of each participant, and the Plan is intended to satisfy the requirements of Section 404(c) of ERISA. A participant may elect or change investment funds and/or the contribution allocation percentage among funds at any time.

Vesting and Distribution

A participant is 100% vested in their Plan account balance attributable to employee, employer transition credit contributions, and company matching contributions (and earnings on those contributions). Employer retirement contributions and associated investment earnings are subject to a three-year vesting requirement and also vest, if while employed the employee dies, becomes disabled or attains age 65. The Plan provides for several different types of in-service withdrawals for certain contributions, including hardship (in compliance with Section 401 (k) of the IRC) and age 59 1/2 withdrawals, and withdrawals of rollover and after-tax accounts at any time. Special COVID-19 in-service distribution provisions were adopted by the Plan in 2020, as permitted by the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

Forfeitures

Generally, upon distribution of vested balances following termination of employment, participants’ nonvested balances are forfeited. Such forfeitures can be applied to reduce employer contributions or Plan administrative expenses. Forfeitures of $0.1 million and $0.6 million were included in the Plan assets at December 31, 2020 and 2019, respectively. In 2020, forfeited nonvested participant balances of $3 million were applied to reduce employer contributions and an insignificant amount was used to reduce Plan administrative expenses.

Payment of Benefits

Upon termination of employment, including retirement, death or disability, a participant or, if the participant is deceased, his or her beneficiary, may request the distribution of all or a portion of the balance of the participant’s Plan account. Distributions may be made as soon as practicable after the occasion for the distribution, or generally may be delayed until no later than April 1 of the calendar year following the calendar year in which the participant attains age 70 ½ (or age 72 for those participants who attain age 70 ½ after December 31, 2019.) A beneficiary of a deceased participant may elect that a distribution be delayed for up to five years following the date of death. In accordance with the CARES Act, required minimum distributions from the Plan for 2020 were waived.

If the balance of a participant’s (or beneficiary's) vested account is at least $1, but $5,000 or less (small benefit), it is distributed as soon as practicable. If a distribution election is not made by the participant, the distribution will be made to an individual retirement account (IRA) maintained by Millennium Trust Company for any participant who has not attained age 69 (effective January 25, 2020, age 71 and has not attained age 70½ before January 1, 2021 or any beneficiary).

Notes Receivable from Participants

Participants may borrow, with some limitations, from their accounts a minimum of $1,000 up to a maximum equal to the lesser of (i) $50,000 minus the highest outstanding loan balance during the 12-month period prior to the new loan, or (ii) 50% of their vested account balances. Loans are to be repaid within 58 months, or up to 15 years for the purchase of a primary residence, through regular payroll deductions (and, following termination of employment, as prescribed by the Benefits Committee). The loan is secured by 50% of the balance in the participant’s Plan account at the issuance of the loan and bears interest at a rate of 1% more than the prime interest rate in effect at the issuance of the loan, as determined by the Benefits Committee. Principal and interest are paid ratably through payroll deductions (and, following termination of employment, as prescribed by the Benefits Committee). Loan receipts will be reinvested based on the participant’s investment election for employee contributions at the time of repayment. Special COVID-19 in-service loan limits and loan repayment provisions have been adopted by the Plan in 2020, as permitted by the CARES Act.

Plan Merger

Effective at the close of business on December 31, 2020, the REC Solar Commercial Corporation 401(k) Plan and the REC Solar Prevailing Wage Plan (collectively, the REC Solar Plans) were merged into the Plan. As a result, plan assets from the REC Solar Plans totaling approximately $10.1 million were transferred into the trust maintained to hold Plan assets on or about December 31, 2020. The transfer is reflected in the Statement of Changes in Net Assets Available for Benefits for the year ended December 31, 2020 as a Transfer from REC Solar Plans. In the Statement of Net Assets Available for Benefits as of December 31, 2020, approximately $9.8 million is included in Investments at fair value, and $226 thousand is included in Notes receivable from participants.

DUKE ENERGY RETIREMENT SAVINGS PLAN

Notes to Financial Statements

December 31, 2020 and 2019

Plan Termination

Duke Energy expects and intends to continue the Plan indefinitely but has the right under the Plan to amend, suspend or terminate the Plan subject to the provisions set forth in ERISA. In the event of termination of the Plan, the net assets of the Plan would be distributed to participants based on their Plan accounts.

2. Summary of Significant Accounting Policies

Basis of Accounting

The accompanying financial statements have been prepared on an accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America (US GAAP).

Use of Estimates

The preparation of financial statements in conformity with US GAAP requires Plan management to make estimates and assumptions that affect the reported amounts of net assets available for benefits and changes therein. Actual results could differ from those estimates. The Plan invests in various securities which are exposed to various risks, such as interest rate, credit, and overall market volatility. Due to the level of risk associated with certain investment securities, it is reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect the amounts reported in the financial statements.

Investment Valuation and Income Recognition

Investments are reported at fair value except for the fully benefit-responsive synthetic guaranteed investment contracts (GICs), which are stated at contract value. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. See Note 7 for discussion of fair value measurements. Contract value represents contributions and reinvested income, less any withdrawals plus accrued interest, because these investments have fully benefit-responsive features. Contract value is the relevant measurement attribute for that portion of the net assets available for benefits of a defined contribution plan attributable to fully benefit-responsive investment contracts because contract value is the amount participants would receive if they were to initiate permitted transactions under the terms of the Plan. See Note 6 for further discussion of fully benefit-responsive investment contracts.

Purchases and sales of securities are recorded on a trade-date basis. Interest income is recorded on the accrual basis and dividends are recorded on the ex-dividend date. Management fees and operating expenses charged to the Plan for investments were deducted from income earned on a daily basis and were not separately reflected. Consequently, management fees and operating expenses are reflected as a reduction of investment return for such investments.

Notes Receivable from Participants

Notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest. No allowance for credit losses has been recorded as of December 31, 2020 and 2019. Delinquent participant loans are reclassified as distributions based upon the terms of the Plan document.

Payment of Benefits

Benefits paid to participants are recorded when paid.

Administrative Expenses

A portion of administrative expenses of the Plan are paid by Duke Energy.

Plan Management's Review of Subsequent Events

In preparing the accompanying financial statements, Plan management has reviewed all known events that have occurred after December 31, 2020, and through June 25, 2021, which is the date the financial statements were available to be issued, for inclusion in the financial statements and footnotes and has determined that, except for the matter noted below, no significant events occurred that would have a material impact on the financial statements and footnotes.

3. Exempt Party-in-Interest Transactions (PII)

Fidelity is the Trustee for all Plan investments, as defined by the Plan. Fidelity invests a significant portion of the Duke Energy Common Stock Fund in shares of Duke Energy Common Stock, which qualifies these transactions as PII. BrokerageLink is managed by Fidelity, which qualifies them as a PII. These PII transactions are exempt under ERISA.

DUKE ENERGY RETIREMENT SAVINGS PLAN

Notes to Financial Statements

December 31, 2020 and 2019

4. Federal Income Tax Status

The Internal Revenue Service (IRS) has determined and informed Duke Energy by a letter dated March 16, 2015, that the Plan is qualified and the related trust is exempt from federal income tax under the provisions of Section 501(a) of the Internal Revenue Code (IRC) of 1986. The Plan is intended to be tax-qualified under Section 401(a) of the IRC of 1986, as amended. The Plan has been amended since receiving the determination letter. However, the Plan administrator and the Plan’s legal counsel believe the Plan is currently designed and being operated in compliance with the applicable requirements of the IRC and the Plan and the related trust continue to be tax exempt. Therefore, no provision for income taxes has been included in the Plan’s financial statements.

US GAAP requires Plan management to evaluate tax positions taken by the Plan and recognize a tax liability if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the IRS. There are no uncertain tax positions taken or expected to be taken that would require recognition of a liability or disclosure in the financial statements. The Plan is not currently under audit by any taxing jurisdictions.

5. Investment Risk

Investment securities, in general, are exposed to various risks, such as interest rate, credit and overall market volatility risks. Further, due to the level of risk associated with certain investment securities, it is reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect the amounts reported in the accompanying Statements of Net Assets Available for Benefits.

The Plan has invested a significant portion of its assets in the Duke Energy Common Stock Fund. This investment in the Duke Energy Common Stock Fund approximated 13% and 15% of the Plan’s net assets available for benefits as of December 31, 2020 and 2019, respectively. As a result of this concentration, any significant fluctuation in the market value of the Duke Energy Common Stock Fund could affect individual participant accounts and the net assets of the Plan.

6. Benefit-Responsive Investments

The Plan has an interest in a Stable Value Fund that has investments in fixed income securities and bond funds and may include derivative instruments, such as futures contracts and swap agreements. The Stable Value Fund also enters into a wrapper contract issued by a third-party.

As described in Note 2, contract value is the relevant measurement attribute for that portion of the net assets available for benefits attributable to these contracts. For indirect investments in fully benefit-responsive investment contracts within collective investment trusts, net asset value per share should be calculated in a manner consistent with the measurement principles of the Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) 946, Financial Services - Investment Companies (ASC 946). As required by ASC 946, the net asset value calculated by the fund is based on the net assets, which includes fully benefit-responsive contracts at contract value. This net asset value represents the plan's fair value. As a result, investments are reported on the Statement of Net Assets Available for Benefits at fair value except for the fully benefit-responsive synthetic GICs, which are stated at contract value. Contract value represents contributions made under the contract, plus earnings, less participant withdrawals and administrative expenses. Participants may ordinarily direct the withdrawal or transfer of all or a portion of their investment at contract value. The Stable Value Fund's 2020 contract value of $391.7 million approximates its fair value of $719.2 million while the Stable Value Fund's 2019 contract value of $595.3 million approximates its fair value of $606.6 million.

Occurrence of certain events may limit the ability of the Plan to transact at contract value with the issuer. The Plan administrator does not believe that the occurrence of such an event is probable.

There are no reserves against contract value for credit risk of the contract issuer or otherwise. The crediting interest rate is based on a formula agreed upon with the issuer, but it may not be less than 0%. Such interest rates are reviewed on a quarterly basis for resetting.

As of December 31, 2020, the contract value of the Plan’s fully benefit-responsive synthetic GICs within the Stable Value Fund was approximately $654.6 million. As of December 31, 2019, the contract value of the Plan’s fully benefit-responsive synthetic guaranteed contracts within the Stable Value Fund was approximately $558.9 million.

7. Fair Value Measurements

The FASB ASC 820, Fair Value Measurements and Disclosures (ASC 820), defines fair value, establishes a framework for measuring fair value in US GAAP and expands disclosure requirements about fair value measurements. Under ASC 820, fair value is considered to be the exchange price in an orderly transaction between market participants to sell an asset or transfer a liability at the measurement date. The fair value definition under ASC 820 focuses on an exit price, which is the price that would be received by the Plan to sell an asset or paid to transfer a liability versus an entry price, which would be the price paid to acquire an asset or received to assume a liability. Although ASC 820 does not require additional fair value measurements, it applies to other accounting pronouncements that require or permit fair value measurements.

The Plan determines fair value of financial assets and liabilities based on the following fair value hierarchy, as prescribed by ASC 820, which prioritizes the inputs to valuation techniques used to measure fair value into three levels:

DUKE ENERGY RETIREMENT SAVINGS PLAN

Notes to Financial Statements

December 31, 2020 and 2019

Level 1 inputs: Unadjusted quoted prices in active markets for identical assets or liabilities that the Plan has the ability to access. An active market for the asset or liability is one in which transactions for the asset or liability occurs with sufficient frequency and volume to provide ongoing pricing information.

Level 2 inputs: Inputs other than quoted market prices included in Level 1 that are observable, either directly or indirectly, for the asset or liability. Level 2 inputs include, but are not limited to, quoted prices for similar assets or liabilities in an active market, quoted prices for identical or similar assets or liabilities in markets that are not active and inputs other than quoted market prices that are observable for the asset or liability, such as interest rate curves and yield curves observable at commonly quoted intervals, volatilities, credit risk and default rates.

Level 3 inputs: Unobservable inputs for the asset or liability. Unobservable inputs reflect the Plan’s own assumptions about the factors that other market participants would use in pricing an investment that would be based on the best information available in the circumstances.

Changes in Fair Value Levels

The availability of observable market data is monitored to assess the appropriate classification of the Plan’s investments within the fair value hierarchy. Changes in economic conditions or valuation techniques may require the transfer of investments from one fair value level to another. Transfers between levels are evaluated for their significance based upon the nature of the investments and size of the transfer relative to the net assets available for benefits.

We evaluated the classification of the Stable Value Fund collective investments trusts in consideration of FASB Accounting Standards Update (ASU) 2018-09 Codification Improvement. The amendment removes the stable value common collective trust fund from the illustrative example in FASB ASC 962-325-55-17 to avoid the interpretation that such an investment would never have a readily determinable fair value. As a result of our evaluation, the Stable Value Fund collective investments trusts has been reclassified to Level 1 from investments measured at net asset value because the fair value of the Stable Value Fund collective investments trusts is readily determinable.

The following table provides by level, within the fair value hierarchy, the Plan’s investments at fair value as of December 31, 2020 (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2020

|

|

Description

|

Total Level 1

|

|

Total

|

|

BrokerageLink

|

$

|

866,545

|

|

|

$

|

866,545

|

|

|

Stable Value Fund - collective investment trusts

|

37,127

|

|

|

37,127

|

|

|

|

|

|

|

|

Investments measured at net asset value:

|

|

|

|

|

Duke Energy Common Stock Fund

|

|

|

1,280,782

|

|

|

Commingled funds

|

|

|

2,266,116

|

|

|

Institutional funds

|

|

|

4,760,442

|

|

|

|

|

|

|

|

Total investments at fair value

|

|

|

$

|

9,211,012

|

|

The following table provides by level, within the fair value hierarchy, the Plan's investments at fair value as of December 31, 2019 (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019

|

|

Description

|

Total Level 1

|

|

Total

|

|

BrokerageLink

|

$

|

671,799

|

|

|

$

|

671,799

|

|

|

Stable Value Fund - collective investment trusts

|

36,437

|

|

|

36,437

|

|

|

|

|

|

|

|

Investments measured at net asset value:

|

|

|

|

|

Duke Energy Common Stock Fund

|

|

|

1,412,099

|

|

|

Commingled funds

|

|

|

2,102,120

|

|

|

Institutional funds

|

|

|

4,258,525

|

|

|

|

|

|

|

|

Total investments at fair value

|

|

|

$

|

8,480,980

|

|

Valuation methods of the primary fair value measurements disclosed above are as follows. There have been no changes in the methodologies used at December 31, 2020 or 2019.

DUKE ENERGY RETIREMENT SAVINGS PLAN

Notes to Financial Statements

December 31, 2020 and 2019

Common Stock Fund: Valued at the closing price in the principal active market on which the securities are traded. Principal active markets include published exchanges such as National Association of Securities Dealers Automated Quotations (NASDAQ), New York Stock Exchange (NYSE), New York Mercantile Exchange (NYMEX) and Chicago Board of Trade, as well as pink sheets, which is an electronic quotation system that displays quotes for broker-dealers for many over-the-counter securities. The Plans’ investments in common stock within the BrokerageLink account are valued using Level 1 measurements.

The Duke Energy Common Stock Fund is comprised of common stock as well as cash and cash equivalents. The value of a unit reflects the combined market value of the underlying stock and market value of the short-term cash position. The market value of the common stock portion of the fund is based on the closing market price of the common stock on the NYSE times the number of shares held in the fund. The market value of the cash and cash equivalents is based on the net asset value of shares held in the Fidelity Institutional Money Market Treasury Portfolio Class I.

Institutional funds: The fair value of these investments has been estimated using the net asset value of units held by the Plan at year end. Net asset value is not a publicly-quoted price in an active market. There are currently no redemption restrictions or redemption notice period, and the redemption frequency was immediate for these funds.

Commingled funds: Valued at the net asset value of shares held by the Plan at year end.

Stable Value Fund: The Plan's investment in the Stable Value Fund's collective investment trusts are valued using Level 1 measurements. Investments in the Stable Value Fund collective investment trusts are based on the underlying unit value reported by the Wells Fargo/BlackRock Short Term Investment Fund S. The Plan does not allow for direct exchanges from the Stable Value Fund to the BrokerageLink account. Exchanges from the Stable Value Fund must be made first with another Plan fund and held by that Plan fund for at least 90 days before an exchange can occur with the BrokerageLink account.

8. Plan Changes

Effective as of January 1, 2019, the Plan was amended to modify the hardship withdrawal rules to address IRS regulations, including (i) eliminating the requirement to first obtain all nontaxable loans, (ii) permitting earnings on before-tax and Roth contributions to be withdrawn, (iii) expanding eligibility for casualty loss withdrawals, and (iv) eliminating 6-month suspension from making elective contributions.

Effective as of January 1, 2019, the Plan was amended to (i) clarify the treatment of back pay for employees who are reinstated pursuant to Duke Energy’s Employee Recourse Policy or in accordance with a grievance settlement or arbitration/judicial settlement, (ii) modify the nondiscrimination testing provisions for collective bargaining employees, (iii) modify the correction ordering rule when IRS maximum benefits are exceeded, and (iv) modify the minimum required distribution provisions for beneficiaries.

Effective as of January 2, 2019, the Plan was amended to permit the hardship withdrawal of amounts attributable to qualified non-elective contributions (QNECs).

Effective as of February 1, 2019, the Plan was amended to permit hardship withdrawal of amounts attributable to employer matching contributions, deferred profit sharing contributions, and Roth basic contributions.

Effective as of November 1, 2019, the Plan was amended to (i) add in-plan Roth rollover contributions, (ii) increase the small amount cash-out to $5,000 and (iii) revise the provisions regarding unclaimed benefits.

Effective as of January 1, 2020, the Plan was amended to update the hardship withdrawal provisions in light of final IRS regulations.

Effective as of December 31, 2020, the REC Plans were merged into the Plans.

Effective as of January 25, 2020, the small benefit cash-out provisions were revised.

Effective as of January 1, 2020, the minimum required distribution provisions of the Plan were revised to reflect the changes made by the Setting Every Community Up for Retirement Enhancement (SECURE) Act.

Effective as of May 4, 2020, the Plan’s claims procedure was updated to reflect the COVID-19 pandemic relief regarding time deadlines.

Effective as of March 27, 2020, special COVID-19 pandemic relief for in-service distribution, participant loan limits and loan repayment provisions were adopted by the Plan as permitted by the CARES Act.

Effective as of January 1, 2020, miscellaneous clarifications were made to the Plan.

DUKE ENERGY RETIREMENT SAVINGS PLAN

EIN: 20-2777218 PN: 002

Form 5500, Schedule H, Part IV, Line 4i – Schedule of Assets (Held at End of Year)

December 31, 2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

(b) Identity of Issue, Borrower, Lessor or Similar Party

|

(c) Description of Investment including Maturity Date, Rate of Interest, Collateral, Par or Maturity Value

|

(d) Cost

|

(e) Current

Market Value (in thousands)

|

|

*

|

Duke Energy Common Stock Fund

|

Common Stock

|

**

|

$

|

1,280,782

|

|

|

*

|

US Equity Small/Midcap Blend Fund

|

Institutional Fund

|

**

|

675,814

|

|

|

*

|

US Equity All Cap Blend Fund

|

Institutional Fund

|

**

|

750,156

|

|

|

*

|

Non-US Equity Blend Fund

|

Institutional Fund

|

**

|

870,798

|

|

|

*

|

Fixed Income Blend Fund

|

Institutional Fund

|

**

|

656,621

|

|

|

*

|

US Equity S&P 500 Index Fund

|

Commingled Fund

|

**

|

2,228,302

|

|

|

*

|

Target Retirement Date Fund 2010

|

Institutional Fund

|

**

|

18,500

|

|

|

*

|

Target Retirement Date Fund 2015

|

Institutional Fund

|

**

|

44,119

|

|

|

*

|

Target Retirement Date Fund 2020

|

Institutional Fund

|

**

|

183,896

|

|

|

*

|

Target Retirement Date Fund 2025

|

Institutional Fund

|

**

|

300,824

|

|

|

*

|

Target Retirement Date Fund 2030

|

Institutional Fund

|

**

|

292,369

|

|

|

*

|

Target Retirement Date Fund 2035

|

Institutional Fund

|

**

|

211,889

|

|

|

*

|

Target Retirement Date Fund 2040

|

Institutional Fund

|

**

|

190,251

|

|

|

*

|

Target Retirement Date Fund 2045

|

Institutional Fund

|

**

|

203,716

|

|

|

*

|

Target Retirement Date Fund 2050

|

Institutional Fund

|

**

|

160,634

|

|

|

*

|

Target Retirement Date Fund 2055

|

Institutional Fund

|

**

|

122,852

|

|

|

*

|

Target Retirement Date Fund 2060

|

Institutional Fund

|

**

|

43,308

|

|

|

*

|

Target Retirement Date Fund Post Retirement

|

Institutional Fund

|

**

|

34,698

|

|

|

*

|

Diversified Real Asset Fund

|

Commingled Fund

|

**

|

8,697

|

|

|

*

|

Fidelity BrokerageLink

|

Self-directed brokerage account

|

**

|

866,545

|

|

|

|

Stable Value Fund

|

Common Collective Trust Fund

|

**

|

691,711

|

|

|

*

|

Global Real Estate Investment Trust Fund

|

Commingled Fund

|

**

|

29,114

|

|

|

|

|

|

|

|

|

|

Total Investments

|

|

|

$

|

9,865,596

|

|

|

|

|

|

|

|

|

*

|

Participant Loans

|

Participant Loans

|

– 0 –

|

145,707

|

|

|

|

|

Interest Rates ranging from 3.25% - 9.25%

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

$

|

10,011,303

|

|

* Permitted party-in-interest

** Cost information is not required for participant-directed investments, and therefore, is not included

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EXHIBITS

|

|

|

|

|

|

|

|

|

Exhibit Number

|

Description

|

|

|

|

|

|

|

|

|

23.1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Duke Energy Benefits Committee has duly caused this Annual Report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DUKE ENERGY RETIREMENT SAVINGS PLAN

|

|

Date:

|

|

|

|

June 25, 2021

|

By:

|

|

/s/ Renee Metzler

|

|

|

|

|

Renee Metzler

|

|

|

|

|

Managing Director, Total Rewards

|

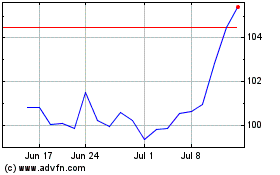

Duke Energy (NYSE:DUK)

Historical Stock Chart

From Mar 2024 to Apr 2024

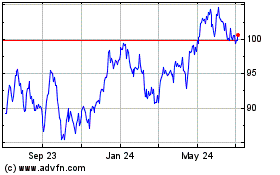

Duke Energy (NYSE:DUK)

Historical Stock Chart

From Apr 2023 to Apr 2024