Duke Energy Florida Completes $900 Million in Debt Issuances

November 26 2019 - 2:06PM

Dow Jones News

By Michael Dabaie

Duke Energy's (DUK) Duke Energy Florida subsidiary completed two

totaling $900 million debt issuances.

The first transaction, totaling $700 million, was a green bond,

which will finance eligible green energy projects. This includes

the development, construction and procurement of solar generation

and utility-scale battery storage projects in the state, Duke

said.

Duke Energy Florida said the second transaction, totaling $200

million, was led by PNC Bank and five financial institutions

representing African American-owned, women-owned, Hispanic-owned

and disabled veteran-owned institutions. Each of the firms served

as an active bookrunner. The firms included CastleOak Securities,

C.L. King & Associates, Drexel Hamilton, Great Pacific

Securities and Ramirez & Co., Duke said.

The funds from this bond will be used to cover costs associated

with Hurricane Dorian, as well as other general corporate

purposes.

Write to Michael Dabaie at michael.dabaie@wsj.com

(END) Dow Jones Newswires

November 26, 2019 13:51 ET (18:51 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

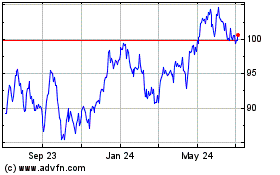

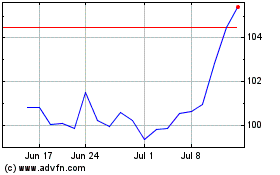

Duke Energy (NYSE:DUK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Duke Energy (NYSE:DUK)

Historical Stock Chart

From Apr 2023 to Apr 2024