Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

August 26 2019 - 1:34PM

Edgar (US Regulatory)

The information in this preliminary pricing supplement is not complete and may be changed. This preliminary

pricing supplement and the accompanying prospectus supplement and prospectus are not offers to sell these securities and are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion

Preliminary Pricing Supplement dated August 26, 2019

Filed under 424(b)(3), Registration Statement No. 333-232862-01

Pricing Supplement No. 5 - Dated Monday, August 26,

2019 (To: Prospectus Dated July 26, 2019, and Prospectus Supplement Dated July 26, 2019)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CUSIP

Number

|

|

Principal

Amount

|

|

Selling

Price

|

|

Gross

Concession

|

|

Net

Proceeds

|

|

Coupon

Rate

|

|

Coupon

Frequency

|

|

Maturity

Date

|

|

1st

Coupon

Date

|

|

1st

Coupon

Amount

|

|

Survivor’s

Option

|

|

Product

Ranking

|

|

26054LL27

|

|

|

|

100%

|

|

1.250%

|

|

|

|

2.250%

|

|

Semi-Annual

|

|

09/15/2024

|

|

03/15/2020

|

|

$11.81

|

|

Yes

|

|

Senior Unsecured Notes

|

|

|

|

Redemption Information: Callable at 100.000% on 3/15/2020 and any time thereafter.

Joint Lead Managers and Lead Agents: Incapital

LLC Agents: Citigroup, Morgan Stanley, Wells Fargo Advisors

|

|

This tranche of The Dow Chemical Company InterNotes will be subject to redemption at the option of The Dow Chemical Company, in whole or

in part, on the interest payment date occurring on 03/15/2020 and any time thereafter at a redemption price equal to 100% of the principal amount of such The Dow Chemical Company InterNotes plus accrued interest thereon, if any, upon not less than

10 nor more than 60 days prior notice to the noteholder and the trustee, as described in the prospectus.

Investment advisers purchasing for the account of their advisory clients and selected dealers purchasing on an agency basis or for their own accounts on a principal or

riskless principal basis, may be offered Notes at a 0.8500% discount to the public offering rate. Notes purchased by selected dealers in level-fee and retirement accounts may be sold to such accounts at a

discount up to 0.8500% to the public offering price, thereby not retaining any portion of the discount as compensation.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26054LL35

|

|

|

|

100%

|

|

1.800%

|

|

|

|

2.750%

|

|

Semi-Annual

|

|

09/15/2029

|

|

03/15/2020

|

|

$14.44

|

|

Yes

|

|

Senior Unsecured Notes

|

|

|

|

Redemption Information: Callable at 100.000% on 3/15/2020 and any time

thereafter.

Joint Lead Managers and Lead Agents:

Incapital LLC Agents: Citigroup, Morgan Stanley, Wells Fargo Advisors

This tranche of The Dow Chemical Company InterNotes will be subject to redemption at the option of The Dow Chemical Company, in whole or in part, on the interest

payment date occurring on 03/15/2020 and any time thereafter at a redemption price equal to 100% of the principal amount of such The Dow Chemical Company InterNotes plus accrued interest thereon, if any, upon not less than 10 nor more than 60 days

prior notice to the noteholder and the trustee, as described in the prospectus.

Investment

advisers purchasing for the account of their advisory clients and selected dealers purchasing on an agency basis or for their own accounts on a principal or riskless principal basis, may be offered Notes at a 1.2500% discount to the public offering

rate. Notes purchased by selected dealers in level-fee and retirement accounts may be sold to such accounts at a discount up to 1.2500% to the public offering price, thereby not retaining any portion of the

discount as compensation.

|

|

|

|

26054LL43

|

|

|

|

100%

|

|

3.150%

|

|

|

|

3.750%

|

|

Semi-Annual

|

|

09/15/2049

|

|

03/15/2020

|

|

$19.69

|

|

Yes

|

|

Senior Unsecured Notes

|

|

Redemption

Information: Callable at 100.000% on 3/15/2020 and any time thereafter.

Joint Lead Managers and Lead Agents: Incapital LLC Agents:

Citigroup, Morgan Stanley, Wells Fargo Advisors

This tranche of The Dow Chemical Company InterNotes will be subject to redemption at the option of The Dow

Chemical Company, in whole or in part, on the interest payment date occurring on 03/15/2020 and any time thereafter at a redemption price equal to 100% of the principal amount of such The Dow Chemical Company InterNotes plus accrued interest

thereon, if any, upon not less than 10 nor more than 60 days prior notice to the noteholder and the trustee, as described in the prospectus.

Investment advisers purchasing for the account of their advisory clients and selected dealers purchasing on an agency basis or for their own accounts on a principal or

riskless principal basis, may be offered Notes at a 2.4000% discount to the public offering rate. Notes purchased by selected dealers in level-fee and retirement accounts may be sold to such accounts at a

discount up to 2.4000% to the public offering price, thereby not retaining any portion of the discount as compensation.

|

|

|

|

|

|

|

|

The Dow Chemical Company

2211 H.H. Dow Way

Midland, Michigan 48674

|

|

Trade Date: Tuesday, September 3, 2019 @ 12:00 PM ET

Settle

Date: Friday, September 6, 2019

Minimum Denomination/Increments: $1,000.00/$1,000.00

Initial trades settle flat and clear SDFS: DTC Book Entry only

DTC Number 0235 via

RBC Dain Rauscher Inc

If the maturity date or an interest payment date for any note is not a

business day (as such term is defined in prospectus), principal and premium, if any, and interest for that note is paid on the next business day, and no further such interest will accrue from, and including, the maturity date or such interest

payment date.

InterNotes® is a registered trademark of Incapital Holdings LLC. All Rights Reserved.

|

|

The Dow Chemical Company

The Dow Chemical Company InterNotes

|

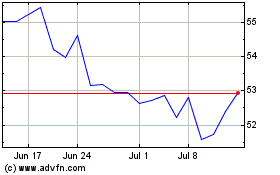

Dow (NYSE:DOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

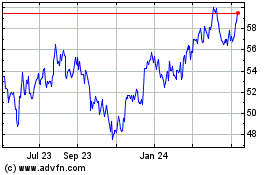

Dow (NYSE:DOW)

Historical Stock Chart

From Apr 2023 to Apr 2024