Dominion Energy, Berkshire Hathaway Affiliate Scrap Sale of Questar Pipelines

July 12 2021 - 8:02AM

Dow Jones News

By Dave Sebastian

Dominion Energy Inc. has agreed to scrap the planned sale of

Questar Pipelines to a Berkshire Hathaway Inc. affiliate, the

companies said.

The companies on Monday said they decided to terminate the sale

due to ongoing uncertainty related to achieving clearance from the

Federal Trade Commission.

The decision doesn't affect the sale of gas transmission and

storage assets to Berkshire Hathaway Energy completed in November

2020, the companies said. That sale reflected about 80% of the

original transaction value, the companies added.

Dominion Energy said it is starting a competitive sale process

for Questar Pipelines, with a target close of the end of 2021. The

company said the deal's termination doesn't change its existing

financial guidance. It said it would continue to account for

Questar Pipelines as discontinued operations.

Dominion Energy said it intends to enter into a 364-day term

loan and use proceeds from the loan to repay the roughly $1.3

billion transaction deposit made by Berkshire Hathaway Energy. It

expects to repay the loan by the end of 2021 with proceeds from the

sale of Questar Pipelines to an alternative buyer.

Write to Dave Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

July 12, 2021 07:55 ET (11:55 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

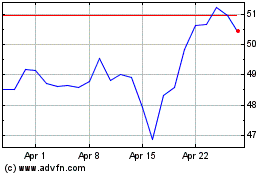

Dominion Energy (NYSE:D)

Historical Stock Chart

From Mar 2024 to Apr 2024

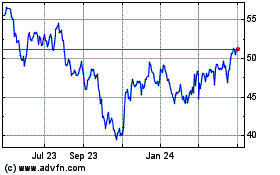

Dominion Energy (NYSE:D)

Historical Stock Chart

From Apr 2023 to Apr 2024