Initial Statement of Beneficial Ownership (3)

April 27 2021 - 6:45PM

Edgar (US Regulatory)

FORM 3

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

INITIAL STATEMENT OF BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0104

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Son Christine K. |

2. Date of Event Requiring Statement (MM/DD/YYYY)

4/23/2021

|

3. Issuer Name and Ticker or Trading Symbol

Dine Brands Global, Inc. [DIN]

|

|

(Last)

(First)

(Middle)

450 N BRAND BLVD, 7TH FLOOR |

4. Relationship of Reporting Person(s) to Issuer (Check all applicable)

_____ Director _____ 10% Owner

___X___ Officer (give title below) _____ Other (specify below)

SVP, Legal, GC and Secretary / |

|

(Street)

GLENDALE, CA 91203

(City)

(State)

(Zip)

| 5. If Amendment, Date Original Filed(MM/DD/YYYY)

| 6. Individual or Joint/Group Filing(Check Applicable Line)

_X_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Beneficially Owned

|

1.Title of Security

(Instr. 4) | 2. Amount of Securities Beneficially Owned

(Instr. 4) | 3. Ownership Form: Direct (D) or Indirect (I)

(Instr. 5) | 4. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| COMMON STOCK | 3029 | D | |

| COMMON STOCK | 3033 (1) | D | |

| COMMON STOCK | 2250 (2) | D | |

| COMMON STOCK | 1691 (3) | D | |

| COMMON STOCK | 1151 (4) | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 4) | 2. Date Exercisable and Expiration Date

(MM/DD/YYYY) | 3. Title and Amount of Securities Underlying Derivative Security

(Instr. 4) | 4. Conversion or Exercise Price of Derivative Security | 5. Ownership Form of Derivative Security: Direct (D) or Indirect (I)

(Instr. 5) | 6. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| STOCK OPTION (RIGHT TO BUY) | (5) | 2/24/2025 | COMMON STOCK | 1621 | $113.72 | D | |

| STOCK OPTION (RIGHT TO BUY) | (6) | 2/26/2026 | COMMON STOCK | 3764 | $90.90 | D | |

| STOCK OPTION (RIGHT TO BUY) | (7) | 3/3/2027 | COMMON STOCK | 12593 | $53.49 | D | |

| STOCK OPTION (RIGHT TO BUY) | (8) | 2/22/2028 | COMMON STOCK | 4767 | $68.80 | D | |

| STOCK OPTION (RIGHT TO BUY) | (9) | 2/25/2029 | COMMON STOCK | 2559 | $98.97 | D | |

| STOCK OPTION (RIGHT TO BUY) | (10) | 2/26/2030 | COMMON STOCK | 4143 | $87.17 | D | |

| Explanation of Responses: |

| (1) | Represents shares of restricted stock that will vest as to one-third of the shares on each of March 4, 2022, 2023 and 2024 subject to the reporting person's continued service with the Issuer on each vesting date. |

| (2) | Represents shares of restricted stock that will vest as to one-third of the shares on each of December 15, 2021, 2022 and 2023 subject to the reporting person's continued service with the Issuer on each vesting date. |

| (3) | Represents shares of restricted stock that will vest on February 26, 2023 subject to the reporting person's continued service with the Issuer on the vesting date. |

| (4) | Represents shares of restricted stock that will vest on February 25, 2022 subject to the reporting person's continued service with the Issuer on the vesting date. |

| (5) | The stock option was granted to the reporting person under the Issuer's 2011 Stock Incentive Plan. The option vested as to one-third of the shares on each of February 24, 2016, 2017 and 2018. |

| (6) | The stock option was granted to the reporting person under the Issuer's 2011 Stock Incentive Plan. The option vested as to one-third of the shares on each of February 26, 2017, 2018 and 2019. |

| (7) | The stock option was granted to the reporting person under the Issuer's 2016 Stock Incentive Plan. The option vested as to one-third of the shares on each of March 3, 2018, 2019 and 2020. |

| (8) | The stock option was granted to the reporting person under the Issuer's 2016 Stock Incentive Plan. The option vested as to one-third of the shares on each of February 22, 2019, 2020 and 2021. |

| (9) | The stock option was granted to the reporting person under the Issuer's 2016 Stock Incentive Plan. The option vested as to one-third of the shares on each of February 25, 2020 and 2021 and will vest as to one-third of the shares on February 25, 2022. |

| (10) | The stock option was granted to the reporting person under the Issuer's 2019 Stock Incentive Plan. The option vested as to one-third of the shares on February 26, 2021 and will vest as to one-third of the shares on each of February 26, 2022 and 2023. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Son Christine K.

450 N BRAND BLVD

7TH FLOOR

GLENDALE, CA 91203 |

|

| SVP, Legal, GC and Secretary |

|

Signatures

|

| /s/ Christine K. Son | | 4/27/2021 |

| **Signature of Reporting Person | Date |

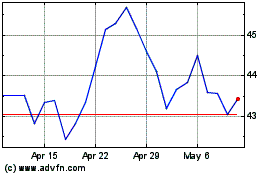

Dine Brands Global (NYSE:DIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

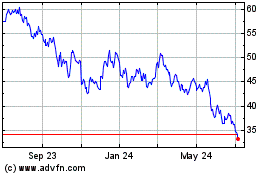

Dine Brands Global (NYSE:DIN)

Historical Stock Chart

From Apr 2023 to Apr 2024