Current Report Filing (8-k)

July 28 2021 - 4:14PM

Edgar (US Regulatory)

0001582961false00015829612021-07-272021-07-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (date of earliest event reported): July 27, 2021

DigitalOcean Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

001-40252

|

45-5207470

|

|

(State or other jurisdiction of incorporation or organization)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

101 6th Avenue

|

New York

|

New York

|

10013

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

(646) 827-4366

Registrant's telephone number, including area code

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, par value $0.000025 per share

|

DOCN

|

The New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On July 27, 2021, the board of directors (the “Board”) of DigitalOcean Holdings, Inc. (the “Company”) granted a restricted stock unit (“RSU”) award to the Company’s Chief Executive Officer, Yancey Spruill (the “CEO Performance Award”). The Company believes that the CEO Performance Award serves to align Mr. Spruill’s interests with those of the Company’s stockholders by creating a strong and visible link between Mr. Spruill’s incentives and the Company’s long-term stock performance.

The CEO Performance Award consists of an RSU award under the Company’s 2021 Equity Incentive Plan for 3,000,000 shares of the Company’s common stock and will vest upon the satisfaction of certain service conditions and the achievement of certain Company stock price goals, as described below.

The CEO Performance Award will be earned based on the Company’s stock price performance over a seven-year period beginning on the date of grant. The CEO Performance Award, which is estimated to have a grant date fair value of approximately $85 million, is divided into five tranches that will be earned based on the achievement of stock price goals, measured based on the average of the Company’s closing stock price over a consecutive ninety (90) trading day period during the performance period as set forth in the table below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tranche

|

|

Company Stock Price Target

|

|

Number of Eligible RSUs

|

|

1

|

|

$93.50

|

|

475,000

|

|

2

|

|

$140.00

|

|

575,000

|

|

3

|

|

$187.00

|

|

650,000

|

|

4

|

|

$233.50

|

|

650,000

|

|

5

|

|

$280.50

|

|

650,000

|

If the average stock price over a consecutive ninety (90) trading day period fails to reach $93.50 during the performance period, no portion of the CEO Performance Award will be earned.

To the extent earned based on the stock price targets set forth above, the CEO Performance Award will vest over a seven-year period beginning on the date of grant in annual amounts equal to 14%, 14%, 14%, 14%, 14%, 15% and 15%, respectively, on each anniversary of the date of grant. In the event of a change in control of the Company during the performance period, stock price performance for purposes of the CEO Performance Award will be measured based on the per share consideration to be received by the Company’s stockholders in connection with the change in control, using linear interpolation if the price is between tranches.

In the event Mr. Spruill is terminated for “cause” or resigns without “good reason” (each as defined in the CEO Performance Award RSU Agreement) such that he no longer serves as the Company’s Chief Executive Officer, in another C-level executive role or as the full-time Executive Chair of the Board, any unearned RSUs and earned but unvested RSUs will be forfeited. If Mr. Spruill is terminated without cause or resigns for good reason, any unearned RSUs will be forfeited (except as set forth below) and earned but unvested RSUs will continue to vest in accordance with the schedule set forth above. Notwithstanding the foregoing, if Mr. Spruill is terminated without cause or resigns for good reason prior to or within 12 months following a change in control, any earned but unvested RSUs will accelerate and become vested as of the date of the change of control or termination. If Mr. Spruill is terminated by reason of death or “disability” (as defined in the CEO Performance Award RSU Agreement), any unearned RSUs will be forfeited (except as set forth below) and earned but unvested RSUs will accelerate and become vested as of the date of termination. In the event of (a) a termination without cause or resignation for good reason other than within 12 months following a change in control or (b) termination by reason of death or disability, if the Company’s trailing ninety (90) trading day average stock price as of the termination date is at least 90% of the next unachieved stock price target and the next stock price target is achieved within the six-month period following termination, then such stock price target shall be deemed to have been met and the related tranche of RSUs will vest according to the terms applicable to such termination.

While providing services to the Company, Mr. Spruill must hold any shares that are issued to him pursuant to the CEO Performance Award for at least one year following the date that the portion of the CEO Performance Award satisfies the relevant service-based condition, except to satisfy certain tax withholding obligations.

The Board intends for the CEO Performance Award to be the exclusive equity award that Mr. Spruill receives for a period of at least four years from the date of grant.

The foregoing description of the CEO Performance Award does not purport to be complete and is qualified in its entirety by reference to the Performance-Based Restricted Stock Unit Award Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

10.1

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date:

|

July 28, 2021

|

DigitalOcean Holdings, Inc.

|

|

|

|

By:

|

/s/ Alan Shapiro

|

|

|

|

|

General Counsel and Secretary

|

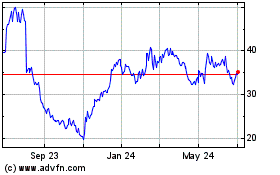

DigitalOcean (NYSE:DOCN)

Historical Stock Chart

From Mar 2024 to Apr 2024

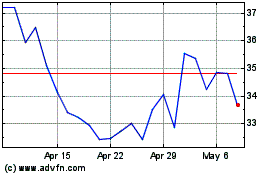

DigitalOcean (NYSE:DOCN)

Historical Stock Chart

From Apr 2023 to Apr 2024