By David Hodari and Ryan Dezember

Oil prices climbed sharply Thursday as tensions mounted in the

Middle East and the dollar fell, extending a period of high

volatility for crude.

West Texas Intermediate futures rose 5.4% to $56.65 a barrel on

the New York Mercantile Exchange, the biggest daily gain since

December. Brent crude, the global benchmark, was up 4.3% at $64.45

a barrel on London's ICE Futures exchange.

Shares of U.S. oil producers, rig operators, pipelines owners

and refiners also rallied, leading the S&P 500 higher to close

at a record. Energy shares in the stock index were up 2.2%, while

those in the S&P 600 index of smaller companies climbed

4.4%.

Energy stocks have been among the poorest performers of 2019,

but turmoil in the Middle East has recently lured back investors,

who are betting that domestic producers will grab global market

share from the Organization for Petroleum Exporting Countries.

Among the big gainers Thursday were producers Noble Energy Inc. and

Devon Energy Corp., up 6.1% and 4.3%, respectively, and refiner

HollyFrontier Corp., which added 5.4%. Oilfield services firm

Halliburton Co. gained 4.9%.

Iran's Revolutionary Guard said early Thursday it had shot down

a U.S. drone over its territory. That claim came hours after the

U.S. military said a Saudi desalination plant was struck by a

missile that appeared to come from Yemen.

"The market has been largely underpricing ongoing Middle Eastern

tension for some time now, but these growing tensions between Iran

and the U.S., and Iran and the Saudis bring it back to center stage

for many of us," said Warren Patterson, commodities strategist at

ING.

These developments mark the latest in a series of flashpoints in

the Middle East, with hostilities ratcheting up over recent weeks.

Saudi Arabia and the U.S. are on one side. Iran and Houthi Yemenis

are on the other.

Oil prices received a sharp boost last week, after attacks on

two tankers in the Gulf of Oman, which neighbors the Strait of

Hormuz -- the thoroughfare for a third of the world's shipped oil.

In May, prices jumped after attacks on Saudi pumping stations and

its East-West pipeline.

Hostility between Saudi Arabia and Iran has come against the

backdrop of U.S. sanctions aimed at driving Iranian oil exports to

zero. Iran has attempted to evade those strictures, while also

repeatedly threatening to shut down the Strait of Hormuz if

sanctions aren't lifted.

"Each time we've had an attack in the Middle East -- we've now

had a drone downed -- we've seen prices reacting positively," said

Giovanni Staunovo, director at UBS Wealth Management's chief

investment office. "But the risk premium will only stay if it risks

production disruptions and so far we've seen none."

Flare-ups in the region have added to volatility in oil prices,

providing shocks boosts in a period of anxiety over the health of

global economic growth.

The International Energy Agency, the Energy Information

Administration, and OPEC have all recently said that weakening

growth -- partly driven by the U.S.-China trade spat -- would

stymie oil demand in the coming months.

EIA data released Wednesday showed a larger-than-expected weekly

decline in U.S. crude inventories as well as record gasoline

demand, and a generally weaker economic backdrop has prompted

policy reaction this week from central banks. The European Central

Bank signaled possible stimulus measures Wednesday, while Federal

Reserve Chairman Jerome Powell signaled increasing willingness

Thursday to cut interest rates this year or next.

The ensuing drop in the dollar has helped buoy

dollar-denominated commodities, which become less expensive for

other currency holders when the dollar falls. The WSJ Dollar Index

was down 0.5% on the day, extending its decline over the past month

to 1.3%.

"There's also an economic part to the story, with the weakening

dollar obviously bullish for oil," said Tamas Varga, an analyst at

PVM Oil Associates.

A cocktail of geopolitical and fundamental factors threaten to

inject further volatility into oil over the coming days.

President Trump and China's President Xi Jinping are due to meet

at the G-20 summit in Japan next week. After trade talks broke down

several weeks ago, even the announcement of their plan prompted

buying across equities and commodities markets.

"If there's a break in the trade war, stocks and oil are going

to rally, " said Mr. Varga.

Separately, OPEC altered the dates of its coming meeting

Wednesday. With the bloc and its allies having finally agreed to

meet July 1-2, investor focus has returned to whether the cartel

will extend its continuing production cut. United Arab Emirates Oil

Minister Suhail al-Mazroui said Wednesday that a longer cut would

be reasonable, according to reports.

Meanwhile, U.S. natural gas prices plumbed new three-year lows,

with futures falling 4% to $2.185 per million British thermal

units, after the EIA reported greater injections into storage than

expected by analysts. Unseasonably mild weather has limited demand

for electricity to power air conditioners while the recent rise in

crude prices portends more gas produced as a byproduct of oil

drilling.

--Ryan Dezember contributed to this article.

Write to David Hodari at David.Hodari@dowjones.com and Ryan

Dezember at ryan.dezember@wsj.com

(END) Dow Jones Newswires

June 20, 2019 16:49 ET (20:49 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

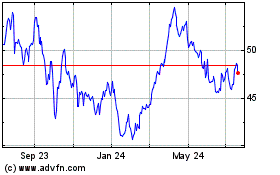

Devon Energy (NYSE:DVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

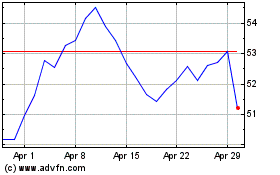

Devon Energy (NYSE:DVN)

Historical Stock Chart

From Apr 2023 to Apr 2024