Filed by Stratasys Ltd.

(Commission File No. 001-35751)

Pursuant to Rule 425 of the Securities Act of 1933

and deemed filed Pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Desktop Metal, Inc. (Commission

File No. 001-38835)

The following email was sent to certain of Stratasys Ltd.’s investors and analysts

by Yonah Lloyd, Stratasys Ltd.'s VP Investor Relations, on May 25, 2023.

Good afternoon,

I am reaching out to make sure you saw the news that Stratasys entered

an agreement to combine with Desktop Metal in an all-stock transaction valued at approximately $1.8 billion. You can read more about the

transaction in our press release here https://investors.stratasys.com/news-events/press-releases/detail/820/stratasys-to-combine-with-desktop-metal-in-approximately.

Stratasys and Desktop Metal will host a conference call at 8:30 am

ET to discuss the transaction and its benefits in more detail. An investor presentation will be available at investors.stratasys.com appx.

30 minutes before the call. Details for the call:

| ● | U.S.

toll-free: 877-524-8416 |

| ● | International

dial-in: +1 412-902-1028 |

| ● | Webcast:

https://event.choruscall.com/mediaframe/webcast.html?webcastid=TAE4tFjn. |

The

combination with Desktop Metal will accelerate our growth trajectory by uniting two leaders to create a next-generation additive manufacturing

company that is expected to be well-positioned to serve the evolving needs of customers in manufacturing. Here are a few strategic

and financial highlights of the transaction:

| ● | Stratasys

and Desktop Metal are expected to generate $1.1 billion in revenue with adjusted EBITDA margin

of 10% - 12% in 2025, and significant upside potential in a total addressable market of more

than $100 billion by 2032. |

| ● | This

combination is expected to generate approximately $50 million in additional annual run-rate

cost synergies by 2025 and an additional $50 million in annual run-rate revenue synergies

by 2025. |

| ● | This

transaction accelerates the combined company’s financial flexibility through a well-capitalized

balance sheet to drive future growth. |

| ● | The

combined company will have a broad product portfolio and attractive positions across multiple

additive manufacturing technologies and solutions. Upon close, more than 50% of pro forma

combined company revenue is expected to be derived from end-use-parts manufacturing and mass

production, one of the fastest growing segments in additive manufacturing. |

| ● | The

transaction brings together complementary IP portfolios with more than 3,400 patents and

pending patent applications and one of the largest R&D and engineering teams in the industry

focused on driving innovation across a differentiated materials library. |

I hope you share our enthusiasm as we embark on this exciting next

chapter. If you’re interested in a call to discuss further, please advise.

Best,

Yonah

Forward-Looking Statements

This communication contains forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995.

Such forward-looking statements include statements relating to the

proposed transaction between Stratasys Ltd. (“Stratasys”) and Desktop Metal, Inc. (“Desktop Metal”), including

statements regarding the benefits of the transaction and the anticipated timing of the transaction, and information regarding the businesses

of Stratasys and Desktop Metal, including expectations regarding outlook and all underlying assumptions, Stratasys’ and Desktop

Metal’s objectives, plans and strategies, information relating to operating trends in markets where Stratasys and Desktop Metal

operate, statements that contain projections of results of operations or of financial condition and all other statements other than statements

of historical fact that address activities, events or developments that Stratasys or Desktop Metal intends, expects, projects, believes

or anticipates will or may occur in the future. Such statements are based on management’s beliefs and assumptions made based on

information currently available to management. All statements in this communication, other than statements of historical fact, are forward-looking

statements that may be identified by the use of the words “outlook,” “guidance,” “expects,” “believes,”

“anticipates,” “should,” “estimates,” and similar expressions. These forward-looking statements involve

known and unknown risks and uncertainties, which may cause Stratasys’ or Desktop Metal’s actual results and performance to

be materially different from those expressed or implied in the forward-looking statements. Factors and risks that may impact future results

and performance include, but are not limited to those factors and risks described in Item 3.D “Key Information - Risk Factors”,

Item 4 “Information on the Company”, and Item 5 “Operating and Financial Review and Prospects” in Stratasys’

Annual Report on Form 20-F for the year ended December 31, 2022 and Part 1, Item 1A, “Risk Factors” in Desktop Metal’s

Annual Report on Form 10-K for the year ended December 31, 2022, each filed with the Securities and Exchange Commission (the “SEC”),

and in other filings by Stratasys and Desktop Metal with the SEC. These include, but are not limited to: the ultimate outcome of the proposed

transaction between Stratasys and Desktop Metal, including the possibility that Stratasys or Desktop Metal shareholders will reject the

proposed transaction; the effect of the announcement of the proposed transaction on the ability of Stratasys and Desktop Metal to operate

their respective businesses and retain and hire key personnel and to maintain favorable business relationships; the timing of the proposed

transaction; the occurrence of any event, change or other circumstance that could give rise to the termination of the proposed transaction;

the ability to satisfy closing conditions to the completion of the proposed transaction (including any necessary shareholder approvals);

other risks related to the completion of the proposed transaction and actions related thereto; changes in demand for Stratasys’

or Desktop Metal’s products and services; global market, political and economic conditions, and in the countries in which Stratasys

and Desktop Metal operate in particular; government regulations and approvals; the extent of growth of the 3D printing market generally;

the global macro-economic environment, including headwinds caused by inflation, rising interest rates, unfavorable currency exchange rates

and potential recessionary conditions; the impact of shifts in prices or margins of the products that Stratasys or Desktop Metal sells

or services Stratasys or Desktop Metal provides, including due to a shift towards lower margin products or services; the potential adverse

impact that recent global interruptions and delays involving freight carriers and other third parties may have on Stratasys’ or

Desktop Metal’s supply chain and distribution network and consequently, Stratasys’ or Desktop Metal’s ability to successfully

sell both existing and newly-launched 3D printing products; litigation and regulatory proceedings, including any proceedings that may

be instituted against Stratasys or Desktop Metal related to the proposed transaction; impacts of rapid technological change in the additive

manufacturing industry, which requires Stratasys and Desktop Metal to continue to develop new products and innovations to meet constantly

evolving customer demands and which could adversely affect market adoption of Stratasys’ or Desktop Metal’s products; and

disruptions of Stratasys’ or Desktop Metal’s information technology systems.

These risks, as well as other risks related to the proposed transaction,

will be included in the registration statement on Form F-4 and joint proxy statement/prospectus that will be filed with the Securities

and Exchange Commission (“SEC”) in connection with the proposed transaction. While the list of factors presented here is,

and the list of factors to be presented in the registration statement on Form F-4 are, considered representative, no such list should

be considered to be a complete statement of all potential risks and uncertainties. For additional information about other factors that

could cause actual results to differ materially from those described in the forward-looking statements, please refer to Stratasys’

and Desktop Metal’s respective periodic reports and other filings with the SEC, including the risk factors identified in Stratasys’

and Desktop Metal’s Annual Reports on Form 20-F and Form 10-K, respectively, and Stratasys’ Form 6-K reports that published

its results for the quarter ended March 31, 2023, which it furnished to the SEC on May 16, 2023, and Desktop Metal’s most recent

Quarterly Reports on Form 10-Q. The forward-looking statements included in this communication are made only as of the date hereof. Neither

Stratasys nor Desktop Metal undertakes any obligation to update any forward-looking statements to reflect subsequent events or circumstances,

except as required by law.

No Offer or Solicitation

This communication is not intended to and shall not constitute an offer

to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there

be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification

under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the

requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Additional Information about the Transaction and Where to Find It

In connection with the proposed transaction, Stratasys intends to file

with the SEC a registration statement on Form F-4 that will include a joint proxy statement of Stratasys and Desktop Metal and that also

constitutes a prospectus of Stratasys. Each of Stratasys and Desktop Metal may also file other relevant documents with the SEC regarding

the proposed transaction. This document is not a substitute for the joint proxy statement/prospectus or registration statement or any

other document that Stratasys or Desktop Metal may file with the SEC. The definitive joint proxy statement/prospectus (if and when available)

will be mailed to shareholders of Stratasys and Desktop Metal. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT,

THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS

TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION

ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of the registration statement and joint

proxy statement/prospectus (if and when available) and other documents containing important information about Stratasys, Desktop Metal

and the proposed transaction, once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov.

Copies of the documents filed with, or furnished, to the SEC by Stratasys will be available free of charge on Stratasys’ website

at https://investors.stratasys.com/sec-filings. Copies of the documents filed with the SEC by Desktop Metal will be available free of

charge on Desktop Metal’s website at https://ir.desktopmetal.com/sec-filings/all-sec-filings.

Participants in the Solicitation

Stratasys, Desktop Metal and certain of their respective directors

and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information

about the directors and executive officers of Stratasys, including a description of their direct or indirect interests, by security holdings

or otherwise, is set forth in Stratasys’ proxy statement for its 2022 Annual General Meeting of Shareholders, which was filed with

the SEC on August 8, 2022, and Stratasys’ Annual Report on Form 20-F for the fiscal year ended December 31, 2022, which was filed

with the SEC on March 3, 2023. Information about the directors and executive officers of Desktop Metal, including a description of their

direct or indirect interests, by security holdings or otherwise, is set forth in Desktop Metal’s proxy statement for its 2023 Annual

Meeting of Stockholders, which was filed with the SEC on April 25, 2023 and Desktop Metal’s Annual Report on Form 10-K for the fiscal

year ended December 31, 2022, which was filed with the SEC on March 1, 2023. Other information regarding the participants in the proxy

solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint

proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when such materials

become available. Investors should read the joint proxy statement/prospectus carefully when it becomes available before making any voting

or investment decisions. You may obtain free copies of these documents from Stratasys or Desktop Metal using the sources indicated above.

3

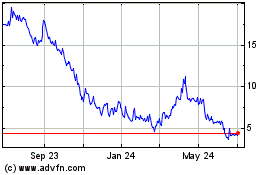

Desktop Metal (NYSE:DM)

Historical Stock Chart

From Mar 2024 to Apr 2024

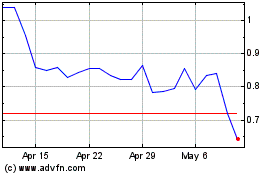

Desktop Metal (NYSE:DM)

Historical Stock Chart

From Apr 2023 to Apr 2024