UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 25, 2023

Desktop Metal, Inc.

(Exact name of Registrant as Specified in Its

Charter)

| Delaware |

|

001-38835 |

|

83-2044042 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

63 3rd Avenue

Burlington, MA 01803

(Address of principal

executive offices) (Zip Code)

(978) 224-1244

(Registrant’s telephone number, include

area code)

N/A

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions

A.2 below):

| |

x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant

to Section 12(b) of the Exchange Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Class A Common stock, par value $0.0001 per share |

|

DM |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01 Regulation FD Disclosure.

On May 25, 2023, Desktop Metal, Inc.

(the “Company”) and Stratasys Ltd. (“Stratasys”) issued a joint press release announcing, among other things,

the execution of an Agreement and Plan of Merger (the “Merger Agreement”), dated as of May 25, 2023, by and among the

Company, Stratasys and Tetris Sub Inc., a Delaware corporation and wholly-owned subsidiary of Stratasys (“Merger Sub”), pursuant

to which, subject to the terms and conditions of the Merger Agreement, Merger Sub will merge with and into the Company, with the Company

surviving the merger as a wholly-owned subsidiary of Stratasys (the “Merger”).

Subject to the terms and conditions of the

Merger Agreement, stockholders of the Company will receive 0.123 Stratasys ordinary shares in exchange for each share of our common stock

held immediately prior to the Merger.

The parties expect the transaction to close

in the fourth quarter of 2023, subject to the receipt of required regulatory approvals, including expiration or termination of the applicable

waiting period under the Hart-Scott-Rodino Antitrust Improvements Act, approval of the Committee on Foreign Investment in the United States,

approvals of the shareholders of the Company and Stratasys and other customary closing conditions.

The Merger Agreement provides each of the

Company and Stratasys with certain termination rights and, under certain circumstances, may require the Company or Stratasys to pay a

termination fee.

A copy of the joint press release is attached

hereto as Exhibit 99.1 and incorporated herein by reference.

The Company also provided supplemental information regarding the proposed

transaction. A copy of the supplemental information is attached hereto as Exhibit 99.2 and incorporated herein by reference.

The information in Item 7.01 of this Current

Report and Exhibits 99.1 and 99.2 hereto are being furnished and shall not be deemed “filed” for the purpose of Section 18

of the Exchange Act. The information in Item 7.01 of this Current Report and Exhibits 99.1 and 99.2 hereto shall not be incorporated by

reference into any registration statement or other document pursuant to the Securities Act.

Forward-Looking Statements

This Current Report contains forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995.

Such forward-looking statements include statements

relating to the proposed transaction between Stratasys and the Company, including statements regarding the benefits of the transaction

and the anticipated timing of the transaction, and information regarding the businesses of Stratasys and the Company, including expectations

regarding outlook and all underlying assumptions, Stratasys’ and the Company’s objectives, plans and strategies, information

relating to operating trends in markets where Stratasys and the Company operate, statements that contain projections of results of operations

or of financial condition and all other statements other than statements of historical fact that address activities, events or developments

that Stratasys or the Company intends, expects, projects, believes or anticipates will or may occur in the future. Such statements are

based on management’s beliefs and assumptions made based on information currently available to management. All statements in this

communication, other than statements of historical fact, are forward-looking statements that may be identified by the use of the words

“outlook,” “guidance,” “expects,” “believes,” “anticipates,” “should,”

“estimates,” and similar expressions. These forward-looking statements involve known and unknown risks and uncertainties,

which may cause Stratasys’ or the Company’s actual results and performance to be materially different from those expressed

or implied in the forward-looking statements. Factors and risks that may impact future results and performance include, but are not limited

to those factors and risks described in Item 3.D “Key Information - Risk Factors”, Item 4 “Information on the Company”,

and Item 5 “Operating and Financial Review and Prospects” in Stratasys’ Annual Report on Form 20-F for the year

ended December 31, 2022 and Part 1, Item 1A, “Risk Factors” in the Company’s Annual Report on Form 10-K

for the year ended December 31, 2022, each filed with the Securities and Exchange Commission (the “SEC”), and in other

filings by Stratasys and the Company with the SEC. These include, but are not limited to: the ultimate outcome of the proposed transaction

between Stratasys and the Company, including the possibility that Stratasys or the Company shareholders will reject the proposed transaction;

the effect of the announcement of the proposed transaction on the ability of Stratasys and the Company to operate their respective businesses

and retain and hire key personnel and to maintain favorable business relationships; the timing of the proposed transaction; the occurrence

of any event, change or other circumstance that could give rise to the termination of the proposed transaction; the ability to satisfy

closing conditions to the completion of the proposed transaction (including any necessary shareholder approvals); other risks related

to the completion of the proposed transaction and actions related thereto; changes in demand for Stratasys’ or the Company’s

products and services; global market, political and economic conditions, and in the countries in which Stratasys and the Company operate

in particular; government regulations and approvals; the extent of growth of the 3D printing market generally; the global macro-economic

environment, including headwinds caused by inflation, rising interest rates, unfavorable currency exchange rates and potential recessionary

conditions; the impact of shifts in prices or margins of the products that Stratasys or the Company sells or services Stratasys or the

Company provides, including due to a shift towards lower margin products or services; the potential adverse impact that recent global

interruptions and delays involving freight carriers and other third parties may have on Stratasys’ or the Company’s supply

chain and distribution network and consequently, Stratasys’ or the Company’s ability to successfully sell both existing and

newly-launched 3D printing products; litigation and regulatory proceedings, including any proceedings that may be instituted against Stratasys

or the Company related to the proposed transaction; impacts of rapid technological change in the additive manufacturing industry, which

requires Stratasys and the Company to continue to develop new products and innovations to meet constantly evolving customer demands and

which could adversely affect market adoption of Stratasys’ or the Company’s products; and disruptions of Stratasys’

or the Company’s information technology systems.

These risks, as well as other risks related

to the proposed transaction, will be included in the registration statement on Form F-4 and joint proxy statement/prospectus that

will be filed with the SEC in connection with the proposed transaction. While the list of factors presented here is, and the list of factors

to be presented in the registration statement on Form F-4 are, considered representative, no such list should be considered to be

a complete statement of all potential risks and uncertainties. For additional information about other factors that could cause actual

results to differ materially from those described in the forward-looking statements, please refer to Stratasys’ and the Company’s

respective periodic reports and other filings with the SEC, including the risk factors identified in Stratasys’ and the Company’s

Annual Reports on Form 20-F and Form 10-K, respectively, and the Company’s most recent Quarterly Reports on Form 10-Q.

The forward-looking statements included in this communication are made only as of the date hereof. Neither Stratasys nor the Company undertakes

any obligation to update any forward-looking statements to reflect subsequent events or circumstances, except as required by law.

No Offer or Solicitation

This communication is not intended to and

shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote

or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful

prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except

by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Additional Information about the Transaction

and Where to Find It

In connection with the proposed transaction,

Stratasys intends to file with the SEC a registration statement on Form F-4 that will include a joint proxy statement of Stratasys

and the Company and that also constitutes a prospectus of Stratasys. Each of Stratasys and the Company may also file other relevant documents

with the SEC regarding the proposed transaction. This document is not a substitute for the joint proxy statement/prospectus or registration

statement or any other document that Stratasys or the Company may file with the SEC. The definitive joint proxy statement/prospectus (if

and when available) will be mailed to shareholders of Stratasys and the Company. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE

REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS

WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY

CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free

copies of the registration statement and joint proxy statement/prospectus (if and when available) and other documents containing important

information about Stratasys, the Company and the proposed transaction, once such documents are filed with the SEC through the website

maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Stratasys will be available free of charge

on Stratasys’ website at https://investors.stratasys.com/sec-filings. Copies of the documents filed with the SEC by the Company

will be available free of charge on the Company’s website at https://ir.desktopmetal.com/sec-filings/all-sec-filings.

Participants in the Solicitation

Stratasys, the Company and certain of their

respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed

transaction. Information about the directors and executive officers of Stratasys, including a description of their direct or indirect

interests, by security holdings or otherwise, is set forth in Stratasys’ proxy statement for its 2022 Annual General Meeting of

Shareholders, which was filed with the SEC on August 8, 2022, and Stratasys’ Annual Report on Form 20-F for the fiscal

year ended December 31, 2022, which was filed with the SEC on March 3, 2023. Information about the directors and executive officers

of the Company, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in the

Company’s proxy statement for its 2023 Annual Meeting of Shareholders, which was filed with the SEC on April 25, 2023 and the

Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, which was filed with the SEC on March 1,

2023. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests,

by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed

with the SEC regarding the proposed transaction when such materials become available. Investors should read the joint proxy statement/prospectus

carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from

Stratasys or the Company using the sources indicated above.

Item 9.01 Financial Statements and

Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

|

Desktop Metal, Inc. |

| |

|

|

| Date: |

May 25, 2023 |

By: |

/s/ Meg Broderick |

| |

|

Name: |

Meg Broderick |

| |

|

Title: |

General Counsel and Corporate Secretary |

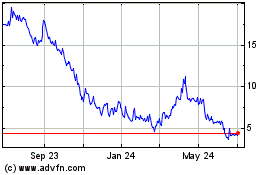

Desktop Metal (NYSE:DM)

Historical Stock Chart

From Mar 2024 to Apr 2024

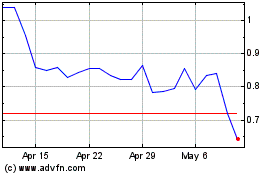

Desktop Metal (NYSE:DM)

Historical Stock Chart

From Apr 2023 to Apr 2024