Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

June 10 2020 - 4:30PM

Edgar (US Regulatory)

Issuer Free Writing Prospectus filed pursuant to Rule 433

Registration Statement No. 333-238725

Pricing Term Sheet

Dated June 10, 2020

DELTA AIR LINES, INC.

7.375%

Notes Due 2026

|

|

|

|

|

Issuer:

|

|

Delta Air Lines, Inc.

|

|

|

|

|

Principal Amount:

|

|

$1,250,000,000

|

|

|

|

|

Maturity Date:

|

|

January 15, 2026

|

|

|

|

|

Coupon:

|

|

7.375%

|

|

|

|

|

Public Offering Price:

|

|

99.986% of the principal amount

|

|

|

|

|

Yield to Maturity:

|

|

7.375%

|

|

|

|

|

Interest Payment Dates:

|

|

January 15 and July 15, commencing January 15, 2021

|

|

|

|

|

Optional Redemption:

|

|

At any time prior to December 15, 2025 (one month prior to the maturity date), the notes will be redeemable, in whole or in part, at a

redemption price equal to the greater of (i) 100% of the principal amount of the notes to be redeemed and (ii) the sum of the present values of the remaining scheduled payments of principal and interest on the notes to be redeemed that would

have been made if such notes matured on December 15, 2025 (exclusive of interest accrued to the redemption date) discounted to the redemption date on a semi-annual basis (assuming a 360-day year

consisting of twelve 30-day months) at the applicable treasury rate plus 50 basis points, plus, in each case, accrued and unpaid interest on the principal amount of the notes to be redeemed to the date of

redemption.

At any time on or after December 15, 2025, the notes will be

redeemable, in whole or in part, at a redemption price of 100% of the principal amount of the notes to be redeemed, plus accrued and unpaid interest thereon to the date of redemption.

|

|

|

|

|

Settlement Date:

|

|

T+2; June 12, 2020

|

|

|

|

|

CUSIP:

|

|

247361 ZZ4

|

|

|

|

|

ISIN:

|

|

US247361ZZ42

|

|

|

|

|

Ratings (Moody’s / S&P / Fitch)*:

|

|

Baa3 / BB / BB+

|

|

|

|

|

Minimum Denomination:

|

|

$2,000 and integral multiples of $1,000 in excess thereof

|

|

|

|

|

Joint Book-Running Managers:

|

|

Goldman Sachs & Co. LLC

Morgan

Stanley & Co. LLC

Barclays Capital Inc.

BofA

Securities, Inc.

J.P. Morgan Securities LLC

Wells Fargo

Securities, LLC

|

|

|

|

|

|

Passive Book-Runners:

|

|

BBVA Securities Inc.

SMBC Nikko Securities

America, Inc.

Standard Chartered Bank

|

|

|

|

|

Co-Managers:

|

|

Credit Agricole Securities (USA) Inc.

|

Changes from Preliminary Prospectus Supplement:

General

All references in the preliminary

prospectus supplement to “2027 Secured Notes” will change to “2025 Secured Notes”.

Recent Developments

The reference to “$3.5 billion of our senior secured notes due 2027” in the second paragraph under the heading “Recent

Developments” will change to “$3.5 billion of our senior secured notes due 2025”.

The information herein supplements the

preliminary prospectus supplement and supersedes the information in the

preliminary prospectus supplement to the extent inconsistent with the information

in the preliminary prospectus supplement.

Unless otherwise indicated, terms used but not defined herein have the meanings assigned to such terms in the

preliminary prospectus supplement.

It is expected that

delivery of the notes will be made against payment on the notes on or about June 12, 2020, which will be two business days (as such term is used for purposes of Rule 15c6-1 of the Securities Exchange Act, as

amended) following the date of pricing of the notes (this settlement cycle is referred to as “T+2”).

|

*

|

Note: A securities rating is not a recommendation to buy, sell or hold securities and may be revised or

withdrawn at any time.

|

The issuer has filed a registration statement (including a base prospectus and preliminary prospectus

supplement) with the SEC for the offering to which this communication relates. Before you invest, you should read the base prospectus and preliminary prospectus supplement in that registration statement and other documents the issuer has filed with

the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the

offering will arrange to send you the prospectus if you request it by calling Goldman Sachs & Co. LLC at 1-866-471-2526

or Morgan Stanley & Co. LLC at 1-800-718-1649.

- 2 -

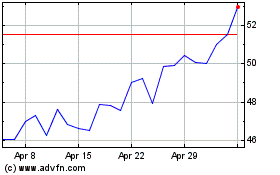

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

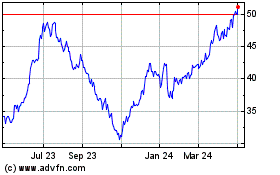

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Apr 2023 to Apr 2024