Passenger Airlines Start Shifting Idled Planes Into Freight Business

March 20 2020 - 5:26PM

Dow Jones News

By Jennifer Smith

The coronavirus pandemic is reshaping global airfreight

operations as passenger airlines ground planes and companies

scramble for capacity to keep medical supplies, industrial parts

and high-demand consumer goods moving.

Some airlines are putting passenger planes to work as

freight-only aircraft, with main cabins empty and cargo holds

filled with shipments. The tactic provides some revenue for

carriers hit hard by plunging travel demand and may help ease

freight bottlenecks caused by cascading cancellations of passenger

services, which has dramatically reduced capacity for goods

traveling in the bellies of planes.

American Airlines Group Inc. is launching its first scheduled

cargo flight since 1984 on Friday, with two round-trip flights over

four days between Dallas-Fort Worth International Airport and

Frankfurt on a wide-body Boeing Co. 777-300 passenger plane that

can carry more than 100,000 pounds of freight. The flights are

expected to be booked to capacity and will move cargo including

medical supplies, e-commerce packages, and telecommunications

equipment and electronics, the airline said.

Global carriers including Delta Air Lines Inc., Korean Air Lines

Co., and Qantas Airways Ltd. also are running passenger aircraft on

freight-only flights in certain lanes. "The business strategies of

passenger and cargo should be shifted as the transatlantic road in

the sky is now blocked," Korean Air Chairman Walter Cho said in a

statement. "We must flexibly respond to market demand."

Deutsche Lufthansa AG, which has cut 95% of its passenger

flights but continues to operate its freighter fleet, said this

week it may use some of the passenger planes to move cargo. "The

transport demand has clearly increased, and we want to make our

contribution wherever possible to maintain the delivery chains,"

Chief Executive Carsten Spohr said in a news conference.

The moves come as airlines around the world have been battered

by fallout from the coronavirus pandemic. Carriers are furloughing

workers and cutting costs to try to stay afloat while they seek

government bailouts.

Industry executives say airfreight prices have started to surge

on key trade lanes, including routes in Asia where production is

starting back up even as industrial operations in Europe and North

America shut down in an effort to contain the coronavirus.

"In intra-Asia, there is a great demand for inventory

replenishment as manufacturing comes back on line," said Cathy

Roberson, president of supply-chain research firm Logistics Trends

& Insights LLC.

The coronavirus-driven suspension of most passenger flights in

Asia cut about 60% to 67% of the airfreight capacity in the region

and "clogged up the feeder system for intercontinental flights,"

said Brian Clancy, managing director of consulting firm Logistics

Capital & Strategy LLC.

He said that freight forwarders who typically pay $3 a kilogram

to move freight in the belly of Cathay Pacific planes, for

instance, may see rates of between $9 and $11 per kilo.

Carriers with idle planes are evaluating cargo revenue on

in-demand routes where they can "maximize the payload per departure

and take advantage of the very high market rate," at a time when

fuel prices have plummeted, Mr. Clancy said. "That makes this type

of scenario economically attractive," particularly on trade lanes

such as the trans-Atlantic, where flights are shorter than on

Pacific lanes and plenty of trade moves in both directions.

The rapid shutdown of flights as the pandemic progresses is

creating upheaval for shippers and freight forwarders that arrange

transport of goods by air. Deutsche Post DHL Group's global

forwarding arm declared force majeure so it can modify its services

without penalties of contract violations. The company said in a

statement that "almost all elements of the air and ocean supply

chain on certain trade lanes" are now "impossible to predict or

control."

Freight rates have increased significantly from Europe to China

and Hong Kong, according to logistics provider Agility, and

airfreight forwarders have started chartering more aircraft on

their own from Belgium, Germany and Italy to China rather than rely

on unpredictable and crowded commercial services. France-based

forwarder Geodis SA is beginning a charter operation between

Amsterdam and Chicago on March 21.

Write to Jennifer Smith at jennifer.smith@wsj.com

(END) Dow Jones Newswires

March 20, 2020 17:11 ET (21:11 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

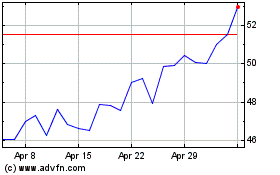

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

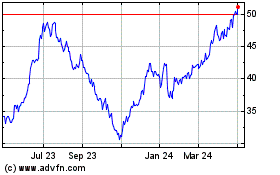

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Apr 2023 to Apr 2024