By Andrew Tangel and Doug Cameron

Boeing Co. is considering cutting its dividend and possibly

laying off workers at its jetliner plants, people familiar with the

matter said, as America's largest manufacturer grapples with an

unprecedented disruption to the global airline industry.

The coronavirus-driven collapse in passenger traffic has forced

airlines to park hundreds of planes and left them unwilling to take

new ones, even as Boeing works to overcome the yearlong grounding

of its 737 MAX.

The crisis has erased nearly 70% of Boeing's market value in

2020 and threatened its production. In response, the company has

pushed for a $60 billion package to support it and the aerospace

manufacturing sector. It also is preparing for a potential halt in

production amid the outbreak.

"Nobody's flying," a Boeing official said. For example, Delta

Air Lines Inc. this week said it had cut 70% of its flying until

demand improves and is parking 600 jets, two-thirds of its fleet.

It won't take any new jets this year.

Airlines are deferring deliveries from this year after the near

collapse in passenger traffic, and cancellations are on the rise,

starving Boeing of new cash and draining liquidity in the form of

deposit refunds. Cargo planes, once a source of strength, are also

under pressure. FedEx Corp. said this week that it had pushed back

delivery of some jets until 2023.

European plane maker Airbus SE, whose shares have fallen almost

as much as Boeing's this year, is also seeking government support

in Europe. Its global supply network is entwined with that of

Boeing, raising questions about how aid packages on both sides of

the Atlantic could be structured.

Boeing's market value approached $50 billion on Thursday, with

analysts ascribing more than half of the total to the Chicago-based

company's defense business versus its larger commercial-airplane

division.

Boeing joined U.S. airlines and other industries this week in

asking for financial aid on behalf of itself, its suppliers and the

broader aerospace sector.

The company's $60 billion request this week caught some

executives at its suppliers by surprise, said a senior industry

executive. While the company has said 70% of its spending is with

suppliers, it didn't detail what share of any aid would be directed

to them. However, Boeing's big clout with the administration and

lawmakers made it the best conduit to secure government support,

the executive said.

Boeing hasn't disclosed details, but it has said it is seeking

private financing as well as taxpayer support.

U.S. lawmakers are calling for conditions to accompany any aid.

"Taxpayers should be paid back, and workers should be protected,"

said U.S. Rep. Rick Larsen (D., Wash.), whose district includes

Boeing's Seattle-area airliner factories. Mr. Larsen is also

chairman of a key U.S. House aviation subcommittee.

A Boeing spokesman said, "We have strong long-term viability,

and we need this short-term assistance to get there." He added, "We

would be good stewards of any assistance provided."

Boeing, the biggest U.S. exporter, has some 150,000 employees

and is at the tip of a pyramid of an industry that accounts for a

fifth of the country's manufacturing workforce.

Aircraft leasing companies, which now rent half the global

airliner fleet to carriers, have turned from being a source of

liquidity to a concern of their own. Shares in Air Lease Corp, one

of the biggest, almost halved in price at one point on Wednesday.

The leasing companies' clout has put them first in line -- ahead of

airlines -- in canceling and deferring orders with Boeing, said one

industry executive.

As pressure mounts, Boeing executives have said they were

working to avoid mass layoffs or furloughs.

Investors are worrying about the company's ability to repay its

debt. The cost of insuring Boeing debt has doubled over the past

week, according to IHS Markit, suggesting investors see a growing

risk the company could default on its borrowing obligations.

Even without government support, Boeing was forecast to end the

year with as much as $45 billion in debt, according to S&P

Global, which downgraded the company this week to two notches above

junk status.

Boeing ended 2019 with $10 billion in cash and typically has

kept that level as a buffer in recent years. Analysts estimate it

burns around $4.3 billion a month to produce jetliners, and has

compensation payments to MAX customers as well as the dividends --

which cost $4.6 billion last year -- and debt repayments. Boeing's

dividend yield is about 8.4%; before the stock's selloff this year,

yield was in the low 2% range for much of the past two years.

After drawing down a $13.8 billion loan last week, Boeing still

has an untapped $9.6 billion bank facility. Boeing has no immediate

plans to pull from it, a person familiar with the matter said.

Aside from possible production cuts, Boeing has been drawing up

contingency plans should Washington state officials order the

closure of its widebody aircraft factory in Everett, north of

Seattle, people familiar with the matter said. Auto makers,

including Detroit's car companies, have said they would suspend

production at their North American factories to curb the virus's

spread.

Fifteen Boeing employees and a contractor had tested positive

for Covid-19 as of Wednesday afternoon, and 10 of them work at the

Everett factory. Several hundred employees have been quarantined.

Boeing is also considering the possibility that supplier shortages

may force a halt in production, as could potential flight

restrictions to and from Washington state, people familiar with the

matter said.

Boeing Chief Executive David Calhoun is among senior company

executives telling the Trump administration and congressional

officials about the dire situation in U.S. aviation, people

familiar with the matter said.

Mr. Calhoun called Mr. Trump last weekend for an update, people

familiar with the matter said. The president asked Mr. Calhoun how

the crisis was affecting Boeing, its production and finances,

asking whether the company was able to hold out, one of these

people said. The White House didn't comment.

Mr. Trump, at a press conference Tuesday, said: "We have to

protect Boeing."

--Alex Leary contributed to this article.

Write to Andrew Tangel at Andrew.Tangel@wsj.com and Doug Cameron

at doug.cameron@wsj.com

(END) Dow Jones Newswires

March 19, 2020 13:43 ET (17:43 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

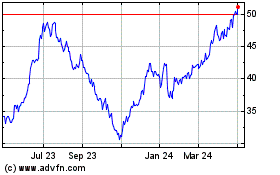

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

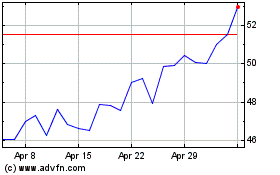

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Apr 2023 to Apr 2024