Delta Air Lines, Inc. 2020-1 EETC Investor

Presentation March 4, 2020 Issuer Free Writing Prospectus Filed Pursuant to Rule 433(d) Registration No. 333-230087 March 4, 2020

Safe Harbor Statement This Investor

Presentation contains various forward-looking statements which represent Delta’s estimates or expectations regarding future events. All forward-looking statements involve a number of assumptions, risks and uncertainties, many of which are

beyond Delta’s control, that could cause the actual results to differ materially from the projected results. Factors which could cause such differences include, without limitation, business, economic, competitive, industry, regulatory, market

and financial uncertainties and contingencies, as well as the “Risk Factors” discussed in Delta’s SEC filings. Caution should be taken not to place undue reliance on Delta’s forward-looking statements, which represent

Delta’s views only as of the date of this presentation, and which Delta has no current intention to update. This Investor Presentation highlights basic information about Delta and this offering. Because it is a summary, it does not contain all

of the information that you should consider before investing. Delta has filed a registration statement (including a prospectus) and a related prospectus supplement with the SEC for the offering to which this Investor Presentation relates (the

“Prospectus Supplement”). Before you invest, you should read such prospectus and the Prospectus Supplement (including the risk factors described in the Prospectus Supplement) and other documents Delta has filed with the SEC for more

complete information about us and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, Delta, any underwriter or any dealer participating in the offering will arrange to send you the

prospectus and the Prospectus Supplement if you request it by calling Morgan Stanley & Co. LLC (“Morgan Stanley”) at 1-800-718-1649 or Credit Suisse Securities (USA) LLC (“Credit Suisse”) at 1-800-221-1037.

Transaction Overview Delta Air Lines, Inc.

(“DAL” or “Delta”) intends to raise $1,000,000,000 through the offering of two classes of Pass Through Certificates, Series 2020-1 (the “Certificates” or “DAL 2020-1”) Class AA face amount of

$795,894,000 Class A face amount of $204,106,000 The Equipment Notes underlying the Certificates will have the benefit of a security interest in 11 Airbus and 22 Boeing aircraft that were delivered new to Delta between August 2014 and April 2017 5

Airbus A321-211 aircraft delivered between March 2016 and April 2017 22 Boeing 737-932ER aircraft delivered between August 2014 and April 2016 6 Airbus A330-302 aircraft delivered between May 2015 and April 2017 The Certificates offered in the

transaction will include two classes: Class AA senior tranche with a 8.2 year maturity / 6.2 year average life and a 54.0% / 54.5% Initial / Max Loan-to-Value ratio (“LTV”)(1) Class A junior tranche with a 8.2 year maturity / 5.4 year

average life and a 67.8% / 68.5% Initial / Max Loan-to-Value ratio (“LTV”)(1) Delta will retain the option to offer one or more subordinate tranches at any time on or after the issuance date of the Certificates Certain aircraft subject

to release from collateral pool after 7.2 and 7.7 years, after payment in full at final maturity of related Equipment Notes The transaction’s legal structure will generally be consistent with Delta’s 2019-1 EETC (“DAL

2019-1”), including: Standard cross-collateralization, cross-default and buy-out rights Liquidity facilities covering three successive semi-annual interest payments on the Class AA Certificates and the Class A Certificates Interest on Eligible

Pool Balance of the Class A Certificates is paid ahead of the principal of the Class AA Certificates Joint Structuring Agents & Joint Lead Bookrunners: Morgan Stanley & Credit Suisse Joint Bookrunners: BofA Securities, Goldman Sachs

Liquidity Facility Provider: National Australia Bank Limited, acting through its New York Branch (1) The Initial LTV for each of Class AA and Class A is as of March 12, 2020, which is assumed to be the closing date of the offering (the

“Closing Date”), and the Maximum LTV for each of Class AA and Class A is as of June 10, 2020. The LTV for the Class A Certificates includes the face amount of the Class AA Certificates.

The Initial LTV for each of Class AA and

Class A is as of the Closing Date, and the Maximum LTV for each of Class AA and Class A is as of June 10, 2020. The LTV for the Class A Certificates includes the face amount of the Class AA Certificates. The Final Legal Distribution Date for each

class of Certificates is 18 months after the Final Expected Distribution Date for the relevant class of Certificates, which corresponds to the applicable Liquidity Facility coverage of three successive semiannual interest payments. Summary of the

Certificates Offering (2) (1) Class AA Class A Aggregate Face Amount $795,894,000 $204,106,000 Ratings (Moody's / S&P) Aa3 / AA- A3 / A- Initial LTV / Max LTV(1) 54.0% / 54.5% 67.8% / 68.5% Initial Average Life (in years from Issuance

Date) 6.2 years 5.4 years Expected Principal Distribution Window (in years from Issuance Date) 0.7 – 8.2 years 0.7 – 8.2 years Regular Distribution Dates June 10 & December 10 June 10 & December 10 Final Expected Distribution

Date June 10, 2028 June 10, 2028 Final Legal Distribution Date(2) December 10, 2029 December 10, 2029 Liquidity Facility Coverage 3 semi-annual interest payments 3 semi-annual interest payments Interest Rate Fixed rates, semi-annual payments, 30/360

day count Fixed rates, semi-annual payments, 30/360 day count Minimum Denomination $2,000 and integral multiples of $1,000 in excess thereof $2,000 and integral multiples of $1,000 in excess thereof

Key Structural Elements Other Structural

Considerations Two Classes of Certificates Offered Each class of Certificates will benefit from a separate Liquidity Facility covering three semi-annual interest payments Delta retains option to issue additional subordinated classes of Certificates

at any time on or after the issuance date of the Certificates Cross-Collateralization and Cross-Default of all Aircraft The Equipment Notes will be cross-collateralized by all aircraft in the portfolio All indentures will include cross-default

provisions Waterfall (consistent with DAL 2019-1 EETC) Same waterfall both before and after an Indenture Event of Default Interest on Eligible Pool Balance of the Class A Certificates is paid ahead of principal on the Class AA Certificates Buyout

Rights After a Certificate Buyout Event, Class A Certificate holders have the right to purchase all (but not less than all) of the then outstanding Class AA Certificates at par plus accrued and unpaid interest No Equipment Note buyout rights

Substitution Delta may, at any time and from time to time, substitute an aircraft in DAL 2020-1 with an aircraft of the same model or a comparable or improved model of the same manufacturer or one or more aircraft of a different model and of the

same or a different manufacturer as the aircraft being replaced as long as certain conditions are satisfied, including: The airframes of the substitute aircraft have a date of manufacture no earlier than one year prior to the date of manufacture of

the original airframe subject to the lien of the related indenture on the Closing Date; The substitute aircraft have an aggregate appraised current market value, adjusted for maintenance status, at least equal to the aircraft being replaced; and In

the case of substitution of one or more aircraft of a different model, Delta will be obligated to obtain written confirmation from each Rating Agency that substituting such substitute aircraft for the replaced aircraft will not result in a

withdrawal, suspension or downgrading of the ratings of any Class of Certificates then rated by such Rating Agency that remains outstanding

Aircraft Collateral Summary (1) Appraised

value is calculated using the lesser of the median and mean (“LMM”) values of each aircraft as appraised by Aircraft Information Services, Inc. (“AISI”), BK Associates, Inc. (“BK”), and Morten Beyer & Agnew,

Inc. (“mba”) as of February 1, 2020. An appraisal is only an estimate of value and should not be relied upon as a measure of realizable value. See Appendix II of the Preliminary Prospectus Supplement for information regarding each

appraiser’s appraisal methodology. (2) The initial collateral cushion is calculated as of the Closing Date, using the Initial LTV set forth under “Loan to Aircraft Value Ratios” in the Summary of the Preliminary Prospectus

Supplement. (3) Assumes that the appraised value of the aircraft depreciates by 3% per year. The initial aggregate Appraised Value is $1,473,880,000(1), indicating an initial collateral cushion of approximately 46.0%(2) and 32.2%(2) on the Class AA

Certificates and the Class A Certificates, respectively, and such aggregate Appraised Value decreases over time based on the assumed depreciation of the appraised value of the collateral(3) Aircraft Aircraft Registration Serial Delivery Appraised

Value ($mm)(1) Equipment Note No. Type Number Number Month AISI BK mba LMM Maturity Date 1 Airbus A321-211 N301DV 6923 March 2016 $41.12 $42.71 $40.83 $41.12 June 10, 2028 2 Airbus A321-211 N305DN 7149 June 2016 41.44 43.78 41.52 41.52 June 10, 2028

3 Airbus A321-211 N306DN 7165 July 2016 41.38 44.00 41.75 41.75 June 10, 2028 4 Airbus A321-211 N307DX 7214 July 2016 41.42 44.03 41.75 41.75 June 10, 2028 5 Airbus A321-211 N319DN 7479 April 2017 43.32 47.69 43.87 43.87 June 10, 2028 6 Boeing

737-932ER N826DN 31937 August 2014 32.52 31.68 33.31 32.50 June 10, 2027 7 Boeing 737-932ER N827DN 31938 September 2014 32.90 32.02 33.93 32.90 June 10, 2027 8 Boeing 737-932ER N828DN 31939 October 2014 33.16 32.45 34.34 33.16 June 10, 2027 9 Boeing

737-932ER N829DN 31941 November 2014 33.45 32.99 34.89 33.45 June 10, 2027 10 Boeing 737-932ER N830DN 31940 November 2014 33.97 33.48 35.33 33.97 June 10, 2027 11 Boeing 737-932ER N831DN 31942 December 2014 33.83 33.59 35.25 33.83 June 10, 2027 12

Boeing 737-932ER N832DN 31943 January 2015 34.95 33.49 35.35 34.60 June 10, 2027 13 Boeing 737-932ER N834DN 31946 February 2015 35.25 34.02 35.84 35.04 June 10, 2027 14 Boeing 737-932ER N835DN 31945 February 2015 35.79 34.59 36.40 35.59 June 10,

2027 15 Boeing 737-932ER N836DN 31947 March 2015 35.31 34.34 36.07 35.24 December 10, 2027 16 Boeing 737-932ER N837DN 31948 March 2015 34.95 33.96 35.70 34.87 December 10, 2027 17 Boeing 737-932ER N838DN 31949 April 2015 35.93 35.29 36.96 35.93

December 10, 2027 18 Boeing 737-932ER N839DN 31950 April 2015 35.56 34.84 36.54 35.56 December 10, 2027 19 Boeing 737-932ER N840DN 31951 May 2015 35.22 34.76 36.37 35.22 December 10, 2027 20 Boeing 737-932ER N841DN 31952 June 2015 36.46 36.32 37.84

36.46 December 10, 2027 21 Boeing 737-932ER N851DN 31962 January 2016 38.36 38.37 38.17 38.30 December 10, 2027 22 Boeing 737-932ER N852DN 31963 January 2016 37.73 38.14 37.53 37.73 December 10, 2027 23 Boeing 737-932ER N853DN 31964 February 2016

38.52 39.19 38.39 38.52 December 10, 2027 24 Boeing 737-932ER N854DN 31965 February 2016 37.47 38.04 37.25 37.47 June 10, 2028 25 Boeing 737-932ER N855DN 31966 March 2016 37.52 38.47 37.46 37.52 June 10, 2028 26 Boeing 737-932ER N856DN 31967 March

2016 38.09 39.09 37.96 38.09 June 10, 2028 27 Boeing 737-932ER N857DZ 31968 April 2016 38.19 39.54 38.18 38.19 June 10, 2028 28 Airbus A330-302 N822NW 1627 May 2015 80.03 71.44 77.28 76.25 June 10, 2027 29 Airbus A330-302 N824NW 1637 June 2015 80.07

72.05 77.60 76.57 June 10, 2027 30 Airbus A330-302 N823NW 1628 August 2015 80.42 73.57 78.69 77.56 December 10, 2027 31 Airbus A330-302 N825NW 1679 November 2015 84.93 77.50 82.05 81.49 December 10, 2027 32 Airbus A330-302 N826NW 1701 January 2016

83.25 75.64 82.26 80.38 June 10, 2028 33 Airbus A330-302 N831NW 1783 April 2017 87.47 95.99 82.49 87.47 June 10, 2028 TOTAL $1,489.98 $1,467.06 $1,489.15 $1,473.88

Introduction 2020-1 Collateral Fleet

Breakdown Delta has obtained desktop appraisals from three appraisers (AISI, BK and mba) Liquid, high quality aircraft collateral consisting of a diversified mix of narrowbody and widebody aircraft with strategic importance to Delta 22 aircraft are

scheduled to be released from the collateral pool in years 7.2 and 7.7(1), while maintaining a similar aircraft mix 9 737-932ER and 2 A330-302 aircraft are scheduled to be released from the collateral at year 7.2(1) 9 737-932ER and 2 A330-302

aircraft are scheduled to be released from the collateral at year 7.7(1) Aircraft Size(2)(3) Aircraft Type(2)(3) See "Description of the Equipment Notes - Security" in the Preliminary Prospectus Supplement for further information on release of

aircraft. Collateral breakdown is calculated as of the Closing Date. Appraised value is the lesser of the median and mean of the maintenance-adjusted base values of the aircraft as appraised by AISI, BK, and mba as of February 1, 2020. Each

appraisal indicates the base value of each aircraft, adjusted as described in such appraisal. Aircraft Type by Year(2) By Aircraft Count By Appraised Value By Appraised Value

Strategic Importance to Delta Airbus

A321-211 Boeing 737-932ER Airbus A330-302 130 Boeing 737-900ER aircraft delivered validates strategic importance to the Delta fleet 2,800 mile range efficiently replaces more than 90% of Boeing 757 missions Outstanding seat mile costs and

operational reliability High training and parts commonality with existing Boeing 737-700/800 models Range and low seat costs make the A321-200 an integral part of Delta’s U.S. domestic network and upgauging strategy; Delta has 127 of these

aircraft on order/delivered Significant training and parts commonality with existing A319-100 and A320-200 fleets Customer satisfaction has been best-in-class among Delta fleets Delta’s 31 A330-300 aircraft offer leading seat cost economics

among Delta’s widebody fleet for transatlantic flights; Delta’s A330-300 aircraft in service have an average age of 11.0 years Significant commonality with existing A330-200 fleet Entire fleet expected to be upgraded with Premium Select

cabin by 2022

Delta’s A321-211 offers 34 more

seats than the A320 and has more than 400 miles of additional range These aircraft feature CFM56-5B3 engines with 33,000 lbs of thrust A321-211 aircraft are configured with 191 total seats: 20 First Class recliner seats with high resolution 11" IFE

29 Delta Comfort+ seats with high resolution 9" IFE 142 Main Cabin seats with high resolution 9" IFE Delta’s A321-211 are outfitted with an interior featuring high-capacity overhead bins, Delta’s latest in-flight entertainment, full

spectrum LED ambient lighting and in-flight Wi-Fi Aircraft Importance to Delta Delta has 96 aircraft delivered and an additional 31 on order Given their seat count, range, and low seat costs, the A321-211 is an integral part of Delta’s U.S.

domestic network and upgauging strategy Significant commonality with existing A319 and A320 fleets Customer satisfaction has been best-in-class among Delta fleets A321-211 Aircraft Characteristics Airbus A321-211 Source: Delta Air Lines, Inc. as of

December 31, 2019

The Boeing 737-932ER has 180 seats,

increasing seat numbers compared to other 737-NG models, and offers more premium seats compared to Boeing 737-800 Aircraft configured with 180 total seats: 20 recliner seats in the First Class cabin with high resolution 11" IFE, 21 Delta Comfort+

seats with high resolution 9" IFE 139 Main Cabin seats with high resolution 9" IFE Attractive three-class seating capacity Aircraft cabin has Boeing’s modern “Sky Interior” with Wi-Fi and a full-spectrum LED lighting system

Aircraft Importance to Delta 130 737-900ER aircraft in fleet 2,800 mile range efficiently replaces more than 90% of Boeing 757 missions Ability to reach entire West Coast from Atlanta fully loaded, even with winter winds Outstanding seat mile costs

and operational reliability High training and parts commonality with existing Boeing 737-700/800 models 737-932ER Aircraft Characteristics Boeing 737-932ER Source: Delta Air Lines, Inc. as of December 31, 2019

A330-300 is one of the pillars of

Delta’s widebody fleet with over 5,500 mile range, Delta One cabin for leading customer comfort, and a combination of PW4000 and CF6-80E1 engines Aircraft configured with 293 total seats: 34 Delta One seats with flat-bed design, 110v+USB power

and 15.4" IFE 40 Delta Comfort+ seats with USB power for all passengers and 9" IFE 219 Main Cabin seats with USB power for all passengers and 9" IFE Designed for long-haul travel, cabin layout will soon include Delta Premium Select to provide

comfort that’s even more customizable to customer needs Aircraft cabin equipped with 110v power in all rows, USB power for each passenger, Wi-Fi and advanced LED lighting intended to reduce feeling of jetlag Aircraft Importance to Delta 31

A330-300 aircraft in service with an average age of only 11.0 years Significant commonality with A330-200 fleet A330-302 aircraft offer leading seat cost economics among Delta’s widebody fleet for transatlantic flights, exceeded only by the

newest A350-900 and A330-900neo aircraft Entire fleet planned to be upgraded with Premium Select cabin by 2022 A330-302 Aircraft Characteristics Boeing 737-932ER Source: Delta Air Lines, Inc. as of December 31, 2019

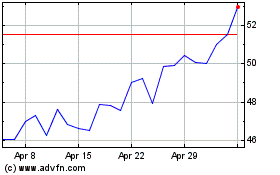

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

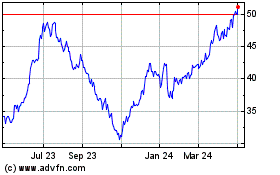

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Apr 2023 to Apr 2024