Securities Registration: Employee Benefit Plan (s-8)

June 10 2021 - 6:01AM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on June 9, 2021

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

DELEK LOGISTICS PARTNERS, LP

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

45-5379027

|

|

(State of Incorporation)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

7102 Commerce Way

|

|

37027

|

|

Brentwood, Tennessee

|

|

|

|

|

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Delek Logistics GP, LLC Amended and Restated 2012 Long-Term Incentive Plan

(Full title of the plan)

Denise McWatters

Executive Vice President, General Counsel

and Corporate Secretary

Delek Logistics Partners, LP

7102 Commerce Way

Brentwood, Tennessee 37027

(Name and address of agent for service)

(615) 771-6701

(Telephone number, including area code, of agent for service)

Copies to:

Stephen C. Hinton

Bradley Arant Boult Cummings LLP 1600 Division Street, Suite 700

Nashville, Tennessee 37203

(615) 244-2582

☑ Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

☐

|

|

Accelerated filer

|

☑

|

|

Non-accelerated filer

|

☐

|

Do not check if a smaller reporting company)

|

Smaller reporting company

|

☐

|

|

|

|

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Securities to be Registered

|

Amount to be

Registered

|

Proposed Maximum Offering Price

Per Share

|

Proposed Maximum Aggregate

Offering Price

|

Amount of Registration Fee

|

|

Common Units, representing limited partner interests

|

300,000 units (1)

|

$42.31 (2)

|

$12,693,000 (2)

|

$1,385 (3)

|

(1)Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement (“Registration Statement”) shall also cover any additional securities that may be offered or issued pursuant to the Delek Logistics GP, LLC Amended and Restated 2012 Long-Term Incentive Plan (the “Plan”), as a result of adjustments for unit dividends, unit splits or similar transactions effected without receipt of consideration, that increase the number of outstanding common units representing limited partner interests (the “Common Units”) of Delek Logistics Partners, LP (the “Partnership” or the “Registrant”).

(2)Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) and Rule 457(h) of the Securities Act, based upon the average of the high and low sales prices of the Common Units on the New York Stock Exchange on June 2, 2021.

(3)The Partnership is registering an additional 300,000 Common Units relating to the Plan. Pursuant to General Instruction E to Form S-8, the fee set forth in the table above is only with respect to those additional shares.

EXPLANATORY NOTE

The Partnership previously filed with the Securities and Exchange Commission (the “SEC”) a Registration Statement on Form S-8 on December 4, 2012 (Registration No. 333-185264) (the “Initial Registration Statement”) registering an aggregate of 612,207 Common Units (the “Prior Registration Statement”).

On June 4, 2021, the Partnership’s unitholders approved an amendment and restatement of the Plan that increased the number of Common Units available for issuance under the Plan by 300,000 Common Units. This Registration Statement is being filed to register these additional 300,000 Common Units.

Pursuant to General Instruction E to Form S-8, the contents of the Prior Registration Statement, including each of the documents filed with the SEC and incorporated (or deemed to be incorporated) by reference therein, and each of the documents filed as exhibits thereto, are incorporated by reference herein except as otherwise updated or modified by this filing. All exhibits required by General Instruction E to Form S-8 are filed as exhibits hereto.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference

We incorporate by reference in this Registration Statement the documents listed below, excluding any portions of such documents that have been “furnished” but not “filed” for purposes of the Securities Exchange Act of 1934, as amended (the “Exchange Act”):

▪our Annual Report on Form 10-K for the year ended December 31, 2020, filed with the SEC on March 1, 2021 (“Annual Report”);

▪our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2021, filed with the SEC on May 7, 2021;

▪all other reports filed with the SEC pursuant to Section 13(a) or 15(d) of the Exchange Act since December 31, 2020; and

▪the disclosures set forth under the caption “Description of Common Units” in the Partnership’s Registration Statement on Form S-3 (File No. 333-248202), first filed with the SEC on August 20, 2020, and any other amendment or report filed for the purpose of updating such description, including the Description of Common Units set forth in Exhibit 4.1 to the Annual Report.

In addition, any future filings made by us with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, prior to the filing of a post-effective amendment which indicates that all securities offered have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference in this Registration Statement and to be part hereof from the date of filing of such documents; provided, however, that documents or information deemed to have been furnished and not filed in accordance with SEC rules shall not be deemed incorporated by reference into this Registration Statement.

Any statement contained in a document incorporated or deemed to be incorporated by reference in or deemed to be part of this Registration Statement shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained in this Registration Statement or in any subsequently filed document that also is or is deemed to be incorporated by reference in this Registration Statement modifies or supersedes that statement. Any statement contained in a document that is deemed to be incorporated by reference or deemed to be part of this Registration Statement after the most recent effective date may modify or replace existing statements contained in this Registration Statement. Any such statement so modified or replaced shall not be deemed, except as so modified or replaced, to constitute a part of this Registration Statement.

Item 6. Indemnification of Directors and Officers.

Indemnification

Section 17-108 of the Delaware Revised Uniform Limited Partnership Act empowers a Delaware limited partnership to indemnify and hold harmless any partner or other persons from and against all claims and demands whatsoever.

Section 7.7(a) of the Registrant's Second Amended and Restated Agreement of Limited Partnership (the “Partnership Agreement”) provides that the Registrant will indemnify and hold harmless the following persons (each, an “Indemnitee”), in most circumstances, to the fullest extent permitted by law, from and against all losses, claims, damages, liabilities, joint or several, expenses (including legal fees and expenses), judgments, fines, penalties, interest, settlements or other amounts arising from any and all threatened, pending or completed claims, demands, actions, suits or proceedings, whether civil, criminal, administrative or investigative, and whether formal or informal and including appeals:

•the General Partner;

•any departing general partner;

•any person who is or was an affiliate of the General Partner or any departing general partner;

•any person who is or was a manager, managing member, general partner, director, officer, fiduciary or trustee of the Registrant, its subsidiaries, the General Partner or any departing general partner or any of their affiliates;

•any person who is or was serving at the request of the General Partner or any departing general partner or any of their respective affiliates as a manager, managing member, general partner, director, officer, fiduciary or trustee of another person owing a fiduciary duty to the Registrant or any of its subsidiaries; and

•any person the General Partner designates as an indemnitee for purposes of the Partnership Agreement because such person's status, service or relationship exposes such person to potential claims, demands, suits or proceedings relating to the business and affairs of the Registrant and its subsidiaries.

Any indemnification described above will be made only out of the Registrant's assets. The General Partner will not be personally liable for such indemnification and will have no obligation to contribute or loan any monies or property to the Registrant to enable the Registrant to effectuate such indemnification.

Section 7.7(b) of the Partnership Agreement states that to the fullest extent permitted by law, expenses (including legal fees and expenses) incurred by an Indemnitee in defending any claim, demand, action, suit or proceeding will, from time to time, be advanced by the Registrant prior to a determination that the Indemnitee is not entitled to be indemnified upon receipt by the Partnership of any undertaking by or on behalf of the Indemnitee to repay such amount if it shall be determined that the Indemnitee is not entitled to be indemnified as authorized by Section 7.7 of the Partnership Agreement.

The Registrant may purchase and maintain (or reimburse the General Partner or its affiliates for the cost of) insurance, on behalf of the General Partner, its affiliates and such other persons as the General Partner determines, covering liabilities that may be asserted against, or expense that may be incurred by, such persons for the Registrant's activities or such person's activities on behalf of the Registrant, regardless of whether the Registrant would have the power to indemnify such person against such liability under the Partnership Agreement.

Subject to any terms, conditions or restrictions set forth in the limited liability company agreement, Section 18-108 of the Delaware Limited Liability Company Act empowers a Delaware limited liability company to indemnify and hold harmless any member or manager or other person from and against any and all claims and demands whatsoever.

Under the amended and restated limited liability agreement of the General Partner (the “LLC Agreement”), in most circumstances, the General Partner will indemnify will indemnify the following persons, to the fullest extent permitted by law, from and against any and all losses, claims, damages, liabilities (joint or several), expenses (including legal fees and expenses), judgments, fines, penalties, interest, settlements or other amounts arising from any and all claims, demands, actions, suits or proceedings (whether civil, criminal, administrative or investigative): (i) any person who is or was an affiliate of the General Partner (other than the Registrant and its subsidiaries); (ii) any person who is or was a manager, member, partner, officer, director, fiduciary or trustee of the General Partner or its affiliates (other than the Registrant or its subsidiaries); (iii) any person who is or was serving at the request of the General Partner or any affiliate of the General Partner as an officer, director, manager, member, partner, fiduciary or trustee of another person; and (iv) any person designated by the General Partner.

The General Partner currently maintains insurance covering its officers and directors against liabilities asserted and expenses incurred in connection with their activities as officers and directors of the General Partner or any of its subsidiaries.

Indemnification Agreements

The Registrant has entered into indemnification agreements with its directors and executive officers which would require the Registrant, among other things, to indemnify them against certain liabilities which may arise by reason of their status.

Item 8. Exhibits

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description of Exhibit

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23.3

|

|

Consent of Counsel (included in Exhibit 5.1).

|

|

24.1

|

|

Power of Attorney (contained on the signature page hereto).

|

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized in the City of Brentwood, State of Tennessee, on June 9, 2021.

Delek Logistics Partners, LP

By: Delek Logistics GP, LLC, its general partner

By: /s/ Reuven Spiegel

Name: Reuven Spiegel

Title: Executive Vice President and Chief Financial Officer

(Principal Financial Officer)

POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Ezra Uzi Yemin and Reuven Spiegel, and each of them, his or her true and lawful attorneys-in-fact and agents with full powers of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any or all amendments to this Registration Statement on Form S-8, including post-effective amendments, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he or she might or could do in person, and hereby ratifies and confirms all his or her said attorneys-in-fact and agents, or any of them, or his or her substitute or substitutes may lawfully do or cause to be done by virtue thereof.

Pursuant to the requirements of the Securities Act of 1933, as amended, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature

|

|

Title

|

|

Date

|

|

/s/ Ezra Uzi Yemin

|

|

Director (Chair) and Chief Executive Officer

|

|

June 9, 2021

|

|

Ezra Uzi Yemin

|

|

(Principal Executive Officer)

|

|

|

|

|

|

|

|

|

|

/s/ Reuven Spiegel

|

|

Director, Executive Vice President and

|

|

June 9, 2021

|

|

Reuven Spiegel

|

|

Chief Financial Officer (Principal Financial Officer)

|

|

|

|

|

|

|

|

|

|

/s/ Nilah Staskus

|

|

Senior Vice President and Chief Accounting Officer

|

|

June 9, 2021

|

|

Nilah Staskus

|

|

(Principal Accounting Officer)

|

|

|

|

|

|

|

|

|

|

/s/ Sherri A. Brillon

|

|

Director

|

|

June 9, 2021

|

|

Sherri A. Brillon

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Charles J. Brown, III

|

|

Director

|

|

June 9, 2021

|

|

Charles J. Brown, III

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Francis C. D’Andrea

|

|

Director

|

|

June 9, 2021

|

|

Francis C. D’Andrea

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Eric D. Gadd

|

|

Director

|

|

June 9, 2021

|

|

Eric D. Gadd

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Frederic Charles Green

|

|

Director

|

|

June 9, 2021

|

|

Frederic Charles Green

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Ron W. Haddock

|

|

Director

|

|

June 9, 2021

|

|

Ron W. Haddock

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Gennifer F. Kelly

|

|

Director

|

|

June 9, 2021

|

|

Gennifer F. Kelly

|

|

|

|

|

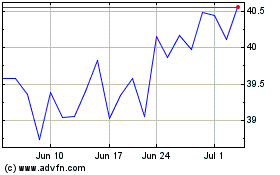

Delek Logistics Partners (NYSE:DKL)

Historical Stock Chart

From Mar 2024 to Apr 2024

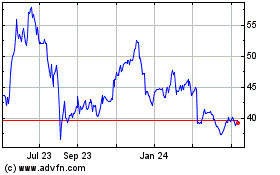

Delek Logistics Partners (NYSE:DKL)

Historical Stock Chart

From Apr 2023 to Apr 2024