Boy Scouts Sex-Abuse Lawyers Decry 'Intimidation' From Insurers

February 08 2021 - 7:01PM

Dow Jones News

By Andrew Scurria and Peg Brickley

Law firms representing sexual-abuse victims accused the Boy

Scouts of America's liability insurers of trying to intimidate

victims from seeking compensation as the youth organization moves

closer to proposing a settlement plan.

Insurers affiliated with Chubb Ltd., Hartford Financial Services

Group Inc. and other companies that wrote policies covering the Boy

Scouts against legal liabilities have questioned whether some of

those law firms filed poorly vetted claims about their clients'

experience, which the firms have denied doing.

The Boy Scouts, faced with sex-abuse claims, filed for

bankruptcy nearly a year ago. The organization is near to proposing

a chapter 11 plan that would set up a compensation trust for men

who were abused as children. Abuse victims are counting on

insurance policies from decades ago, when most of the trauma took

place, to fund a big chunk of the settlement program.

In court papers, the insurers question if many of the 95,000

sexual abuse claims filed against the Boy Scouts are legitimate and

are seeking to interrogate a sampling of 1,400 men to determine

whether their claims stand up to scrutiny.

That would require permission from the judge overseeing the

chapter 11 case. An informal group of law firms calling itself the

Coalition of Abused Scouts for Justice said in a Friday filing that

the questioning would potentially retraumatize the men and that

there were safeguards already in place to unearth phony claims. The

discovery request "serves no legitimate purpose at this time other

than for purposes of delay, harassment and intimidation," the

Coalition lawyers said on the behalf of the victims they

represent.

In the filing Friday, the Coalition responded to the insurers

singling out one claimant whose mother had emailed the Boy Scouts

to dispute his claim of abuse and who withdrew his claim when the

insurers asked him to respond to questions about it.

"Scaring survivors so that they withdraw presumptively valid

claims is not good cause; it is disgusting," the Coalition lawyers

said. Lawyers for several other law firms also filed papers denying

what one called "grossly misleading allegations, and outright

fabrications by" insurers.

The amount of potential insurance coverage available to fund

settlement payments hasn't been revealed as the Boy Scouts' and

victims' lawyers negotiate behind closed doors.

Tancred Schiavoni, an attorney representing Chubb affiliates,

said in response to the Coalition's filing that it didn't "cite to

or provide the declaration of a single person to refute any of the

detailed factual declarations and expert statements" put forth by

the insurers.

A Boy Scouts spokesperson said the organization continues to

cooperate with the insurers and other participants in private

mediation and anticipates any concerns will be appropriately

addressed through that process.

The Boy Scouts have said repeatedly that they believe the abuse

victims, but are staying out of the scuffle between their insurers

and those representing the victims.

Insurers cite the attorneys' use of claims generators and

advertisements as grounds for demanding a closer look.

Law firms filed claims without sufficient information, in some

instances on behalf of men with criminal backgrounds, the insurers

said.

The insurers suggested that the profiles of some victims with

criminal pasts provide a basis for further investigations of the

validity of their claims.

A life of addiction and crime are part of the damage thousands

of men sustained after being sexually assaulted in Boy Scouts, said

Andrew Van Arsdale, one of the plaintiffs' lawyers.

"A lot of these people have not had very good lives. They were

abused as children, and that left them alone and fragile in this

world," Mr. Van Arsdale said. "Many times they took difficult

paths."

The number of claims is likely to fall by roughly 10,000 once

duplicate claims are weeded out, according to lawyers involved in

the bankruptcy.

Many claimants don't recall the names of their abusers, but are

asked by lawyers when gathering the claims to provide other

corroborating details such as the location of regular troop

meetings or outings where abuse occurred.

The Boy Scouts are on a tight timetable to leave chapter 11. The

organization has said it needs to leave bankruptcy by August or

risk running low on cash, owing to a slump in revenue from the

coronavirus pandemic that has resulted in curbs against camping and

other activities.

Write to Andrew Scurria at Andrew.Scurria@wsj.com and Peg

Brickley at peg.brickley@wsj.com

(END) Dow Jones Newswires

February 08, 2021 18:46 ET (23:46 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

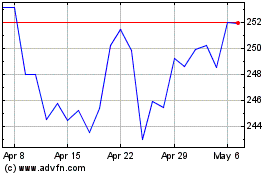

DBA Chubb (NYSE:CB)

Historical Stock Chart

From Mar 2024 to Apr 2024

DBA Chubb (NYSE:CB)

Historical Stock Chart

From Apr 2023 to Apr 2024