Statement of Changes in Beneficial Ownership (4)

July 27 2021 - 4:43PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

CROSKREY STEPHEN |

2. Issuer Name and Ticker or Trading Symbol

Danimer Scientific, Inc.

[

DNMR

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

CEO and Chairman of the Board |

|

(Last)

(First)

(Middle)

C/O DANIMER SCIENTIFIC, INC., 140 INDUSTRIAL BOULEVARD |

3. Date of Earliest Transaction

(MM/DD/YYYY)

7/23/2021 |

|

(Street)

BAINBRIDGE, GA 39817

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Performance Stock Award | $0 | 7/23/2021 | | A | | 95943 | | (1)(2)(3)(4) | (5) | Class A Common Stock ("Common Stock") | 95943 | $0 | 95943 | D | |

| Stock Option (right to purchase) | $18.24 | 7/23/2021 | | A | | 244073 | | (6) | 7/23/2031 | Common Stock | 244073 | $0 | 244073 | D | |

| Explanation of Responses: |

| (1) | Comprised of a performance stock award (the "PSA") granted under the Danimer Scientific, Inc. 2020 Long-Term Incentive Plan (the "Plan") consisting of 95,943 performance shares of the Common Stock (the "Performance Shares"). |

| (2) | Under the PSA, the Performance Shares shall be issued only if (A) to the extent necessary, after the approval by the shareholders of the Issuer of an amendment to the Plan to increase the number of shares available under the Plan in an amount sufficient to permit the vesting and issuance of the Performance Shares in accordance with the PSA, and (B) they have vested in accordance with the following vesting criteria: (i) 30% of the Performance Shares (the "ROE Metric Shares") shall be subject to vesting upon achievement of the pre-tax return on equity ("ROE") metric as follows: the threshold for vesting the ROE Metric Shares shall be the Issuer achieving ROE of at least 5%, in which event 50% of the ROE Metric Shares shall vest, and upon the Issuer achieving ROE of 9%, 100% of the ROE Metric Shares shall vest, with pro rata vesting of the ROE Metric Shares for any amount of ROE in between such ranges; (ii) 30% of the Performance Shares (the "EBITDA Metric Shares") shall be subject to vesting upon achievement of the earnings before interest, taxes, depreciation and amortization ("EBITDA") metric as follows: |

| (3) | (continuation of footnote 2) the threshold for vesting the EBITDA Metric Shares shall be the Issuer achieving EBITDA of at least $45 million, in which event 50% of the EBITDA Metric Shares shall vest, and upon the Issuer achieving $65 million of EBITDA, 100% of the EBITDA Metric Shares shall vest, with pro rata vesting of the EBITDA Metric Shares for any amount of EBITDA in between such ranges; and (iii) 40% of the Performance Shares (the "Neat Capacity Metric Shares") shall be subject to vesting upon achievement of the nameplate capacity for neat PHA production ("Neat Capacity") metric as follows: the threshold for vesting the Neat Capacity Metric Shares shall be the Issuer achieving a Neat Capacity of at least 75 million pounds, in which event 50% of the Neat Capacity Metric Shares shall vest, and upon the Issuer achieving 90 million pounds of Neat Capacity, 100% of the Neat Capacity Shares shall vest, with pro rata vesting of the Neat Capacity Metric Shares for any amount of Neat Capacity in between such ranges. |

| (4) | ROE shall mean the pre-tax return on equity equal to earnings before taxes divided by the average shareholders' equity, based on the Issuer's consolidated financial statements for the period in question. The vesting of the ROE Metric Shares shall be measured based on the Issuer's audited consolidated financial statements for the fiscal year ended December 31, 2023. EBITDA shall be determined based on the Issuer's consolidated financial statements for the period in question. The vesting of the EBITDA Metric Shares shall be measured based on the Issuer's audited consolidated financial statements for the fiscal year ended December 31, 2023. Neat Capacity shall be determined based upon a third-party certification of the ability of the Issuer to produce the quantities of neat PHA set forth above based on its facilities, and not necessarily actual production of such quantities. The vesting of the Neat Capacity Metric Shares shall be measured as of December 31, 2023. |

| (5) | The earlier of July 23, 2024 or the Reporting Person's Termination Date (as defined in the Plan). |

| (6) | The option to purchase 244,073 shares of the Issuer's Common Stock (the "Option Shares") was granted under the Plan, which shall only be exercisable if (A) to the extent necessary, after the approval by the shareholders of the Issuer of an amendment to the Plan to increase the number of shares available under the Plan in an amount sufficient to permit the exercise of the Option Shares, and (B) the Option Shares have vested, which vesting shall occur as follows: (i) one-third of the Option Shares shall vest on July 23, 2022; (ii) one-third of the Option Shares shall vest on July 23, 2023; and (iii) one-third of the Option Shares shall vest on July 23, 2024. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

CROSKREY STEPHEN

C/O DANIMER SCIENTIFIC, INC.

140 INDUSTRIAL BOULEVARD

BAINBRIDGE, GA 39817 | X |

| CEO and Chairman of the Board |

|

Signatures

|

| /s/ Stephen E. Croskrey | | 7/27/2021 |

| **Signature of Reporting Person | Date |

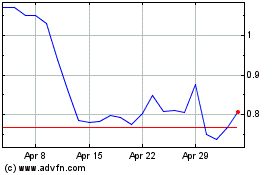

Danimer Scientific (NYSE:DNMR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Danimer Scientific (NYSE:DNMR)

Historical Stock Chart

From Apr 2023 to Apr 2024