Amended Statement of Beneficial Ownership (sc 13d/a)

November 10 2020 - 6:08AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of

1934

(Amendment No. 2)*

|

Danaos

Corporation

|

|

(Name of Issuer)

|

|

Common

Stock, par value $0.01 per share

|

|

(Title of Class of Securities)

|

|

Y1968P121

|

|

(CUSIP Number)

|

|

|

|

Hamburg Commercial Bank AG

Gerhart-Hauptmann-Platz 50

20095 Hamburg, Germany

Tel: +49 40 3333-0

|

|

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

|

|

|

|

November 9, 2020

|

|

(Date of

Event Which Requires Filing of this Statement)

|

|

|

If the filing person has previously

filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this

schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box [ ].

Note: Schedules filed in paper format

shall include a signed original and five copies of the schedule, including all exhibits. See § 240.13d-7 for other parties

to whom copies are to be sent.

* The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures

provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section

18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

|

CUSIP No. Y1968P121

|

|

1.

|

Names of Reporting Persons:

|

|

|

Hamburg Commercial Bank AG (formerly

known as HSH Nordbank AG)

|

|

2.

|

Check the Appropriate Box if a Member of a Group

|

(a) [ ]

|

|

|

|

(b) [ ]

|

|

|

3.

|

SEC Use Only

|

|

4.

|

Source of Funds (See Instructions): OO

(See Item 3)

|

|

5.

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e):

|

|

|

[ ]

|

|

|

6.

|

Citizenship or Place of Organization: Germany

|

|

|

|

|

Number of

|

7. Sole Voting Power:

|

0

|

|

|

|

Shares Beneficially

|

8. Shared Voting Power:

|

0

|

|

|

|

Owned by

|

|

|

|

|

|

Each Reporting

|

9. Sole Dispositive Power:

|

0

|

|

|

|

Person With

|

10. Shared Dispositive Power

|

0

|

|

|

|

|

|

|

|

11.

|

Aggregate Amount Beneficially Owned by Each Reporting Person:

|

|

|

0

|

|

|

12.

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions):

|

|

|

[ ]

|

|

|

13.

|

Percent of Class Represented by Amount in Row (11): 0.0%

|

|

14.

|

Type of Reporting Person (See Instructions): BK

|

|

|

|

|

|

|

|

|

|

|

Explanatory Note

This Amendment No. 2

to Schedule 13D (this “Amendment”) amends the initial Schedule 13D (the “Initial Schedule 13D”)

filed by Hamburg Commercial Bank AG (formerly known as HSH Nordbank AG) (the “Reporting Person”) with the United

States Securities and Exchange Commission (the “SEC”) on August 17, 2018, as amended by Amendment No. 1

to Schedule 13D filed by the Reporting Person with the SEC on December 17, 2018 (the Initial Schedule 13D, as amended by Amendment

No. 1 to Schedule 13D, the “Schedule 13D”). The Schedule 13D, as amended by this Amendment, relates to the common

stock, par value $0.01 per share (the “Common Stock”), of Danaos Corporation, a Marshall Islands corporation

(the “Company”).

|

|

Item 2.

|

Identity and Background.

|

The first paragraph of Item 2 of the Schedule

13D is hereby amended and restated as follows, in order to reflect the change in the legal name of the Reporting Person:

This Schedule 13D is being

filed by Hamburg Commercial Bank AG (formerly known as HSH Nordbank AG), a corporation organized under the laws of the Federal

Republic of Germany (the “Reporting Person”). The address of the principal place of business of the Reporting

Person is Gerhart-Hauptmann-Platz 50, 20095 Hamburg, Germany.

|

|

Item 5.

|

Interest in Securities of the Issuer.

|

Item 5 of the Schedule 13D is hereby amended

by deleting the text thereof in its entirety and substituting the following in lieu thereof:

On November 9, 2020, the

Reporting Person and Promontoria North Shipping Designated Activity Company (“Promontoria”) entered into an

Elevation Agreement (the “Elevation Agreement”) pursuant to which full legal title in the 3,138,748 shares of

Common Stock previously reported in this Schedule 13D as beneficially owned by the Reporting Person (as adjusted to give effect

to the Company’s 1-for-14 reverse stock split implemented on May 2, 2019), has been transferred, distributed and elevated

from the Reporting Person to Promontoria. As of the date hereof and as a result of the Elevation Agreement, the Reporting Person

does not beneficially own any shares of Common Stock. Pursuant to the terms of the Elevation Agreement, the Reporting Person assigned

to Promontoria all rights and obligations of the Reporting Person under the Stockholders Agreement and the Registration Rights

Agreement which the Company had previously entered into with Reporting Person, among other parties. This description of the Elevation

Agreement is qualified in its entirety by the terms of the Elevation Agreement, which is filed as an exhibit to this Schedule 13D.

During the sixty (60) days

prior to November 9, 2020 (the “Event Date”), and from the Event Date to the filing date of this Schedule 13D,

there were no purchases or sales of shares of the Common Stock, or securities convertible into or exchangeable for shares of the

Common Stock, by the Reporting Person or any person or entity for which the Reporting Person possesses voting or dispositive control

over the securities thereof, except as expressly set forth in this Schedule 13D.

On November 9, 2020, the

Reporting Person ceased to be the beneficial owner of more than five percent of the Common Stock.

|

|

Item 7.

|

Material to be Filed as Exhibits.

|

Item 7 of the Schedule 13D is hereby

amended to include the following exhibit:

|

Exhibit 7.6

|

Elevation Agreement, dated as of

November 9, 2020.

|

|

|

|

Signature

After reasonable inquiry

and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

Dated: November 9, 2020

|

|

|

|

|

|

|

|

|

HAMBURG COMMERCIAL BANK AG

|

|

|

|

|

|

|

|

|

Name:

|

N. Krüger

|

|

|

|

|

Title:

|

Director

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name:

|

M. Eltermann

|

|

|

|

|

Title:

|

Authorized Signatory

|

|

|

|

|

|

|

|

|

|

Attention: Intentional misstatements

or omissions of fact constitute

Federal criminal violations (see 18 U.S.C. 1001).

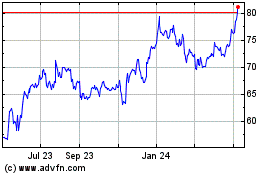

Danaos (NYSE:DAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

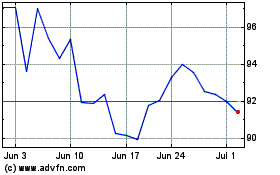

Danaos (NYSE:DAC)

Historical Stock Chart

From Apr 2023 to Apr 2024