By Brent Kendall

WASHINGTON -- A federal judge on Monday sharply questioned the

Justice Department's decision to green-light CVS Health Corp.'s

nearly $70 billion acquisition of Aetna Inc., and said he may order

CVS to halt its integration of Aetna's assets while he considers

the merger's implications.

It is highly unusual for a judge to make such an announcement,

since Justice Department antitrust enforcers had approved the deal

in October under the condition the companies sell Aetna's Medicare

drug business to preserve competition. The companies sold those

assets to WellCare Health Plans Inc.

When the Justice Department identifies concerns with a merger --

and reaches an agreement with the merging companies to address them

-- a federal law called the Tunney Act requires the government to

file the proposed settlement for approval by a federal court, which

determines whether the deal is in the public interest.

Such settlements are almost universally approved, often without

a judge calling a hearing. But U.S. District Judge Richard Leon --

who was a central figure in AT&T Inc.'s merger with Time Warner

Inc. -- made clear he would play an active role. He said at a terse

hearing Monday -- in which he sought no input from either the

Justice Department or the companies -- that he was concerned that

the department hadn't adequately addressed the potential

competitive harms raised by the merger.

"I am concerned that your complaint raises anticompetitive

concerns about one-tenth of 1% of this $69 billion deal," said the

judge, who sits on the U.S. District Court in Washington, D.C.

Judge Leon, whose courtroom style can be unorthodox, is looming

large over the current antitrust landscape. In June, he issued a

scathing opinion rejecting the Justice Department's challenge to

the AT&T-Time Warner deal. His ruling in that case is now on

appeal, with a high-stakes hearing set for Thursday.

In this case, the judge expressed, with equal vehemence, his

skepticism about the department declining to challenge the

CVS-Aetna merger more forcefully.

The judge's combined actions have left frustrations at the

Justice Department, with officials there finding his latest

position ironic in light of his rejection of the DOJ's AT&T

lawsuit challenging a merger, according to a person familiar with

their thinking.

Among other things, Judge Leon cited objections by the American

Medical Association, which argued the merger would substantially

reduce competition in health care to the detriment of patients. The

judge said he was eager to review other public comments on the

settlement before making up his mind.

Judge Leon, who was nominated to the court by President George

W. Bush, said he is considering requiring that CVS hold the Aetna

assets separate for now, which he said "seems to me more than

reasonable." If he does so, it could cause considerable disruption

for the newly merged company, since CVS began integrating Aetna's

assets immediately after the deal closed last week.

He ordered the companies and the Justice Department to file

legal papers by Dec. 14, and scheduled another court hearing for

Dec. 18.

A spokesman for the merged business said the two companies no

longer are separate entities, raising questions about how they

could disentangle themselves if the judge ordered it. "CVS Health

and Aetna are one company, and our focus is on transforming the

consumer health experience, " the spokesman said.

Judge Leon has made waves in antitrust settlements before.

During the Obama administration, he warned in 2011 that he might

not approve a Justice Department settlement that allowed Comcast

Corp. to acquire control of NBCUniversal.

The judge ultimately approved the agreement, but he chose to

hold annual oversight hearings and required the government to

report back on how many online-content companies used an

arbitration provision in the settlement.

Antitrust practitioners said they couldn't remember a judge ever

forcing substantial changes to a merger in a Tunney Act review.

James Tierney, a former Justice Department antitrust lawyer now

with the Orrick law firm, said the department and the companies

were handling the CVS-Aetna case in a traditional way. "What's

happening here is consistent with the Tunney Act and decades of

precedent," he said.

The act gives judges the authority to make sure that Justice

Department antitrust settlements address the harms the government

has identified, but it doesn't give courts free-roaming ability to

require the department to challenge other aspects of a merger the

department didn't find problematic, Mr. Tierney said.

The merger combines CVS's sprawling network of pharmacies and

its pharmacy-benefit manager business with Aetna's health insurance

practices focused on employers, Medicare and Medicaid managed-care.

The companies argued that the vertical integration of their

businesses would lead to better integrated, more efficient care for

consumers.

In an earlier court session last week, Judge Leon appeared

surprised that the companies had already closed the merger and said

he wouldn't be a "rubber stamp" for the settlement.

Merging parties normally begin integrating their units after

receiving government antitrust approval, without waiting for a

court to formally sign off.

Over the weekend, the Justice Department filed court papers

arguing that Judge Leon had a limited role in the matter, with no

authority to raise objections that the government hadn't. And it

said the judge already had signed a preliminary order that

effectively allowed the companies to move forward on their

merger.

Justice Department lawyers -- including antitrust chief Makan

Delrahim -- turned out in large numbers for Monday's hearing,

filling two rows of the courtroom.

Judge Leon addressed the government contingent, saying he did

have authority to ensure that the Justice Department hadn't settled

the case so narrowly as to make a "mockery" of the judicial system.

He spoke for less than 10 minutes without hearing from either the

department or CVS, then adjourned the session.

Mr. Delrahim, upon exiting, declined to comment.

Write to Brent Kendall at brent.kendall@wsj.com

(END) Dow Jones Newswires

December 03, 2018 19:33 ET (00:33 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

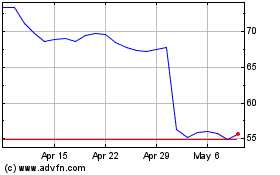

CVS Health (NYSE:CVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

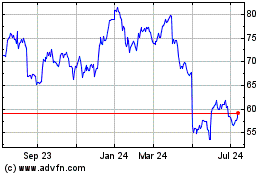

CVS Health (NYSE:CVS)

Historical Stock Chart

From Apr 2023 to Apr 2024