CVS Warns of Surge in Non-Coronavirus Health Problems -- 2nd Update

May 06 2020 - 3:09PM

Dow Jones News

By Sharon Terlep

CVS Health Corp. executives warned Wednesday of an impending

surge in medical problems unrelated to coronavirus, as the pharmacy

chain's data suggest Americans are delaying routine health care

during the pandemic.

CVS, which owns insurance giant Aetna, says patients in April

received fewer new prescriptions, starting fewer new treatments and

seeing doctors less frequently, a concern especially for patients

who have chronic conditions such as diabetes and heart disease,

which can lead to costly hospitalizations when not treated

consistently.

Meantime, store and prescription sales dropped in April

following a pandemic-driven surge in business earlier in the year,

the company said. Aetna also saw a decline in commercial contracts

as businesses dropped insurance coverage for workers to cut costs,

laid off workers or closed.

The emerging trends follow a first quarter during which CVS had

higher sales as the pandemic prompted consumers to fill more

routine prescriptions and to spend more at the pharmacy chain's

stores.

The pandemic has led to dramatic shift in consumer patterns, the

company said. Virtual visits to the company's urgent-care clinic

grew sixfold while prescription home delivery grew 10-fold. Online

prescription refill requests grew 50%.

"We are seeing a new normal emerge," CVS CEO Larry Merlo said.

"We expect elements of today's new norm will become part of

tomorrow's everyday routines."

CVS's Aetna unit saw a drop-off of around 30% in use of

health-care services in April, as much of the health-care system

paused elective procedures to brace for coronavirus surges.

But Mr. Merlo said in an interview that the Aetna business has

picked up slightly in response to shelter-in-place orders being

lifted in certain locations. The company expects "the trough, the

low point will be in the second quarter, and we will see some

pickup in the second half of the year," but it is too soon to tell

how soon or how much, Mr. Merlo said.

While people weren't starting new drug therapies for health

conditions, Mr. Merlo said it appeared that patients with chronic

conditions were keeping up their existing prescriptions.

Prescription volume for the quarter ended March 31 grew more

than 8%, as customers rushed to stock up on medications amid the

pandemic, either by refilling prescriptions early or switching to

90-day prescriptions. Same-store sales grew 8% and shoppers scooped

up health-related items and other goods.

"We're uniquely positioned to understand consumer and patient

needs and how to address them," Mr. Merlo said in a statement.

CVS reported first-quarter net income of $2 billion, or $1.53 a

share, compared with $1.4 billion, or $1.09 a share, in the

comparable quarter a year before. Adjusted earnings were $1.91 a

share.

Analysts were looking for earnings of $1.22 a share, or $1.62 a

share on an adjusted basis.

CVS said its revenue rose 8.3% to $66.8 billion from the same

period the year before as revenue grew across all segments.

Analysts were targeting $64.1 billion.

Revenue in its retail segment, which fulfills prescription

medications and sells a range of merchandise, was $22.7 billion, up

7.7% compared with the year-earlier period. CVS has faced pressure

in its retail-pharmacy business but has begun to fare better than

rival Walgreens Boots Alliance Inc.

Walgreens also generated stronger-than-expected sales during its

latest quarter, though the company's operating income fell 19%, in

part because of reimbursement pressure on prescription drugs. Like

CVS, Walgreens said sales in April dropped off following a surge in

March.

CVS's health-care benefits business, which includes Aetna,

posted revenue of $19.2 billion, an increase of 7.4%. The company

last year sold its Medicare Part D prescription business to a

WellCare Health Plans Inc., but said it generated more revenue in

the quarter from government products.

Revenue grew 4.2%, to $35 billion, in the pharmacy-services

segment.

CVS said its expectations for full-year earnings and cash flow

remain unchanged while withdrawing guidance for all other metrics

due to uncertainty around coronavirus.

CVS shares were up nearly 1% in afternoon trading.

--Anna Mathews contributed to this article.

Write to Sharon Terlep at sharon.terlep@wsj.com

(END) Dow Jones Newswires

May 06, 2020 14:54 ET (18:54 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

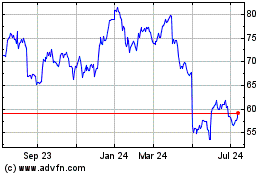

CVS Health (NYSE:CVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

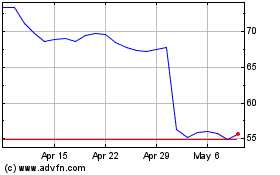

CVS Health (NYSE:CVS)

Historical Stock Chart

From Apr 2023 to Apr 2024