Current Report Filing (8-k)

March 19 2019 - 4:10PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

_______________________________________________________________________

FORM 8-K

__________________________________________________________________________

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 15, 2019

________________________________________________________________________

CURO GROUP HOLDINGS CORP.

(Exact Name of Registrant as Specified in its Charter)

________________________________________________________________________

|

|

|

|

|

|

|

Delaware

|

001-38315

|

90-0934597

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

|

3527 North Ridge Road, Wichita, Kansas

|

67205

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(316)425-1410

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

________________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the

registrant under any of the following provisions:

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule12b-2of the Securities Exchange Act of 1934(§240.12b-2of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

2019 Short-Term Incentive Program

On March 15, 2019, the Board of Directors (the “Board”) of CURO Group Holdings Corp. (the “Company”) approved the 2019 Short-Term Incentive Program (the “2019 STIP”) for participation by key employees, including our named executive officers. Under the 2019 STIP, participants will be eligible to earn a cash bonus in an amount based upon a targeted percentage of the participant’s base salary. A participant’s cash bonus will be earned based upon the achievement of two specified Company performance objectives (net revenue (40%) and adjusted pre-tax income (40%)) and personal performance objectives (20%).

For the portion attributable to the net revenue performance objective, a participant will be eligible to earn 50% of target bonus if the Company achieves 95% of the net revenue objective and up to 150% of target bonus if the Company achieves 105% or more of the net revenue objective. The amount of cash bonus earned based upon the Company achieving between 95% and 105% of the net revenue objective will be calculated on a pro-rata basis.

For the portion attributable to the adjusted pre-tax income objective, a participant will be eligible to earn 50% of target bonus if the Company achieves 90% of the adjusted pre-tax income objective and up to 150% of target bonus if the Company achieves 110% or more of the adjusted pre-tax income objective. The amount of cash bonus earned based upon the Company achieving between 90% and 110% of the adjusted pre-tax income objective will be calculated on a pro-rata basis.

If a participant achieves all of his or her personal objectives, the participant will earn 100% of target bonus attributable to personal objectives. A participant may be eligible to earn a portion of target bonus upon the achievement of some, but not all, personal objectives, as determined by the Board. A participant will not earn a cash bonus if he or she achieves some or all personal objectives unless the Company achieves at least the minimum target level for either the net revenue objective or the adjusted pre-tax income objective.

A participant must be employed by the Company for the entire performance period to be eligible to receive a cash bonus under the 2019 STIP, except as otherwise provided in an employment agreement between the participant and the Company.

2019 Long-Term Incentive Program

On March 15, 2019, the Company’s Board also approved the 2019 Long-Term Incentive Program (the “2019 LTIP”) for participation by identified key employees of the Company, including our named executive officers. Under the 2019 LTIP, participants will be granted restricted stock units pursuant to the Company’s stockholder-approved 2017 Incentive Plan in an amount based upon a targeted percentage of the participant’s base salary.

One-half of the restricted stock units will be performance-based and one-half will be time-based. For the one-half of the restricted stock units that will be performance based, if the specified Company performance objective (relative total stockholder return) is met or exceeded as of the third anniversary date of the grant date (measurement date), the equity awards will be earned and will vest if the participant has been employed by the Company for the entire performance period, including on the measurement date.

For the one-half of the restricted stock units that will be time-based, these equity awards will vest in three equal installments on the first, second and third anniversary dates of the day immediately prior to the grant date, if the participant is employed by the Company on such dates.

A form of notice and award agreement for the 2019 STIP is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated into this Item 5.02 by reference. Forms of notice and award agreements for the 2019 LTIP are filed as Exhibit 10.2 and Exhibit 10.3 to this Current Report on Form 8-K and are incorporated into this Item 5.02 by reference.

ITEM 9.01 Financial Statements and Exhibits

(d). Exhibits

|

|

|

|

|

|

Exhibit Number

|

Description

|

|

99.1

|

|

|

99.2

|

|

|

99.3

|

|

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized on this 19th day of March, 2019.

CURO Group Holdings Corp.

By:

/s/ Roger Dean______

Roger Dean

Executive Vice President and Chief Financial Officer

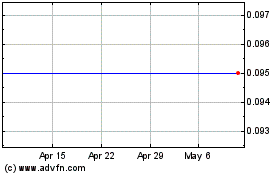

CURO (NYSE:CURO)

Historical Stock Chart

From Mar 2024 to Apr 2024

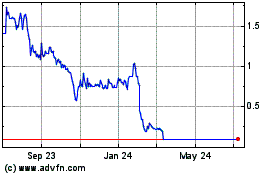

CURO (NYSE:CURO)

Historical Stock Chart

From Apr 2023 to Apr 2024