Current Report Filing (8-k)

December 16 2019 - 9:14AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

_______________________________________________________________________

FORM 8-K

__________________________________________________________________________

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): December 11, 2019

________________________________________________________________________

CURO GROUP HOLDINGS CORP.

(Exact Name of Registrant as Specified in Its Charter)

________________________________________________________________________

|

|

|

|

|

|

|

Delaware

|

001-38315

|

90-0934597

|

|

(State or other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

|

3527 North Ridge Road, Wichita, Kansas

|

67205

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

(316) 772-3801

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

________________________________________________________________________

Check the appropriate box below if the Form8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

Trading symbol(s)

|

Name of each exchange on which registered

|

|

Common stock

|

CURO

|

NYSE

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule12b-2of the Securities Exchange Act of 1934(§240.12b-2of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

|

|

ITEM 1.01

|

Entry into a Material Definitive Agreement

|

On December 11, 2019, CURO Intermediate Holdings Corp., (the “Purchaser”), a wholly-owned subsidiary of CURO Group Holdings Corp. (the “Company”) entered into a Stock Purchase Agreement (the “SPA”) by and among Doug Rippel, Chad Faulkner, Mike McKnight (each a “Seller” and collectively the “Sellers”) and Ad Astra Recovery Services, Inc. (“Ad Astra”), pursuant to which the Purchaser agreed to purchase from the Sellers all of the outstanding capital stock of Ad Astra for a base purchase price of $15,802,278, subject to customary adjustments for net-working capital, cash and debt (the “Transaction”). Ad Astra is currently the Company’s exclusive provider of third-party collection services for the Company’s U.S. operations.

Under the SPA, each of the Purchaser, the Sellers and Ad Astra have made customary representations and warranties and agreed to undertake customary covenants. Closing of the Transaction is subject to regulatory approval in the various jurisdictions in which the Company operates and contains customary closing conditions.

The Sellers are founders and significant stockholders of the Company and each Seller is a member of the Company’s board of directors. Mr. Rippel is the Company’s Executive Chairman of its board of directors. A committee of independent directors with independent legal and financial advisors negotiated the Transaction and determined it to be in the best interests of the Company, and the Transaction was approved by the unanimous vote of disinterested members of the Company’s board of directors.

The foregoing descriptions of the SPA and the Transaction do not purport to be complete and are qualified in their entirety by reference to the full text of the SPA, which will be attached as an exhibit to the Company’s Annual Report on Form 10-K for the year ending December 31, 2019.

|

|

|

|

ITEM 7.01

|

Regulation FD Disclosure

|

On December 16, 2019, the Company issued a press release, which is attached hereto as Exhibit 99.l. The information reported in this Item 7.01 (including the press release) is furnished to and not “filed” with the Securities and Exchange Commission for the purposes of the Securities Exchange Act of 1934, and it shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

ITEM 9.01 Financial Statements and Exhibits

(d). Exhibits

|

|

|

|

|

|

Exhibit Number

|

Description

|

|

99.1

|

|

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized on this 16th day of December, 2019.

CURO Group Holdings Corp.

By: /s/ Roger Dean_________

Roger Dean

Executive Vice President and Chief Financial Officer

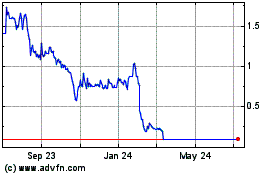

CURO (NYSE:CURO)

Historical Stock Chart

From Mar 2024 to Apr 2024

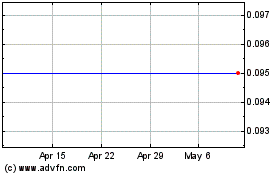

CURO (NYSE:CURO)

Historical Stock Chart

From Apr 2023 to Apr 2024