Current Report Filing (8-k)

June 05 2020 - 4:17PM

Edgar (US Regulatory)

CROWN CASTLE INTERNATIONAL CORP false 0001051470 0001051470 2020-06-04 2020-06-04 0001051470 us-gaap:CommonStockMember 2020-06-04 2020-06-04 0001051470 us-gaap:SeriesAPreferredStockMember 2020-06-04 2020-06-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 4, 2020

Crown Castle International Corp.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-16441

|

|

76-0470458

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

1220 Augusta Drive, Suite 600, Houston, Texas 77057-2261

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (713) 570-3000

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbols

|

|

Name of each exchange

on which registered

|

|

Common Stock, $0.01 par value

|

|

CCI

|

|

New York Stock Exchange

|

|

|

|

|

|

|

|

6.875% Mandatory Convertible Preferred Stock, Series A, $0.01 par value

|

|

CCI.PRA

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 1.01 – ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On June 4, 2020, Crown Castle International Corp. (“Company”) entered into an underwriting agreement (“Underwriting Agreement”) with J.P. Morgan Securities LLC, Mizuho Securities USA LLC, SG Americas Securities, LLC, SMBC Nikko Securities America, Inc. and TD Securities (USA) LLC, as Representatives for the several Underwriters (“Underwriters”), pursuant to which the Company agreed to issue and sell to the Underwriters $500,000,000 aggregate principal amount of the Company’s 1.350% Senior Notes due 2025, $1,100,000,000 aggregate principal amount of the Company’s 2.250% Senior Notes due 2031 and $900,000,000 aggregate principal amount of the Company’s 3.250% Senior Notes due 2051 in a registered public offering (“Offering”) pursuant to the Company’s shelf registration statement on Form S-3 (Registration File No. 333-223921). The Company intends to use the net proceeds of the Offering, together with available cash, to redeem or repurchase all of its outstanding 3.400% Senior Notes due 2021, 2.250% Senior Notes due 2021 and 4.875% Senior Notes due 2022. On June 5, 2020, the Company delivered notices of redemption to the holders of each such series of notes, which provide that all such notes will, conditional upon the closing of the Offering (which is expected to occur on June 15, 2020), be redeemed by the Company on July 6, 2020 in accordance with the indenture (and the applicable supplements thereto) governing such notes. For a complete description of the terms and conditions of the Underwriting Agreement, please refer to the Underwriting Agreement, which is filed as Exhibit 1.1 hereto, and is incorporated herein by reference.

ITEM 8.01 – OTHER EVENTS

On June 4, 2020, the Company issued a press release announcing the commencement of the Offering. The Company’s press release is filed as Exhibit 99.1 hereto, and is incorporated herein by reference.

On June 4, 2020, the Company issued a press release announcing the pricing of the Offering. The Company’s press release is filed as Exhibit 99.2 hereto, and is incorporated herein by reference.

ITEM 9.01 – FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

Exhibit Index

|

|

|

|

|

|

|

Exhibit

No.

|

|

|

Description

|

|

|

|

|

|

|

|

|

1.1

|

|

|

Underwriting Agreement, dated June 4, 2020, among the Company and J.P. Morgan Securities LLC, Mizuho Securities USA LLC, SG Americas Securities, LLC, SMBC Nikko Securities America, Inc. and TD Securities (USA) LLC, as Representatives for the several Underwriters

|

|

|

|

|

|

|

|

|

99.1

|

|

|

Press Release, dated June 4, 2020

|

|

|

|

|

|

|

|

|

99.2

|

|

|

Press Release, dated June 4, 2020

|

|

|

|

|

|

|

|

|

104

|

|

|

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document

|

Cautionary Language Regarding Forward Looking Statements

This Current Report on Form 8-K contains forward-looking statements that are based on current expectations of management of the Company. Such statements include plans, projections and estimates regarding the proposed offering, including the net proceeds therefrom, the use of such proceeds and the anticipated closing date. Such forward-looking statements are subject to certain risks, uncertainties and assumptions, including prevailing market conditions and other factors. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those expected.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

CROWN CASTLE INTERNATIONAL CORP.

|

|

|

|

|

|

By:

|

|

/s/ Kenneth J. Simon

|

|

Name:

|

|

Kenneth J. Simon

|

|

Title:

|

|

Executive Vice President and General Counsel

|

Date: June 5, 2020

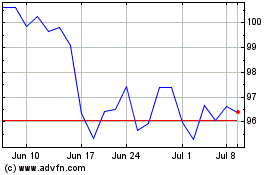

Crown Castle (NYSE:CCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

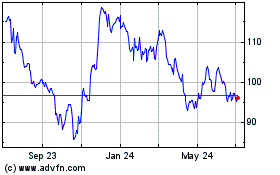

Crown Castle (NYSE:CCI)

Historical Stock Chart

From Apr 2023 to Apr 2024