SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

F O R M 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of

July 2022

Commission File Number 001-36258

Crescent Point Energy Corp.

(Name of Registrant)

Suite 2000,

585-8th Avenue S.W.

Calgary, Alberta, T2P 1G1

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or

will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☐ Form

40-F ☒

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether by furnishing the information

contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934.

Yes

☐ No ☒

If "Yes" is marked, indicate below the file

number assigned to the registrant in connection with Rule 12g3-2(b): 82- ________

DOCUMENTS FILED AS PART OF THIS FORM 6-K:

|

Exhibit No.

99.1 |

Description

News Release dated July 6, 2022 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Crescent Point Energy Corp. |

|

| |

(Registrant) |

|

| |

|

|

|

| |

By: |

/s/ Ken Lamont |

|

| |

Name: |

Ken Lamont |

|

| |

Title: |

Chief Financial Officer |

Date: July 6, 2022

EXHIBITS

Exhibit 99.1

Crescent Point Increases Quarterly Dividend,

Provides Updated Return of Capital Framework and Releases Sustainability Report

CALGARY, AB, July 6, 2022 /CNW/ - Crescent Point Energy

Corp. ("Crescent Point" or the "Company") (TSX: CPG) and (NYSE: CPG) is pleased to announce an increase to its quarterly

dividend, an updated return of capital framework, the disposition of non-core assets, updated 2022 guidance and the release of its annual

Sustainability Report.

KEY HIGHLIGHTS

- Achieved near-term net debt target earlier than anticipated, benefitting

from proceeds of $300 million from asset dispositions.

- Increasing quarterly base dividend over 20 percent to $0.08 per

share, representing an annualized dividend of $0.32 per share.

- Executed $150 million of planned share repurchases, representing

17.5 million shares, since December 2021.

- Updated framework targeting the return of up to 50 percent of

discretionary excess cash flow, in addition to base dividends.

- Expect to return over $430 million to shareholders in the second

half of 2022 based on US$100/bbl WTI.

- Introduced new targets to reduce scope 1 and 2 emissions intensity

and freshwater use, further enhancing ESG practices.

"Through our continued execution and capital

discipline we have achieved our near-term net debt target ahead of our expected timeline," said Craig Bryksa, President and CEO of

Crescent Point. "This success has allowed us to further increase our base dividend and provide shareholders with an updated return

of capital framework, with a target to return the majority of our excess cash flow to shareholders. Our business model remains centered

around our key pillars of balance sheet strength and sustainability, which allows us to create long-term value for shareholders."

INCREASING RETURN OF CAPITAL

The Company's Board of Directors has approved and

declared a third quarter 2022 base dividend increase to $0.08 per share to be paid on October 3, 2022 to shareholders

of record on September 15, 2022. This equates to an annualized base dividend of $0.32 per share, representing an increase

of over 20 percent from the prior level and marking Crescent Point's fourth dividend increase in less than one year. The Company's dividend

policy and payout ratio are based on its framework which targets dividend sustainability at lower commodity prices, allows for flexibility

in its capital allocation process and provides the potential to grow the base dividend over time.

Given continued improvement in Crescent Point's financial

position and outlook, the Company is seeking to further increase its current return of capital offering. On a quarterly basis and beginning

in third quarter 2022, Crescent Point will target the return of up to 50 percent of its discretionary excess cash flow to shareholders.

Discretionary excess cash flow is calculated as excess cash flow less base dividends.

This additional return of capital will be provided

to shareholders within the Company's updated framework that utilizes a combination of accretive share repurchases and special dividends.

Given Crescent Point's current valuation relative to its intrinsic value at mid-cycle commodity prices, the Company initially plans to

utilize a greater proportion of share repurchases within its return of capital framework. The Company successfully executed its previously

announced planned share repurchases of approximately $150 million, repurchasing approximately 17.5 million shares since December 2021.

Crescent Point has approval to repurchase, for cancellation, up to 10 percent of its public float under its normal course issuer bid ("NCIB"),

which expires on March 8, 2023.

Crescent Point expects to generate over $1.4 billion

of excess cash flow in 2022, of which approximately $775 million is expected to be realized during the second half of the year based on

a WTI price of approximately US$100/bbl. The Company plans to return over $430 million of capital directly to shareholders, including

its base dividend, based on current guidance and expectations for the second half of 2022, or approximately $865 million on an annualized

basis. To supplement its return of capital offering to shareholders, Crescent Point also plans to further strengthen its balance sheet.

| All financial figures are approximate and in Canadian dollars unless otherwise noted. This press release contains forward-looking information and references to the specified financial measures: excess cash flow, discretionary excess cash flow and net debt. Refer to the Specified Financial Measures and Forward-Looking Information sections in this press release for further information. |

ASSET DISPOSITIONS AND 2022 GUIDANCE

Crescent Point has completed the disposition of its

non-core Saskatchewan Viking assets ("Assets"), which were previously identified as disposition candidates, for total cash consideration

of approximately $260 million, prior to closing adjustments.

The Assets included approximately 4,000 boe/d of production,

comprised primarily of oil and liquids. Crescent Point considered these Assets to be non-core due to their limited scalability. These

Assets also possessed a higher decline rate and emissions intensity profile in comparison to the Company's corporate average. During second

quarter 2022, Crescent Point also completed the disposition of certain non-core East Shale Duvernay assets for approximately $40 million,

which included approximately 1,000 boe/d of production (50 percent oil and liquids). Proceeds from these transactions have been directed

toward the Company's balance sheet.

National Bank Financial Inc. acted as financial advisor

and ATB Capital Markets Inc. acted as strategic advisor to the Company with respect to these transactions.

Crescent Point has updated its 2022 annual average

production guidance to 130,000 to 134,000 boe/d to reflect the impact of the non-core asset dispositions. The Company's 2022 development

capital expenditures guidance remains unchanged at $875 to $900 million, as minimal development capital was allocated to these assets

for the remainder of the year.

As previously announced, Crescent Point's North Dakota

operations were temporarily impacted by a severe storm that affected electricity distribution beginning late April 2022. The Company is

pleased to report that operations returned to full capacity toward the end of May 2022, slightly earlier than anticipated. This unexpected

downtime impacted annual average production by approximately 1,000 boe/d.

ANNUAL SUSTAINABILITY REPORT

"Our 2022 Sustainability Report demonstrates

our strong execution over the past year and sets new performance targets to help us deliver on our purpose of 'Bringing Energy To Our

World - The Right Way'," said Bryksa. "We ensure that accountability is aligned throughout the organization, including our compensation

program. By embedding ESG perspectives throughout our business, we are better able to mitigate risks and capitalize on opportunities to

ensure we are delivering safe, secure and responsibly developed energy to our world."

As part of its goal to reduce emissions, Crescent

Point is targeting a further reduction of 38 percent in its scope 1 and 2 emissions intensity by 2030, relative to the Company's 2020

baseline. This achievement would result in a combined emissions intensity of 0.020 tCO2e/boe. This target builds upon Crescent

Point's recent achievement that reduced scope 1 emissions intensity by 50 percent at year-end 2021, well ahead of its expected timeframe.

The Company is also announcing two new water targets

to build upon its existing strong water management performance, including a 50 percent reduction in surface freshwater use in southeast

Saskatchewan by 2025. Crescent Point's environmental stewardship also includes a previously announced target to reduce its inactive well

inventory by 30 percent by 2031.

Safety remains a top priority for the Company and

through engagement with its employees and contractors, Crescent Point is pleased to report that it achieved a new six year low in Serious

Incident Frequency ("SIF") in 2021.

Additional details on the Company's ESG performance,

including its strong governance practices, diversity initiatives and significant community investment, and a full copy of the Sustainability

Report can be found on Crescent Point's website at www.crescentpointenergy.com.

2022 GUIDANCE

The Company's guidance for 2022 is as follows:

| |

Prior |

Revised |

| Total Annual Average Production (boe/d) (1) |

133,000 – 137,000 |

130,000 – 134,000 |

| |

|

|

| Capital Expenditures |

|

|

| Development capital expenditures ($ millions) |

$875 - $900 |

$875 - $900 |

| Capitalized G&A ($ millions) |

$40 |

$40 |

| Total ($ millions) (2) |

$915 - $940 |

$915 - $940 |

| |

|

|

| Other Information for 2022 Guidance |

|

|

| Reclamation activities ($ millions) (3) |

$20 |

$20 |

| Capital lease payments ($ millions) |

$20 |

$20 |

| Annual operating expenses ($/boe) |

$13.75 - $14.25 |

$13.75 - $14.25 |

| Royalties |

13.5% - 14.0% |

13.5% - 14.0% |

| 1) |

Total annual average production (boe/d) is comprised of approximately 80% Oil, Condensate & NGLs and 20% Natural Gas |

| 2) |

Land expenditures and net property acquisitions and dispositions are not included. Development capital expenditures spend is allocated on an approximate basis as follows: 85% drilling & development and 15% facilities & seismic |

| 3) |

Reflects Crescent Point's portion of its expected total budget |

| |

|

RETURN OF CAPITAL OUTLOOK

| |

|

| Base Dividend |

|

| Current quarterly base dividend per share |

$0.08 |

| Additional Return of Capital |

|

| % of discretionary excess cash flow (1) (2) |

50 % |

| 1) |

Discretionary excess cash flow is calculated as excess cash flow less base dividends |

| 2) |

Additional return of capital % to begin in third quarter 2022. This % is part of a framework that targets to return up to 50% of discretionary excess cash flow to shareholders |

| |

|

Specified Financial Measures

Throughout this press release, the Company uses the

terms "excess cash flow", "discretionary excess cash flow" and "net debt". These terms do not have any standardized

meaning as prescribed by IFRS and, therefore, may not be comparable with the calculation of similar measures presented by other issuers.

For information on the composition of these measures and how the Company uses these measures, refer to the Specified Financial Measures

section of the Company's MD&A for the period ended March 31, 2022, which sections are incorporated herein by reference, and available

on SEDAR at www.sedar.com and on EDGAR at www.sec.gov/edgar.

The most directly comparable financial measure to

excess cash flow disclosed in the Company's primary financial statements is cash flow from operating activities, which for the period

ended March 31, 2022 was $426.1 million.

Excess cash flow forecasted for 2022 is a forward-looking

non-GAAP measure and is calculated consistently with the measure disclosed in the Company's MD&A. Refer to the Specified Financial

Measures section of the Company's MD&A for the period ended March 31, 2022.

Discretionary excess cash flow is a historical non-GAAP

financial measure and is defined as excess cash flow less base dividends. The most directly comparable financial measure to discretionary

excess cash flow disclosed in the Company's financial statements is cash flow from operating activities. Discretionary excess cash flow

is a key measure that assesses the funds available for reinvestment in the Company's business or for return of capital to shareholders

beyond the base dividend.

Discretionary excess cash flow forecasted for 2022

is a forward-looking non-GAAP measure and is calculated consistently with the historical measure disclosed herein.

The following table reconciles cash flow from operating

activities to discretionary excess cash flow:

| |

Three months ended March 31 |

|

| ($ millions) |

2022 |

|

2021 (1) |

|

% Change |

|

| Cash flow from operating activities |

426.1 |

|

303.7 |

|

40 |

|

| Changes in non-cash working capital |

101.4 |

|

(47.2) |

|

(315) |

|

| Transaction costs |

0.1 |

|

0.1 |

|

— |

|

| Decommissioning expenditures (2) |

6.4 |

|

6.1 |

|

5 |

|

| Adjusted funds flow from operations |

534.0 |

|

262.7 |

|

103 |

|

| Capital expenditures |

(226.8) |

|

(134.4) |

|

69 |

|

| Payments on lease liability |

(5.1) |

|

(5.1) |

|

— |

|

| Decommissioning expenditures |

(6.4) |

|

(6.1) |

|

5 |

|

| Other items (3) |

(6.4) |

|

12.8 |

|

(150) |

|

| Excess cash flow |

289.3 |

|

129.9 |

|

123 |

|

| Dividends(4) |

0.2 |

|

(1.3) |

|

(115) |

|

| Discretionary excess cash flow |

289.5 |

|

128.6 |

|

125 |

|

| (1) |

Comparative period revised to reflect current period presentation. |

| (2) |

Excludes amounts received from government subsidy programs. |

| (3) |

Other items include, but are not limited to, unrealized gains and losses on equity derivative contracts and transaction costs. Other items exclude net acquisitions and dispositions. |

| (4) |

The March 31, 2022 dividend was accrued based on shares outstanding as of December 31, 2021. As a result of common shares purchased and cancelled under the NCIB during the first quarter of 2022, dividends declared to the shareholders was reduced by $0.2 million. |

| |

|

Management believes the presentation of the specified

financial measures above provide useful information to investors and shareholders as the measures provide increased transparency and the

ability to better analyze performance against prior periods on a comparable basis.

Forward-Looking Statements

Any "financial outlook" or "future

oriented financial information" in this press release, as defined by applicable securities legislation has been approved by management

of Crescent Point. Such financial outlook or future oriented financial information is provided for the purpose of providing information

about management's current expectations and plans relating to the future. Readers are cautioned that reliance on such information may

not be appropriate for other purposes.

Certain statements contained in this press release

constitute "forward-looking statements" within the meaning of section 27A of the Securities Act of 1933 and section 21E of the

Securities Exchange Act of 1934 and "forward-looking information" for the purposes of Canadian securities regulation (collectively,

"forward-looking statements"). The Company has tried to identify such forward-looking statements by use of such words as "could",

"should", "can", "anticipate", "expect", "believe", "will", "may",

"intend", "projected", "sustain", "continues", "strategy", "potential", "projects",

"grow", "take advantage", "estimate", "well-positioned" and other similar expressions, but these

words are not the exclusive means of identifying such statements.

In particular, this press release contains forward-looking

statements pertaining, among other things, to the following: dividend amounts, record dates, payment dates and annualized amounts; the

return of capital framework including the return of up to 50 percent of discretionary excess cash flow, in addition to base dividends;

expectations of returning over $430 million to shareholders in the second half of 2022 based on US$100/bbl WTI; targeting the return of

a majority of the Company's excess cash flow to shareholders; the Company's business model creating long-term value for shareholders;

the return of capital framework targeting dividend sustainability at lower commodity prices, allowing for flexibility in the capital allocation

process and the potential for dividend growth over time; beginning third quarter 2022, a target to return up to 50 percent of the Company's

discretionary excess cash flow to shareholders through a combination of accretive share repurchases and special dividends; the belief

that the Company's common shares remain undervalued relative to intrinsic value, assuming mid-cycle commodity prices; at current strip

commodity prices, Crescent Point expecting to generate over $1.4 billion of excess cash flow in 2022, of which approximately $775 million

is expected to be realized during the second half of 2022 based on a WTI price of approximately US$100/bbl; plans to return over $430

million of capital directly to shareholders, including base dividend, based on current guidance and expectations for the second half of

2022, or approximately $865 million on an annualized basis; plans to supplement the return of capital offering to shareholders by further

strengthening the balance sheet; goals to reduce emissions; targeted reduction of scope 1 and 2 greenhouse gas emissions intensity of

38 percent by 2030 relative to the Company's 2020 baseline, with combined emissions intensity of 0.020 tCO2e/boe; new water

targets, including a 50 percent reduction in surface freshwater use in southeast Saskatchewan by 2025; a target to reduce inactive well

inventory by 30 percent by 2031; the Company's 2022 annual average production guidance of 130,000 to 134,000 boe/d; 2022 development capital

expenditures guidance of $875 to $900 million; 2022 capitalized G&A of $40 million; total 2022 capital expenditures of $915 - $940

million; 2022 reclamation activities of $20 million, capital lease payments of $20 million, annual operating expenses of $13.75-$14.25/boe,

and royalties of 13.5% to 14.0%; and return of capital outlook including a quarterly base divided per share of $0.08, and an additional

return of capital of 50% of discretionary cash flow.

All forward-looking statements are based on Crescent

Point's beliefs and assumptions based on information available at the time the assumption was made. Crescent Point believes that the expectations

reflected in these forward-looking statements are reasonable but no assurance can be given that these expectations will prove to be correct

and such forward-looking statements included in this report should not be unduly relied upon. By their nature, such forward-looking statements

are subject to a number of risks, uncertainties and assumptions, which could cause actual results or other expectations to differ materially

from those anticipated, expressed or implied by such statements, including those material risks discussed in the Company's Annual Information

Form for the year ended December 31, 2021 under "Risk Factors" and our Management's Discussion and Analysis for the year ended

December 31, 2021, and for the quarter ended March 31, 2022, under the headings "Risk Factors" and "Forward-Looking Information".

The material assumptions are disclosed in the Management's Discussion and Analysis for the three months ended March 31, 2022, under the

headings "Overview", "Commodity Derivatives", "Liquidity and Capital Resources", "Guidance", "Royalties"

and "Operating Expenses". In addition, risk factors include: financial risk of marketing reserves at an acceptable price given

market conditions; volatility in market prices for oil and natural gas, decisions or actions of OPEC and non-OPEC countries in respect

of supplies of oil and gas; delays in business operations or delivery of services due to pipeline restrictions, rail blockades, outbreaks,

blowouts and business closures and social distancing measures mandated by public health authorities in response to COVID-19; uncertainty

regarding the benefits and costs of the Acquisition; failure to complete the Acquisition; the risk of carrying out operations with minimal

environmental impact; industry conditions including changes in laws and regulations including the adoption of new environmental laws and

regulations and changes in how they are interpreted and enforced; uncertainties associated with estimating oil and natural gas reserves;

risks and uncertainties related to oil and gas interests and operations on Indigenous lands; economic risk of finding and producing reserves

at a reasonable cost; uncertainties associated with partner plans and approvals; geopolitical conflict, including the Russian invasion

of Ukraine; operational matters related to non-operated properties; increased competition for, among other things, capital, acquisitions

of reserves and undeveloped lands; competition for and availability of qualified personnel or management; incorrect assessments of the

value and likelihood of acquisitions and dispositions, and exploration and development programs; unexpected geological, technical, drilling,

construction, processing and transportation problems; the impact of severe weather events; availability of insurance; fluctuations in

foreign exchange and interest rates; stock market volatility; general economic, market and business conditions, including uncertainty

in the demand for oil and gas and economic activity in general as a result of the COVID-19 pandemic; uncertainties associated with regulatory

approvals; uncertainty of government policy changes; the impact of the implementation of the Canada-United States Mexico Agreement; uncertainty

regarding the benefits and costs of dispositions; failure to complete acquisitions and dispositions; uncertainties associated with credit

facilities and counterparty credit risk; changes in income tax laws, tax laws, crown royalty rates and incentive programs relating to

the oil and gas industry; the wide-ranging impacts of the COVID-19 pandemic, including on demand, health and supply chain; and other factors,

many of which are outside the control of the Company. The impact of any one risk, uncertainty or factor on a particular forward-looking

statement is not determinable with certainty as these are interdependent and Crescent Point's future course of action depends on management's

assessment of all information available at the relevant time.

The Company's return of capital framework is based

on certain facts, expectations and assumptions that may change and, therefore, this framework may be amended as circumstances necessitate

or require.

Barrels of oil equivalent ("boe") may be

misleading, particularly if used in isolation. A boe conversion ratio of 6 mcf : 1 bbl is based on an energy equivalency conversion method

primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. Given that the value ratio based on

the current price of crude oil and condensate as compared to natural gas is significantly different from the energy equivalency of oil,

utilizing a conversion on a 6:1 basis may be misleading as an indication of value.

The annual aggregate production for 2021 for the Assets

consisted of the following product types: 28% Light & Medium Crude Oil (bbl/d), 70% Tight Crude Oil (bbl/d) and 2% Conventional Natural

Gas (mcf/d); and the annual aggregate production for 2021 for certain non-core East Shale Duvernay assets consisted of the following product

types: 8% Tight Crude Oil (bbl/d), 43% NGLs (bbl/d) and 49% Shale Gas (mcf/d), as defined in NI 51-101 and using a conversion ratio of

6 mcf : 1 bbl where applicable.

Additional information on these and other factors

that could affect Crescent Point's operations or financial results are included in Crescent Point's reports on file with Canadian and

U.S. securities regulatory authorities. Readers are cautioned not to place undue reliance on this forward-looking information, which is

given as of the date it is expressed herein or otherwise. Crescent Point undertakes no obligation to update publicly or revise any forward-looking

statements, whether as a result of new information, future events or otherwise, unless required to do so pursuant to applicable law. All

subsequent forward-looking statements, whether written or oral, attributable to Crescent Point or persons acting on the Company's behalf

are expressly qualified in their entirety by these cautionary statements.

FOR MORE INFORMATION ON CRESCENT POINT ENERGY,

PLEASE CONTACT:

Shant Madian, Vice President, Capital

Markets, or

Sarfraz Somani, Manager, Investor Relations

Telephone: (403) 693-0020 Toll-free (US and Canada):

888-693-0020 Fax: (403) 693-0070

Address: Crescent Point Energy Corp. Suite 2000, 585

- 8th Avenue S.W. Calgary AB T2P 1G1

www.crescentpointenergy.com

Crescent Point shares are traded on the Toronto Stock

Exchange and New York Stock Exchange under the symbol CPG.

View original content:https://www.prnewswire.com/news-releases/crescent-point-increases-quarterly-dividend-provides-updated-return-of-capital-framework-and-releases-sustainability-report-301581821.html

SOURCE Crescent Point Energy Corp.

View original content: http://www.newswire.ca/en/releases/archive/July2022/06/c1206.html

%CIK: 0001545851

CO: Crescent Point Energy Corp.

CNW 16:35e 06-JUL-22

This regulatory filing also includes additional resources:

ex991.pdf

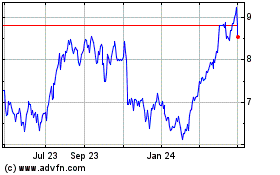

Crescent Point Energy (NYSE:CPG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Crescent Point Energy (NYSE:CPG)

Historical Stock Chart

From Apr 2023 to Apr 2024