Investor Set to Boost Stake in Coty -- WSJ

February 13 2019 - 3:02AM

Dow Jones News

By Saabira Chaudhuri

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 13, 2019).

JAB Ltd. has offered to significantly boost its stake in Coty

Inc. by buying up to $1.75 billion in shares, a move intended to

signal its confidence in the embattled beauty giant.

JAB on Tuesday launched a tender offer to buy up to 150 million

Coty shares for $11.65 a share in cash, a 21% premium to Monday's

closing price. If successful, the purchase would boost JAB's stake

in Coty, whose products include OPI nail polish and CoverGirl

makeup, to 60% from 40%. The move comes as Coty shares have fallen

sharply over the past year.

JAB, which also owns Krispy Kreme, Dr Pepper and Peet's Coffee,

has run Coty since buying the castoff perfume business from Pfizer

Inc. in 1992.

While JAB has become a consumer-goods powerhouse after a string

of acquisitions, Coty's $12 billion purchase of more than 40 brands

from Procter & Gamble Co. in 2016 has been problematic.

Since that deal, Coty's sales have slumped and the company has

named a new chief executive and financial head. Its former

chairman, a JAB senior partner, has also left both Coty and the

investment firm.

Coty has said some of the former P&G brands were in worse

condition than it anticipated when it agreed to buy them and

suffered further as consumers shifted away from mass-market brands

sold in drugstores.

However, JAB managing partner Peter Harf on Tuesday defended the

deal and said integrating the business had been the major

problem.

"We underestimated its complexity, we took it lightly, that's

the problem," Mr. Harf said in an interview.

He said an aging population and social media could benefit

hair-color products and cosmetics, and that the business is

relatively resilient. Even in a tough economy, people still want to

look good, he said.

Mr. Harf said JAB's plan to buy more shares in the beauty

company was intended to signal that the investment firm thinks

Coty's problems can be fixed under the new CEO.

"We want to show the market that we support the company and

believe in management," said Mr. Harf, noting that the move also

offers shareholders looking for an exit an easy out.

Coty's new chief, Pierre Laubies, is from JAB's executive

stable. He previously ran Jacobs Douwe Egberts, which was created

in 2014 by the combination of Mondelez International Inc.'s coffee

business with a European coffee company controlled by JAB.

JAB's offer to buy more shares is contingent on the

recommendation of Coty's independent directors.

Jonathan Feeney, an analyst at Consumer Edge, raised his price

target on Coty stock to $14 from $10 on the news, saying he expects

the board to approve the deal and the full offer to be subscribed.

The move, Mr. Feeney said, gives JAB more control to cut Coty's

high expenses and "shows confidence from knowledgeable insiders in

existing management's plans."

JAB's focus on Coty is a relative outlier for the company, whose

priorities have increasingly shifted toward food and drinks brands.

Last year it agreed to pay $26 billion to buy Dr Pepper Snapple

Group Inc., the No. 3 soft-drink company in the U.S. It also

acquired British sandwich chain Pret A Manger Ltd. It already owns

Peet's Coffee & Tea, Krispy Kreme doughnuts and Panera Bread

Co., after a decadeslong acquisition spree. In late 2015, JAB took

control of Keurig Green Mountain in a $13.9 billion deal that

further expanded its coffee business.

--Micah Maidenberg contributed to this article.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

February 13, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

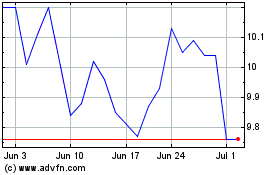

Coty (NYSE:COTY)

Historical Stock Chart

From Mar 2024 to Apr 2024

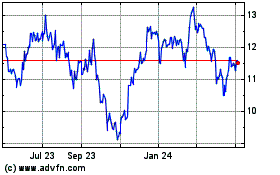

Coty (NYSE:COTY)

Historical Stock Chart

From Apr 2023 to Apr 2024