Current Report Filing (8-k)

November 08 2021 - 6:36AM

Edgar (US Regulatory)

FALSE000102430500010243052021-11-082021-11-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 8, 2021 (November 6, 2021)

Coty Inc.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-35964

|

|

13-3823358

|

|

(State or other Jurisdiction

of Incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

350 Fifth Avenue

|

|

|

|

New York,

|

NY

|

|

10118

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (212) 389-7300

(Former name or former address, if changed from last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading symbol(s)

|

Name of each exchange on which registered

|

|

|

|

Class A Common Stock, $0.01 par value

|

COTY

|

New York Stock Exchange

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.o

Item 1.01 Entry Into a Material Definitive Agreement.

On November 6, 2021, the Coty Inc. (the “Company”) entered into a Redemption Agreement (the “Redemption Agreement”) with KKR Rainbow Aggregator L.P. (“KKR Rainbow”) and Rainbow Capital Group Limited, affiliates of Kohlberg Kravis Roberts & Co. L.P. (“KKR”), pursuant to which the Company has agreed to sell an approximately 5% stake in Rainbow JVCo Limited, a company incorporated under the laws of Jersey (“JVCo”), valued at approximately $215.7 million, in exchange for the redemption of 154,683 shares of Series B Convertible Preferred Stock, par value $0.01 per share, of the Company, including approximately $1.4 million of unpaid dividends related to such shares that will be redeemed for cash (the “Redemption”).

JVCo is a joint venture between the Company and affiliates of KKR that holds the Professional Beauty (including Professional Hair, OPI and ghd) and Retail Hair businesses that the Company divested in 2020. Following the Redemption, the Company will continue to indirectly hold approximately 25.9% of the JVCo shares.

The foregoing description of the Redemption Agreement and the transactions contemplated thereby does not purport to be complete and is subject to, and qualified in its entirety by reference to, the full text of the Redemption Agreement, which is attached as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 2.02 Results of Operations and Financial Condition.

On November 8, 2021, the Company issued a press release announcing its financial results for its fiscal quarter ended September 30, 2021. The release also includes forward-looking statements about the Company’s outlook. A copy of the press release is attached as Exhibit 99.1 and is incorporated in this report by reference.

The information furnished with this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

The Company is making reference to non-GAAP financial information in both the press release and its earnings call. Reconciliation of these non-GAAP financial measures to the nearest comparable GAAP financial measures are contained in the press release attached as Exhibit 99.1.

Item 8.01 Other Events.

KKR Director Designee

Pursuant to the terms of the Investment Agreement, dated as of May 11, 2020 (as amended by that certain Amendment No. 1 to the Investment Agreement, effective as of June 1, 2020, the “Investment Agreement”), by and between the Company and KKR Rainbow, for so long as KKR Rainbow and its permitted transferees (as such term is defined in the Investment Agreement) continue to beneficially own shares of Series B Convertible Preferred Stock and/or shares of Class A common stock that represent, in the aggregate and on an as converted basis, at least 20% of the number of shares of Class A common stock beneficially owned by KKR Rainbow and its permitted transferees, on an as converted basis, as of immediately following the Second Closing (as defined in the Investment Agreement) (such threshold, the “Second Fall-Away Threshold”), KKR Rainbow is entitled to designate one director to the Company’s Board of Directors. Following the completion of the Redemption, KKR Rainbow will no longer meet the Second Fall-Away Threshold and, as a result, KKR Rainbow will no longer be entitled to designate a director to the Company’s Board of Directors. Notwithstanding the forgoing, it is expected that

Johannes Huth, a Partner of KKR, will continue to serve as a director on the Company’s Board of Directors following the Redemption.

Press Release

On November 8, 2021, the Company issued a press release announcing the execution of the Redemption Agreement. A copy of the press release is furnished herewith as Exhibit 99.2 to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits

(d)Exhibits:

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

|

|

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Coty Inc.

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

Date: November 8, 2021

|

By:

|

/s/ Sue Nabi

|

|

|

|

|

Sue Nabi

|

|

|

|

|

Chief Executive Officer

|

|

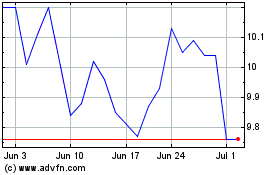

Coty (NYSE:COTY)

Historical Stock Chart

From Mar 2024 to Apr 2024

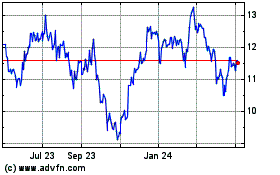

Coty (NYSE:COTY)

Historical Stock Chart

From Apr 2023 to Apr 2024