UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) June 29, 2022

CONSTELLATION BRANDS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-08495 | 16-0716709 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

207 High Point Drive, Building 100, Victor, NY 14564

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (585) 678-7100

| | |

| Not Applicable |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

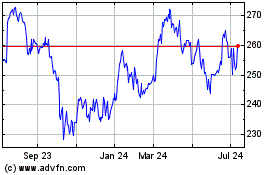

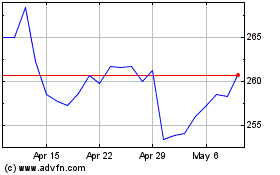

| Class A Common Stock | STZ | New York Stock Exchange |

| Class B Common Stock | STZ.B | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | | | | |

| Emerging growth company | | ☐ |

| | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On June 30, 2022, Constellation Brands, Inc. (“Constellation” or the “Company”), a Delaware corporation, issued a news release (the “release”) announcing its financial condition and results of operations as of and for the first fiscal quarter ended May 31, 2022. A copy of the release is attached hereto as Exhibit 99.1 and incorporated herein by reference. The projections constituting the guidance included in the release involve risks and uncertainties, the outcome of which cannot be foreseen at this time; therefore, actual results may vary materially from these forecasts. In this regard, see the information included in the release under the caption “Forward-Looking Statements.”

The information in the release is “furnished” and not “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 and is not otherwise subject to the liabilities of that section. Such information may be incorporated by reference in another filing under the Securities Exchange Act of 1934 or the Securities Act of 1933 only if and to the extent such subsequent filing specifically references the information incorporated by reference herein.

The release contains non-GAAP financial measures; in the release these are referred to as “comparable” measures. For purposes of Regulation G, a non-GAAP financial measure is a numerical measure of a registrant’s historical or future financial performance, financial position, or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statement of income, balance sheet, or statement of cash flows (or equivalent statements) of the registrant; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. In this regard, GAAP refers to generally accepted accounting principles in the United States. Pursuant to the requirements of Regulation G, the Company has provided reconciliations within the release of the non-GAAP financial measures to the most directly comparable GAAP financial measures.

Comparable measures, including those presenting the impact of the Company’s equity method investment in Canopy Growth Corporation (“Canopy”), are provided because management uses this information in monitoring and evaluating the results and underlying business trends of the core operations of the Company, its investment in Canopy, and/or in internal goal setting. In addition, the Company believes this information provides investors valuable insight on underlying business trends and results in order to evaluate year-over-year financial performance.

| | | | | |

| Item 7.01 | Regulation FD Disclosure. |

On June 30, 2022, Constellation issued a news release regarding its first fiscal quarter ended May 31, 2022, a copy of which release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

On June 29, 2022, Constellation issued a news release announcing that its indirect, wholly-owned subsidiary, Greenstar Canada Investment Limited Partnership (“Greenstar”), has entered into an exchange agreement with Canopy, pursuant to which Greenstar has agreed to sell an aggregate of C$100,000,000 principal amount of existing 4.25% senior notes due 2023 to Canopy in exchange for Canopy common shares. A copy of this news release is furnished herewith as Exhibit 99.2 and is incorporated herein by reference.

On June 30, 2022, Constellation issued a news release announcing a plan to reclassify the Company’s common stock to eliminate its Class B Common Stock (the “Reclassification”). In support of the Reclassification, the Company has entered into a Reclassification Agreement (the “Reclassification Agreement”), dated June 30, 2022, with Richard Sands, Robert Sands, other members of the Sands family, and certain of their affiliated entities, the beneficial owners of approximately 98% of the issued and outstanding shares of the Class B Common Stock, par value $0.01 per share, of the Company. A copy of this news release is furnished herewith as Exhibit 99.3 and is incorporated herein by reference. A copy of the Reclassification Agreement will be filed with the Securities and Exchange Commission (the “SEC”) as soon as is reasonably practicable.

On June 29, 2022, the Company’s Board of Directors declared a quarterly cash dividend in the amount of $0.80 per issued and outstanding share of the Company’s Class A Common Stock, $0.72 per issued and outstanding share of the Company’s Class B Convertible Common Stock, and $0.72 per issued and outstanding share of the Company’s Class 1 Convertible Common Stock, in each case payable on August 24, 2022, to stockholders of record of each respective class as of the close of business on August 10, 2022.

References to Constellation’s website and/or other social media sites or platforms in the news releases do not incorporate by reference the information on such websites, social media sites, or platforms into this Current Report on Form 8-K, and Constellation disclaims any such incorporation by reference. The information in the news releases attached as Exhibit 99.1, Exhibit 99.2, and Exhibit 99.3 is incorporated by reference into this Item 7.01 in satisfaction of the public disclosure requirements of Regulation FD. This information is “furnished” and not “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 and is not otherwise subject to the liabilities of that section. Such information may be incorporated by reference in another filing under the Securities Exchange Act of 1934 or the Securities Act of 1933 only if and to the extent such subsequent filing specifically references the information incorporated by reference herein.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements. All statements other than statements of historical fact are forward-looking statements. The word “expect,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These statements may relate to future plans and objectives of management and Constellation’s Board of Directors, as well as information concerning expected actions of third parties. All forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those set forth in, or implied by, such forward-looking statements. No assurances can be given that any of the events anticipated by the forward-looking statements will transpire or occur.

The forward-looking statements are based on management's current expectations and should not be construed in any manner as a guarantee that such results will in fact occur. All forward-looking statements speak only as of the date of this Current Report on Form 8-K and Constellation does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Statements in this Current Report on Form 8-K regarding Constellation and the Reclassification that are forward-looking, including projections as to the anticipated benefits of the proposed transaction, the impact of the proposed transaction on Constellation’s business and future financial and operating results and capital structure following the closing of the proposed Reclassification and the closing date for the proposed transaction, are based on management’s estimates, assumptions and projections, and are subject to significant uncertainties and other factors, many of which are beyond Constellation’s control. These factors include, among other things, (1) failure to receive the requisite approvals of Constellation’s shareholders necessary to achieve the Reclassification; (2) any other delays with respect to, or the failure to complete, the Reclassification; (3) the ultimate outcome of any litigation matter related to the Reclassification; (4) the ability to recognize the anticipated benefits of the Reclassification; (5) Constellation’s ability to execute successfully its strategic plans; and (6) the effect of the announcement or the consummation of the proposed Reclassification on the market price of the capital stock of Constellation. The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included elsewhere. Additional information concerning risks that could cause actual future performance or events to differ from current expectations can be found in Constellation’s filings with the SEC, including the risk factors discussed in Constellation’s most recent Annual Report on Form 10-K for the fiscal year ended February 28, 2022.

IMPORTANT ADDITIONAL INFORMATION

This Current Report on Form 8-K does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Constellation intends to file with the SEC a Registration Statement on Form S-4, which will contain a proxy statement/prospectus in connection with the proposed Reclassification. STOCKHOLDERS OF CONSTELLATION ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders will be able to obtain a free copy of the proxy statement/prospectus (when available), as well as other filings containing information about Constellation, without charge, at the SEC’s website, www.sec.gov, and on Constellation’s Investor Relations website at https://ir.cbrands.com.

PARTICIPANTS IN THE SOLICITATION

The directors and executive officers of Constellation and other persons may be considered participants in the solicitation of proxies from stockholders in connection with the proposed Reclassification transaction. Information regarding Constellation’s directors and executive officers is available in Constellation’s most recent proxy statement, dated May 27, 2022, for the Annual Meeting of Stockholders to be held on July 19, 2022, which was filed with the SEC on June 2, 2022, and Constellation’s other filings with the SEC. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests will be contained in the proxy statement/prospectus when it becomes available.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

For the exhibits that are furnished herewith, see the Index to Exhibits immediately following.

INDEX TO EXHIBITS

| | | | | |

| Exhibit No. | Description |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| (99) | ADDITIONAL EXHIBITS |

| |

| (99.1) | |

| |

| (99.2) | |

| |

| (99.3) | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| (104) | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

| |

| |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Date: | June 30, 2022 | CONSTELLATION BRANDS, INC. |

| | |

| | By: | /s/ Garth Hankinson |

| | | Garth Hankinson |

| | | Executive Vice President and

Chief Financial Officer |

Constellation Delivers Strong Start to Fiscal 2023

Beer Business Achieves Double-Digit Net Sales and Operating Income Growth

Advances Capital Allocation Priorities Completing Share Repurchase Goal

| | | | | | | | | | | | | | | | | | | | |

| Net

Sales | Operating

Income | Net Income (Loss)

Attributable to CBI | Earnings Before

Interest & Taxes

(EBIT) | Diluted Net Income

(Loss) Per Share

Attributable to CBI

(EPS) | Diluted EPS

Excluding Canopy |

First Quarter Fiscal Year 2023 Financial Highlights (1) | In millions, except per share data |

| Reported | $2,363 | $816 | $390 | NA | $2.06 | NA |

| % Change | 17% | NM | 143% | NA | 143% | NA |

| Comparable | $2,363 | $793 | $504 | $740 | $2.66 | $2.90 |

| % Change | 17% | 10% | 10% | 9% | 14% | 16% |

(1) Definitions of reported and comparable, as well as reconciliations of non-GAAP financial measures, are contained elsewhere in this news release.

NA=Not Applicable NM=Not Meaningful

HIGHLIGHTS

•Generates reported basis EPS of $2.06 and comparable basis EPS of $2.66, including Canopy equity losses of $0.24; excluding Canopy equity losses, achieves comparable basis EPS of $2.90

•Beer Business achieves double-digit net sales and operating income growth and strong depletion growth driven by continued solid performance from Modelo Especial and Corona Extra

•Wine and Spirits Business delivers net sales and depletion growth driven by strong performance of higher-end brands including Meiomi, Kim Crawford, SIMI, The Prisoner Wine Company, High West Whiskey, and Casa Noble Tequila

•Generates $758 million of operating cash flow, an increase of 6%, and $562 million of free cash flow

•Updates fiscal 2023 reported basis EPS outlook to $10.50 - $10.80 and affirms comparable basis EPS outlook of $11.20 - $11.50; including shares repurchased through June 2022 and digital business acceleration investments

•Affirms fiscal 2023 operating cash flow target of $2.6 - $2.8 billion and free cash flow projection of $1.3 - $1.4 billion

•Returns $1.3 billion to shareholders in share repurchases through June 2022, including previously announced $500 million accelerated share repurchase

•Declares quarterly cash dividend of $0.80 per share Class A and $0.72 per share Class B common stock

| | | | | | | | | | | | | | | | | | | | |

| "We're pleased with our strong start to the fiscal year. Across the business we're driving consumer demand for our exceptional portfolio of premium, high-end products while executing strong financial and operational performance." | | | "Our solid business fundamentals and excellent operating performance are driving strong free cash flow results, which has enabled us to accelerate progress against one of our key capital allocation priorities with the completion of our share repurchase goal." |

|

| Bill Newlands | | | Garth Hankinson | |

| President and Chief Executive Officer | | | Chief Financial Officer |

| | | | | |

| Constellation Brands, Inc. Q1 FY2023 Earnings Release | #WORTHREACHINGFOR I 1 |

| | | | | | | | | | | | | | | | | | | |

| beer |

| Shipments | | Depletions | Net Sales | | Operating Income |

Three Months Ended | In millions; branded product, 24-pack, 12-ounce case equivalents |

| May 31, 2022 | 99.5 | | | $1,898.2 | | $762.8 |

| May 31, 2021 | 84.8 | | | $1,572.0 | | $673.1 |

| % Change | 17.3% | | 8.7% | 21% | | 13% |

HIGHLIGHTS•Constellation’s Beer Business posted depletion growth of almost 9%, driven by the continued explosive performance of Modelo Especial and resilient growth from Corona Extra. Depletion volume selling days were flat year-over-year.

•In IRI channels, our Beer Business significantly outpaced the entire beer category, as well as high-end beer; Constellation was the #1 share gainer in the U.S. beer industry in total, adding 1.4 market dollar share points, and carrying 4 of the top 15 share gaining high-end brands.

•Modelo Especial achieved more than 15% depletion growth and continued to be the #1 brand in the high-end and #1 brand share gainer in the entire U.S. beer category in IRI dollar sales.

•Modelo Chelada remains the #1 chelada in the U.S. beer market posting more than 39% depletion growth and expanding its share to more than half of the entire chelada segment.

•Corona Extra reported depletion growth of over 4% and remained the #2 import share gainer and #3 brand in the high-end in IRI channels.

•Pacifico posted depletion growth of more than 21% as the brand regained distribution with increased brown glass availability.

•Operating margin decreased 260 basis points to 40.2%, as benefits from favorable pricing, foreign currency, and marketing and SG&A as a percent of net sales were more than offset by increased COGS driven by expected higher raw material, transportation, brewery, and depreciation costs.

•The Beer Business continues to expect net sales and operating income growth of 7 - 9% and 2 - 4%, respectively, for fiscal 2023 reflecting the strong performance of the core beer portfolio.

| | | | | | | | | | | | | | | | | | | | | |

| wine and spirits |

| Shipments | | | Depletions | Net Sales | | | Operating

Income |

| Three Months Ended | In millions; branded product, 9-liter case equivalents |

| May 31, 2022 | 6.8 | | | | $465.0 | | | $91.0 |

| May 31, 2021 | 6.7 | | | | $454.5 | | | $104.2 |

| % Change | 1.5% | | | 1.2% | 2% | | | (13%) |

HIGHLIGHTS

•Constellation's Wine and Spirits Business posted positive depletion growth driven by double-digit growth for Meiomi, The Prisoner Wine Company, High West Whiskey, and Casa Noble Tequila.

•In IRI channels, our Wine and Spirits Business outperformed the total U.S. wine and spirits category and gained share.

•Our fine wine and crafts spirits portfolio (Aspira) achieved 16% depletion growth, with The Prisoner Wine Company, High West Whiskey, and Casa Noble Tequila growing significantly ahead of their corresponding categories.

•Our Wine and Spirits Business innovation strategy continued to gain traction as Meiomi Red Blend became the second largest new product contributor in the wine category; Meiomi continues to outperform in IRI channels, with Cabernet Sauvignon, Red Blend, and Pinot Noir holding the top 3 share gaining positions in the ultra premium segment.

•Operating margin decreased 330 basis points to 19.6% as benefits from favorable mix and pricing were more than offset by increased COGS primarily driven by higher raw material and transportation costs, increased G&A and planned increased marketing spend.

•The Wine and Spirits Business continues to expect fiscal 2023 reported net sales decline of 1 - 3% and operating income growth of 4 - 6%.

| | | | | |

| Constellation Brands, Inc. Q1 FY2023 Earnings Release | #WORTHREACHINGFOR I 2 |

| | | | | | | | | | | | | | | | | | | | | | | |

outlook |

| The table sets forth management's current EPS expectations for fiscal 2023 compared to fiscal 2022 actual results, on a reported basis, a comparable basis, and a comparable basis excluding Canopy equity earnings (losses) and related activities. |

| Reported Basis | | Comparable Basis |

| FY23 Estimate | FY22 Actual | | FY23 Estimate (Excl. Canopy) | FY22 Actual | FY22 Actual

(Excl. Canopy) |

| Fiscal Year Ending February 28 | $10.50 - $10.80 | $(0.22) | | $11.20 - $11.50 | $10.20 | $10.99 |

| Fiscal 2023 Guidance Assumptions: |

•Beer: net sales growth 7 - 9%; operating income growth 2 - 4% •Wine and Spirits: net sales decline 1 - 3% and operating income growth 4 - 6% •Interest expense: approximately $350 - $360 million •Tax rate: reported approximately 21.5%; comparable excluding Canopy equity earnings impact approximately 20%

| •Weighted average diluted shares outstanding: approximately 186.5 million; includes shares repurchased through June 2022 •Operating cash flow: $2.6 - $2.8 billion •Capital expenditures: $1.3 - $1.4 billion, including approximately $1.2 billion targeted for Mexico beer operations expansion, optimization, and/or construction activities •Free cash flow: $1.3 - $1.4 billion |

| The reported basis EPS guidance includes the fiscal 2023 year to date Canopy equity earnings and related activities impact. Our guidance does not reflect future changes in the fair value of the company’s investment in Canopy’s warrants and convertible debt securities. Additionally, the company continues to evaluate the future potential equity earnings impact from the Canopy equity method investment and related activities and, as such, these items have been excluded from the guidance assumptions noted above. |

BEER BUSINESS CAPITAL EXPANSION

The company plans to invest in the next increment of capacity in Mexico that will provide the long-term flexibility needed to support the expected future growth of its high-end Mexican beer portfolio. As previously announced, total capital expenditures for the Beer Business are expected to be $5.0 billion to $5.5 billion over fiscal 2023 to fiscal 2026, with the majority of the spend expected to occur in the first three years of that timeframe. The investment will support the addition of up to 30 million hectoliters of modular capacity and includes the construction of a new brewery in Southeast Mexico in the state of Veracruz, as well as continued expansion, optimization, and/or construction at the company's existing sites in Nava and Obregon.

| | | | | | | | | | | |

| canopy Constellation’s share of Canopy’s equity earnings (losses) and related activities were as follows: |

| Reported

Basis | Comparable

Basis |

| |

| | |

| | |

| Three Months Ended I In millions | | |

May 31, 2022 | $(165.0) | $(52.0) |

May 31, 2021 | $(155.8) | $(44.3) |

Constellation has recognized a $556 million unrealized net loss in reported basis results since the initial Canopy investment in November 2017; a $22 million decrease in the fair value of our Canopy investment was recognized for first quarter of fiscal 2023.

QUARTERLY DIVIDEND

On June 29, 2022, Constellation’s board of directors declared a quarterly cash dividend of $0.80 per share of Class A Common Stock and $0.72 per share of Class B Convertible Common Stock, payable on August 24, 2022, to stockholders of record as of the close of business on August 10, 2022.

† A copy of this news release, including the attachments and other financial information that may be discussed during the call, will be available on our investor relations website, ir.cbrands.com, prior to the call.

| | | | | |

| Constellation Brands, Inc. Q1 FY2023 Earnings Release | #WORTHREACHINGFOR I 3 |

| | | | | | | | |

| SUPPORTING OUR COMMUNITIES |

Corona Helping To Protect Our Beaches | | |

| |

Corona is committed to bringing together communities across America to refresh our beaches by removing one million pounds of plastic by the brand's 100th birthday in 2025. Through high-impact cleanups and internal plastic reduction, Corona eliminated over 570,000 pounds of plastic from 30 beaches nationwide in the first year of the Protect Our Beaches initiative, which is more than 50% of the overall goal. As the brand launches year two with more beach clean-ups and upcycled-plastic merchandise collaborations, the mission is succeeding in building awareness around social and environmental change to keep Corona's place, the beach, clean for years to come. Learn more about the brand’s efforts here. | |

| | |

Recognizing Environmental Sustainability Best Practices At Our Facilities |

Across our company, the spirit of environmental stewardship is not only embraced, but embedded into our ways of working as a part of our strategic pillar to deliver on bold Environmental, Social, and Governance goals that are good for the world and good business. We recognize this work through our annual Environmental Sustainability Awards process, which honors extraordinary initiatives that drive business value and demonstrate meaningful commitment to enhancing our environmental stewardship. The recipients of the 2021 Environmental Sustainability Awards were the Nava Brewery, whose comprehensive environmental sustainability initiatives spanned all categories and whose state-of-the-art brewery is an industry benchmark in technology, efficiency, and quality, and Awatere Hills Vineyard, awarded for implementing an impressive ecosystem project to eradicate a highly invasive pest plant – Chilean Needle Grass – that negatively impacts animal welfare in the Marlborough region. Learn more about our sustainability efforts here. |

|

| | |

| | |

| | |

ABOUT CONSTELLATION BRANDS

At Constellation Brands (NYSE: STZ and STZ.B), our mission is to build brands that people love because we believe sharing a toast, unwinding after a day, celebrating milestones, and helping people connect, are Worth Reaching For. It’s worth our dedication, hard work, and the bold calculated risks we take to deliver more for our consumers, trade partners, shareholders, and communities in which we live and work. It’s what has made us one of the fastest-growing large CPG companies in the U.S. at retail, and it drives our pursuit to deliver what’s next.

Today, we are a leading international producer and marketer of beer, wine, and spirits with operations in the U.S., Mexico, New Zealand, and Italy. Every day, people reach for our high-end, iconic imported beer brands such as Corona Extra, Corona Light, Corona Premier, Modelo Especial, Modelo Negra, and Pacifico, our fine wine and craft spirits brands, including The Prisoner Wine Company, Robert Mondavi Winery, Casa Noble Tequila, and High West Whiskey, and our premium wine brands such as Meiomi and Kim Crawford.

But we won’t stop here. Our visionary leadership team and passionate employees from barrel room to boardroom are reaching for the next level, to explore the boundaries of the beverage alcohol industry and beyond. Join us in discovering what’s Worth Reaching For.

To learn more, visit www.cbrands.com and follow us on Twitter, Instagram, and LinkedIn. |

| | | | | | | | | | | | | | | | | |

| MEDIA CONTACTS | INVESTOR RELATIONS CONTACTS |

| Mike McGrew | 773-251-4934 | michael.mcgrew@cbrands.com | Patty Yahn-Urlaub | 585-678-7483 | patty.yahn-urlaub@cbrands.com |

| Amy Martin | 585-678-7141 | amy.martin@cbrands.com | Joseph Suarez | 773-551-4397 | joseph.suarez@cbrands.com |

| | | | | |

| | | | | |

| | | | | |

| Constellation Brands, Inc. Q1 FY2023 Earnings Release | #WORTHREACHINGFOR I 4 |

SUPPLEMENTAL INFORMATION

Reported basis (“reported”) are amounts as reported under generally accepted accounting principles. Comparable basis (“comparable”) are amounts which exclude items that affect comparability (“comparable adjustments”), as they are not reflective of core operations of the segments. The company’s measure of segment profitability excludes comparable adjustments, which is consistent with the measure used by management to evaluate results. The company discusses various non-GAAP measures in this news release. Financial statements, as well as supplemental schedules and tables reconciling non-GAAP measures, together with definitions of these measures and the reasons management uses these measures, are included in this news release.

FORWARD-LOOKING STATEMENTS

The statements made under the heading Outlook and all statements other than statements of historical fact set forth in this news release regarding the company's business strategy, future operations, business, and financial position, expected net sales and operating income, projected costs and expenses, expected effective tax rates and anticipated tax liabilities, estimated diluted EPS and shares outstanding, expected capital expenditures, operating cash flow, and free cash flow, future payments of dividends, amount, manner, and timing of share repurchases under the share repurchase authorization, consumer demand, ESG goals and efforts, and prospects, plans, and objectives of management, as well as information concerning expected actions of third parties, are forward-looking statements (collectively, “Projections”) that involve risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by the Projections.

During the current quarter, Constellation Brands may reiterate the Projections. Prior to the start of the company’s quiet period, which will begin at the close of business on August 31, 2022, the public can continue to rely on the Projections as still being Constellation Brands’ current expectations on the matters covered, unless the company publishes a notice stating otherwise. During Constellation Brands’ quiet period, the Projections should not be considered to constitute the company’s expectations and should be considered historical, speaking as of prior to the quiet period only and not subject to update by the company.

The Projections are based on management’s current expectations and, unless otherwise noted, do not take into account the impact of any future acquisition, investment, merger, or any other business combination, divestiture, restructuring or other strategic business realignments, financing or share repurchase that may be completed after the issuance of this release, potential common stock declassification, or incremental contingent consideration payment paid or specific amount of incremental contingent consideration payment received in association with divestitures. The Projections should not be construed in any manner as a guarantee that such results will in fact occur.

In addition to the risks and uncertainties of ordinary business operations, the Projections of the company contained in this news release are subject to risk uncertainty, and possible variance from management's expectations regarding:

•water, agricultural and other raw material, and packaging material supply, production, and/or shipment difficulties could adversely affect our ability to supply our customers;

•inflationary pressures and our ability to pass along rising costs to consumers through increased selling prices;

•actual impact to supply, production levels, and costs from global supply chain logistics, transportation challenges, wildfires, and severe weather events, due to, among other reasons, actual supply chain and transportation performance and the actual severity and geographical reach of wildfires and severe weather events;

•actual balance of supply and demand for our products and percentage of our portfolio distributed through any particular distributor;

•actual demand, net sales, channel proportions, and volume trends for our products;

•beer operations expansion, optimization, and/or construction activities, scope, capacity, costs (including impairments), capital expenditures, and timing due to, among other reasons, market conditions, our cash and debt position, receipt of required regulatory approvals in accordance with expected dates and terms, results of discussions with government officials in Mexico, the actual amount of non-recoverable brewery construction assets and other costs, and other factors determined by management;

•duration and impact of the COVID-19 pandemic, including but not limited to new variants, vaccine efficacy and immunization rates, closures of non-essential businesses, which may include our manufacturing facilities, and other associated governmental containment actions, and the increase in cyber-security attacks that have occurred while non-production employees work remotely;

•impact of the military conflict in Ukraine and associated geopolitical tensions and responses, including on inflation, supply chains, commodities, energy, and cyber-security;

•amount, timing, and source of funds for any share repurchases, exact duration of share repurchase programs, and number of shares outstanding;

•amount and timing of future dividends which are subject to the determination and discretion of our Board of Directors and may be impacted if our ability to use cash flow to fund dividends is affected by unanticipated increases in total net debt, we are unable to generate cash flow at anticipated levels, or we fail to generate expected earnings;

•fair value of and accuracy of projections relating to the Canopy investment, including any potential future impairment thereof;

•amount of contingent consideration, if any, received in divestitures depending upon actual future brand performance;

•expected impacts of wine and spirits portfolio refinement activities;

•accuracy of supply projections, including relating to beer operations expansion, optimization, and construction activities, wine and spirits operating activities, product inventory levels, and glass sourcing;

•operating cash flow, free cash flow, effective tax rate, and capital expenditures to support long-term growth;

•accuracy of projections associated with market opportunities, new products, and previously announced acquisitions, investments, and divestitures;

•general economic, geopolitical, domestic, international, and regulatory conditions, world financial market instability, recession, health epidemics or pandemics, unanticipated environmental liabilities and costs, or enhanced competitive activities;

•changes to international trade agreements, tariffs, accounting standards, elections, assertions, or policies, tax laws, or other governmental regulations, and other factors which could impact the company’s reported financial position, results of operations, effective tax rate, or accuracy of any associated Projections;

•changes in interest rates and the inherent unpredictability of currency fluctuations, commodity prices, and raw materials; and

•other factors and uncertainties disclosed in the company’s filings with the SEC, including its Annual Report on Form 10-K for the fiscal year ended February 28, 2022, which could cause actual future performance to differ from current expectations.

| | | | | |

| Constellation Brands, Inc. Q1 FY2023 Earnings Release | #WORTHREACHINGFOR I 5 |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(in millions)

(unaudited)

| | | | | | | | | | | |

| May 31,

2022 | | February 28,

2022 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 101.8 | | | $ | 199.4 | |

| Accounts receivable | 879.9 | | | 899.0 | |

| Inventories | 1,656.4 | | | 1,573.2 | |

| Prepaid expenses and other | 664.1 | | | 658.1 | |

| | | |

| Total current assets | 3,302.2 | | | 3,329.7 | |

| Property, plant, and equipment | 6,163.3 | | | 6,059.6 | |

| Goodwill | 7,915.1 | | | 7,862.4 | |

| Intangible assets | 2,765.7 | | | 2,755.2 | |

| Equity method investments | 2,534.0 | | | 2,688.7 | |

| Securities measured at fair value | 172.3 | | | 191.4 | |

| Deferred income taxes | 2,334.8 | | | 2,351.5 | |

| | | |

| Other assets | 653.7 | | | 617.3 | |

| Total assets | $ | 25,841.1 | | | $ | 25,855.8 | |

| | | |

| LIABILITIES AND STOCKHOLDER’S EQUITY | | | |

| Current liabilities: | | | |

| Short-term borrowings | $ | 124.0 | | | $ | 323.0 | |

| Current maturities of long-term debt | 575.1 | | | 605.3 | |

| Accounts payable | 874.6 | | | 899.2 | |

| Other accrued expenses and liabilities | 792.1 | | | 871.3 | |

| Total current liabilities | 2,365.8 | | | 2,698.8 | |

| Long-term debt, less current maturities | 10,278.2 | | | 9,488.2 | |

| | | |

| Deferred income taxes and other liabilities | 1,638.6 | | | 1,621.0 | |

| Total liabilities | 14,282.6 | | | 13,808.0 | |

| CBI stockholders’ equity | 11,231.4 | | | 11,731.9 | |

| Noncontrolling interests | 327.1 | | | 315.9 | |

| Total stockholders’ equity | 11,558.5 | | | 12,047.8 | |

| Total liabilities and stockholders’ equity | $ | 25,841.1 | | | $ | 25,855.8 | |

| | | | | |

| Constellation Brands, Inc. Q1 FY2023 Earnings Release | #WORTHREACHINGFOR I 6 |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(in millions, except per share data)

(unaudited)

| | | | | | | | | | | | | | | |

| Three Months Ended | | |

| May 31,

2022 | | May 31,

2021 | | | | |

| Sales | $ | 2,540.7 | | | $ | 2,188.3 | | | | | |

| Excise taxes | (177.5) | | | (161.8) | | | | | |

| Net sales | 2,363.2 | | | 2,026.5 | | | | | |

| Cost of product sold | (1,108.2) | | | (907.2) | | | | | |

| Gross profit | 1,255.0 | | | 1,119.3 | | | | | |

| Selling, general, and administrative expenses | (438.6) | | | (378.3) | | | | | |

| Impairment of brewery construction in progress | — | | | (665.9) | | | | | |

| | | | | | | |

| | | | | | | |

| Operating income (loss) | 816.4 | | | 75.1 | | | | | |

| Income (loss) from unconsolidated investments | (187.9) | | | (899.2) | | | | | |

| Interest expense | (88.5) | | | (86.7) | | | | | |

| Loss on extinguishment of debt | (15.3) | | | — | | | | | |

| Income (loss) before income taxes | 524.7 | | | (910.8) | | | | | |

| (Provision for) benefit from income taxes | (125.4) | | | 13.5 | | | | | |

| Net income (loss) | 399.3 | | | (897.3) | | | | | |

| Net (income) loss attributable to noncontrolling interests | (9.8) | | | (10.8) | | | | | |

| Net income (loss) attributable to CBI | $ | 389.5 | | | $ | (908.1) | | | | | |

| | | | | | | |

| Net income (loss) per common share attributable to CBI: | | | | | | | |

| Basic – Class A Common Stock | $ | 2.09 | | | $ | (4.74) | | | | | |

| Basic – Class B Convertible Common Stock | $ | 1.89 | | | $ | (4.31) | | | | | |

| | | | | | | |

| Diluted – Class A Common Stock | $ | 2.06 | | | $ | (4.74) | | | | | |

| Diluted – Class B Convertible Common Stock | $ | 1.89 | | | $ | (4.31) | | | | | |

| | | | | | | |

| Weighted average common shares outstanding: | | | | | | | |

| Basic – Class A Common Stock | 165.335 | | | 170.602 | | | | | |

| Basic – Class B Convertible Common Stock | 23.206 | | | 23.247 | | | | | |

| | | | | | | |

| Diluted – Class A Common Stock | 189.333 | | | 170.602 | | | | | |

| Diluted – Class B Convertible Common Stock | 23.206 | | | 23.247 | | | | | |

| | | | | | | |

| Cash dividends declared per common share: | | | | | | | |

| Class A Common Stock | $ | 0.80 | | | $ | 0.76 | | | | | |

| Class B Convertible Common Stock | $ | 0.72 | | | $ | 0.69 | | | | | |

| | | | | |

| Constellation Brands, Inc. Q1 FY2023 Earnings Release | #WORTHREACHINGFOR I 7 |

| | | | | | | | | | | |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions) (unaudited) |

| Three Months Ended |

| May 31,

2022 | | May 31,

2021 |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | |

| Net income (loss) | $ | 399.3 | | | $ | (897.3) | |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | | | |

| Unrealized net (gain) loss on securities measured at fair value | 22.4 | | | 745.1 | |

| Deferred tax provision (benefit) | 21.5 | | | (98.7) | |

| Depreciation | 92.7 | | | 76.0 | |

| Stock-based compensation | 16.8 | | | 16.0 | |

| Equity in (earnings) losses of equity method investees and related activities, net of distributed earnings | 165.5 | | | 154.1 | |

| Noncash lease expense | 21.6 | | | 19.7 | |

| | | |

| Amortization of debt issuance costs and loss on extinguishment of debt | 17.7 | | | 2.7 | |

| | | |

| Impairment of brewery construction in progress | — | | | 665.9 | |

| | | |

| | | |

| Gain (loss) on settlement of pre-issuance hedge contracts | 20.7 | | | — | |

| Change in operating assets and liabilities, net of effects from purchase and sale of business: | | | |

| Accounts receivable | 17.2 | | | (136.7) | |

| Inventories | (83.0) | | | (82.3) | |

| Prepaid expenses and other current assets | 93.7 | | | (11.7) | |

| Accounts payable | 94.5 | | | 224.1 | |

| Deferred revenue | 26.2 | | | 130.5 | |

| Other accrued expenses and liabilities | (166.2) | | | (61.7) | |

| Other | (2.4) | | | (29.7) | |

| Total adjustments | 358.9 | | | 1,613.3 | |

| Net cash provided by (used in) operating activities | 758.2 | | | 716.0 | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | |

| Purchase of property, plant, and equipment | (196.6) | | | (113.9) | |

| Purchase of business, net of cash acquired | (37.2) | | | — | |

| Investments in equity method investees and securities | — | | | (8.5) | |

| Proceeds from sale of assets | 6.5 | | | 0.8 | |

| | | |

| Proceeds from sale of business | — | | | 5.0 | |

| Other investing activities | 0.5 | | | — | |

| Net cash provided by (used in) investing activities | (226.8) | | | (116.6) | |

| | | |

| | | | | |

| Constellation Brands, Inc. Q1 FY2023 Earnings Release | #WORTHREACHINGFOR I 8 |

| | | | | | | | | | | |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions) (unaudited) |

| Three Months Ended |

| May 31,

2022 | | May 31,

2021 |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | |

| Proceeds from issuance of long-term debt | 1,846.8 | | | 6.3 | |

| Principal payments of long-term debt | (1,084.7) | | | (7.4) | |

| Net proceeds from (repayments of) short-term borrowings | (199.0) | | | — | |

| Dividends paid | (149.3) | | | (146.7) | |

| Purchases of treasury stock | (1,007.6) | | | (400.8) | |

| Proceeds from shares issued under equity compensation plans | 14.0 | | | 12.5 | |

| Payments of minimum tax withholdings on stock-based payment awards | (10.4) | | | (9.8) | |

| Payments of debt issuance, debt extinguishment, and other financing costs | (25.8) | | | — | |

| Distributions to noncontrolling interests | (11.2) | | | (10.6) | |

| | | |

| | | |

| | | |

| | | |

| Net cash provided by (used in) financing activities | (627.2) | | | (556.5) | |

| | | |

| Effect of exchange rate changes on cash and cash equivalents | (1.8) | | | 0.3 | |

| | | |

| Net increase (decrease) in cash and cash equivalents | (97.6) | | | 43.2 | |

| Cash and cash equivalents, beginning of period | 199.4 | | | 460.6 | |

| Cash and cash equivalents, end of period | $ | 101.8 | | | $ | 503.8 | |

| | | | | |

| Constellation Brands, Inc. Q1 FY2023 Earnings Release | #WORTHREACHINGFOR I 9 |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

SUMMARIZED SEGMENT AND INCOME (LOSS) FROM UNCONSOLIDATED INVESTMENTS INFORMATION

(in millions)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | | | |

| May 31,

2022 | | May 31,

2021 | | Percent

Change | | | | | | |

| Beer | | | | | | | | | | | |

| Segment net sales | $ | 1,898.2 | | | $ | 1,572.0 | | | 21 | % | | | | | | |

| Segment gross profit | $ | 1,019.5 | | | $ | 893.7 | | | 14 | % | | | | | | |

| % Net sales | 53.7 | % | | 56.9 | % | | | | | | | | |

| Segment operating income (loss) | $ | 762.8 | | | $ | 673.1 | | | 13 | % | | | | | | |

| % Net sales | 40.2 | % | | 42.8 | % | | | | | | | | |

| | | | | | | | | | | |

| Wine and Spirits | | | | | | | | | | | |

| Wine net sales | $ | 404.1 | | | $ | 397.7 | | | 2 | % | | | | | | |

| Spirits net sales | 60.9 | | | 56.8 | | | 7 | % | | | | | | |

| Segment net sales | $ | 465.0 | | | $ | 454.5 | | | 2 | % | | | | | | |

| Segment gross profit | $ | 211.1 | | | $ | 207.5 | | | 2 | % | | | | | | |

| % Net sales | 45.4 | % | | 45.7 | % | | | | | | | | |

| Segment operating income (loss) | $ | 91.0 | | | $ | 104.2 | | | (13 | %) | | | | | | |

| % Net sales | 19.6 | % | | 22.9 | % | | | | | | | | |

| Segment income (loss) from unconsolidated investments | $ | 1.5 | | | $ | 1.3 | | | 15 | % | | | | | | |

| | | | | | | | | | | |

| Corporate Operations and Other | | | | | | | | | | | |

| Segment operating income (loss) | $ | (61.3) | | | $ | (54.5) | | | (12 | %) | | | | | | |

| Segment income (loss) from unconsolidated investments | $ | (2.0) | | | $ | (0.6) | | | NM | | | | | | |

| | | | | | | | | | | |

Canopy equity earnings (losses) (1) | $ | (52.0) | | | $ | (44.3) | | | (17 | %) | | | | | | |

| | | | | | | | | | | |

| Consolidated operating income (loss) | $ | 816.4 | | | $ | 75.1 | | | NM | | | | | | |

| Comparable Adjustments | (23.9) | | | 647.7 | | | (104 | %) | | | | | | |

| Comparable operating income (loss) | $ | 792.5 | | | $ | 722.8 | | | 10 | % | | | | | | |

| | | | | | | | | | | |

| Consolidated income (loss) from unconsolidated investments | $ | (187.9) | | | $ | (899.2) | | | 79 | % | | | | | | |

| Comparable Adjustments | 135.4 | | | 855.6 | | | (84 | %) | | | | | | |

| Comparable income (loss) from unconsolidated investments | $ | (52.5) | | | $ | (43.6) | | | (20 | %) | | | | | | |

| | | | | | | | | | | |

Consolidated EBIT (2) | $ | 740.0 | | | $ | 679.2 | | | 9 | % | | | | | | |

| | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1) | We recognize our equity in earnings (losses) for Canopy Growth Corporation ("Canopy") on a two-month lag. The summarized financial information below represents 100% of Canopy’s reported results, prepared in accordance with generally accepted accounting principles in the U.S. (“GAAP”), and converted from Canadian dollars to U.S. dollars using the applicable weighted average exchange rates. |

| | | Three Months Ended | | | | | | |

| | | May 31,

2022 | | May 31,

2021 | | Percent

Change | | | | | | |

| | Net sales | $ | 88.2 | | | $ | 117.3 | | | (25 | %) | | | | | | |

| | Gross profit (loss) | $ | (125.7) | | | $ | 7.7 | | | NM | | | | | | |

| | % Net sales | NM | | 6.6 | % | | | | | | | | |

| | Operating income (loss) | $ | (418.2) | | | $ | (184.2) | | | (127 | %) | | | | | | |

| | % Net sales | NM | | (157.0) | % | | | | | | | | |

(2) | See reconciliation of the applicable non-GAAP financial measures on page 12. | | | | | | |

| | | | | |

| Constellation Brands, Inc. Q1 FY2023 Earnings Release | #WORTHREACHINGFOR I 10 |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

SUPPLEMENTAL SHIPMENT AND DEPLETION INFORMATION

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | | | |

| May 31,

2022 | | May 31,

2021 | | Percent

Change | | | | | | |

| Beer | | | | | | | | | | | |

| (in millions, branded product, 24-pack, 12-ounce case equivalents) | | | | | | | | | | | |

| Shipments | 99.5 | | | 84.8 | | | 17.3 | % | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Depletions (1) | | | | | 8.7 | % | | | | | | |

| | | | | | | | | | | |

| Wine and Spirits | | | | | | | | | | | |

| (in millions, branded product, 9-liter case equivalents) | | | | | | | | | | | |

| Shipments | 6.8 | | | 6.7 | | | 1.5 | % | | | | | | |

| | | | | | | | | | | |

| U.S. Domestic shipments | 5.8 | | | 6.0 | | | (3.3 | %) | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Depletions (1) | | | | | 1.2 | % | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

(1) | Depletions represent U.S. domestic distributor shipments of our respective branded products to retail customers, based on third-party data. |

| |

| | | | | |

| Constellation Brands, Inc. Q1 FY2023 Earnings Release | #WORTHREACHINGFOR I 11 |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

RECONCILIATIONS OF GAAP TO NON-GAAP FINANCIAL MEASURES

(in millions, except per share data)

(unaudited)

We report our financial results in accordance with GAAP. However, non-GAAP financial measures, as defined in the reconciliation tables below, are provided because we use this information in evaluating the results of our core operations and/or internal goal setting. In addition, we believe this information provides investors valuable insight on underlying business trends and results in order to evaluate year-over-year financial performance. See the tables below for supplemental financial data and corresponding reconciliations of these non-GAAP financial measures to GAAP financial measures for the periods presented. Non-GAAP financial measures should be considered in addition to, not as a substitute for, or superior to, our reported results prepared in accordance with GAAP. Please refer to our investor relations website at ir.cbrands.com/financial-information/financial-history-non-gaap for a more detailed description and further discussion of these non-GAAP financial measures.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended May 31, 2022 | | Three Months Ended May 31, 2021 | | Percent

Change -

Reported

Basis

(GAAP) | | Percent

Change -

Comparable

Basis

(Non-GAAP) |

| Reported

Basis

(GAAP) | Comparable

Adjustments | Comparable

Basis

(Non-GAAP) | | Reported

Basis

(GAAP) | Comparable

Adjustments | Comparable

Basis

(Non-GAAP) | |

| Net sales | $ | 2,363.2 | | | $ | 2,363.2 | | | $ | 2,026.5 | | | $ | 2,026.5 | | | 17 | % | | 17 | % |

| Cost of product sold | (1,108.2) | | $ | (24.4) | | | | (907.2) | | $ | (18.1) | | | | | | |

| Gross profit | 1,255.0 | | (24.4) | | $ | 1,230.6 | | | 1,119.3 | | (18.1) | | $ | 1,101.2 | | | 12 | % | | 12 | % |

| Selling, general, and administrative expenses | (438.6) | | 0.5 | | | | (378.3) | | (0.1) | | | | | | |

| Impairment of brewery construction in progress | — | | | | | (665.9) | | 665.9 | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Operating income (loss) | 816.4 | | (23.9) | | $ | 792.5 | | | 75.1 | | 647.7 | | $ | 722.8 | | | NM | | 10 | % |

| Income (loss) from unconsolidated investments | (187.9) | | 135.4 | | | | (899.2) | | 855.6 | | | | | | |

| EBIT | | | $ | 740.0 | | | | | $ | 679.2 | | | NA | | 9 | % |

| Interest expense | (88.5) | | | | | (86.7) | | | | | | | |

| Loss on extinguishment of debt | (15.3) | | 15.3 | | | | — | | | | | | | |

| Income (loss) before income taxes | 524.7 | | 126.8 | | $ | 651.5 | | | (910.8) | | 1,503.3 | | $ | 592.5 | | | 158 | % | | 10 | % |

(Provision for) benefit from income taxes (1) | (125.4) | | (12.5) | | | | 13.5 | | (138.1) | | | | | | |

| Net income (loss) | 399.3 | | 114.3 | | | | (897.3) | | 1,365.2 | | | | | | |

| Net (income) loss attributable to noncontrolling interests | (9.8) | | | | | (10.8) | | | | | | | |

| Net income (loss) attributable to CBI | $ | 389.5 | | $ | 114.3 | | $ | 503.8 | | | $ | (908.1) | | $ | 1,365.2 | | $ | 457.1 | | | 143 | % | | 10 | % |

| | | | | | | | | | | |

EPS (2) | $ | 2.06 | | $ | 0.60 | | $ | 2.66 | | | $ | (4.74) | | $ | 6.97 | | $ | 2.33 | | | 143 | % | | 14 | % |

| | | | | | | | | | | |

Weighted average common shares outstanding – diluted (3) | 189.333 | | | 189.333 | | | 170.602 | | 25.281 | | 195.883 | | | | | |

| | | | | | | | | | | |

| Gross margin | 53.1 | % | | 52.1 | % | | 55.2 | % | | 54.3 | % | | | | |

| Operating margin | 34.5 | % | | 33.5 | % | | 3.7 | % | | 35.7 | % | | | | |

| Effective tax rate | 23.9 | % | | 21.2 | % | | 1.5 | % | | 21.0 | % | | | | |

| | | | | |

| Constellation Brands, Inc. Q1 FY 2023 Earnings Release | #WORTHREACHINGFOR I 12 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended May 31, 2022 | | Three Months Ended May 31, 2021 |

| Comparable Adjustments | Acquisitions,

Divestitures,

and Related

Costs | Restructuring and Other Strategic Business Development Costs (4) | Other (5) | Total | | Acquisitions,

Divestitures,

and Related

Costs | Restructuring and Other Strategic Business Development Costs (4) | Other (5) | Total |

| | | | | | | | | |

| Cost of product sold | $ | (1.0) | | $ | — | | $ | 25.4 | | $ | 24.4 | | | $ | — | | $ | (2.6) | | $ | 20.7 | | $ | 18.1 | |

| Selling, general, and administrative expenses | $ | 1.6 | | $ | (1.4) | | $ | (0.7) | | $ | (0.5) | | | $ | 1.0 | | $ | (0.9) | | $ | — | | $ | 0.1 | |

| Impairment of brewery construction in progress | $ | — | | $ | — | | $ | — | | $ | — | | | $ | — | | $ | — | | $ | (665.9) | | $ | (665.9) | |

| | | | | | | | | |

| | | | | | | | | |

| Operating income (loss) | $ | 0.6 | | $ | (1.4) | | $ | 24.7 | | $ | 23.9 | | | $ | 1.0 | | $ | (3.5) | | $ | (645.2) | | $ | (647.7) | |

| Income (loss) from unconsolidated investments | $ | (0.4) | | $ | (100.9) | | $ | (34.1) | | $ | (135.4) | | | $ | (1.6) | | $ | (24.6) | | $ | (829.4) | | $ | (855.6) | |

| | | | | | | | | |

| Loss on extinguishment of debt | $ | — | | $ | — | | $ | (15.3) | | $ | (15.3) | | | $ | — | | $ | — | | $ | — | | $ | — | |

(Provision for) benefit from income taxes (1) | $ | 1.0 | | $ | 4.2 | | $ | 7.3 | | $ | 12.5 | | | $ | (0.2) | | $ | 1.8 | | $ | 136.5 | | $ | 138.1 | |

| | | | | | | | | |

| Net income (loss) attributable to CBI | $ | 1.2 | | $ | (98.1) | | $ | (17.4) | | $ | (114.3) | | | $ | (0.8) | | $ | (26.3) | | $ | (1,338.1) | | $ | (1,365.2) | |

| | | | | | | | | |

EPS (2) | $ | 0.01 | | $ | (0.52) | | $ | (0.09) | | $ | (0.60) | | | $ | — | | $ | (0.13) | | $ | (6.83) | | $ | (6.97) | |

(1) The effective tax rate applied to each Comparable Adjustment amount is generally based upon the jurisdiction in which the Comparable Adjustment was recognized. For the three months ended May 31, 2021, the (provision for) benefit from income taxes primarily includes a net income tax provision recognized as a result of a legislative update in Switzerland.

(2) May not sum due to rounding as each item is computed independently. The comparable adjustments and comparable basis diluted net income (loss) per share are calculated on a fully dilutive basis. (3)

(3) For the three months ended May 31, 2021, we have excluded the following weighted average common shares outstanding from the calculation of diluted net income (loss) per common share, as the effect of including these would have been anti-dilutive, in millions:

| | | | | | | |

| | | |

| | | |

| Class B Convertible Common Stock | | | 23.247 | |

| Stock-based awards, primarily stock options | | | 2.034 | |

(4) For the three months ended May 31, 2022, and May 31, 2021, restructuring and other strategic business development costs consist predominantly of equity losses from Canopy largely related to costs designed to improve their organizational focus, streamline operations, and align product capability with projected demand.

(5) For the three months ended May 31, 2022, other consists primarily of (i) an unrealized net loss from the mark to fair value of our investment in Canopy, (ii) a loss on extinguishment of debt, and (iii) costs associated with Canopy equity earnings (losses), partially offset by a net gain from the mark to fair value of undesignated commodity derivative contracts. For the three months ended May 31, 2021, adjustments consist primarily of (i) an unrealized net loss from the mark to fair value of our investment in Canopy, (ii) an impairment of long-lived assets in connection with certain assets at the Mexicali Brewery, (iii) costs associated with Canopy equity earnings (losses), and (iv) a net income tax provision recognized as a result of a legislative update in Switzerland, partially offset by a net gain from the mark to fair value of undesignated commodity derivative contracts.

| | | | | |

| Constellation Brands, Inc. Q1 FY 2023 Earnings Release | #WORTHREACHINGFOR I 13 |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

RECONCILIATIONS OF GAAP TO NON-GAAP FINANCIAL MEASURES (continued)

(in millions, except per share data)

(unaudited)

Canopy Equity Earnings (Losses) and Related Activities (“Canopy EIE”)

Canopy EIE non-GAAP financial measures are provided because management uses this information to monitor our investment in Canopy. In addition, we believe this information provides investors valuable insight on underlying business trends and results in order to evaluate year-over-year financial performance.

| | | | | | | | | | | | | | | |

| Three Months Ended | | |

| May 31,

2022 | | May 31,

2021 | | | | |

Equity earnings (losses) and related activities - reported basis, Canopy EIE (GAAP) (1) | $ | (165.0) | | | $ | (155.8) | | | | | |

Comparable Adjustments (2)(3) | 113.0 | | | 111.5 | | | | | |

| Equity earnings (losses) and related activities - comparable basis, Canopy EIE (Non-GAAP) | (52.0) | | | (44.3) | | | | | |

(Provision for) benefit from income taxes (3) | 7.2 | | | 9.6 | | | | | |

| Net income (loss) attributable to CBI - comparable basis, Canopy EIE (Non-GAAP) | $ | (44.8) | | | $ | (34.7) | | | | | |

| | | | | | | | | | | | | | | |

| Three Months Ended | | |

| May 31,

2022 | | May 31,

2021 | | | | |

| EPS - reported basis, Canopy EIE (GAAP) | $ | (0.78) | | | $ | (0.70) | | | | | |

| Comparable Adjustments - Canopy EIE (Non-GAAP) | 0.53 | | | 0.50 | | | | | |

EPS - comparable basis, Canopy EIE (Non-GAAP) (4) | $ | (0.24) | | | $ | (0.18) | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| May 31, 2022 | | May 31, 2021 |

| Income (loss) before income taxes | | (Provision for) benefit from income taxes (3) | | Effective tax rate (5) | | Income (loss) before income taxes | | (Provision for) benefit from income taxes (3) | | Effective tax rate (5) |

| Reported basis (GAAP) | $ | 524.7 | | | $ | (125.4) | | | 23.9 | % | | $ | (910.8) | | | $ | 13.5 | | | 1.5 | % |

| Comparable Adjustments - (Non-GAAP) | 126.8 | | | (12.5) | | | | | 1,503.3 | | | (138.1) | | | |

| Comparable basis (Non-GAAP) | 651.5 | | | (137.9) | | | 21.2 | % | | 592.5 | | | (124.6) | | | 21.0 | % |

| Comparable basis, Canopy EIE (Non-GAAP) | (52.0) | | | 7.2 | | | | | (44.3) | | | 9.6 | | | |

| Comparable basis, excluding Canopy EIE (Non-GAAP) | $ | 703.5 | | | $ | (145.1) | | | 20.6 | % | | $ | 636.8 | | | $ | (134.2) | | | 21.1 | % |

| | | | | | | | | | | |

| | | | | | | | | | | |

| |

| | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Three Months Ended | | |

| May 31,

2022 | | May 31,

2021 | | | | |

EPS - comparable basis (Non-GAAP) (6) | $ | 2.66 | | | $ | 2.33 | | | | | |

| Comparable basis, Canopy EIE (Non-GAAP) | 0.24 | | | 0.18 | | | | | |

EPS - comparable basis, excluding Canopy EIE (Non-GAAP) (4) | $ | 2.90 | | | $ | 2.51 | | | | | |

| | | | | | | | | | | | | | |

(1) | Equity earnings (losses) and related activities are included in income (loss) from unconsolidated investments. |

(2) | Comparable Adjustments, Canopy EIE include: restructuring and other strategic business development costs, unrealized net (gain) loss from the mark to fair value of securities measured at fair value and related activities, acquisition costs, and other (gains) losses. |

| | | | | |

| Constellation Brands, Inc. Q1 FY2023 Earnings Release | #WORTHREACHINGFOR I 14 |

| | | | | | | | | | | | | | |

(3) | The Comparable Adjustment effective tax rate applied to each Comparable Adjustment amount is generally based upon the jurisdiction in which the adjustment was recognized. The benefit from income taxes effective tax rate applied to our Canopy equity earnings (losses) and related activities is generally based on the tax rates of the legal entities that hold our investment. |

(4) | May not sum due to rounding as each item is computed independently. The comparable adjustments and comparable basis diluted net income per share are calculated on a fully dilutive basis. |

(5) | Effective tax rate is not considered a GAAP financial measure, for purposes of this reconciliation, we derived the reported GAAP measure based on GAAP results, which serves as the basis for the reconciliation to the comparable non-GAAP financial measure. |

(6) | See reconciliation of the applicable non-GAAP financial measures on page 12. |

| | | | | | | | | | | |

| EPS Guidance | Range for the Year Ending February 28, 2023 |

| Forecasted EPS - reported basis (GAAP) | $ | 10.50 | | | $ | 10.80 | |

Acquisitions, divestitures, and related costs (1) | 0.05 | | | 0.05 | |

Restructuring and other strategic business development costs (2) | 0.53 | | | 0.53 | |

Other (3) | (0.12) | | | (0.12) | |

| Comparable basis, Canopy EIE (Non-GAAP) | 0.24 | | | 0.24 | |

Forecasted EPS - comparable basis, excluding Canopy EIE (Non-GAAP) (4) | $ | 11.20 | | | $ | 11.50 | |

| | | | | |

| Actual for the Year Ended February 28, 2022 |

| EPS - reported basis (GAAP) | $ | (0.22) | |

Acquisitions, divestitures, and related costs (1) | (0.24) | |

Restructuring and other strategic business development costs (2) | 0.32 | |

Other (3) | 10.32 | |

EPS - comparable basis (Non-GAAP) (4) | 10.20 | |

| Comparable basis, Canopy EIE (Non-GAAP) | 0.80 | |

EPS - comparable basis, excluding Canopy EIE (Non-GAAP) (4) | $ | 10.99 | |

| | | | | | | | | | | | | | | | |

(1) | Acquisitions, divestitures, and related costs include: (4) | Estimated for the Year Ending February 28, 2023 | | Actual for the Year Ended February 28, 2022 | | |

| Transition services agreements activity | $ | 0.06 | | | $ | 0.08 | | | |

| My Favorite Neighbor transaction, integration, and other acquisition-related costs | $ | 0.02 | | | $ | — | | | |

| Gain on the remeasurement of our previously held equity method investments | $ | (0.03) | | | $ | (0.07) | | | |

| Canopy equity (earnings) losses and related activities comparable adjustments | $ | — | | | $ | 0.02 | | | |

| Net gain on sale of unconsolidated investment | $ | — | | | $ | (0.25) | | | |

| Net income tax provision recognized for the reversal of valuation allowances | $ | — | | | $ | (0.02) | | | |

| Net (gain) loss on sale of business | $ | — | | | $ | (0.01) | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

(2) | For the year ending February 28, 2023, and year ended February 28, 2022, restructuring and other strategic business development costs primarily consist of equity losses from Canopy largely related to costs designed to improve their organizational focus, streamline operations, and align product capability with projected demand. For the year ended February 28, 2022, restructuring and other strategic business development costs were partially offset by a net income tax benefit recognized as a result of an intra-entity transfer of assets. | | |

| | | | | |

| Constellation Brands, Inc. Q1 FY2023 Earnings Release | #WORTHREACHINGFOR I 15 |

| | | | | | | | | | | | | | | | |

(3) | Other includes: (4) | Estimated for the Year Ending February 28, 2023 | | Actual for the Year Ended February 28, 2022 | | |

| Unrealized net (gain) loss from mark to fair value of our investment in Canopy | $ | 0.12 | | | $ | 8.33 | | | |

| Loss on extinguishment of debt | $ | 0.09 | | | $ | 0.11 | | | |

| Canopy equity (earnings) losses and related activities comparable adjustments | $ | 0.01 | | | $ | (0.66) | | | |

| Net (gain) loss from mark to fair value of undesignated commodity derivative contracts | $ | (0.10) | | | $ | (0.29) | | | |

| Impairment of brewery construction in progress | $ | — | | | $ | 3.08 | | | |

| Adjustments related to a prior period acquisition | $ | — | | | $ | 0.08 | | | |

| Net income tax provision recognized as a result of a legislative update in Switzerland | $ | — | | | $ | 0.06 | | | |

| Net loss on change in estimated fair value of contingent liabilities associated with prior period acquisitions | $ | — | | | $ | 0.04 | | | |

| Unconsolidated investments, other | $ | — | | | $ | (0.35) | | | |

| Net flow through of reserved inventory | $ | — | | | $ | (0.05) | | | |

| Property tax settlement | $ | — | | | $ | (0.04) | | | |

(4) | May not sum due to rounding as each item is computed independently. The comparable adjustments and comparable basis diluted net income per share are calculated on a fully dilutive basis. | | |

| | | | | | | | | | | |

Free Cash Flow Guidance Free cash flow, as defined in the reconciliation below, is considered a liquidity measure and is considered to provide useful information to investors about the amount of cash generated, which can then be used, after required debt service and dividend payments, for other general corporate purposes. A limitation of free cash flow is that it does not represent the total increase or decrease in the cash balance for the period. Free cash flow should be considered in addition to, not as a substitute for, or superior to, cash flow from operating activities prepared in accordance with GAAP. |

| Range for the Year

Ending February 28, 2023 |

| Net cash provided by operating activities (GAAP) | $ | 2,600.0 | | | $ | 2,800.0 | |

| Purchase of property, plant, and equipment | (1,300.0) | | | (1,400.0) | |

| Free cash flow (Non-GAAP) | $ | 1,300.0 | | | $ | 1,400.0 | |

| | | |

| Three Months Ended |

| May 31,

2022 | | May 31,

2021 |

| Net cash provided by operating activities (GAAP) | $ | 758.2 | | | $ | 716.0 | |

| Purchase of property, plant, and equipment | (196.6) | | | (113.9) | |

| Free cash flow (Non-GAAP) | $ | 561.6 | | | $ | 602.1 | |

| | | | | |

| Constellation Brands, Inc. Q1 FY2023 Earnings Release | #WORTHREACHINGFOR I 16 |

CONSTELLATION BRANDS ANNOUNCES

EXCHANGE OF CANOPY NOTES

VICTOR, N.Y., Jun. 29, 2022 - Constellation Brands, Inc. (NYSE: STZ and STZ.B), a leading beverage alcohol company, announced today that its indirect, wholly-owned subsidiary, Greenstar Canada Investment Limited Partnership (“Greenstar”), has entered into an exchange agreement (the “Exchange Agreement”) with Canopy Growth Corporation (“Canopy”), pursuant to which Greenstar has agreed to sell an aggregate of C$100,000,000 principal amount of outstanding 4.25% senior notes due 2023 (“Notes”) to Canopy in consideration for common shares (“Common Shares”) in the capital of Canopy (other than in respect of accrued but unpaid interest which will be paid in cash). The transaction forms part of an exchange by Canopy of an aggregate of approximately C$255,373,000 principal amount of Notes held by certain holders, including Greenstar (together, the “Exchanging Holders”) into Common Shares.

The number of Common Shares issuable to Greenstar will be calculated based on the volume-weighted average trading price of the Common Shares on the Nasdaq for a 10-day period beginning on and including June 30, 2022 (the “Exchange Price”), provided that the Exchange Price will not be less than US$2.50 (the “Floor Price”) or more than US$3.50, being the closing price of the Common Shares on the Nasdaq on June 29, 2022 (the “Market Price”). As the Exchange Price is not yet known, the actual number of Common Shares issuable to Greenstar pursuant to the Exchange Agreement is not yet known. Assuming the Floor Price and current exchange rates, Greenstar would receive an aggregate of 30,701,880 Common Shares, representing approximately 7.6% of the currently issued and outstanding Common Shares. Assuming the Market Price and current exchange rates, Greenstar would receive an aggregate of 21,929,914 Common Shares, representing approximately 5.4% of the currently issued outstanding Common Shares. The actual number of Common Shares to be issued will vary depending on the finally determined Exchange Price, but will not be less than the Floor Price or more than the Market Price.

Prior to Canopy entering into a second supplemental indenture amending the terms of the Notes that was effected on June 29, 2022 (the “Second Supplement”), the C$200,000,000 principal amount of Notes held by Greenstar were convertible in certain circumstances and subject to certain conditions into an aggregate of 4,151,540 Common Shares. Pursuant to the Second Supplement, Canopy irrevocably surrendered its right to settle the conversion of any Note by the issuance of Common Shares or a combination of cash and Common Shares. As a result, the conversion of any Note will now be settled in cash. Accordingly, Greenstar no longer has beneficial ownership of any Common Shares as a result of its ownership of any Notes, including in respect of its remaining C$100,000,000 aggregate principal amount of Notes not subject to the Exchange Agreement.

Prior to the Second Supplement and entering the Exchange Agreement, Greenstar, individually, held 37,753,802 Common Shares, no warrants and C$200,000,000 principal amount of Notes. The Common Shares held by Greenstar represented approximately 9.4% of the issued and outstanding Common Shares. Prior to the Second Supplement and entering the Exchange Agreement, subsidiaries of Constellation Brands held an aggregate of 142,253,802 Common Shares, 139,745,453 warrants and C$200,000,000 principal amount of Notes, representing approximately 35.3% of the issued and outstanding Common Shares and, assuming full exercise of the warrants and the conversion of the Notes held by these entities, would have held approximately 52.3% of the then issued and outstanding Common Shares.

As a result of the Second Supplement and upon completion of the exchange contemplated by the Exchange Agreement, and the issuance of additional Common Shares to all other Exchanging Holders, Greenstar, individually, would hold 68,455,682 Common Shares (representing approximately 14.2% of the then issued and outstanding Common Shares) if the Exchange Price equals the Floor Price and 59,683,716 Common Shares (representing approximately 13.0% of the then issued and outstanding Common Shares) if the Exchange Price equals the Market Price. Greenstar itself would hold C$100,000,000 principal amount of Notes and no warrants.

As a result of the Second Supplement and following completion of the exchange contemplated by the Exchange Agreement and the issuance of additional Common Shares to all other Exchanging Holders, subsidiaries of Constellation Brands would hold 172,955,682 Common Shares (representing approximately 35.9% of the then issued and outstanding Common Shares) if the Exchange Price equals the Floor Price and 164,183,716 Common Shares (representing approximately 35.8% of the then issued and outstanding Common Shares) if the Exchange Price equals the Market Price, 139,745,453 warrants, and C$100,000,000 aggregate principal amount of Notes. Assuming full exercise of the warrants held by these subsidiaries and the transactions noted above, subsidiaries of Constellation Brands would hold 312,701,135 Common Shares, (representing approximately 50.3% of the then issued and outstanding Common Shares) if the Exchange Price equals the Floor Price or 303,929,169 Common Shares, (representing approximately 50.7% of the then issued and outstanding Common Shares) if the Exchange Price equals the Market Price, in each case assuming no other changes in Canopy’s issued and outstanding Common Shares.

Constellation Brands may from time to time acquire or dispose of Common Shares or other securities of Canopy or exercise its warrants in the future, either on the open market or in private transactions, in each case, depending on a number of factors, including general market and economic conditions and other available investment opportunities. Depending on market conditions, general economic and industry conditions, Canopy’s business and financial condition and/or other relevant factors, Constellation Brands may develop other plans or intentions in the future.

A copy of the early warning report filed in connection with this press release will be available on Canopy’s profile on SEDAR at www.sedar.com or may be obtained by contacting Constellation Brands’ Investor Center at 1-888-922-2150.

FORWARD-LOOKING STATEMENTS

This news release contains forward-looking statements. All statements other than statements of historical fact are forward-looking statements. The words “expect,” “intend,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These statements may relate to business strategy, future operations, prospects, plans, and objectives of management, as well as information concerning expected actions of third parties. All forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those set forth in, or implied by, such forward-looking statements.

The forward-looking statements are based on management's current expectations and should not be construed in any manner as a guarantee that such actions will in fact occur or will occur on the timetable contemplated hereby. All forward-looking statements speak only as of the date of this news release and Constellation Brands undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

In addition to risks and uncertainties associated with ordinary business operations, the forward-looking statements contained in this news release are subject to other risks and uncertainties, including other factors and uncertainties disclosed from time-to-time in Constellation Brands’ filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the fiscal year ended February 28, 2022, which could cause actual future performance to differ from current expectations.

ABOUT CONSTELLATION BRANDS

At Constellation Brands (NYSE: STZ and STZ.B), our mission is to build brands that people love because we believe sharing a toast, unwinding after a day, celebrating milestones, and helping people connect, are Worth Reaching For. It’s worth our dedication, hard work, and the bold calculated risks we take to deliver more for our consumers, trade partners, shareholders, and communities in which we live and work. It’s what has made us one of the fastest-growing large CPG companies in the U.S. at retail, and it drives our pursuit to deliver what’s next.