0000016918false00000169182020-06-302020-06-300000016918us-gaap:CommonClassAMember2020-06-302020-06-300000016918us-gaap:CommonClassBMember2020-06-302020-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) June 30, 2020

CONSTELLATION BRANDS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-08495 | 16-0716709 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

207 High Point Drive, Building 100, Victor, NY 14564

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (585) 678-7100

| | |

| Not Applicable |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Class A Common Stock | STZ | New York Stock Exchange |

| Class B Common Stock | STZ.B | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | | | | |

| Emerging growth company | | ☐ |

| | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | | ☐ |

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On July 1, 2020, Constellation Brands, Inc. (“Constellation” or the “Company”), a Delaware corporation, issued a news release (the “release”) announcing its financial condition and results of operations as of and for the first fiscal quarter ended May 31, 2020. A copy of the release is attached hereto as Exhibit 99.1 and incorporated herein by reference. The projections included in the release involve risks and uncertainties, the outcome of which cannot be foreseen at this time; therefore, actual results may vary materially from these expectations. In this regard, see the information included in the release under the caption “Forward-Looking Statements.”

The information in the release is “furnished” and not “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, and is not otherwise subject to the liabilities of that section. Such information may be incorporated by reference in another filing under the Securities Exchange Act of 1934 or the Securities Act of 1933 only if and to the extent such subsequent filing specifically references the information incorporated by reference herein.

The release contains non-GAAP financial measures; in the release these are referred to as “comparable” or “organic” measures. For purposes of Regulation G, a non-GAAP financial measure is a numerical measure of a registrant’s historical or future financial performance, financial position or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statement of income, balance sheet, or statement of cash flows (or equivalent statements) of the issuer; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. In this regard, GAAP refers to generally accepted accounting principles in the United States. Pursuant to the requirements of Regulation G, the Company has provided reconciliations within the release of the non-GAAP financial measures to the most directly comparable GAAP financial measures.

Comparable measures, including those presenting the impact of the Company’s equity method investment in Canopy Growth Corporation (“Canopy”), and organic net sales measures are provided because management uses this information in monitoring and evaluating the results and underlying business trends of the core operations of the Company and/or in internal goal setting. In addition, the Company believes this information provides investors valuable insight on underlying business trends and results in order to evaluate year-over-year financial performance. As such, the following items, including any related income tax effect, are excluded from comparable basis results, when appropriate: net gain (loss) on the mark to fair value of undesignated commodity derivative contracts; restructuring and other strategic business development costs; COVID-19 incremental costs; settlements of undesignated commodity derivative contracts; accelerated depreciation in connection with certain restructuring and other strategic business development costs; flow through of inventory step-up associated with acquisitions and equity method investments; net loss on change in fair value of derivative instrument entered into to hedge the U.S. dollar cost of a foreign currency denominated investment; transaction, integration, and other acquisition-related costs recognized in connection with acquisitions, divestitures, and investments; certain other selling, general, and administrative gains (losses); impairment of assets held for sale; unrealized net gain (loss) from the mark to fair value of securities measured at fair value; adjustments related to our equity method investment in Canopy and related activities; loss on extinguishment of debt; net income tax provision recognized as a result of adjustments to valuation allowances; net income tax provision related to the Coronavirus Aid, Relief, and Economic Security Act; and net income tax benefit recognized for the reversal of a valuation allowance for capital loss carryforwards as a result of classifying assets held for sale. The Company sold its Black Velvet Canadian Whisky business on November 1, 2019 (the “Black Velvet Divestiture”). The Company sold its Ballast Point craft beer business on March 2, 2020 (the “Ballast Point Divestiture”). Accordingly, during the indicated periods, organic net sales measures exclude the net sales of products of the Black Velvet Divestiture and the Ballast Point Divestiture, as appropriate.

Canopy equity earnings (losses) and related activities comparable measures are provided because management uses this information to monitor our investment in Canopy. In addition, the Company believes this information provides investors valuable insight on underlying business trends and results in order to evaluate

year-over-year financial performance. As such, the following items, including any related income tax effect, are excluded from Canopy comparable basis results, when appropriate: restructuring and other strategic business development costs; unrealized net (gain) loss from the mark to fair value of securities measured at fair value and related activities; flow through of inventory step-up associated with acquisitions; share-based compensation expense related to acquisition milestones; acquisition costs; gain (loss) on dilution due to Canopy’s issuance of additional stock; and other gains (losses), net. In addition, comparable measures for Canopy equity earnings (losses), including any related income tax effect, are also excluded from certain comparable basis results.

| | | | | |

| Item 7.01 | Regulation FD Disclosure. |

On July 1, 2020, Constellation issued a news release, a copy of which release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

In addition, on June 30, 2020, the Company’s Board of Directors declared a quarterly cash dividend in the amount of $0.75 per issued and outstanding share of the Company’s Class A Common Stock, $0.68 per issued and outstanding share of the Company’s Class B Common Stock, and $0.68 per issued and outstanding share of the Company’s Class 1 Common Stock, in each case payable on August 25, 2020, to stockholders of record of each respective class as of the close of business on August 11, 2020.

References to Constellation’s website and/or other social media sites or platforms in the release do not incorporate by reference the information on such websites, social media sites or platforms into this Current Report on Form 8-K, and Constellation disclaims any such incorporation by reference. The information in the news release attached as Exhibit 99.1 is incorporated by reference into this Item 7.01 in satisfaction of the public disclosure requirements of Regulation FD. This information is “furnished” and not “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, and is not otherwise subject to the liabilities of that section. Such information may be incorporated by reference in another filing under the Securities Exchange Act of 1934 or the Securities Act of 1933 only if and to the extent such subsequent filing specifically references the information incorporated by reference herein.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

For the exhibit that is furnished herewith, see the Index to Exhibits immediately following.

INDEX TO EXHIBITS

| | | | | |

| Exhibit No. | Description |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| (99) | ADDITIONAL EXHIBITS |

| |

| (99.1) | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| (104) | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

| |

| |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Date: | July 1, 2020 | CONSTELLATION BRANDS, INC. | |

| | | |

| | By: | /s/ Garth Hankinson |

| | | Garth Hankinson |

| | | Executive Vice President and

Chief Financial Officer |

Exhibit 99.1

Delivers Solid Business Performance and Generates Strong Cash Flow

Beer Business Achieves Depletion Growth of 5.6%, or Nearly 7% Adjusted for Sell Day Impact

Beer Production in Mexico Returns to Normal Levels; Wine & Spirits Power Brands Continue to Gain Traction

| | | | | | | | | | | | | | | | | |

| Net

Sales | Operating

Income | Earnings Before Interest & Taxes (EBIT) | Diluted Net Income (Loss) Per Share Attributable to CBI (EPS) | Diluted EPS

Excluding Canopy |

First Quarter Fiscal Year 2021 Financial Highlights (1) | In millions, except per share data | | | | | |

| Reported | | $1,963 | $610 | NA | $(0.94) | NA |

| % Change | | (6 | %) | (2 | %) | NA | 28 | % | NA |

| Comparable | | $1,963 | $691 | $663 | $2.30 | $2.44 |

| % Change | | (6 | %) | (1 | %) | 3 | % | 4 | % | 2 | % |

(1) Definitions of reported, comparable, and organic, as well as reconciliations of non-GAAP financial measures, are contained elsewhere in this news release. NA=Not Applicable

HIGHLIGHTS

•Despite COVID-related challenges, generates reported basis EPS of $(0.94) and comparable basis EPS of $2.30, including Canopy Growth equity losses of $0.14; excluding Canopy Growth equity losses, achieved comparable basis EPS of $2.44

•Generates $687 million of operating cash flow and $542 million of free cash flow, an increase of 16% and 24%, respectively

•Beer depletions remain strong and consistent with long-term trends; production in Mexico returns to normal levels in June

•Wine & spirits premiumization strategy gains momentum, with strong Power Brands performance in IRI channels

•Fully redeems outstanding 2.25% Senior Notes due November 2020

•Declares quarterly cash dividend of $0.75 per share Class A and $0.68 per share Class B common stock

•Contributes nearly $4 million in COVID-19 related support

•Signs agreements to sell Nobilo New Zealand Sauvignon Blanc and Paul Masson Grande Amber Brandy

•Acquires Empathy Wines, a digitally-native wine brand, which strengthens the company’s position in the direct-to-consumer and eCommerce markets within the wine and spirits category

•Fiscal 2021 guidance is unavailable at this time due to the uncertainty and potential impacts on the business from COVID-19

| | | | | | | | | | | | | | | | | | | | |

| “We overcame a number of headwinds to deliver solid first quarter results marked by margin improvement and impressive depletion growth for our Beer Business and our Wine & Spirits Power Brand portfolio. While the slowdown of our Mexican beer production due to COVID-19 created short-term impact to distributor inventory levels, shipments, and net sales, we continue to win in sales channels that are open, consumer demand for our brands remains strong, and our outlook for the year remains positive.” | | | | “Our strong cash flow results provide financial flexibility as we continue to focus on reducing our debt levels. During the quarter we refinanced debt at favorable rates to enhance liquidity during this time of uncertainty.” | |

| | | | | | |

| Bill Newlands | | | | Garth Hankinson | |

| President and Chief Executive Officer | | | | Chief Financial Officer | |

| | | | | |

| Constellation Brands, Inc. Q1 FY2021 Earnings Release | #WORTHREACHINGFOR I 1 |

| | | | | | | | | | | | | | | | | | | | |

| beer | | | | | | |

| Shipment Volume | Organic Shipment Volume (2) | Depletion Volume (2) | Net Sales (3) | Organic Net Sales (1) | Operating Income (3) |

Three Months Ended | In millions; branded product, 24-pack, 12-ounce case equivalents | | | | | | |

| May 31, 2020 | 76.2 | 76.2 | | $1,384.1 | $1,384.1 | $577.8 |

| May 31, 2019 | 82.1 | 81.3 | | $1,477.4 | $1,448.8 | $580.6 |

| % Change | (7.2 | %) | (6.3 | %) | 5.6 | % | (6 | %) | (4 | %) | — | % |

(2) Three months ended May 31, 2019, includes an adjustment to remove volume associated with the Ballast Point craft beer business “Ballast Point Divestiture” for the period March 2, 2019, through May 31, 2019.

(3) Three months ended May 31, 2019, includes $28.6 million of net sales and $3.8 million of gross profit less marketing that are no longer part of the beer segment results after the Ballast Point Divestiture.

HIGHLIGHTS

•Constellation’s Beer Business posted depletion growth of 5.6% as strong performance in off-premise channels more than offset the impact of the 75% reduction in the on-premise channel due to COVID-19 related shut-downs. When adjusted for one less selling day in the quarter, the beer business generated nearly 7% depletion growth.

•The Corona Brand Family grew double-digits in IRI channels driven by the accelerated growth of Corona Extra, the successful launch of Corona Hard Seltzer, and the continued strength of Corona Premier and Corona Refresca.

•With the successful launch of Corona Hard Seltzer, the brand has quickly become the #4 hard seltzer player, approaching 6% IRI market share in the U.S. hard seltzer category. Ongoing distribution gains have led to IRI ACV distribution of nearly 65 since product launch in early March.

•Modelo Especial continues to see accelerating consumer takeaway trends in IRI channels and delivered 12% depletion growth during the quarter.

| | | | | |

•Impacts from the COVID-19 related slowdown of beer production in Mexico impacted shipment volumes and distributor inventory levels and will extend into Q2. Product inventories are expected to return to more normal levels during the third quarter fiscal 2021; long-term outlook remains intact. •Operating margin increased 240 basis points to 41.7%, as benefits from timing of marketing spend and favorable pricing were partially offset by increased COGS. | |

| |

| | | | | | | | | | | | | | | | | | | | | | |

| wine and spirits | | | | | | | | |

| Shipment

Volume | | Organic Shipment Volume (4) | Depletion Volume (4) | Net Sales (5) | | Organic Net Sales (1) | Operating Income (5) |

| Three Months Ended | In millions; branded product, 9-liter case equivalents | | | | | | | | |

| May 31, 2020 | 10.8 | | 10.8 | | $579.3 | | $579.3 | $164.0 |

| May 31, 2019 | 12.4 | | 11.9 | | $619.8 | | $601.1 | $160.8 |

| % Change | (12.9 | %) | | (9.2 | %) | (1.1 | %) | (7 | %) | | (4 | %) | 2 | % |

(4) Three months ended May 31, 2019, includes an adjustment to remove volume associated with the Black Velvet Canadian Whisky business “Black Velvet Divestiture” for the period March 1, 2019, through May 31, 2019.

(5) Three months ended May 31, 2019, includes $18.7 million of net sales and $8.3 million of gross profit less marketing that are no longer part of the wine and spirits segment results after the Black Velvet Divestiture.

HIGHLIGHTS

•The Power Brands are winning in the higher-end and across the majority of price segments of the U.S. Wine category with strong velocity, and distribution gains that are outpacing the market. Power Brand depletion volume grew 5% driven by Kim Crawford, Meiomi, SVEDKA, The Prisoner Brand Family, and Woodbridge by Robert Mondavi.

•Innovation initiatives are driving growth with Power Brands like The Prisoner Unshackled and Robert Mondavi Private Selection Buttery Chardonnay.

•Operating margin increased 240 basis points to 28.3% as benefits from price, SG&A, and mix were partially offset by the Black Velvet Divestiture and higher COGS.

•Empathy Wines acquisition reinforces and supports the company’s direct-to-consumer and 3-tier eCommerce strategy, as consumers continue to migrate to these channels.

| | | | | |

| Constellation Brands, Inc. Q1 FY2021 Earnings Release | #WORTHREACHINGFOR I 2 |

| | | | | | | | | | | | | | | | | | | | | | | |

Information Related to the Wine and Spirits Businesses to be Sold | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

The further revised Wine and Spirits transaction to sell a portion of the business to E. & J. Gallo Winery (“Gallo”) (the “Further Revised Wine and Spirits Transaction”) is now assumed to close during Q2 fiscal 2021 and the separate, but related, agreement to divest the Nobilo Wine brand to Gallo (the “Nobilo Transaction”) is assumed to close by the end of Q2 of fiscal 2021. In addition, the company intends to divest the Paul Masson Grande Amber Brandy brand and the concentrate business in separate transactions that are assumed to close during Q2 fiscal 2021 and plans to retain the Cooks and J. Roget brands and the Mission Bell Winery.

The following table presents estimated selected wine and spirits segment financial information included in our consolidated financial statements that will no longer be part of our consolidated results after these transactions:

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Estimated Information for Wine and Spirits Businesses to be Sold | | | FY20 Q2 | | FY20 Q3 | | FY20 Q4 | | FY21 Q1 |

| (in millions) | | | | | | | | | |

| Shipment volume (9-liter case equivalents) | | | 5.8 | | 4.7 | | 6.1 | | 4.5 |

| Net sales | | | $229 | | $179 | | $237 | | $187 |

| CAM (gross profit less marketing) | | | $83 | | $62 | | $84 | | $77 |

In addition, the company sold the Black Velvet Canadian Whisky business on November 1, 2019. The approximate fiscal 2020 shipment volume, net sales, and gross profit less marketing totaled 1.6 million 9-liter case equivalents, $50.3 million, and $23.2 million, respectively.

As a result of the Further Revised Wine and Spirits transactions, a stranded cost reduction plan of $130 million is expected to be realized over the fiscal 2021 to fiscal 2022 timeframe.

| | | | | | | | | | | | | | |

| DOING OUR PART TO DRIVE MEANINGFUL AND LASTING CHANGE | | | | |

The conditions that have allowed systemic racial injustice to persist in the U.S. have existed far too long. We must do better as individuals, as a company, and as a country. To learn more about commitments our company is making to achieve greater equity for our African American/Black colleagues at Constellation, within our industry, and within the communities where we live and work, visit www.cbrands.com/news.

| | | | | | | | | | | |

| Initiatives: | | | |

•Committed to invest $100 million to support African American/Black and minority-owned startups in the beverage alcohol space and related categories over the next 10 years. •Entered a multi-year partnership with the Equal Justice Initiative, including an investment of $1 million to further EJI's mission and provide training opportunities for Constellation leadership.

| | | |

| | | |

| | | | | | | | | | | | | | |

| RALLYING AROUND OUR COMMUNITIES AND INDUSTRY PARTNERS TO SUPPORT COVID-19 RELIEF EFFORTS WHILE KEEPING EMPLOYEES’ SAFETY THE #1 PRIORITY | | | | |

Constellation has worked tirelessly to help pave the path to recovery for industry partners such as local restaurants and bars and at-risk communities disproportionately impacted by COVID-19, including Hispanic and African American/Black communities, across the U.S. To learn more about our corporate social responsibility efforts, visit our 2020 Corporate Social Responsibility report.

| | | | | |

•National Restaurant Association Education Foundation: Donated more than $1.5 million to help provide relief to over 40,000 restaurant workers whose jobs were impacted by the COVID-19 pandemic. •#FirstRespondersFirst: Donated nearly $1 million to help provide equipment and support to serve on the front lines, helping those most in need in communities across the U.S. •U.S. Bartenders’ Guild National Charity Fund: Provided $500,000 to bartenders and support staff who were forced out of work due to COVID-19. •Mexican Red Cross: Contributed $500,000 to help first responders with needed medical supplies in Mexico. •Healthcare professionals in Veneto Region in Italy: Provided much-needed support to the hard-hit Veneto region, contributing $250,000 to provide hospital supplies to healthcare professionals. •Implemented various measures to reduce the spread of the virus including working from home, restricting visitors to our production locations, reducing the on-site production workforce levels, screening workers before they enter facilities, and implementing social distancing. •Sent thousands of face coverings to CBI team members across the country and our operations facilities.

| |

| |

| |

| |

| |

| |

| | | | | |

| Constellation Brands, Inc. Q1 FY2021 Earnings Release | #WORTHREACHINGFOR I 3 |

QUARTERLY DIVIDEND

On June 30, 2020, Constellation’s board of directors declared a quarterly cash dividend of $0.75 per share of Class A Common Stock and $0.68 per share of Class B Common Stock, payable on August 25, 2020, to stockholders of record as of the close of business on August 11, 2020.

† A copy of this news release, including the attachments and other financial information that may be discussed during the call, will be available on our website cbrands.com under “Investors/Reporting” prior to the call.

CANOPY GROWTH INVESTMENT

Constellation’s share of Canopy Growth’s equity earnings and related activities for first quarter of fiscal 2021 totaled a loss of $377.6 million on a reported basis and a loss of $31.7 million on a comparable basis.

Constellation has recognized a $112 million unrealized net gain in reported basis results since the initial Canopy investment in November 2017; $197 million decrease in the fair value of Canopy investments was recognized for first quarter of fiscal 2021.

On May 1, 2020, Constellation exercised the November 2017 Canopy Warrants at an exercise price of C$12.98 per warrant share for C$245.0 million, or $173.9 million. On May 1, 2020, Constellation’s ownership interest in Canopy increased to 38.6%. The closing stock price on the date of exercise was C$21.43.

LEADERSHIP PERSPECTIVES

| | | | | |

Our team puts its deep experience in business, strategy, and leadership to work, shaping an environment where we realize our ambitions and beliefs. In the Leadership Perspective blog, President and CEO Bill Newlands and other Constellation thought leaders share their vision for the brands, insights about the industry, and the cultural foundations that drive our company forward. We invite you to join us as we build a future Worth Reaching For.

| |

3-Tier eCommerce: Understanding Our Evolving Digital Consumer in an Unexpected Time | |

| | |

ABOUT CONSTELLATION BRANDS

At Constellation Brands (NYSE: STZ and STZ.B), our mission is to build brands that people love because we believe sharing a toast, unwinding after a day, celebrating milestones, and helping people connect, are Worth Reaching For. It’s worth our dedication, hard work, and the bold calculated risks we take to deliver more for our consumers, trade partners, shareholders, and communities in which we live and work. It’s what has made us one of the fastest-growing large CPG companies in the U.S. at retail, and it drives our pursuit to deliver what’s next.

Today, we are a leading international producer and marketer of beer, wine, and spirits with operations in the U.S., Mexico, New Zealand, and Italy. Every day, people reach for our high-end, iconic imported beer brands such as Corona Extra, Corona Light, Corona Premier, Modelo Especial, Modelo Negra, and Pacifico, and our high-quality premium wine and spirits brands, including the Robert Mondavi Brand Family, Kim Crawford, Meiomi, The Prisoner Brand Family, SVEDKA Vodka, Casa Noble Tequila, and High West Whiskey.

But we won’t stop here. Our visionary leadership team and passionate employees from barrel room to boardroom are reaching for the next level, to explore the boundaries of the beverage alcohol industry and beyond. Join us in discovering what’s Worth Reaching For.

To learn more, follow us on Twitter @cbrands and visit www.cbrands.com. |

| | | | | | | | | | | | | | | | | |

| MEDIA CONTACTS | | | INVESTOR RELATIONS CONTACTS | | |

| Mike McGrew | 773-251-4934 | michael.mcgrew@cbrands.com | Patty Yahn-Urlaub | 585-678-7483 | patty.yahn-urlaub@cbrands.com |

| Amy Martin | 585-678-7141 | amy.martin@cbrands.com | Bob Czudak | 585-678-7170 | bob.czudak@cbrands.com |

| | | | | |

| | | | | |

| Constellation Brands, Inc. Q1 FY2021 Earnings Release | #WORTHREACHINGFOR I 4 |

SUPPLEMENTAL INFORMATION

Reported basis (“reported”) are amounts as reported under generally accepted accounting principles. Comparable basis (“comparable”) are amounts which exclude items that affect comparability (“comparable adjustments”), as they are not reflective of core operations of the segments. The company’s measure of segment profitability excludes comparable adjustments, which is consistent with the measure used by management to evaluate results. The company discusses various non-GAAP measures in this news release. Financial statements, as well as supplemental schedules and tables reconciling non-GAAP measures, together with definitions of these measures and the reasons management uses these measures, are included in this news release.

FORWARD-LOOKING STATEMENTS

All statements other than statements of historical fact set forth in this news release regarding Constellation Brands’ business strategy, future operations, future financial position, estimated revenues, projected costs, expected net sales and operating income, expected cash flow, future payments of dividends, and prospects, plans and objectives of management, as well as information concerning expected actions of third parties, are forward-looking statements (collectively, the “Projections”) that involve risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by the Projections.

During the current quarter, Constellation Brands may reiterate the Projections. Prior to the start of the company’s quiet period, which will begin at the close of business on August 31, 2020, the public can continue to rely on the Projections as still being Constellation Brands’ current expectations on the matters covered, unless the company publishes a notice stating otherwise. During Constellation Brands’ “quiet period,” the Projections should not be considered to constitute the company’s expectations and should be considered historical, speaking as of prior to the quiet period only and not subject to update by the company.

The Projections are based on management’s current expectations and, unless otherwise noted, do not take into account the impact of any future acquisition, merger, or any other business combination, divestiture, restructuring, or other strategic business realignments, financing or share repurchase that may be completed after the date of this release. The Projections should not be construed in any manner as a guarantee that such results will in fact occur. The actual impact of COVID-19 and its associated operating environment may be materially different than management’s expectations. The pending Further Revised Wine and Spirits Transaction and the pending Nobilo Transaction, the pending Paul Masson Grande Amber Brandy transaction, and the pending concentrate business transaction (collectively, the “Wine and Spirits Transactions”) are each subject to the satisfaction of certain closing conditions, including, but not limited to, receipt of required regulatory clearances. The Nobilo Transaction is also conditioned on completion of the Further Revised Wine and Spirits Transaction. There can be no assurance the Wine and Spirits Transactions will occur or will occur on the terms or timetables contemplated hereby.

In addition to the risks and uncertainties of ordinary business operations, the Projections of the company contained in this news release are subject to a number of risks and uncertainties, including:

•duration and impact of the COVID-19 pandemic, including but not limited to closure of non-essential businesses, which may include our manufacturing facilities, and other governmental containment actions;

•completion of the pending Wine and Spirits Transactions;

•impact of the Wine and Spirits Transactions, amount and use of expected proceeds from the pending transactions, amount of stranded costs, and amount and timing of cost reductions may vary from management’s current expectations;

•amount of contingent consideration, if any, received in the Further Revised Wine and Spirits Transaction will depend on actual brand performance;

•beer operations expansion, construction, and optimization activities, and costs and timing associated with these activities, may vary from management’s current estimates;

•accuracy of supply projections, including those relating to beer operations expansion activities and glass sourcing;

•operating cash flow, free cash flow, effective tax rate, and capital expenditures to support long-term growth may vary from management’s current estimates;

•accuracy of projections associated with market opportunities and with previously announced acquisitions, investments, and divestitures;

•accuracy of projections relating to the Canopy investments may vary from management’s current expectations;

•exact duration of the share repurchase implementation and the amount, timing, and source of funds for any share repurchases;

•amount and timing of future dividends are subject to the determination and discretion of the board of directors;

•raw material and water supply, production or shipment difficulties could adversely affect the company’s ability to supply its customers;

•general economic, geo-political, domestic, international and regulatory conditions, instability in world financial markets, health epidemics or pandemics, quarantines or curfews, unanticipated environmental liabilities and costs, or enhanced competitive activities;

•changes to international trade agreements and tariffs, accounting standards, elections or assertions, tax laws or other governmental rules and regulations, and other factors which could impact the company’s reported financial position, results of operations, or effective tax rate, and accuracy of any associated projections;

•changes in interest rates and the inherent unpredictability of currency fluctuations, commodity prices, and raw material costs; and

•other factors and uncertainties disclosed in the company’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the fiscal year ended February 29, 2020, which could cause actual future performance to differ from current expectations.

| | | | | |

| Constellation Brands, Inc. Q1 FY2021 Earnings Release | #WORTHREACHINGFOR I 5 |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(in millions)

(unaudited)

| | | | | | | | | | | |

| May 31,

2020 | | February 29,

2020 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 302.8 | | | $ | 81.4 | |

| Accounts receivable | 700.5 | | | 864.8 | |

| Inventories | 1,332.6 | | | 1,373.6 | |

| Prepaid expenses and other | 470.1 | | | 535.8 | |

| Assets held for sale - current | 590.2 | | | 628.5 | |

| Total current assets | 3,396.2 | | | 3,484.1 | |

| Property, plant, and equipment | 5,098.2 | | | 5,333.0 | |

| Goodwill | 7,684.9 | | | 7,757.1 | |

| Intangible assets | 2,735.4 | | | 2,718.9 | |

| Equity method investments | 2,885.7 | | | 3,093.9 | |

| Securities measured at fair value | 809.5 | | | 1,117.1 | |

| Deferred income taxes | 2,599.5 | | | 2,656.3 | |

| Assets held for sale | 376.4 | | | 552.1 | |

| Other assets | 564.0 | | | 610.7 | |

| Total assets | $ | 26,149.8 | | | $ | 27,323.2 | |

| | | |

| LIABILITIES AND STOCKHOLDER’S EQUITY | | | |

| Current liabilities: | | | |

| Short-term borrowings | $ | — | | | $ | 238.9 | |

| Current maturities of long-term debt | 534.7 | | | 734.9 | |

| Accounts payable | 505.5 | | | 557.6 | |

| Other accrued expenses and liabilities | 712.2 | | | 780.4 | |

| Total current liabilities | 1,752.4 | | | 2,311.8 | |

| Long-term debt, less current maturities | 11,639.3 | | | 11,210.8 | |

| | | |

| Deferred income taxes and other liabilities | 1,380.5 | | | 1,326.3 | |

| Total liabilities | 14,772.2 | | | 14,848.9 | |

| CBI stockholders’ equity | 11,066.0 | | | 12,131.8 | |

| Noncontrolling interests | 311.6 | | | 342.5 | |

| Total stockholders’ equity | 11,377.6 | | | 12,474.3 | |

| Total liabilities and stockholders’ equity | $ | 26,149.8 | | | $ | 27,323.2 | |

| | | | | |

| Constellation Brands, Inc. Q1 FY2021 Earnings Release | #WORTHREACHINGFOR I 6 |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(in millions, except per share data)

(unaudited)

| | | | | | | | | | | | | | | |

| Three Months Ended | | | | | | |

| May 31,

2020 | | May 31,

2019 | | | | |

| Sales | $ | 2,131.7 | | | $ | 2,282.5 | | | | | |

| Excise taxes | | (168.3) | | | (185.3) | | | | | |

| Net sales | | 1,963.4 | | | 2,097.2 | | | | | |

| Cost of product sold | | (975.1) | | | (1,068.5) | | | | | |

| Gross profit | | 988.3 | | | 1,028.7 | | | | | |

| Selling, general, and administrative expenses | | (353.3) | | | (406.0) | | | | | |

| | | | | | | |

| Impairment of assets held for sale | | (25.0) | | | — | | | | | |

| | | | | | | |

| Operating income (loss) | | 610.0 | | | 622.7 | | | | | |

| Income (loss) from unconsolidated investments | | (571.2) | | | (930.6) | | | | | |

| Interest expense | | (100.0) | | | (114.6) | | | | | |

| Loss on extinguishment of debt | | (7.0) | | | — | | | | | |

| Income (loss) before income taxes | | (68.2) | | | (422.5) | | | | | |

| (Provision for) benefit from income taxes | | (104.4) | | | 185.4 | | | | | |

| Net income (loss) | | (172.6) | | | (237.1) | | | | | |

| Net income (loss) attributable to noncontrolling interests | | (5.3) | | | (8.3) | | | | | |

| Net income (loss) attributable to CBI | | $ | (177.9) | | | $ | (245.4) | | | | | |

| | | | | | | |

| Net income (loss) per common share attributable to CBI: | | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Basic and Diluted – Class A Common Stock | | $ | (0.94) | | | $ | (1.30) | | | | | |

| Basic and Diluted – Class B Convertible Common Stock | | $ | (0.86) | | | $ | (1.19) | | | | | |

| | | | | | | |

| Weighted average common shares outstanding: | | | | | | | | |

| Basic and Diluted – Class A Common Stock | | 169.604 | | | 168.118 | | | | | |

| Basic and Diluted – Class B Convertible Common Stock | | 23.293 | | | 23.317 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Cash dividends declared per common share: | | | | | | | | |

| Class A Common Stock | | $ | 0.75 | | | $ | 0.75 | | | | | |

| Class B Convertible Common Stock | | $ | 0.68 | | | $ | 0.68 | | | | | |

| | | | | |

| Constellation Brands, Inc. Q1 FY2021 Earnings Release | #WORTHREACHINGFOR I 7 |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions)

(unaudited)

| | | | | | | | | | | |

| Three Months Ended | | |

| May 31,

2020 | | May 31,

2019 |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | |

| Net income (loss) | $ | (172.6) | | | $ | (237.1) | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | |

| Unrealized net (gain) loss on securities measured at fair value | 197.3 | | | 827.5 | |

| Deferred tax provision (benefit) | 98.9 | | | (245.4) | |

| Depreciation | 71.0 | | | 86.6 | |

| Stock-based compensation | 14.6 | | | 15.5 | |

| Equity in (earnings) losses of equity method investees and related activities, net of distributed earnings | 373.9 | | | 91.1 | |

| Noncash lease expense | 20.9 | | | 22.8 | |

| | | |

| | | |

| | | |

| | | |

| Impairment of assets held for sale | 25.0 | | | — | |

| | | |

| Loss on inventory and related contracts | 24.3 | | | 44.5 | |

| | | |

| Loss on settlement of treasury lock contracts | (29.3) | | | — | |

| Change in operating assets and liabilities, net of effects from purchases of businesses: | | | |

| Accounts receivable | 167.0 | | | 58.6 | |

| Inventories | 48.6 | | | (50.3) | |

| Prepaid expenses and other current assets | 40.5 | | | (8.7) | |

| Accounts payable | (28.4) | | | (22.3) | |

| Deferred revenue | 34.4 | | | 53.1 | |

| Other accrued expenses and liabilities | (155.5) | | | (77.4) | |

| Other | (44.1) | | | 34.6 | |

| Total adjustments | 859.1 | | | 830.2 | |

| Net cash provided by (used in) operating activities | 686.5 | | | 593.1 | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | |

| Purchases of property, plant, and equipment | (144.2) | | | (155.7) | |

| Purchases of businesses, net of cash acquired | — | | | (36.2) | |

| Investments in equity method investees and securities | (213.4) | | | (20.0) | |

| Proceed from sales of assets | 17.7 | | | 0.3 | |

| | | |

| Proceeds from sale of business | 41.1 | | | — | |

| Other investing activities | (0.3) | | | (1.9) | |

| Net cash provided by (used in) investing activities | (299.1) | | | (213.5) | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | |

| Proceeds from issuance of long-term debt | 1,194.6 | | | — | |

| Principal payments of long-term debt | (959.5) | | | (22.9) | |

| Net proceeds from (repayments of) short-term borrowings | (238.9) | | | (205.0) | |

| Dividends paid | (143.9) | | | (143.0) | |

| | | |

| Proceeds from shares issued under equity compensation plans | 4.4 | | | 10.4 | |

| Payments of minimum tax withholdings on stock-based payment awards | (7.6) | | | (13.9) | |

| Payments of debt issuance, debt extinguishment, and other financing costs | (18.1) | | | — | |

| | | |

| | | |

| | | |

| | | |

| Net cash provided by (used in) financing activities | (169.0) | | | (374.4) | |

| | | |

| Effect of exchange rate changes on cash and cash equivalents | 3.0 | | | (0.1) | |

| | | |

| Net increase (decrease) in cash and cash equivalents | 221.4 | | | 5.1 | |

| Cash and cash equivalents, beginning of period | 81.4 | | | 93.6 | |

| Cash and cash equivalents, end of period | $ | 302.8 | | | $ | 98.7 | |

| | | | | |

| Constellation Brands, Inc. Q1 FY2021 Earnings Release | #WORTHREACHINGFOR I 8 |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

RECONCILIATION OF REPORTED AND ORGANIC NET SALES

(in millions)

(unaudited)

For periods of acquisition, we define organic net sales as current period reported net sales less net sales of products of acquired businesses reported for the current period, as appropriate. For periods of divestiture, we define organic net sales as prior period reported net sales less net sales of products of divested businesses reported for the prior period, as appropriate. We provide organic net sales because we use this information in monitoring and evaluating the underlying business trends of our core operations. In addition, we believe this information provides investors valuable insight on underlying business trends and results in order to evaluate year-over-year financial performance.

The divestitures impacting the period below consist of the Black Velvet Divestiture (sold November 1, 2019) and the Ballast Point Divestiture (sold March 2, 2020).

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | | | | | | | | | | | | | | | |

| May 31,

2020 | | May 31,

2019 | | Percent

Change | | | | | | | | | | | | | | |

| Consolidated net sales | $ | 1,963.4 | | | $ | 2,097.2 | | | (6 | %) | | | | | | | | | | | | | | |

Less: Black Velvet Divestiture (1) | — | | | (18.7) | | | | | | | | | | | | | | | | | |

Less: Ballast Point Divestiture (2) | — | | | (28.6) | | | | | | | | | | | | | | | | | |

| Consolidated organic net sales | $ | 1,963.4 | | | $ | 2,049.9 | | | (4 | %) | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Beer net sales | $ | 1,384.1 | | | $ | 1,477.4 | | | (6 | %) | | | | | | | | | | | | | | |

Less: Ballast Point Divestiture (2) | — | | | (28.6) | | | | | | | | | | | | | | | | | |

| Beer organic net sales | $ | 1,384.1 | | | $ | 1,448.8 | | | (4 | %) | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Wine and Spirits net sales | $ | 579.3 | | | $ | 619.8 | | | (7 | %) | | | | | | | | | | | | | | |

Less: Black Velvet Divestiture (1) | — | | | (18.7) | | | | | | | | | | | | | | | | | |

| Wine and Spirits organic net sales | $ | 579.3 | | | $ | 601.1 | | | (4 | %) | | | | | | | | | | | | | | |

(1)For the period March 1, 2019, through May 31, 2019, included in the three months ended May 31, 2019.

(2)For the period March 2, 2019, through May 31, 2019, included in the three months ended May 31, 2019.

| | | | | |

| Constellation Brands, Inc. Q1 FY2021 Earnings Release | #WORTHREACHINGFOR I 9 |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

SUPPLEMENTAL SHIPMENT AND DEPLETION INFORMATION

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | | | | | | | |

| May 31,

2020 | | May 31,

2019 | | Percent

Change | | | | | | |

| Beer | | | | | | | | | | | |

| (in millions, branded product, 24-pack, 12-ounce case equivalents) | | | | | | | | | | | |

| Shipment volume | 76.2 | | | 82.1 | | | (7.2 | %) | | | | | | |

Organic shipment volume (1) | 76.2 | | | 81.3 | | | (6.3 | %) | | | | | | |

| | | | | | | | | | | |

Depletion volume (2) (3) | | | | | 5.6 | % | | | | | | |

| | | | | | | | | | | |

| Wine and Spirits | | | | | | | | | | | |

| (in millions, branded product, 9-liter case equivalents) | | | | | | | | | | | |

| Shipment volume | 10.8 | | | 12.4 | | | (12.9 | %) | | | | | | |

Organic shipment volume (4) | 10.8 | | | 11.9 | | | (9.2 | %) | | | | | | |

| U.S. Domestic shipment volume | 9.9 | | | 11.3 | | | (12.4 | %) | | | | | | |

U.S. Domestic organic shipment volume (4) | 9.9 | | | 10.8 | | | (8.3 | %) | | | | | | |

U.S. Domestic Power Brands shipment volume (5) | 5.0 | | | 4.5 | | | 11.1 | % | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

U.S. Domestic depletion volume (2) (6) | | | | | (1.1 | %) | | | | | | |

U.S. Domestic Power Brands depletion volume (2) (5) | | | | | 4.7 | % | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

(1) | Includes an adjustment to remove shipment volume associated with the Ballast Point Divestiture for the period March 2, 2019, through May 31, 2019, for the three months ended May 31, 2019. | | | | | | |

(2) | Depletions represent distributor shipments of our respective branded products to retail customers, based on third-party data. | | | | | | |

(3) | Includes an adjustment to remove depletion volume associated with the Ballast Point Divestiture for the period March 2, 2019, through May 31, 2019, for the three months ended May 31, 2019. | | | | | | |

(4) | Includes an adjustment to remove shipment volume associated with the Black Velvet Divestiture for the period March 1, 2019, through May 31, 2019, for the three months ended May 31, 2019. | | | | | | |

(5) | U.S. Domestic Power Brands include the following brands and/or portfolio of brands: | | | | | | |

| Wine Brands | | | | Wine Portfolio of Brands | | Spirits Brands |

| ● 7 Moons | ● Drylands | ● SIMI | | ● Charles Smith | | ● Casa Noble |

| ● Auros | ● Kim Crawford | ● Spoken Barrel | | ● Prisoner | | ● High West |

| ● Champagne Palmer & Co | ● Meiomi | | | ● Robert Mondavi | | ● Mi CAMPO |

| ● Cooper & Thief | ● Mount Veeder | | | ● Schrader | | ● Nelson’s Green Brier |

| ● Crafters Union | ● Nobilo (7) | | | | | ● SVEDKA |

| ● Cuvée Sauvage | ● Ruffino | | | | | ● The Real McCoy |

(6) | Includes an adjustment to remove depletion volume associated with the Black Velvet Divestiture for the period March 1, 2019, through May 31, 2019, for the three months ended May 31, 2019. | | | | | | |

(7) | Brand is expected to be divested by the end of second quarter of fiscal 2021. | | | | | | |

| | | | | |

| Constellation Brands, Inc. Q1 FY2021 Earnings Release | #WORTHREACHINGFOR I 10 |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

SUMMARIZED SEGMENT AND INCOME (LOSS) FROM UNCONSOLIDATED INVESTMENTS INFORMATION

(in millions)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | | | | | | | |

| May 31,

2020 | | May 31,

2019 | | Percent

Change | | | | | | |

| Beer | | | | | | | | | | | |

| Segment net sales | $ | 1,384.1 | | | $ | 1,477.4 | | | (6 | %) | | | | | | |

| Segment gross profit | $ | 769.7 | | | $ | 819.5 | | | (6 | %) | | | | | | |

| % Net sales | 55.6 | % | | 55.5 | % | | | | | | | | |

| Segment operating income (loss) | $ | 577.8 | | | $ | 580.6 | | | — | % | | | | | | |

| % Net sales | 41.7 | % | | 39.3 | % | | | | | | | | |

| | | | | | | | | | | |

| Wine and Spirits | | | | | | | | | | | |

| Wine net sales | $ | 499.6 | | | $ | 535.0 | | | (7 | %) | | | | | | |

| Spirits net sales | 79.7 | | | 84.8 | | | (6 | %) | | | | | | |

| Segment net sales | $ | 579.3 | | | $ | 619.8 | | | (7 | %) | | | | | | |

| Segment gross profit | $ | 263.9 | | | $ | 271.7 | | | (3 | %) | | | | | | |

| % Net sales | 45.6 | % | | 43.8 | % | | | | | | | | |

| Segment operating income (loss) | $ | 164.0 | | | $ | 160.8 | | | 2 | % | | | | | | |

| % Net sales | 28.3 | % | | 25.9 | % | | | | | | | | |

| Segment income (loss) from unconsolidated investments | $ | 3.5 | | | $ | 4.0 | | | (13 | %) | | | | | | |

| | | | | | | | | | | |

| Corporate Operations and Other | | | | | | | | | | | |

| Segment operating income (loss) | $ | (50.5) | | | $ | (43.7) | | | (16 | %) | | | | | | |

| Segment income (loss) from unconsolidated investments | $ | 0.2 | | | $ | (1.1) | | | NM | | | | | | | |

| | | | | | | | | | | |

Canopy equity earnings (losses) (1) | $ | (31.7) | | | $ | (54.4) | | | 42 | % | | | | | | |

| | | | | | | | | | | |

| Consolidated operating income (loss) | $ | 610.0 | | | $ | 622.7 | | | (2 | %) | | | | | | |

| Comparable Adjustments | 81.3 | | | 75.0 | | | NM | | | | | | | |

| Comparable operating income (loss) | $ | 691.3 | | | $ | 697.7 | | | (1 | %) | | | | | | |

| | | | | | | | | | | |

| Consolidated income (loss) from unconsolidated investments | $ | (571.2) | | | $ | (930.6) | | | 39 | % | | | | | | |

| Comparable Adjustments | 543.2 | | | 879.1 | | | NM | | | | | | | |

| Comparable income (loss) from unconsolidated investments | $ | (28.0) | | | $ | (51.5) | | | 46 | % | | | | | | |

| | | | | | | | | | | |

| Consolidated EBIT | $ | 663.3 | | | $ | 646.2 | | | 3 | % | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

(1) | We recognize our equity in earnings (losses) for Canopy on a two-month lag. Accordingly, we recognized our share of Canopy’s earnings (losses) for the periods January 1, 2020, through March 31, 2020, and January 1, 2019, through March 31, 2019, in our consolidated results for the three months ended May 31, 2020, and May 31, 2019, respectively. The summarized financial information below represents 100% of Canopy’s reported results, prepared in accordance with generally accepted accounting principles in the U.S. (“GAAP”), and converted from Canadian dollars to U.S. dollars using the applicable weighted average exchange rates. | | | | | | | | | |

| | | Three Months Ended | | | | | | | |

| | | May 31,

2020 | | May 31,

2019 | | | | | |

| | Net sales | $ | 80.3 | | | $ | 70.7 | | | | | | |

| | Gross profit (loss) | $ | (57.3) | | | $ | 11.3 | | | | | | |

| | % Net sales | (71.4) | % | | 16.0 | % | | | | | |

| | Operating income (loss) | $ | (733.2) | | | $ | (170.0) | | | | | | |

| | % Net sales | NM | | | NM | | | | | | |

NM=Not Meaningful

| | | | | |

| Constellation Brands, Inc. Q1 FY2021 Earnings Release | #WORTHREACHINGFOR I 11 |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

RECONCILIATIONS OF GAAP TO NON-GAAP FINANCIAL MEASURES

(in millions, except per share data)

(unaudited)

We report our financial results in accordance with GAAP. However, non-GAAP financial measures, as defined in the reconciliation tables below, are provided because we use this information in evaluating the results of our core operations and/or internal goal setting. In addition, we believe this information provides investors valuable insight on underlying business trends and results in order to evaluate year-over-year financial performance. See the tables below for supplemental financial data and corresponding reconciliations of these non-GAAP financial measures to GAAP financial measures for the periods presented. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, our reported results prepared in accordance with GAAP. Please refer to our website at http://www.cbrands.com/investors/reporting for a more detailed description and further discussion of these non-GAAP financial measures.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended May 31, 2020 | | | | Three Months Ended May 31, 2019 | | | | Percent

Change -

Reported

Basis

(GAAP) | | Percent

Change -

Comparable

Basis

(Non-GAAP) |

| Reported

Basis

(GAAP) | Comparable

Adjustments | Comparable

Basis

(Non-GAAP) | | Reported

Basis

(GAAP) | Comparable

Adjustments | Comparable

Basis

(Non-GAAP) | | | | |

| Net sales | $ | 1,963.4 | | | $ | 1,963.4 | | | $ | 2,097.2 | | | $ | 2,097.2 | | | (6 | %) | | (6 | %) |

| Cost of product sold | (975.1) | | $ | 45.3 | | | | (1,068.5) | | $ | 62.5 | | | | | | |

| Gross profit | 988.3 | | 45.3 | | $ | 1,033.6 | | | 1,028.7 | | 62.5 | | $ | 1,091.2 | | | (4 | %) | | (5 | %) |

| Selling, general, and administrative expenses | (353.3) | | 11.0 | | | | (406.0) | | 12.5 | | | | | | |

| | | | | | | | | | | |

| Impairment of assets held for sale | (25.0) | | 25.0 | | | | — | | | | | | | |

| | | | | | | | | | | |

| Operating income (loss) | 610.0 | | 81.3 | | $ | 691.3 | | | 622.7 | | 75.0 | | $ | 697.7 | | | (2 | %) | | (1 | %) |

| Income (loss) from unconsolidated investments | (571.2) | | 543.2 | | | | (930.6) | | 879.1 | | | | | | |

| EBIT | | | $ | 663.3 | | | | | $ | 646.2 | | | NA | | | 3 | % |

| Interest expense | (100.0) | | | | | (114.6) | | | | | | | | |

| Loss on extinguishment of debt | (7.0) | | 7.0 | | | | — | | | | | | | | |

| Income (loss) before income taxes | (68.2) | | 631.5 | | $ | 563.3 | | | (422.5) | | 954.1 | | $ | 531.6 | | | 84 | % | | 6 | % |

(Provision for) benefit from income taxes (1) | (104.4) | | (5.9) | | | | 185.4 | | (278.9) | | | | | | |

| Net income (loss) | (172.6) | | 625.6 | | | | (237.1) | | 675.2 | | | | | | |

| Net income (loss) attributable to noncontrolling interests | (5.3) | | | | | (8.3) | | | | | | | |

| Net income (loss) attributable to CBI | $ | (177.9) | | $ | 625.6 | | $ | 447.7 | | | $ | (245.4) | | $ | 675.2 | | $ | 429.8 | | | 28 | % | | 4 | % |

| | | | | | | | | | | |

EPS (2) | $ | (0.94) | | $ | 3.21 | | $ | 2.30 | | | $ | (1.30) | | $ | 3.46 | | $ | 2.21 | | | 28 | % | | 4 | % |

| | | | | | | | | | | |

Weighted average common shares outstanding – diluted (3) | 169.604 | | 25.201 | | 194.805 | | | 168.118 | | 26.750 | | 194.868 | | | | | |

| | | | | | | | | | | |

| Gross margin | 50.3 | % | | 52.6 | % | | 49.1 | % | | 52.0 | % | | | | |

| Operating margin | 31.1 | % | | 35.2 | % | | 29.7 | % | | 33.3 | % | | | | |

| Effective tax rate | (153.1) | % | | 19.6 | % | | 43.9 | % | | 17.6 | % | | | | |

| | | | | |

| Constellation Brands, Inc. Q1 FY 2021 Form 10-Q | #WORTHREACHINGFOR I 12 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended May 31, 2020 | | | | | Three Months Ended May 31, 2019 | | | |

| Comparable Adjustments | Acquisitions, Divestitures, and Related Costs (4) | Restructuring and Other Strategic Business Development Costs (5) | Other (6) | Total | | Acquisitions, Divestitures, and Related Costs (4) | Restructuring and Other Strategic Business Development Costs (5) | Other (6) | Total |

| | | | | | | | | |

| Cost of product sold | $ | — | | $ | (24.3) | | $ | (21.0) | | $ | (45.3) | | | $ | (0.4) | | $ | (48.0) | | $ | (14.1) | | $ | (62.5) | |

| Selling, general, and administrative expenses | $ | (1.4) | | $ | (3.1) | | $ | (6.5) | | $ | (11.0) | | | $ | 9.2 | | $ | (23.6) | | $ | 1.9 | | $ | (12.5) | |

| | | | | | | | | |

| Impairment of assets held for sale | $ | — | | $ | (25.0) | | $ | — | | $ | (25.0) | | | $ | — | | $ | — | | $ | — | | $ | — | |

| | | | | | | | | |

| Operating income (loss) | $ | (1.4) | | $ | (52.4) | | $ | (27.5) | | $ | (81.3) | | | $ | 8.8 | | $ | (71.6) | | $ | (12.2) | | $ | (75.0) | |

| Income (loss) from unconsolidated investments | $ | (0.5) | | $ | (235.4) | | $ | (307.3) | | $ | (543.2) | | | $ | (9.3) | | $ | — | | $ | (869.8) | | $ | (879.1) | |

| | | | | | | | | |

| Loss on extinguishment of debt | $ | — | | $ | — | | $ | (7.0) | | $ | (7.0) | | | $ | — | | $ | — | | $ | — | | $ | — | |

(Provision for) benefit from income taxes (1) | $ | (23.6) | | $ | 21.9 | | $ | 7.6 | | $ | 5.9 | | | $ | 54.2 | | $ | 17.4 | | $ | 207.3 | | $ | 278.9 | |

| | | | | | | | | |

| Net income (loss) attributable to CBI | $ | (25.5) | | $ | (265.9) | | $ | (334.2) | | $ | (625.6) | | | $ | 53.7 | | $ | (54.2) | | $ | (674.7) | | $ | (675.2) | |

| | | | | | | | | |

EPS (2) | $ | (0.13) | | $ | (1.36) | | $ | (1.72) | | $ | (3.21) | | | $ | 0.28 | | $ | (0.28) | | $ | (3.46) | | $ | (3.46) | |

(1) The effective tax rate applied to each Comparable Adjustment amount is generally based upon the jurisdiction in which the Comparable Adjustment was recognized. For the three months ended May 31, 2020, the (provision for) benefit from income taxes includes a net income tax provision recognized as a result of adjustments to valuation allowances and a net income tax provision related to legislative and governmental initiatives under the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”). For the three months ended May 31, 2019, the (provision for) benefit from income taxes includes net income tax benefit primarily from the reversal of a valuation allowance related to capital loss carryforwards as a result of classifying assets held for sale in connection with the definitive agreement to sell a portion of the wine and spirits business to E. & J. Gallo Winery.

(2) May not sum due to rounding as each item is computed independently. For the three months ended May 31, 2020, and May 31, 2019, the comparable adjustments and comparable basis diluted net income per share are calculated on a fully dilutive basis. (3)

(3) We have excluded the following weighted average common shares outstanding from the calculation of diluted net income (loss) per common share, as the effect of including these would have been anti-dilutive, in millions:

| | | | | | | | | | | |

| For the Three Months Ended | | |

| May 31, 2020 | | May 31, 2019 |

| | | |

| Class B Convertible Common Stock | 23.293 | | | 23.317 | |

| Stock-based awards, primarily stock options | 1.908 | | | 3.433 | |

(4) For the three months ended May 31, 2020, acquisitions, divestitures, and related costs primarily consist of a net income tax provision recognized for the adjustments to valuation allowances and a a net loss on foreign currency contracts, partially offset by a net gain recognized in connection with a vineyard sale. For the three months ended May 31, 2019, acquisitions, divestitures, and related costs consist primarily of a net income tax benefit recognized for the reversal of a valuation allowance and a gain related to the remeasurement of our previously held equity interest in Nelson’s Green Brier Distillery business to the acquisition-date fair value.

(5) For the three months ended May 31, 2020, restructuring and other strategic business development costs consist primarily of equity losses from Canopy Growth Corporation (“Canopy”) related to costs designed to improve their organizational focus, streamline operations, and align production capability with projected demand. The three months ended May 31, 2020, also included costs to optimize our portfolio, gain efficiencies, reduce our cost structure, and an impairment of long-lived assets held for sale within the wine and spirits segment. For the three months ended May 31, 2019, restructuring and other strategic business development costs consist primarily of costs to optimize our portfolio, gain efficiencies, and reduce our cost structure within the wine and spirits segment.

(6) For the three months ended May 31, 2020, other consists primarily of an unrealized net loss from the mark to fair value of our investments in Canopy, costs associated with Canopy equity losses, a net income tax provision related to the CARES Act, a net loss from the mark to fair value of undesignated commodity derivative contracts, and incremental costs incurred related to the COVID-19 pandemic. For the three months ended May 31, 2019, other consists primarily of an unrealized net loss from the mark to fair value of our investments in Canopy and costs associated with Canopy equity losses.

| | | | | |

| Constellation Brands, Inc. Q1 FY 2021 Form 10-Q | #WORTHREACHINGFOR I 13 |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

RECONCILIATIONS OF GAAP TO NON-GAAP FINANCIAL MEASURES (continued)

(in millions, except per share data)

(unaudited)

Canopy Equity Earnings (Losses) and Related Activities (“Canopy EIE”)

Canopy EIE non-GAAP financial measures are provided because management uses this information to monitor our investment in Canopy. In addition, we believe this information provides investors valuable insight on underlying business trends and results in order to evaluate year-over-year financial performance.

| | | | | | | | | | | |

| Three Months Ended | | |

| May 31,

2020 | | May 31,

2019 |

Equity earnings (losses) and related activities- reported basis, Canopy EIE (GAAP) (1) | $ | (377.6) | | | $ | (106.0) | |

Comparable Adjustments (2)(3) | 345.9 | | | 51.6 | |

| Equity losses and related activities - comparable basis, Canopy EIE (Non-GAAP) | (31.7) | | | (54.4) | |

(Provision for) benefit from income taxes (3) | 4.6 | | | 15.6 | |

| Net income (loss) attributable to CBI - comparable basis, Canopy EIE (Non-GAAP) | $ | (27.1) | | | $ | (38.8) | |

| | | | | | | | | | | |

| Three Months Ended | | |

| May 31,

2020 | | May 31,

2019 |

| EPS - reported basis, Canopy EIE (GAAP) | $ | (1.93) | | | $ | (0.42) | |

| Comparable Adjustments - Canopy EIE (Non-GAAP) | 1.74 | | | 0.20 | |

EPS - comparable basis, Canopy EIE (Non-GAAP) (4) | $ | (0.14) | | | $ | (0.20) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | | | | | | | |

| May 31, 2020 | | | | | | May 31, 2019 | | | | |

| Income (loss) before income taxes | | (Provision for) benefit from income taxes (3) | | Effective tax rate (6) | | Income (loss) before income taxes | | (Provision for) benefit from income taxes (3) | | Effective tax rate (6) |

| Reported basis (GAAP) | $ | (68.2) | | | | $ | (104.4) | | | (153.1) | % | | (422.5) | | | | 185.4 | | | 43.9 | % |

| Comparable Adjustments - (Non-GAAP) | 631.5 | | | | (5.9) | | | | | 954.1 | | | | (278.9) | | | |

| Comparable basis (Non-GAAP) | 563.3 | | | (110.3) | | | 19.6 | % | | $ | 531.6 | | | $ | (93.5) | | | 17.6 | % |

| Comparable basis, Canopy EIE (Non-GAAP) | (31.7) | | | | 4.6 | | | | | (54.4) | | | | 15.6 | | | |

| Comparable basis, excluding Canopy EIE (Non-GAAP) | $ | 595.0 | | | $ | (114.9) | | | 19.3 | % | | $ | 586.0 | | | $ | (109.1) | | | 18.6 | % |

| | | | | | | | | | | |

| Three Months Ended | | |

| May 31,

2020 | | May 31,

2019 |

EPS - comparable basis (Non-GAAP) (5) | $ | 2.30 | | | $ | 2.21 | |

| Comparable basis, Canopy EIE (Non-GAAP) | (0.14) | | | (0.20) | |

EPS - comparable basis, excluding Canopy EIE (Non-GAAP) (4) | $ | 2.44 | | | $ | 2.40 | |

| | | | | | | | | | | | | | |

(1) | Equity earnings (losses) and related activities are included in income (loss) from unconsolidated investments. | | | |

(2) | Comparable Adjustments, Canopy EIE include: restructuring and other strategic business development costs, unrealized net (gain) loss from the mark to fair value of securities measured at fair value and related activities, flow through of inventory step-up, share-based compensation expense related to acquisition milestones, acquisition costs, loss on dilution due to Canopy’s issuance of additional stock, and other (gains) losses. | | | |

| | | | | |

| Constellation Brands, Inc. Q1 FY2021 Earnings Release | #WORTHREACHINGFOR I 14 |

| | | | | | | | | | | | | | |

(3) | The Comparable Adjustment effective tax rate applied to each Comparable Adjustment amount is generally based upon the jurisdiction in which the adjustment was recognized. The benefit from income taxes effective tax rate applied to our equity in earnings (losses) of Canopy is generally based on the tax rates of the legal entities that hold our investment. | | | |

(4) | May not sum due to rounding as each item is computed independently. The comparable adjustments and comparable basis diluted net income per share are calculated on a fully dilutive basis. | | | |

(5) | See reconciliation of the applicable non-GAAP financial measures on page 12. | | | |

(6) | Effective tax rate is not considered a GAAP financial measure, for purposes of this reconciliation, we derived the reported GAAP measure based on GAAP results, which serves as the basis for the reconciliation to the comparable non-GAAP financial measure. | | | |

| | | | | | | | | | | |

Free Cash Flow Free cash flow, as defined in the reconciliation below, is considered a liquidity measure and is considered to provide useful information to investors about the amount of cash generated, which can then be used, after required debt service and dividend payments, for other general corporate purposes. A limitation of free cash flow is that it does not represent the total increase or decrease in the cash balance for the period. Free cash flow should be considered in addition to, not as a substitute for, or superior to, cash flow from operating activities prepared in accordance with GAAP. | | | |

| Three Months Ended | | |

| May 31,

2020 | | May 31,

2019 |

| Net cash provided by operating activities (GAAP) | $ | 686.5 | | | $ | 593.1 | |

| Purchases of property, plant, and equipment | (144.2) | | | (155.7) | |

| Free cash flow (Non-GAAP) | $ | 542.3 | | | $ | 437.4 | |

| | | | | |

| Constellation Brands, Inc. Q1 FY2021 Earnings Release | #WORTHREACHINGFOR I 15 |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe end date of the period reflected on the cover page if a periodic report. For all other reports and registration statements containing historical data, it is the date up through which that historical data is presented. If there is no historical data in the report, use the filing date. The format of the date is CCYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation 12B

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation 12B

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation 12B

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation 12B

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassBMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

This regulatory filing also includes additional resources:

stzex99-1_5312020.pdf

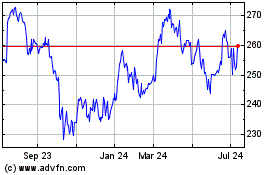

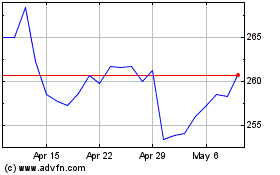

Constellation Brands (NYSE:STZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Constellation Brands (NYSE:STZ)

Historical Stock Chart

From Apr 2023 to Apr 2024