Current Report Filing (8-k)

April 28 2021 - 4:32PM

Edgar (US Regulatory)

CONSOLIDATED EDISON INC false 0001047862 0001047862 2021-04-28 2021-04-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 28, 2021

Consolidated Edison, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

New York

|

|

1-14514

|

|

13-3965100

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

4 Irving Place, New York, New York

|

|

10003

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (212) 460-4600

Securities Registered Pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol

|

|

Name of each exchange

on which registered

|

|

Consolidated Edison, Inc.,

Common Shares ($.10 par value)

|

|

ED

|

|

New York Stock Exchange

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

ITEM 1.01

|

ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

|

On April 28, 2021, Consolidated Edison, Inc. (“Con Edison”) entered into a Credit Agreement, dated as of April 28, 2021, (the “April 2021 Credit Agreement”) among Con Edison, the lenders party thereto (the “Lenders”), TD Securities (USA) LLC as Sole Lead Arranger and Sole Book Runner and Toronto Dominion (Texas) LLC, as Administrative Agent. A copy of the April 2021 Credit Agreement is included as an exhibit to this report, and the description of the April 2021 Credit Agreement that follows is qualified in its entirety by reference to the April 2021 Credit Agreement.

Under the April 2021 Credit Agreement, the Lenders are committed until May 18, 2021, subject to certain conditions, to provide to Con Edison a $500 million variable-rate 364-day term loan. Con Edison has the option to prepay any term loans issued under the April 2021 Credit Agreement prior to maturity. Subject to certain exceptions, the commitments and any term loans issued under the April 2021 Credit Agreement are subject to mandatory termination and prepayment with the net cash proceeds of certain debt issuances by Con Edison or certain asset sales by Con Edison or its subsidiaries. Con Edison intends to use the borrowings under the April 2021 Credit Agreement to repay Con Edison’s 2.00 percent debentures, Series 2016 A, that mature on May 15, 2021.

The Lenders’ obligations to make loans under the April 2021 Credit Agreement are subject to certain conditions, including that there be no payment or bankruptcy default. The commitments are not subject to maintenance of credit rating levels. Upon a change of control of Con Edison, or upon an event of default, the Lenders may terminate their commitments and declare the loans outstanding under the April 2021 Credit Agreement immediately due and payable.

Events of Default include Con Edison exceeding at any time a ratio of consolidated debt to consolidated total capital of 0.65 to 1; Con Edison or its subsidiaries having liens on its or their assets in an aggregate amount exceeding five percent of Con Edison’s consolidated total capital, subject to certain exceptions; Con Edison or its material subsidiaries failing to make one or more payments in respect of material financial obligations (in excess of an aggregate $150 million of debt or derivative obligations other than non-recourse debt); the occurrence of an event or condition which results in the acceleration of the maturity of any material debt (in excess of an aggregate $150 million of debt other than non-recourse debt) or enables the holders of such debt to accelerate the maturity thereof; and other customary events of default.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

CONSOLIDATED EDISON, INC.

|

|

|

|

|

By:

|

|

/s/ Joseph Miller

|

|

|

|

Joseph Miller

|

|

|

|

Vice President and Controller

|

Date: April 28, 2021

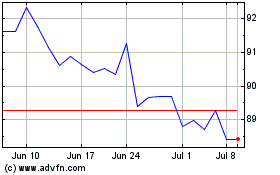

Consolidated Edison (NYSE:ED)

Historical Stock Chart

From Mar 2024 to Apr 2024

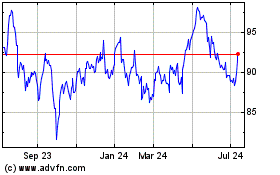

Consolidated Edison (NYSE:ED)

Historical Stock Chart

From Apr 2023 to Apr 2024