ConocoPhillips Outlines 10-Year Financial Plan

November 19 2019 - 9:54AM

Dow Jones News

By Michael Dabaie

ConocoPhillips (COP) said it is outlining details of its 2020 to

2029 operating and financial plan at its Analyst & Investor

Meeting Tuesday.

The oil and gas company said the 10-year plan includes free cash

flow of about $50 billion based on a real West Texas Intermediate

price of $50 per barrel and annual capital expenditures averaging

less than $7 billion over the decade.

The capital expenditures plan reflects optimized pace of

development within each asset, low capital intensity and overall

low-declining base production, Conoco said.

ConocoPhillips said it forecasts underlying compound annual

production growth averaging over 3%.

The company said its plan projects $30 billion in share buybacks

over the 10-year period, representing almost 50% of current market

capitalization.

Conoco said planned dividends and repurchases funded from free

cash flow over life of the plan represent a combined annual

shareholder payout that exceeds its distribution target of more

than 30% of cash from operations.

Shares were up 0.7% premarket to $57.10.

Write to Michael Dabaie at michael.dabaie@wsj.com

(END) Dow Jones Newswires

November 19, 2019 09:39 ET (14:39 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

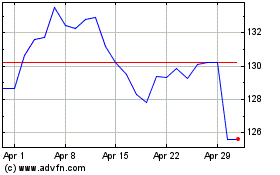

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Mar 2024 to Apr 2024

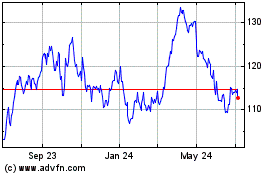

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Apr 2023 to Apr 2024