Current Report Filing (8-k)

July 01 2019 - 4:06PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 1, 2019 (June 28, 2019)

COMPASS DIVERSIFIED HOLDINGS

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-34927

|

|

57-6218917

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

COMPASS GROUP DIVERSIFIED HOLDINGS LLC

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-34926

|

|

20-3812051

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

301 Riverside Avenue, Second Floor, Westport, CT 06880

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (203) 221-1703

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

Title of Each Class

|

|

Trading Symbol(s)

|

|

Name of Each Exchange on Which Registered

|

|

Shares representing beneficial interests in Compass Diversified Holdings

|

|

CODI

|

|

New York Stock Exchange

|

|

Series A Preferred Shares representing Series A Trust Preferred Interest in Compass Diversified Holdings

|

|

CODI PR A

|

|

New York Stock Exchange

|

|

Series B Preferred Shares representing Series B Trust Preferred Interest in Compass Diversified Holdings

|

|

CODI PR B

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company

|

o

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Section 2 Financial Information

Item 2.01 Completion of Acquisition or Disposition of Assets

Compass Group Diversified Holdings LLC (the “Company”) and Compass Diversified Holdings (“Holdings” and, together with the Company, collectively “CODI,” “us” or “we”) acquires and manages small to middle market businesses in the ordinary course of its business. The following description relates to the recent divestiture of one such business.

Clean Earth

On May 8, 2019, the Company, as majority stockholder of CEHI Acquisition Corporation (“CEHI”) and as Sellers’ Representative, entered into a definitive Stock Purchase Agreement (the “Purchase Agreement”) with Calrissian Holdings, LLC (“Buyer”), CEHI, the other holders of stock and options of CEHI and, as Buyer’s guarantor, Harsco Corporation, to sell to Buyer all of the issued and outstanding securities of CEHI, the parent company of the operating entity, Clean Earth, Inc.

On June 28, 2019, Buyer completed the acquisition of all the issued and outstanding securities of CEHI pursuant to the Purchase Agreement (the “Transaction”). The sale price of CEHI was based on an aggregate total enterprise value of $625 million and is subject to customary working capital adjustments. After the allocation of the sales price to CEHI non-controlling equityholders and the payment of transaction expenses, CODI is expected to receive approximately $549 million of total proceeds at closing. This amount is in respect of the Company's outstanding loans to CEHI (including accrued interest) and its equity interests in CEHI, which was acquired by CODI on August 26, 2014. The proceeds will be used, in part, to repay outstanding debt under the Company's revolving credit facility and for general corporate purposes. CODI expects to record a gain on the sale of CEHI ranging between $205 million and $215 million for the quarter ended June 30, 2019.

The foregoing brief description of the Purchase Agreement is not meant to be exhaustive and is qualified in its entirety by the full text of the Purchase Agreement, which is incorporated herein by reference to Exhibit 2.1 to CODI’s Current Report on Form 8-K filed on May 9, 2019.

Forward-Looking Statements

This filing may contain certain forward-looking statements, including statements with regard to the future performance of CODI and expectations related to the sale of CEHI. Words such as "believes," "expects," “anticipates,” “intends,” "projects," and "future" or similar expressions, are intended to identify forward-looking statements. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions. Certain factors could cause actual results to differ materially from those projected in these forward-looking statements, and some of these factors are enumerated in the risk factor discussion in the Form 10-K filed by CODI with the SEC for the year ended December 31, 2018 and other filings with the SEC. Except as required by law, CODI undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Section 8 Other Events

Item 8.01 Other Events

On July 1, 2019, CODI issued a press release announcing the closing of the CEHI sale. The foregoing description of the press release is qualified in its entirety by reference to the complete text of the press release furnished as Exhibit 99.1 hereto, which is hereby incorporated by reference herein.

Section 9 Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits

(b) Pro Forma Financial Information.

The unaudited condensed consolidated pro forma balance sheet of Compass Diversified Holdings at March 31, 2019 and notes thereto and the unaudited condensed consolidated pro forma statements of operations for the three months ended March 31, 2019 and the years ended December 31, 2018, 2017 and 2016 and notes thereto are filed as Exhibit 99.2 hereto and incorporated by reference herein.

d) Exhibits

The following exhibits are furnished herewith:

|

|

|

|

|

|

|

Exhibit

|

|

Description

|

|

|

|

|

|

2.1

|

|

|

|

|

|

|

|

99.1

|

|

|

|

|

|

|

|

99.2

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

Date: July 1, 2019

|

COMPASS DIVERSIFIED HOLDINGS

|

|

|

|

|

|

|

By:

|

|

/s/ Ryan J. Faulkingham

|

|

|

|

|

|

|

|

|

Ryan J. Faulkingham

|

|

|

|

|

Regular Trustee

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

Date: July 1, 2019

|

COMPASS GROUP DIVERSIFIED HOLDINGS LLC

|

|

|

|

|

|

|

By:

|

|

/s/ Ryan J. Faulkingham

|

|

|

|

|

|

|

|

|

Ryan J. Faulkingham

|

|

|

|

|

Chief Financial Officer

|

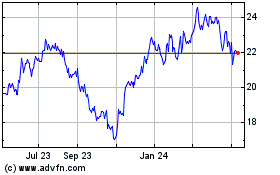

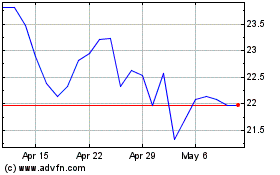

Compass Diversified (NYSE:CODI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Compass Diversified (NYSE:CODI)

Historical Stock Chart

From Apr 2023 to Apr 2024