Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

|

|

|

|

Filed by the Registrant ý

|

Filed by a Party other than the Registrant o

|

Check the appropriate box:

|

o

|

|

Preliminary Proxy Statement

|

o

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

ý

|

|

Definitive Proxy Statement

|

o

|

|

Definitive Additional Materials

|

o

|

|

Soliciting Material under §240.14a-12

|

|

|

|

|

|

|

|

COMMUNITY HEALTHCARE TRUST INCORPORATED

|

(Name of Registrant as Specified In Its Charter)

|

Not Applicable

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

ý

|

|

No fee required.

|

o

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

o

|

|

Fee paid previously with preliminary materials.

|

o

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

Table of Contents

March 20, 2020

Dear

Stockholder:

On

behalf of the Board of Directors, we cordially invite you to attend the 2020 annual meeting of stockholders of Community Healthcare Trust Incorporated, a Maryland corporation (the

"Company"). The annual meeting will be held beginning at 8:00 a.m., Central time, on Thursday, May 7, 2020 at the

principal offices of the Company, located at 3326 Aspen Grove Drive, Suite 150, Franklin, Tennessee 37067. The formal notice of the annual meeting appears on the next page. At the annual

meeting, you will be asked to:

-

1.

-

Elect

five directors, each to serve a one-year term expiring in 2021;

-

2.

-

Vote

to approve, on a non-binding advisory basis, a resolution approving the Company's compensation of its named executive officers;

-

3.

-

Vote

to approve, on a non-binding advisory basis, the frequency of a non-binding advisory vote on executive compensation;

-

4.

-

Ratify

the appointment of BDO USA, LLP as our independent registered public accountants for 2020; and

-

5.

-

Transact

such other business as may properly come before the annual meeting or any adjournment or postponement thereof.

The

accompanying proxy statement provides detailed information concerning the matters to be acted upon at the annual meeting. We urge you to review this proxy statement and each of the

proposals carefully. Your vote is very important. It is important that your views be represented at the annual meeting regardless of the number of shares of common stock you own or whether you are

able to attend the annual meeting in person.

On

March 20, 2020, we posted on the investor's relations page of our Internet website, http://investors.chct.reit, a copy of our

2020 proxy statement, proxy card and our annual report to stockholders. Also, on or around March 20, 2020, we mailed a notice (the "Notice") containing instructions on how to access our proxy

materials and vote online to our institutional stockholders who own our stock directly in their name and in the name of other stockholders.

You

may vote your shares on the Internet. If you request a paper copy of the proxy card or voting instruction form, we will mail you the paper copy and you may sign, date and mail the

accompanying proxy card or voting instruction form in the envelope provided with your proxy card. Instructions regarding the two methods of voting by proxy are contained on the Notice and on the proxy

card. As always, if you are the record holder of our stock, you may vote in person at the annual meeting. The accompanying proxy statement explains how to obtain driving directions to the meeting.

Table of Contents

On

behalf of our Board of Directors, I would like to express our appreciation for your continued interest in Community Healthcare Trust Incorporated.

|

|

|

|

|

|

|

Sincerely,

|

|

|

Timothy G. Wallace

Chairman of the Board, President, and

Chief Executive Officer

|

Important Notice Regarding the Availability of Proxy Materials for

the Stockholder Meeting to be held on May 7, 2020:

Community

Healthcare Trust Incorporated's 2020 proxy statement, proxy card and annual report to

stockholders are available at http://investors.chct.reit.

Table of Contents

Community Healthcare Trust Incorporated

3326 Aspen Grove Drive, Suite 150

Franklin, Tennessee 37067

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

|

|

|

|

|

TIME

|

|

8:00 a.m., Central Time, on Thursday, May 7, 2020

|

PLACE

|

|

Community Healthcare Trust Incorporated

3326 Aspen Grove Drive, Suite 150

Franklin, Tennessee 37067

|

ITEMS OF BUSINESS

|

|

1. To elect five directors, each to serve a one-year term expiring in 2021;

|

|

|

2. To vote to approve, on a non-binding advisory basis, a resolution approving the Company's compensation of its named executive officers;

|

|

|

3. To vote to approve, on a non-binding advisory basis, the frequency of a non-binding advisory vote on executive compensation;

|

|

|

4. To ratify the appointment of BDO USA, LLP as our independent registered public accountants for 2020; and

|

|

|

5. To transact such other business as may properly come before the annual meeting or any adjournment or postponement thereof.

|

RECORD DATE

|

|

You can vote if you are a stockholder of record as of the close of business on March 6, 2020.

|

ANNUAL REPORT

|

|

All of these documents are accessible on our Internet website, http://investors.chct.reit. You may request a paper copy of the proxy statement, the proxy

card, and our annual report to stockholders, which is not part of the proxy solicitation material.

|

PROXY VOTING

|

|

It is important that your shares be represented and voted at the annual meeting. You may vote your shares on the Internet or, if you request and receive written proxy materials, you may vote by signing,

dating and mailing the accompanying proxy card or voting instruction form in the envelope provided. Instructions regarding the two methods of voting are contained on the proxy card. The Notice has instructions regarding voting on the Internet. Any

proxy may be revoked at any time prior to its exercise at the annual meeting.

|

|

|

|

|

|

|

|

By Order of the Board of Directors,

|

|

|

|

|

|

|

W. Page Barnes

Secretary of

Community Healthcare Trust Incorporated

Franklin, Tennessee

March 20, 2020

|

Table of Contents

COMMUNITY HEALTHCARE TRUST INCORPORATED

PROXY STATEMENT

INDEX

Table of Contents

COMMUNITY HEALTHCARE TRUST INCORPORATED

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON THURSDAY, MAY 7, 2020

We are furnishing this proxy statement to the stockholders of Community Healthcare Trust Incorporated in connection with the solicitation of proxies by its Board

of Directors for use at the annual meeting of stockholders of Community Healthcare Trust Incorporated to be held at 8:00 a.m., Central time, on Thursday, May 7, 2020, at 3326 Aspen Grove

Drive, Suite 150, Franklin, Tennessee 37067, as well as in connection with any adjournments or postponements of the meeting. This solicitation is made by Community Healthcare Trust

Incorporated on behalf of our Board of Directors (also referred to as the "Board" in this proxy statement). "We," "our," "us" and the "Company" refer to Community Healthcare Trust Incorporated, a

Maryland corporation.

We

have elected to provide access to our proxy materials and annual report over the Internet through a "notice and access" model. Accordingly, we are sending a Notice of Internet

Availability of Proxy Materials (the "Notice") to our stockholders of record as of March 6, 2020. All stockholders will have the ability to access the proxy materials on the website referred to

in the Notice or to request a printed set of the proxy materials. Instructions on how to request a printed copy by mail or electronically may be found on the Notice and on the website referred to in

the Notice, including an option to request paper copies on an ongoing basis. On March 20, 2020, we intend to make this proxy statement available on the Internet and, on or around

March 20, 2020, we intend to mail the Notice to all stockholders entitled to vote at the annual meeting. We intend to mail this Proxy Statement, together with a proxy card, to those

stockholders entitled to vote at the annual meeting who have properly requested paper copies of such materials, within three business days of such receipt.

This

proxy statement, proxy card and our annual report to stockholders are available at http://investors.chct.reit. This website address

contains the following documents: the Notice, the proxy statement and proxy card sample, and the annual report to stockholders. You are encouraged to access and review all of the important information

contained in the proxy materials before voting.

QUESTIONS AND ANSWERS REGARDING THE 2020 ANNUAL MEETING OF

STOCKHOLDERS

Who is soliciting proxies from the stockholders?

Our Board of Directors is soliciting your proxy. The proxy provides you with the opportunity to vote on the proposals presented at the annual

meeting, whether or not you attend the annual meeting.

What will be voted on at the annual meeting?

Our stockholders will vote on four proposals at the annual meeting:

-

1.

-

The

election of five directors, who are each to serve a one-year term expiring in 2021;

-

2.

-

The

approval of, on a non-binding advisory basis, a resolution approving the Company's compensation of its named executive officers;

-

3.

-

The

approval of, on a non-binding advisory basis, the frequency of a non-binding advisory vote on executive compensation; and

-

4.

-

The

ratification of the appointment of BDO USA, LLP as our independent registered public accountants for 2020.

1

Table of Contents

Your

proxy will also give the proxy holders discretionary authority to vote the shares represented by the proxy on any matter, other than the above proposals, that is properly presented

for action at the annual meeting.

How will we solicit proxies, and who bears the cost of proxy solicitation?

Our directors, officers and employees may solicit proxies by telephone, mail, facsimile, via the Internet or by overnight delivery service.

These individuals do not receive separate compensation for these services. Finally, in accordance with the rules and regulations of the U.S. Securities and Exchange Commission (the "SEC"), we will

reimburse brokerage firms and other persons representing beneficial owners of our common stock for their reasonable expenses in forwarding solicitation materials to such beneficial owners.

Who can vote at the annual meeting?

Our Board of Directors has fixed the close of business on Friday, March 6, 2020, as the record date for our annual meeting. Only

stockholders of record on that date are entitled to receive notice of and vote at the annual meeting. As of March 6, 2020, our only outstanding class of securities was common stock, $0.01 par

value per share. On that date, we had 450,000,000 shares of common stock authorized, of which 21,906,352 shares were outstanding.

You

(if you, rather than your broker, are the record holder of our stock) can vote either in person at the annual meeting or by proxy, whether or not you attend the annual meeting. If

you would like to attend the annual meeting in person and need directions, please contact W. Page Barnes by e-mail at investorrelations@chct.reit or by telephone at 615-771-3052. You may vote your

shares on the Internet or, to the extent you request written proxy materials, by signing, dating and mailing the accompanying proxy card in the envelope provided. Instructions regarding the two

methods of voting by proxy are contained on the proxy card.

How many votes must be present to hold the annual meeting?

A quorum must be present to hold our annual meeting. The presence, in person or by proxy, of a majority of the votes entitled to be cast at the

annual meeting constitutes a quorum. Your shares, once represented for any purpose at the annual meeting, are deemed present for purposes of determining a quorum for the remainder of the meeting and

for any adjournment, unless a new record date is set for the adjourned meeting. This is true even if you abstain from voting with respect to any matter brought before the annual meeting. As of

March 6, 2020, we had 21,906,352 shares of

common stock outstanding; thus, we anticipate that the quorum for our annual meeting will be 10,953,177 shares.

How many votes does a stockholder have per share?

Our stockholders are entitled to one vote for each share held.

What is the required vote on each proposal?

Directors are elected by a plurality vote; the candidates up for election who receive the highest number of votes cast, up to the number of

directors to be elected, are elected. Stockholders do not have the right to cumulate their votes.

The

affirmative vote of a majority of the shares represented at the meeting and entitled to vote is required to approve, on an advisory basis, the say on pay vote. As an advisory vote,

this proposal is not binding upon us. However, the Compensation Committee of our Board of Directors, which is responsible for designing and administering our executive compensation program, values the

opinions

2

Table of Contents

expressed

by our stockholders and will consider the outcome of the vote when making future compensation decisions.

The

affirmative vote of a majority of the shares represented at the meeting and entitled to vote is required to approve, on an advisory basis, the frequency of future stockholder say on

pay votes. As an advisory vote, this proposal is not binding upon us. The Compensation Committee of our Board of Directors will consider the outcome of the vote when determining the frequency of

holding future stockholder say on pay votes.

The

proposal to ratify our appointment of BDO USA, LLP, or BDO, as our independent registered public accountants for 2020, is approved by our stockholders if the votes cast

favoring the ratification exceed the votes cast opposing the ratification.

How will the proxy be voted, and how are votes counted?

If you vote by proxy (either voting on the Internet or by properly completing and returning a paper proxy card that you receive upon requesting

written proxy materials), the shares represented by your proxy will be voted at the annual meeting as you instruct, including any adjournments or postponements of the meeting. If you return a signed

proxy card but no voting instructions are given, the proxy holders will exercise their discretionary authority to vote the shares represented by the proxy at the annual meeting and any adjournments or

postponements as follows:

-

1.

-

"FOR" the election of nominees Alan Gardner, Claire Gulmi, Robert Hensley, Lawrence Van Horn, and Timothy Wallace.

-

2.

-

"FOR" the resolution approving the compensation of the Company's named executive officers.

-

3.

-

"ANNUAL" vote on executive compensation.

-

4.

-

"FOR" the ratification of the appointment of BDO USA, LLP as our independent registered public accountants for

2020.

If

you hold your shares in broker's name (sometimes call "street name" or "nominee name"), you must provide voting instructions to your broker. If you do not provide instructions to your

broker, your shares will not be voted in any matter on which your broker does not have discretionary authority to vote, which generally includes non-routine matters. A vote that is not cast for this

reason is called a "broker non-vote." Broker non-votes will be treated as shares present for the purpose of determining whether a quorum is present at the annual meeting, but they will not be

considered present for

purposes of calculating the vote on a particular matter, nor will they be counted as a vote FOR or AGAINST a matter or as an abstention on the matter. Under the rules of the New York Stock Exchange

("NYSE"), which is the stock exchange on which our common stock is listed, the ratification of our appointment of our independent registered public accountants is considered a routine matter for

broker voting purposes, but the election of directors, the advisory (non-binding) vote on the compensation of our named executive officers, and the advisory (non-binding) vote on the frequency of

future stockholder votes on the compensation of our named executive officers are not considered routine. It is important that you instruct your broker as to how you wish to have your shares voted,

even if you wish to vote as recommended by the Board.

Can a proxy be revoked?

Yes. You can revoke your proxy at any time before it is voted. You revoke your proxy (1) by giving written notice to our Corporate

Secretary before the annual meeting, (2) by granting a subsequent proxy on the Internet, or (3) by delivering a signed proxy card dated later than your previous proxy. If you, rather

than your broker, are the record holder of your stock, a proxy can also be revoked by appearing in person and voting at the annual meeting. Written notice of the revocation of a proxy should be

delivered to the following address: W. Page Barnes, Community Healthcare Trust Incorporated, 3326 Aspen Grove Drive, Suite 150, Franklin, Tennessee 37067.

3

Table of Contents

PROPOSAL 1

ELECTION OF DIRECTORS

The persons listed below have been nominated by our Board of Directors to serve as directors for a one-year term expiring at the annual meeting

of stockholders occurring in 2021: Alan Gardner, Claire Gulmi, Robert Hensley, Lawrence Van Horn and Timothy Wallace. Each nominee has consented to serve on our Board of Directors. If any nominee were

to become unavailable to serve as a director, our Board of Directors may designate a substitute nominee. In that case, the persons named as proxies on the accompanying proxy card will vote for the

substitute nominee designated by our Board of Directors. The following lists each director nominated for election to serve as a director for a one-year term expiring at the annual meeting of

stockholders occurring in 2021, which includes a brief discussion of the experience, qualifications and skills that led us to conclude that such individual should be a member of our Board.

Qualifications of Directors

We believe that our Board of Directors consists of a diverse collection of individuals who possess the integrity, education, work ethic and

ability to work with others necessary to oversee our business effectively and to represent the interests of all stockholders, including the qualities listed below. We have attempted below to highlight

certain notable experience, qualifications and skills for each director nominee, rather than provide an exhaustive catalog of each and every qualification and skill that a director possesses. Each of

the nominees set forth below is currently serving as a director of the Company.

|

|

|

|

|

|

|

Name

|

|

Age

|

|

Background, Qualifications and Skills

|

|

Alan Gardner

|

|

66

|

|

Mr. Gardner retired from Wells Fargo in October 2015. Prior to his retirement, he was a senior relationship manager in healthcare corporate banking. He primarily covered national healthcare companies

with market capitalization exceeding $5 billion, generally in the pharmaceutical, medical device and healthcare services sectors. Mr. Gardner has over 26 years of corporate and investment banking experience, with 20 years covering

healthcare companies. Prior to joining Wells Fargo (Wachovia) in March 2004, Mr. Gardner was head of healthcare for FleetBoston Financial from 2003 to 2004 and was a managing director for Banc of America Securities from 1996 to 2003. During his

career, Mr. Gardner has led a number of significant financing transactions for leading public healthcare companies. Mr. Gardner previously served as board member and president of Omni Montessori School in Charlotte, North Carolina, as

Charlotte Chapter chair for the Impact Angel Network ("IAN"). IAN is managed by RENEW, LLC, an investment advisory and management consulting firm based in Addis Ababa, Ethiopia and Washington D.C. and on the board of directors at Christ Lutheran

Church in Charlotte, North Carolina. Mr. Gardner earned a B.S. and M.S. from Virginia Polytechnic Institute and State University and an M.B.A. in finance and accounting from the University of Rochester. Mr. Gardner is our lead independent

director, and Mr. Gardner's commercial banking, capital markets and healthcare industry experience makes him a valuable resource to our Board of Directors.

|

4

Table of Contents

|

|

|

|

|

|

|

Name

|

|

Age

|

|

Background, Qualifications and Skills

|

|

Claire Gulmi

|

|

66

|

|

Ms. Gulmi served as Executive Vice President and Chief Financial Officer of Envision Healthcare, a $7 billion public company, the largest owner/operator of ambulatory surgery centers in the

United States and a leading provider of hospital based physician services, until her retirement in October 2017. Ms. Gulmi continued to serve as an advisor to Envision until September 2018. Prior to Envision's merger with AmSurg Corp in 2016,

Ms. Gulmi served as Executive Vice President and Chief Financial Officer of AmSurg starting in 1994. She was a member of the Board of Directors of AmSurg from 2004 until the merger in 2016. From 2015 to 2017, Ms. Gulmi served on the Board

of Directors and as the audit committee chair of Air Methods Corp, a $1.5 billion public company and the largest provider of air medical emergency transport services in the U.S. From 2001 to 2015 she served on the advisory board of the Bank of

Nashville. Ms. Gulmi has a BBA in Accounting and Finance from Belmont University. Ms. Gulmi is the past board chair of the YWCA of Nashville, serves on the boards of the Frist Center for the Visual Arts and Nashville Public Radio. She has

served as board chair for the Bethlehem Centers of Nashville and has served on the boards of the Girl Scouts, the American Heart Association and All About Women. Ms. Gulmi has been named by the Nashville Business Journal as one of its Healthcare

100, was one of the 2007 winners of the Nashville Business Journal's Women of Influence and in 2011 received the Nashville Business Journal's CFO Lifetime Achievement Award. Ms. Gulmi's over 30 years of experience in corporate finance,

accounting and healthcare makes her a valuable resource to our Board of Directors.

|

Robert Hensley

|

|

62

|

|

Mr. Hensley has more than 35 years of experience serving public and privately-held companies across a range of industries, including healthcare, insurance, real estate and private equity

capital funds. Mr. Hensley is also the founder of a private publishing company and the principal owner of two real estate and rental property development companies. Mr. Hensley was an audit partner with Ernst & Young from 2002 to

2003. Previously, he was with Arthur Andersen, where he served as an audit partner from 1990 to 2002 and was the managing partner of their Nashville office from 1997 to 2002. His significant experience includes mergers and acquisitions,

identification of enterprise and healthcare industry risks, corporate governance and forensic investigations and disputes. Since 2006, Mr. Hensley has served as a senior advisor to the healthcare and transaction advisory services groups of

Alvarez and Marsal, LLC ("A&M"). Mr. Hensley serves on the board of directors for Diversicare Healthcare Services, Inc. Mr. Hensley previously served as a director of Capella Healthcare from 2008 to 2015, Greenway Medical

Technologies from 2011 to 2013, HealthSpring, Inc. from 2006 to 2012 and Comsys IT Partners, Inc. and Spheris, Inc. from 2006 to 2010. Mr. Hensley earned a B.S. in accounting and a Master's of Accountancy from the University of

Tennessee and is a Certified Public Accountant. Mr. Hensley's financial accounting, healthcare industry and transactional experience makes him a valuable resource to our Board of Directors.

|

5

Table of Contents

|

|

|

|

|

|

|

Name

|

|

Age

|

|

Background, Qualifications and Skills

|

|

Lawrence Van Horn

|

|

52

|

|

Professor Van Horn has been an associate professor of Economics and Management and the Executive Director of Health Affairs at the Vanderbilt University Owen Graduate School of Management ("Owen") since

2006. Professor Van Horn is a leading expert and researcher on healthcare management and economics. His current research interests include nonprofit conduct, governance and objectives in healthcare markets and the measurement of healthcare outcomes

and productivity. His research on healthcare organizations, managerial incentives in nonprofit hospitals and the conduct of managed care firms has appeared in leading publications. Professor Van Horn consults for national consulting firms, providers,

managed care organizations, and pharmaceutical firms. Professor Van Horn also holds faculty appointments in the Vanderbilt University School of Medicine and Law School. Prior to his tenure at Owen, from 1996 to 2006, Professor Van Horn served as an

associate professor of economics and management at the William E. Simon Graduate School of Business at the University of Rochester where he was responsible for their graduate programs in health administration. Professor Van Horn began serving on the

board of directors of Quorum Health Corporation in January 2016. Professor Van Horn holds a Ph.D. from the University of Pennsylvania's Wharton School and a Master's in Business Administration, a Master's in Public Health and a B.A. from the

University of Rochester. Professor Van Horn's extensive knowledge and research into healthcare industry economics and governance as well as his unique experience with healthcare decision makers and business executives nationwide regarding healthcare

policy make him a valuable resource to our Board of Directors.

|

Timothy Wallace

|

|

61

|

|

Mr. Wallace has served as our Chairman, Chief Executive Officer and President since the formation of our Company in March 2014. Prior to founding our Company, from 2003 to 2014, Mr. Wallace

was co-founder, President and majority owner of Athena Funding Partners, LLC and related entities which were established in 2002 to provide financing solutions to the higher education industry for on-campus student housing facilities mostly in

rural areas. From 1993 to 2002, Mr. Wallace was a co-founder and Executive Vice President of Healthcare Realty Trust (NYSE: HR) ("HR"). Between HR's initial public offering in 1993 and his departure from HR in 2002, Mr. Wallace was integral

in helping to grow HR from $2,000 to over $2 billion in asset value. Mr. Wallace remained as a paid consultant to HR and was subject to a non-compete until 2008. Mr. Wallace was a senior manager at Ernst & Young from 1988 to

1993. Mr. Wallace began his career in 1980 with Arthur Andersen & Co. Mr. Wallace holds a Bachelor of Science in Business Administration and Masters in Business Administration, both from Western Kentucky University.

Mr. Wallace was selected to serve as Chairman because of his past public company experience, his experience in real estate, including acquiring healthcare real estate, and his role as Chief Executive Officer and President of our

Company.

|

Each

of the persons listed above has been nominated by our Board of Directors to serve as directors for a one-year term expiring at the annual meeting of stockholders occurring in 2021.

Each

6

Table of Contents

nominee

has consented to serve on our Board of Directors. If any nominee were to become unavailable to serve as a director, our Board of Directors may designate a substitute nominee. In that case, the

persons named as proxies on the accompanying proxy card will vote for the substitute nominee designated by our Board of Directors.

Required Vote

Directors are elected by a plurality vote; the nominees who receive the highest number of votes cast, up to the number of directors to be

elected in that class, are elected.

Our Board of Directors unanimously recommends a vote "FOR" the election of each of the five

nominees for director to the Board of Directors.

7

Table of Contents

CORPORATE GOVERNANCE

Board Leadership Structure

Our Board of Directors currently consists of the following five directors: Alan Gardner, Claire Gulmi, Robert Hensley, Lawrence Van Horn and

Timothy Wallace, each for a one-year term. Our Board has affirmatively determined that each of Alan Gardner, Claire Gulmi, Robert Hensley, and Lawrence Van Horn is an "independent director" as defined

under the listing rules of the

NYSE, Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and the Company's Corporate Governance Guidelines.

The

Board considered the relationships between our directors and the Company when determining each director's status as an "independent director" under the listing rules of the NYSE,

Rule 10A-3 of the Exchange Act and the Company's Corporate Governance Guidelines, including the relationships listed below under "Certain Relationships and Related Party Transactions" The Board

determined that these relationships did not affect any director's status as an "independent director." Furthermore, we are not aware of any family relationships between any director, executive officer

or person nominated to become a director or executive officer.

Timothy

Wallace, our President and Chief Executive Officer, serves as Chairman of the Board of the Company, while Alan Gardner serves as "Lead Independent Director" of our Board. The

members of the Board who meet the definition of "independent director" under the listing rules of the NYSE select our lead independent director.

Mr. Wallace

serves as our Chairman because we believe this board structure results in a single voice speaking for the Company and presents a unified and clear chain of command to

execute our strategic initiatives and business plans. Also, the Chairman of the Board is expected to manage the Board in performing its duties and lead Board discussion. As our President and Chief

Executive Officer, Mr. Wallace is ideally positioned to provide insight on the current status of our overall operations, our future plans and prospects and the risks that we face. Thus, the

individual with the most knowledge about us and our operations is responsible for leading the Board's discussions. The Board retains the authority to separate the positions of chairman and chief

executive officer if it finds that the Board's responsibilities can be better fulfilled with a different structure.

Mr. Gardner

serves as our Lead Independent Director and provides an independent counterbalance to the Chairman, ensuring that all of our directors' concerns are addressed and

otherwise facilitating robust discussions among the entire Board (which, as noted above, is comprised almost entirely of "independent directors"). In terms of Board leadership, we view the lead

independent director as essentially a co-equal with the Chairman of the Board. Mr. Gardner has been a director since 2015 and was the second director to join the Board following

Mr. Wallace, which we believe adds weight to his independent voice on the Board. Also, at each meeting of our Board, Mr. Gardner leads the Board in an executive session (that is, a

meeting of only those directors who are "independent directors" under the listing rules of the NYSE) to discuss matters outside the presence of the Chairman and management. Our lead independent

director is selected on an annual basis by a majority of the independent directors then serving on our Board of Directors.

Our

Lead Independent Director Charter sets forth a complete description of the lead independent director's responsibilities. In general, the lead independent director is responsible

for:

-

•

-

serving as liaison between the Chairman and our other independent directors;

-

•

-

calling and presiding at executive sessions of the independent directors;

-

•

-

serving as the focal point of communication to the Board of Directors regarding management plans and initiatives;

8

Table of Contents

-

•

-

ensuring that the management adheres to the Board of Directors' oversight role over management operations;

-

•

-

providing the medium for informal dialogue with and between independent directors, allowing for free and open communication within that group;

and

-

•

-

serving as the communication conduit for third parties who wish to communicate with our Board of Directors.

In

addition to these specific duties, we expect the lead independent director to familiarize himself with the Company and the real estate investment trust and healthcare industries in

general. He also is expected to keep abreast of developments in the principles of sound corporate governance.

The Board's Role in Risk Oversight

One of the key functions of our Board of Directors is to provide oversight of our risk management process. Our Board of Directors administers

this oversight function directly, with support from its three standing committees—the Audit Committee, the Compensation Committee, and the Corporate Governance Committee—each

of which addresses risks specific to their respective areas of oversight. In particular, our Audit Committee has the responsibility to consider and discuss our major financial risk exposures and the

steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The Audit

Committee also monitors compliance with legal and regulatory requirements and has oversight of the performance of our internal audit function. Our Compensation Committee assesses and monitors whether

any of our compensation policies and programs has the potential to encourage excessive risk-taking. Our Corporate Governance Committee monitors the effectiveness of our corporate governance

guidelines, including whether they are successful in preventing illegal or improper liability-creating conduct.

Each

committee meets regularly with management to assist it in identifying all of the risks within such committee's areas of responsibility and in monitoring and, where necessary, taking

appropriate action to mitigate the applicable risks. At each Board meeting, the committee chairman of each committee that met prior to such Board meeting provides a report to the full Board on issues

related to such committee's risk oversight duties, as applicable. To the extent that any risks reported to the full Board need to be discussed outside the presence of management, the Board meets in

executive session to discuss these issues.

We

believe the Board's approach to fulfilling its risk oversight responsibilities complements its leadership structure. In his capacity as Chairman of the Board, Mr. Wallace

reviews whether Board committees are addressing their risk oversight duties in a comprehensive and timely manner. Since he is also our Chief Executive Officer, Mr. Wallace is able to assist

these committees in fulfilling their duties by (1) requiring that our management team provide these committees with all requested reports and other information as well as with access to our

employees and (2) implementing recommendations of the various Board committees to mitigate risk. At the same time, Mr. Gardner, as our lead independent director, is able to lead an

independent review of the risk assessments developed by management and reported to the committees.

Our

Board held five meetings during 2019. In 2019, our directors attended all of our Board meetings and at least 75% of the meetings of the committees on which they served. The members

who are "independent directors" met in executive session four times during 2019.

We

do not have a policy requiring director attendance at our annual stockholder meeting. Mr. Wallace and Ms. Gulmi were the only directors of the Company to attend our 2019

annual stockholder meeting.

9

Table of Contents

Committees of the Board of Directors

Our Board of Directors has three standing committees: an Audit Committee, a Compensation Committee and a Corporate Governance Committee. The

principal functions of each committee are described below. We currently comply, and we intend to continue to comply, with the listing requirements and other rules and regulations of the NYSE and each

of these committees are comprised exclusively of independent directors. Additionally, our Board of Directors may from time to time establish certain other committees to facilitate the management of

our Company.

Audit Committee

Our Audit Committee consists of Mr. Gardner, Ms. Gulmi, and Mr. Hensley, all of whom are independent directors, with

Mr. Hensley serving as the chairman. Ms. Gulmi and Mr. Hensley each qualify as an "audit committee financial expert" as that term is defined by the applicable SEC regulations and

NYSE corporate governance listing standards. Our Board of Directors has determined that each of the Audit Committee members is "financially literate" as that term is defined by the NYSE corporate

governance listing standards. We have adopted an Audit Committee Charter, which details the principal functions of the Audit Committee, including oversight related to:

-

•

-

our accounting and financial reporting processes;

-

•

-

the integrity of our consolidated financial statements and financial reporting process;

-

•

-

our system of disclosure controls and procedures and internal control over financial reporting;

-

•

-

our compliance with financial, legal and regulatory requirements;

-

•

-

the evaluation of the qualifications, independence and performance of our independent registered public accounting firm;

-

•

-

reviewing the adequacy of our Audit Committee Charter on an annual basis;

-

•

-

the performance of our internal audit function; and

-

•

-

our overall risk profile.

The

Audit Committee is also responsible for engaging an independent registered public accounting firm, reviewing with the independent registered public accounting firm the plans and

results of the audit engagement, approving professional services provided by the independent registered accounting firm, including all audit and non-audit services, reviewing the independence of the

independent registered public accounting firm, considering the range of audit and non-audit fees and reviewing the adequacy of our internal accounting controls.

The

Audit Committee met six times in 2019. A copy of the charter of our Audit Committee is available on the investor relations webpage of our website, http://investors.chct.reit.

Compensation Committee

Our Compensation Committee consists of Mr. Gardner, Ms. Gulmi, and Mr. Van Horn, all of whom are "independent directors" as

defined in NYSE Rule 303A.02, with Ms. Gulmi serving as chairperson. Further, each member of the Compensation Committee is a "non-employee director" as defined in Rule 16b-3

promulgated under the Exchange Act. We have adopted a Compensation Committee Charter, which details the principal functions of the Compensation Committee,

including:

-

•

-

reviewing and recommending to our Board of Directors on an annual basis the corporate goals and objectives relevant to our chief executive

officer's compensation, evaluating our chief executive officer's performance in light of such goals and objectives and determining and approving the remuneration of our chief executive officer based

on such evaluation;

10

Table of Contents

-

•

-

reviewing and recommending to our Board of Directors the compensation, if any, of all of our other executive officers;

-

•

-

evaluating our executive compensation policies and plans;

-

•

-

assisting management in complying with our proxy statement and annual report disclosure requirements;

-

•

-

administering our incentive plans;

-

•

-

reviewing and recommending to our Board of Directors policies with respect to incentive compensation and equity compensation arrangements;

-

•

-

reviewing the competitiveness of our executive compensation programs and evaluating the effectiveness of our compensation policy and strategy

in achieving expected benefits to us;

-

•

-

evaluating and overseeing risks associated with compensation policies and practices;

-

•

-

reviewing and recommending to our Board of Directors the terms of any employment agreements, severance arrangements change in control

protections and any other compensatory arrangements for our executive officers;

-

•

-

reviewing the adequacy of its Compensation Committee Charter on an annual basis;

-

•

-

producing a report on executive compensation to be included in our annual proxy statement as required; and

-

•

-

reviewing, evaluating and recommending changes, if appropriate, to the remuneration for directors.

The

Compensation Committee met four times in 2019. A copy of the charter of our Compensation Committee is available on the investor relations webpage of our website, http://investors.chct.reit.

Corporate Governance Committee

Our Corporate Governance Committee consists of Messrs. Van Horn, Hensley and Gardner, all of whom are "independent directors" as defined

in NYSE Rule 303A.02, with Mr. Van Horn serving as chairman. We have adopted a Corporate Governance Committee charter, which details the principal functions of the Corporate Governance

Committee, including:

-

•

-

identifying, evaluating and recommending to the full Board of Directors qualified candidates for election as directors and recommending

nominees for election as directors at the annual meeting of stockholders;

-

•

-

developing and recommending to the Board of Directors corporate governance guidelines and implementing and monitoring such guidelines;

-

•

-

reviewing and making recommendations on matters involving the general operation of the Board of Directors, including Board size and

composition, and committee composition and structure;

-

•

-

evaluating and recommending to the Board of Directors nominees for each committee of the Board of Directors;

-

•

-

annually facilitating the assessment of the Board of Directors' performance as a whole and of the individual directors, as required by

applicable law, regulations and the NYSE corporate governance listing standards;

-

•

-

considering nominations by stockholders of candidates for election to our Board of Directors;

-

•

-

considering and assessing the independence of members of our Board of Directors;

11

Table of Contents

-

•

-

developing, as appropriate, a set of corporate governance principles, and reviewing and recommending to our Board of Directors any changes to

such principles;

-

•

-

periodically reviewing our policy statements; and

-

•

-

reviewing, at least annually, the adequacy of its Corporate Governance Committee Charter.

When

evaluating director candidates, the Corporate Governance Committee's objective is to craft a Board composed of individuals with a broad and diverse mix of backgrounds and

experiences and possessing, as a whole, all of the skills and expertise necessary to guide a company like us in the prevailing business environment. The Corporate Governance Committee uses the same

criteria to assess all candidates for director, regardless of who proposed the candidate. The Corporate Governance Committee considers whether the candidate possesses the following qualifications and

qualities:

-

•

-

independence for purposes of the NYSE rules and SEC rules and regulations, and a record of honest and ethical conduct and personal integrity;

-

•

-

experience in the healthcare, real estate and/or public real estate investment trust industry or in finance, accounting, legal or other

professional disciplines;

-

•

-

ability to represent the interests of all of our stockholders; and

-

•

-

ability to devote time to the Board of Directors and to enhance their knowledge of our industry.

The

Corporate Governance Committee met one time in 2019. A copy of the charter of the Corporate Governance Committee is available on the investor relations webpage of our website, http://investors.chct.reit. Our Corporate Governance Guidelines and Code of Ethics and Business Conduct are also available on the investor relations

webpage of our website, http://investors.chct.reit. If we make any substantive amendment to the Code of Ethics and Business Conduct or grant any waiver,

including any implicit waiver, from a provision of the Code of Ethics and Business Conduct to certain executive officers, we are obligated to disclose the nature of such amendment or waiver, the name

of the person to whom any waiver was granted, and the date of waiver on our website or in a report on Form 8-K filed with the SEC. Since the Company's inception, there have been no such

amendments or waivers.

The

current members of the Board propose nominees for election to the Board. In addition, the Corporate Governance Committee will also consider candidates that stockholders and others

recommend. Stockholder recommendations should be addressed to: W. Page Barnes, Corporate Secretary, 3326 Aspen Grove Drive, Suite 150, Franklin, Tennessee 37067. Your recommendations must be

submitted to us no earlier than October 21, 2020, nor later than 5:00 p.m., Eastern Time, on November 20, 2020, for consideration as a possible nominee for election to the Board

at our 2021 annual meeting.

The

Board has not adopted a formal procedure that you must follow to send communications to it, but it does have informal procedures, described below, which it believes adequately

facilitate stockholder and other interested party communications with the Board. Stockholders and other interested parties can send communications to the Board by contacting W. Page Barnes, our

Corporate Secretary, in one of the following ways:

-

•

-

By writing to Community Healthcare Trust Incorporated, 3326 Aspen Grove Drive, Suite 150, Franklin, Tennessee, 37067, Attention:

Corporate Secretary;

-

•

-

By e-mail to investorrelations@chct.reit; or

-

•

-

By phone at 615-771-3052.

12

Table of Contents

If

you request information or ask questions that can be more efficiently addressed by management, Mr. Barnes will respond to your questions instead of the Board. He will forward

to the Audit Committee any communication concerning employee fraud or accounting matters and will forward to the full Board any communication relating to corporate governance or those requiring action

by the Board of Directors. A stockholder may communicate directly with Mr. Gardner, the lead independent director, by sending a confidential letter addressed to his attention at 3326 Aspen

Grove Drive, Suite 150, Franklin, Tennessee, 37067.

Director Compensation

The Compensation Committee recommends the compensation for our non-employee directors; our full Board approves or modifies the recommendation.

Any modifications are implemented after the annual meeting. Directors who are also employees, currently only Mr. Wallace, receive no additional compensation for their service as a director, but

are reimbursed for any direct board related expenses. Annual compensation of non-employee directors may be a combination of cash and restricted stock at levels set by the Compensation Committee.

Cash compensation

Each non-employee director receives an annual retainer, and chairpersons of our board committees and the lead independent director receives

additional annual retainers. The annual retainers are payable after each annual meeting of our stockholders. The current annual cash retainer for service on our Board of Directors is $40,000 but may

be adjusted by the Compensation Committee based on an evaluation of director compensation at peer companies. Additionally, the chairpersons of the Audit Committee, the Compensation Committee and the

Corporate Governance Committee receive additional annual retainers of $15,000, $10,000 and $10,000, respectively, and our lead independent director receives an additional annual retainer of $17,500.

The Compensation Committee has not retained an independent compensation consultant to advise it with respect to director compensation of the Company since 2018. The most recent time the Board

increased the compensation of our non-employee directors for their service on, and in positions on Committees of, the Board of Directors was in February 2018, effective in May 2018.

Each

year, non-employee directors may elect to acquire shares of restricted stock with all or a portion of each of their retainers. These shares are issued 10 business days following the

date of our annual meeting of stockholders. The number of shares of restricted stock to be acquired is determined by dividing the total amount of annual retainer the director elected to use to acquire

shares by the average price of shares of common stock for the immediately preceding 10 trading days. Pursuant to the Company's Amended and Restated Alignment of Interest Program (the "Amended and

Restated Alignment of Interest Program"), each director who makes an election to acquire shares of restricted stock with all or a portion of their retainers will be awarded additional shares, at no

additional cost to the director, according to the following multiples:

|

|

|

|

|

|

|

Duration of Restriction Period

|

|

Restriction

Multiple

|

|

|

1 year

|

|

|

0.2x

|

|

|

2 years

|

|

|

0.4x

|

|

|

3 years

|

|

|

0.6x

|

|

Accordingly,

for example, if a non-employee director elects to acquire shares of restricted stock in lieu of cash compensation that is equivalent in value to 1,000 shares of common stock

and the director elected a three-year restriction period for such restricted stock, the non-employee director would receive the 1,000 shares of restricted stock plus an award of 600 shares of

restricted common stock for electing to subject his or her restricted stock to a three-year restriction period, resulting in a total

13

Table of Contents

receipt

of 1,600 shares of restricted stock, all of which would be subject to a three-year cliff vesting schedule whereby no shares vest until the third anniversary of the date of grant, at which time

100% of the shares of restricted stock will vest.

The

restriction period subjects the shares purchased by the director and the additional shares awarded by the Company to the risk of forfeiture in the event that a director voluntarily

resigns or is removed by the stockholders prior to the vesting of these shares. All unvested shares will be forfeited if such non-employee director voluntarily resigns or is removed by the

stockholders for any reason prior to vesting. During the restriction periods described above, the restricted shares may not be sold, assigned, pledged, or otherwise transferred. Subject to the risk of

forfeiture and transfer restrictions, non-employee directors have all rights as stockholders with respect to restricted shares, including the right to vote and receive dividends or other distributions

on such shares.

Stock Awards

Each non-employee director is also awarded an annual grant of shares of restricted stock. Our goal is to have a minimum of 60% to 75% of the

aggregate total compensation for our non-employee directors paid in the form of restricted stock having a restriction period of up to three years. Directors are not entitled to receive additional

shares through a restriction multiple for these awards.

For

2019, each non-employee director received an annual equity award of restricted stock with an aggregate market value of $75,000 at the conclusion of the 2019 annual stockholders'

meeting. These shares are subject to a three-year cliff vesting schedule whereby no shares vest until the third anniversary of the date of grant, at which time 100% of the shares of restricted stock

will vest.

2019 Director Compensation

The following table sets forth compensation paid during 2019 to each of our non-employee directors:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fees Earned or Paid

|

|

|

|

|

|

|

|

|

Name(1)

|

|

Fees Paid

in Cash

|

|

Fees Paid

in Stock(2)

|

|

Stock

Awards(3)

|

|

All Other

Compensation

|

|

Total

|

|

|

Alan Gardner

|

|

$

|

—

|

|

$

|

57,500

|

|

$

|

112,148

|

|

$

|

—

|

|

$

|

169,648

|

|

|

Claire Gulmi

|

|

$

|

—

|

|

$

|

50,000

|

|

$

|

107,322

|

|

$

|

—

|

|

$

|

157,322

|

|

|

Robert Hensley

|

|

$

|

15,000

|

|

$

|

40,000

|

|

$

|

100,848

|

|

$

|

—

|

|

$

|

155,848

|

|

|

Lawrence Van Horn

|

|

$

|

—

|

|

$

|

50,000

|

|

$

|

107,322

|

|

$

|

—

|

|

$

|

157,322

|

|

-

(1)

-

Mr. Wallace

is our other director and is also a full-time employee whose compensation is discussed below under the section titled "Executive Officers" and

"Summary Compensation Table." Mr. Wallace receives no additional compensation for his service as a director.

-

(2)

-

This

column represents non-employee director annual retainer and additional annual retainer amounts, approximately 93% of which was paid in shares of our restricted

common stock in lieu of cash. All of the shares are subject to a three-year cliff vesting schedule whereby no shares vest until the third anniversary of the date of grant, at which time 100% of the

shares of restricted stock will vest, subject to the director's continuing service as a director of the Company.

-

(3)

-

Represents

the grant date fair value computed in accordance with FASB ASC Topic 718 of awards of restricted stock to the non-employee directors under the 2014

Incentive Plan, or the 2019 Director Awards. The dollar value of the 2019 Director Awards was based upon the grant date price of our common stock, which was $37.18 on May 16, 2019. This column

also includes the amount of the grant date value of the shares received in accordance with restriction multiples with respect to the deferral of director retainer amounts based on the price of our

common stock of

14

Table of Contents

$39.13

on the determination date, May 31, 2019. All of the shares are subject to a three-year cliff vesting schedule whereby no shares vest until the third anniversary of the date of grant, at

which time 100% of the shares of restricted stock will vest, subject to the director's continuing service as a director of the Company.

We

also reimburse our directors for expenses they incur in connection with their service on our Board, such as director education, travel and lodging expenses.

15

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis describes the material elements of the Company's named executive officer compensation program and

analyzes the compensation decisions made for our executive officers included in the Summary Compensation Table beginning on page 31 (the "named executive officers").

2019 Named Executive Officers

Our named executive officers for 2019 were:

Timothy

Wallace—Chief Executive Officer and President

David

Dupuy—Chief Financial Officer and Executive Vice President

Page

Barnes—Chief Operating Officer and Executive Vice President

Leigh

Ann Stach—Chief Accounting Officer and Executive Vice President

Because

only four individuals served as our executive officers at any time during 2019, we have only four named executive officers for 2019.

2019 Highlights

We believe that 2019 was a successful year for the Company. Our named executive officers continued to execute our business plan during 2019 and

built upon our operating and financial performance results achieved since we became a publicly traded company after our initial public offering in May 2015.

Our

operating and financial performance highlights in 2019 included:

-

•

-

Achieving net income of $0.37 per diluted share, FFO of $1.67 per diluted share and AFFO of $1.77 per diluted share, compared to net income of

$0.19 per diluted share, FFO of $1.53 per diluted share and AFFO of $1.62 per diluted share in 2018;

-

•

-

Acquiring fifteen (15) properties for an aggregate purchase price of approximately $152.0 million with estimated yields ranging

from 9.02% to 11.00%. These properties were approximately 99.5% leased with lease expirations through 2034;

-

•

-

Raising gross proceeds of $107.3 million under our at-the-market offering program;

-

•

-

Maintaining low leverage levels with a debt-to-total capitalization ratio (debt plus stockholders' equity plus accumulated depreciation) of

approximately 31.1%; and

-

•

-

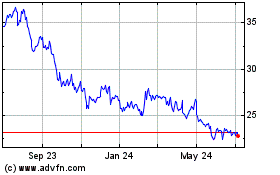

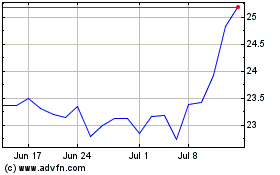

Generating a year-over-year total stockholder return of approximately 48% (versus approximately 27% for the NAREIT All Equity REIT Index) for

the year ended December 31, 2019.

Reconciliations

of FFO and AFFO are provided in Appendix A beginning on page 46 of this Proxy Statement.

Comprehensive Compensation Policy

We believe that the compensation of our executive officers aligns their interests with those of the stockholders in a way that encourages

prudent decision-making, links compensation to our overall performance, provides a competitive level of total compensation necessary to attract and

retain talented and experienced executive officers and motivates the executive officers to contribute to our success.

16

Table of Contents

All

of our executive officers are eligible to receive performance-based compensation under the 2014 Incentive Plan as amended by Amendment No. 1 to the 2014 Incentive Plan,

Amendment No. 2 to the 2014 Incentive Plan, and Amendment No. 3 to the 2014 Incentive Plan (as so amended, our 2014 Incentive Plan).

We

use a combination of allowing the acquisition shares of restricted stock in connection with grants of restricted stock as the primary means of delivering long-term compensation to our

executive officers. Shares of restricted stock are forfeitable until the lapse of the applicable restrictions. We believe that restricted stock with long vesting periods align the interests of

executive officers and stockholders and provide strong incentives to our executive officers to achieve long-term growth in our business, grow the value of our common stock and maintain or increase our

dividends.

The

executive officers personally benefit from these efforts through their restricted stock, which pay dividends at the same rate as unrestricted stock and increase in value as the value

of unrestricted stock increases. However, the Company's executive officers essentially have to earn this equity compensation twice: the first time through their efforts to meet the initial performance

criteria necessary to receive the restricted stock; and the second time by continued service through the at-risk vesting period.

Substantially

all of our executive officers' compensation is tied to the value of our common stock since the officers have elected to receive restricted stock in lieu of cash

compensation. Therefore, if we have superior long-term operating performance, our executive officers, through their restricted stock, will eventually receive more value, due to increases in the price

of our common stock, than if they had been paid in cash. Conversely, if we have inferior long-term operating performance, our executive officers through their restricted stock will eventually receive

less value, due to decreases in the price of our common stock, than if they had been paid in cash.

Our

Compensation Committee determines the restrictions for each award granted pursuant to the 2014 Incentive Plan. Restrictions on the restricted stock may include time-based

restrictions, the achievement of specific performance goals or the occurrence of a specific event. Vesting of restricted stock will generally be subject to cliff vesting periods ranging from three to

eight years and will be conditioned upon the participant's continued employment, among other restrictions that may apply.

If

the performance goals are not achieved or the time-based restrictions do not lapse within the time period provided in the award agreement, the participant will forfeit his or her

unvested restricted stock.

Compensation Methodology

Compensation Committee's Governance

The Board established the Compensation Committee to carry out the Board's responsibilities to administer our compensation programs. The

Compensation Committee has the final decision-making authority for the compensation of our executive officers. The Compensation Committee operates under a written charter adopted by the Compensation

Committee and approved by the Board. The charter is available in the investor relations section of our website (http://investors.chct.reit).

Our

Compensation Committee has independent authority to engage outside consultants and obtain input from external advisers as well as our management team or other employees.

The

Compensation Committee may retain any independent counsel, experts or advisors that it believes to be desirable and appropriate. The Compensation Committee may also use the services

of the Company's regular legal counsel or other advisors to the Company. The Compensation Committee undertakes an independent assessment prior to retaining or otherwise selecting any independent

counsel, compensation consultant, search firm, expert or other advisor that will provide advice to it,

17

Table of Contents

taking

such factors into account and as otherwise may be required by the NYSE from time to time. On at least an annual basis, the Compensation Committee evaluates whether any work by any compensation

consultant to it raised any conflict of interest.

The

Compensation Committee retained FPL Associates ("FPL") as its independent compensation consultant in 2019 to advise it regarding market trends and practices in

executive compensation and with respect to specific compensation decisions. The Compensation Committee expects to meet at least annually with a compensation consultant to discuss executive

compensation trends. The consultant may also attend Compensation Committee meetings periodically. FPL met with the chair of the Compensation Committee in 2019, during and in which it provided a review

of recent trends and developments in executive compensation practices within the Company's industry and in general. FPL received a fee of $20,000 for its compensation consulting services provided to

the Compensation Committee in 2019 with respect to executive compensation.

Our

Chief Executive Officer typically attends Compensation Committee meetings, except for executive sessions (unless specifically requested by the Compensation Committee to be present).

No executive officer attends an executive session at which his or her compensation is considered. Our Chief Executive Officer may provide recommendations with respect to compensation for the executive

officers other than himself. The Compensation Committee considers these recommendations, but may approve, reject or adjust them as it deems appropriate.

Compensation Risk Assessment

The Compensation Committee believes its compensation policies and practices do not promote excessive risk-taking and are not likely to have a

material adverse effect on the Company. In particular, the Compensation Committee believes that the following factors mitigate excessive risk-taking by the named executive

officers:

-

•

-

The use of restricted stock, with long vesting periods during which the stock cannot be sold, provides an incentive to the named executive

officers to make decisions that contribute to long-term growth of the Company, the stability of NOI, and the delivery of dividends to stockholders.

-

•

-

The maximum potential cash and stock incentive payments are capped at levels such that total compensation would remain comparable within the

peer group.

-

•

-

The Compensation Committee retains broad discretionary authority to adjust annual awards and payments, which further mitigates risks associated

with the Company's compensation plans and policies.

Peer Group

For 2019, the Compensation Committee, based on FPL's recommendation, used the companies listed below as the peer group against

which to measure the Company's relative one-year and three-year TSR performance. The peer group is selected each year in accordance with the Amended and Restated Executive Officer Incentive Program.

The Amended and Restated Executive Officer Incentive Program provides a mechanism for determining the peer group, which the Compensation Committee believes provides for the most closely comparable

companies with respect to market capitalization and appropriate pay levels. In determining our peer group, all publicly-traded equity REITs are sorted by market capitalization. Additional criteria

used can include industry segment, asset base, externally/internally managed and years of operating history. The Compensation Committee, based on FPL's recommendations, makes

discretionary adjustments to include or exclude companies in

18

Table of Contents

the

peer group to capture the Company's closest competitors and to adjust for events such as mergers that might occur during the period. The following companies comprised the peer group for 2019:

|

|

|

|

|

Physicians Realty Trust

|

|

One Liberty Properties, Inc.

|

National Health Investors, Inc.

|

|

CatchMark Timber Trust, Inc.

|

LTC Properties, Inc.

|

|

MedEquities Realty Trust, Inc.

|

CareTrust REIT, Inc.

|

|

Sotherly Hotels, Inc.

|

Easterly Government Properties, Inc.

|

|

Wheeler Real Estate Investment Trust, Inc.

|

City Office REIT, Inc.

|

|

Plymouth Industrial REIT, Inc.

|

The

Compensation Committee determines the peer group each year and compares the compensation of the peer group for the year preceding the applicable year.

Material Components of Compensation

Elements of Pay

In 2019, the Company's compensation program for its named executive officers consisted of the following key

elements:

-

•

-

Annual base salaries;

-

•

-

Elective acquisition of restricted shares with corresponding restricted share grants, allowing named executive officers to increase their

ownership portion in the Company;

-

•

-

Performance based awards of cash, stock, or a combination of both; and

-

•

-

Perquisites and retirement benefits.

Annual Base Salary

Each of our named executive officers has an employment agreement that establishes his or her base salary. Adjustments to base salary are

determined by the Compensation Committee and are based upon a review of a variety of factors, including:

-

•

-

individual and Company performance, measured against quantitative and qualitative goals, such as growth, asset quality and other matters;

-

•

-

duties and responsibilities, as well as the named executive officer's experience;

-

•

-

the types and amount of each element of compensation to be paid to the named executive officer; and

-

•

-

salary levels of persons holding similar positions at companies included in our peer group.

19

Table of Contents

The

base salary of the Company's named executive officers for 2020 and 2019, before any elective deferral of cash for restricted stock, is as follows:

|

|

|

|

|

|

|

|

|

|

Named Executive Officer

|

|

2020

Base Salary

|

|

2019

Base Salary

|

|

|

Timothy G. Wallace

|

|

$

|

645,000

|

|

$

|

540,000

|

|

|

Chief Executive Officer and

|

|

|

|

|

|

|

|

|

President

|

|

|

|

|

|

|

|

|

David H. Dupuy

|

|

$

|

392,000

|

|

$

|

233,333

|

(1)

|

|

Executive Vice President and

|

|

|

|

|

|

|

|

|

Chief Financial Officer

|

|

|

|

|

|

|

|

|

W. Page Barnes

|

|

$

|

370,400

|

|

$

|

328,000

|

|

|

Executive Vice President and

|

|

|

|

|

|

|

|

|

Chief Operating Officer

|

|

|

|

|

|

|

|

|

Leigh Ann Stach

|

|

$

|

326,800

|

|

$

|

266,000

|

|

|

Executive Vice President and

|

|

|

|

|

|

|

|

|

Chief Accounting Officer

|

|

|

|

|

|

|

|

-

(1)

-

Mr. Dupuy's

base salary for 2019 is for the period beginning May 1, 2019 through December 31, 2019.

Pursuant

to the Amended and Restated Alignment of Interest Program described below, executive officers may elect to utilize any cash compensation they receive to acquire shares of

restricted stock. In the event that an executive officer elects to acquire shares of restricted stock, rather than cash compensation, the officer will be awarded shares of restricted stock pursuant to

the Amended and Restated Alignment of Interest Program, subject to a three-, five-, or eight- year cliff-vesting schedule, depending on the officer's election. Each executive officer who makes this

election will be awarded the

additional restricted common stock award at no cost to the officer, according to the multiple-based formula set forth on page 21 of this proxy statement.

2014 Incentive Plan

Awards may be made in the form of restricted stock or cash under our 2014 Incentive Plan. The purposes of the 2014 Incentive Plan are to attract

and retain qualified persons upon whom, in large measure, our sustained progress, growth and profitability depend, to motivate the participants to achieve long-term Company goals and to more closely

align the participants' interests with those of our other stockholders by providing them with a proprietary interest in our growth and performance.

Our

executive officers, non-executive officers, employees, consultants and non-employee directors may be eligible to participate in the 2014 Incentive Plan as determined by the

Compensation Committee. As of March 6, 2020, the number of shares of our common stock available for issuance under the 2014 Incentive Plan is 719,870.

The

2014 Incentive Plan is administered by our Compensation Committee, which interprets the 2014 Incentive Plan and has broad discretion to select the eligible persons to whom awards

will be granted, as well as the type, size and terms and conditions of each award, including the amount of cash or number of shares subject to awards and the expiration date of, and the vesting