UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

FOR ANNUAL REPORTS OF EMPLOYEE STOCK PURCHASE, SAVINGS

AND SIMILAR PLANS PURSUANT TO SECTION 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Mark One):

|

|

|

|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended

December 31, 2018

OR

|

|

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ______ to ______

Commission File Number 1-10706

|

|

|

|

A.

|

Full title of the plan and the address of the plan, if different from that of the issuer named below:

|

COMERICA INCORPORATED PREFERRED SAVINGS PLAN

|

|

|

|

B.

|

Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

|

COMERICA INCORPORATED

Comerica Bank Tower

1717 Main Street

MC 6404

Dallas, Texas 75201

Comerica Incorporated Preferred Savings Plan

Table of Contents

Financial Statements and Supplemental Schedule

Audited Financial Statements:

Supplemental Schedule*

Exhibit 23.1 Consent of Independent Registered Public Accounting Firm (Ernst & Young LLP)

* Other schedules required by Section 2520.103-10 of the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974 are not applicable and have been omitted.

FINANCIAL STATEMENTS AND SUPPLEMENTAL SCHEDULE

Comerica Incorporated Preferred Savings Plan

Years Ended

December 31, 2018

and

2017

with Report of Independent Registered Public Accounting Firm

Comerica Incorporated Preferred Savings Plan

Financial Statements and Supplemental Schedule

Years Ended

December 31, 2018

and

2017

Contents

|

|

|

|

|

|

|

|

|

|

|

|

Audited Financial Statements

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Schedule

|

|

|

|

|

|

|

|

Report of Independent Registered Public Accounting Firm

To the Plan Participants and the Plan Administrator of Comerica Incorporated Preferred Savings Plan

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of Comerica Incorporated Preferred Savings Plan (the Plan) as of December 31, 2018 and 2017, and the related statements of changes in net assets available for benefits for the years then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan at December 31, 2018 and 2017, and the changes in its net assets available for benefits for the years then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Schedule

The accompanying supplemental schedule of assets (held at end of year) as of December 31, 2018, has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The information in the supplemental schedule is the responsibility of the Plan’s management. Our audit procedures included determining whether the information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the information, we evaluated whether such information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Ernst & Young LLP

We have served as the Plan’s auditor since 1998.

Dallas, TX

May 30, 2019

Comerica Incorporated Preferred Savings Plan

Statements of Net Assets Available for Benefits

|

|

|

|

|

|

|

|

|

|

|

|

(in millions)

|

|

|

|

|

December 31

|

2018

|

|

2017

|

|

Assets

|

|

|

|

|

Investments:

|

|

|

|

|

Mutual funds

|

$

|

649

|

|

|

$

|

706

|

|

|

Collective trust funds

|

454

|

|

|

504

|

|

|

Comerica Incorporated common stock

|

117

|

|

|

162

|

|

|

Investments, at fair value

|

1,220

|

|

|

1,372

|

|

|

Separate account guaranteed investment contracts

|

26

|

|

|

26

|

|

|

Security-backed guaranteed investment contracts

|

126

|

|

|

127

|

|

|

Investments, at contract value

|

152

|

|

|

153

|

|

|

Total investments

|

1,372

|

|

|

1,525

|

|

|

|

|

|

|

|

Receivables:

|

|

|

|

|

Accrued income receivable

|

1

|

|

|

1

|

|

|

Notes receivable from participants

|

25

|

|

|

26

|

|

|

Total receivables

|

26

|

|

|

27

|

|

|

Net assets available for benefits

|

$

|

1,398

|

|

|

$

|

1,552

|

|

See accompanying notes.

Comerica Incorporated Preferred Savings Plan

Statements of Changes in Net Assets Available for Benefits

|

|

|

|

|

|

|

|

|

|

|

|

(in millions)

|

|

|

|

|

Years Ended December 31

|

2018

|

|

2017

|

|

Additions

|

|

|

|

|

Dividend and interest income

|

$

|

57

|

|

|

$

|

41

|

|

|

Participant contributions

|

48

|

|

|

46

|

|

|

Employer contributions

|

22

|

|

|

22

|

|

|

Interest income on notes receivable from participants

|

1

|

|

|

1

|

|

|

Assets transferred from Retirement Account Plan

|

—

|

|

|

53

|

|

|

Total additions

|

128

|

|

|

163

|

|

|

|

|

|

|

|

Deductions

|

|

|

|

|

Distributions to participants

|

126

|

|

|

141

|

|

|

|

|

|

|

|

Net (depreciation) appreciation in fair value of investments

|

(156

|

)

|

|

184

|

|

|

Net (decrease) increase for the year

|

(154

|

)

|

|

206

|

|

|

Net assets available for benefits:

|

|

|

|

|

Beginning of year

|

1,552

|

|

|

1,346

|

|

|

End of year

|

$

|

1,398

|

|

|

$

|

1,552

|

|

See accompanying notes.

Comerica Incorporated Preferred Savings Plan

Notes to Financial Statements

1.

Description of the Plan

The Comerica Incorporated Preferred Savings Plan (the Plan) is a 401(k) plan covering all eligible employees of Comerica Incorporated (the Corporation) and its subsidiaries. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974 (ERISA). Information about the Plan agreement, participants' investment alternatives and the vesting and benefit provisions is contained in the Summary Plan Description captioned “Comerica Incorporated Preferred Savings 401(k) Plan." Copies of the Summary Plan Description are available on the internet at www.comericaretirement.com.

The Plan's assets were held in the Comerica Incorporated Retirement Account and Preferred Savings Trust (the Master Trust), together with assets of the Comerica Incorporated Retirement Account Plan (the Retirement Account Plan), a profit sharing plan, during 2016. Effective January 1, 2017, the Corporation transferred the assets of the Retirement Account Plan into the Plan and the Master Trust was renamed the Comerica Incorporated Preferred Savings Trust. As a result, assets totaling

$53 million

were transferred from the Retirement Account Plan to the Plan. Balances in participant accounts associated with the former Retirement Account Plan are separately maintained. There were no substantive changes made to the existing terms of the Plan, except for retaining certain features of the Retirement Account Plan.

Although the Corporation has not expressed any intent to do so, the Corporation has the right under the Plan to amend or terminate the Plan at any time. In the event the Plan is terminated, all participants' accounts will be fully vested and non-forfeitable.

The following description of the Plan is provided for general information purposes only. Participants should refer to the Plan document and the Summary Plan Description for more complete information.

Eligibility

Employees are generally eligible to participate in the Plan on the first day of the first payroll period commencing on or after the first day of the month coincident with or following six consecutive calendar months of service.

Participant Contributions and Accounts

Participants may make pre-tax contributions and/or Roth contributions to the Plan through payroll deductions. Total contributions may not exceed the lesser of 50 percent of the participant's annual compensation or the Internal Revenue Service (IRS) allowed maximum ($18,500 for 2018 and $18,000 for 2017 plus an additional $6,000 for participants age 50 or over for both 2018 and 2017). Participants direct the investment of their accounts among the investment funds offered by the Plan. Participants may change their investment options at any time. If a participant does not make an investment election upon enrollment, the participant's contributions are invested in the Comerica Destination Fund appropriate for the participant's age and can be redirected by the participant at any time at their discretion.

Rollover contributions are also accepted from other tax-qualified plans, provided certain specified conditions are met.

The benefit to which a participant is entitled is the benefit that can be provided from the participant's vested account.

Employer Matching Contributions

The Corporation makes a matching contribution on behalf of each participant of 100 percent of the first four percent of qualified earnings contributed by the participant and is invested based on the participant's investment elections. In the absence of a participant's investment election, the funds are initially invested in the Comerica Destination Fund appropriate for the participant's age. Employer matching contributions are 100 percent vested at the time they are contributed to a participant's individual account.

Dividend Election

The Plan discontinued the Corporation's common stock as an investment election available to participants for future contributions or reallocations from other investments in 2008. Participants who retained the Corporation's common stock as an investment either have their dividends reinvested within the Plan or receive the dividends as cash with their regular pay.

Comerica Incorporated Preferred Savings Plan

Notes to Financial Statements (continued)

Participant Loans

Participants generally may borrow from their account balances, excluding their Retirement Account Plan balance, an amount not to exceed the lesser of $50,000 or 50 percent of their total contributions, matching contribution and rollover contribution account balances. Participants may have only two loans outstanding at any time. Each loan is required to be repaid within five years or less, or up to 15 years if the loan is for the purchase of a primary residence. The loans are secured by the balance in the participant's account and bear a fixed rate of interest determined at origination (currently one percent above the Prime Rate published in

The Wall Street Journal

). Principal and interest are paid by the participant through payroll deductions that are credited to the participant's individual account. Participants are charged a fee to initiate each loan as well as a quarterly loan maintenance fee.

Forfeited Accounts

Unallocated employer contributions within the former Retirement Account Plan resulting from employee forfeitures were retained in the Retirement Account Plan in the Stable Value Fund at

December 31, 2018

and are used first to restore the accounts of reemployed Participants, then to pay recoverable administrative expenses of the Plan or to reduce the Corporation's contributions.

Employee forfeitures associated with the former Retirement Account Plan were

$1 million

and reduced the Corporation's contributions and expenses by the same amount for the year ended

December 31, 2017

. Employee forfeitures and associated reduction of employer contribution and expenses within the former Retirement Account Plan for the year ended

December 31, 2018

were insignificant.

Distributions to Participants

Upon separation from service with the Corporation for any reason, a participant whose vested account balance is $5,000 or less may elect to receive either a lump sum or a rollover distribution. A participant whose vested account balance is greater than $5,000 may elect a distribution or remain in the Plan. Distribution options include a rollover, lump sum distribution or monthly, quarterly or annual installments over a fixed period. Distributions are recorded when paid.

In-service withdrawals are permitted upon request of a participant with an attained age of at least 59-1/2 years and in certain other limited circumstances, as defined by the Plan. Hardship withdrawals are allowed for participants incurring an immediate and heavy financial need, as defined by the Plan. Hardship withdrawals are strictly regulated by the IRS and a participant must exhaust all available loan options and available distributions prior to requesting a hardship withdrawal. In-service loans and hardship withdrawals are not permitted on Retirement Account Plan balances.

Plan Expenses

Administrative and investment expenses incurred in connection with the operation of the Plan are paid by the Corporation and by revenue sharing with the recordkeeper. Certain participant loan fees and transaction expenses are deducted from loan or distribution proceeds, as applicable, or are charged directly to the participant's account. Additionally, the Plan offers fee-based advisory services to participants. Fees for these services are charged directly to the participant's account.

2.

Summary of Significant Accounting Policies

Basis of Presentation

The accounting and reporting policies of the Plan conform to U.S. generally accepted accounting principles (GAAP). The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts in the financial statements and accompanying notes. Actual results could differ from those estimates.

Investment Valuation and Income Recognition

Fair value measurement applies whenever accounting guidance requires or permits assets or liabilities to be measured at fair value. Fair value is defined as the exchange price that would be received to sell an asset or paid to transfer a liability in the principal or most advantageous market for the asset or liability in an orderly transaction (i.e., not a forced transaction, such as a liquidation or distressed sale) between market participants at the measurement date. Fair value is based on the assumptions market participants would use when pricing an asset or liability. GAAP establishes a three-level fair value hierarchy that prioritizes the information used to develop fair value. The fair value hierarchy gives the highest priority to quoted prices in active markets and the lowest priority to unobservable data. Fair value measurements are separately disclosed by level within the fair value hierarchy. For assets recorded at fair value, it is the Plan's policy to maximize the use of observable inputs and minimize the use of unobservable inputs when developing fair value measurements for those items for which there is an active market.

Comerica Incorporated Preferred Savings Plan

Notes to Financial Statements (continued)

Investment contracts held by a qualified plan are reported at fair value, except for fully benefit-responsive investment contracts, which are reported at contract value. The contract value represents contributions and allocations plus earnings at the crediting rate, less participant withdrawals and administrative expenses.

Securities transactions are recorded on a trade-date basis. Realized gains and losses are reported based on the average cost of securities sold. Dividend income is recorded on the ex-dividend date. Interest income is accounted for on the accrual basis.

Notes Receivable from Participants

Notes receivable from participants represent participant loans that are recorded at their unpaid principal balance plus accrued but unpaid interest. Interest income on notes receivable from participants is recorded when it is earned. Related fees are recorded as transaction fees and expenses and are expensed when they are incurred. No allowance for credit losses was recorded as of

December 31, 2018

and

2017

. If a participant ceases to make loan repayments and the plan administrator deems the participant loan to be a distribution, the participant loan balance is reduced and a benefit payment is recorded.

3.

Fair Value

Fair value measurements are utilized to record fair value adjustments to certain assets and to determine fair value disclosures. Mutual funds, collective trust funds and Comerica Incorporated common stock are recorded at fair value on a recurring basis.

Assets at fair value in the Plan are categorized into a three-level hierarchy, based on the markets in which the assets are traded and the reliability of the assumptions used to determine fair value. These levels are:

|

|

|

|

|

|

|

|

|

Level 1

|

|

Valuation is based upon quoted prices for identical instruments traded in active markets.

|

|

|

|

|

|

|

|

Level 2

|

|

Valuation is based upon quoted prices for similar instruments in active markets, quoted prices for identical or similar instruments in markets that are not active, and model-based valuation techniques for which all significant assumptions are observable in the market.

|

|

|

|

|

|

|

|

Level 3

|

|

Valuation is generated from model-based techniques that use at least one significant assumption not observable in the market. These unobservable assumptions reflect estimates of assumptions that market participants would use in pricing the asset or liability. Valuation techniques include use of option pricing models, discounted cash flow models and similar techniques.

|

Following is a description of valuation methodologies and key inputs used to measure assets recorded at fair value, including an indication of the level of the fair value hierarchy in which the assets are classified. Transfers of assets between levels of the fair value hierarchy are recognized at the beginning of the reporting period, when applicable.

Mutual funds:

Mutual funds are valued at the daily closing price as reported by the fund. Mutual funds held by the Plan are quoted in an active market and are classified in Level 1 of the fair value hierarchy.

Comerica Incorporated common stock:

Fair value measurement of Comerica Incorporated common stock is based upon the closing price reported on the New York Stock Exchange and is classified in Level 1 of the fair value hierarchy.

Collective trust funds:

Collective trust funds are valued using the net asset value (NAV) provided by the administrator of the fund as a practical expedient to estimate fair value and, therefore, are not categorized into the fair value hierarchy. The Stable Value Fund primarily invests in fully benefit-responsive separate account and security-backed guaranteed investment contracts, as well as collective trust funds. The collective trust funds within the Stable Value Fund are also valued at the NAV provided by the administrators of the funds.

The methods described above may produce a fair value that may not be indicative of net realizable value or reflective of future fair values. Furthermore, while the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

Comerica Incorporated Preferred Savings Plan

Notes to Financial Statements (continued)

The following table presents, by level within the fair value hierarchy, the recorded amount of the Plan's assets measured at fair value on a recurring basis. The Plan had no assets classified within Level 2 or Level 3 of the fair value hierarchy at

December 31, 2018

and

2017

. There were no liabilities measured at fair value at

December 31, 2018

and

2017

. There were no transfers of assets recorded at fair value into or out of Level 1 fair value measurements during the years ended

December 31, 2018

and

2017

.

|

|

|

|

|

|

|

|

|

|

|

|

(in millions)

|

Total

|

|

Level 1

|

|

December 31, 2018

|

|

|

|

|

Investments at fair value:

|

|

|

|

|

Mutual funds

|

$

|

649

|

|

|

$

|

649

|

|

|

Comerica Incorporated common stock

|

117

|

|

|

117

|

|

|

Total investments in the fair value hierarchy

|

766

|

|

|

766

|

|

|

|

|

|

|

|

Collective trust funds, measured at net asset value

|

454

|

|

|

|

|

Total investments at fair value

|

$

|

1,220

|

|

|

|

|

December 31, 2017

|

|

|

|

|

Investments at fair value:

|

|

|

|

|

Mutual funds

|

$

|

706

|

|

|

$

|

706

|

|

|

Comerica Incorporated common stock

|

162

|

|

|

162

|

|

|

Total investments in the fair value hierarchy

|

868

|

|

|

868

|

|

|

|

|

|

|

|

Collective trust funds, measured at net asset value

|

504

|

|

|

|

|

Total investments at fair value

|

$

|

1,372

|

|

|

|

The following table summarizes investments for which fair value is measured using the net asset value per share practical expedient as of

December 31, 2018

and

2017

. There are no participant redemption restrictions for these investments; the redemption notice period is applicable only to the Plan.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions)

|

December 31,

|

|

|

|

|

Collective trust funds:

|

2018

Fair Value

|

2017

Fair Value

|

Unfunded Commitments

|

Redemption Frequency

|

Redemption Notice Period

|

|

Asset allocation funds

|

$

|

254

|

|

$

|

272

|

|

None

|

Daily

|

None

|

|

Large cap fund

|

193

|

|

208

|

|

None

|

Daily

|

None

|

|

Short-term investment fund

|

7

|

|

2

|

|

None

|

Daily

|

None

|

|

Mid cap fund

|

—

|

|

19

|

|

None

|

Daily

|

None

|

|

Stable value fund

|

—

|

|

3

|

|

None

|

Daily

|

12 months

|

|

Total collective trust funds

|

$

|

454

|

|

$

|

504

|

|

|

|

|

4.

Fully Benefit-Responsive Investment Contracts

The Plan holds a portfolio of investment contracts which includes a portfolio of separate account and security-backed guaranteed investment contracts. These contracts meet the fully benefit-responsive investment contract criteria and, therefore, are reported at contract value. Contract value is the relevant measure for fully benefit-responsive investment contracts because this is the amount received by participants when they initiate permitted transactions under the terms of the Plan. Contract value represents contributions and allocations made under each contract, plus earnings, less withdrawals. The following represents the disaggregation of contract value between types of investment contracts held by the Plan.

|

|

|

|

|

|

|

|

|

|

|

(in millions)

|

December 31,

|

|

Contract Value

|

2018

|

2017

|

|

Separate account guaranteed investment contracts

|

$

|

26

|

|

$

|

26

|

|

|

Security-backed guaranteed investment contracts

|

126

|

|

127

|

|

|

Total

|

$

|

152

|

|

$

|

153

|

|

Separate account and security-backed guaranteed investment contracts are issued by insurance companies or other financial institutions, backed by a portfolio of bonds. The bond portfolio is either owned by the contract issuer and segregated in a separate account for the benefit of the Plan (separate account guaranteed investment contract) or owned directly by the Plan (security-

Comerica Incorporated Preferred Savings Plan

Notes to Financial Statements (continued)

backed investment contract). The issuer guarantees that all qualified participant withdrawals will be at contract value and that the crediting rate applied will not be less than zero percent. Crediting rates are typically reset quarterly to account for the difference between the contract value and the fair value of the underlying portfolio.

Risks arise when entering into any investment contract due to the potential inability of the issuer to meet the terms of the contract. In addition, separate account and security-backed guaranteed investment contracts have the risk of default or the lack of liquidity of the underlying portfolio assets. The credit risk of each issuer is evaluated and monitored through the portfolio manager’s credit analysis. The credit analysis includes, but is not limited to, asset quality and liquidity, management quality, surplus adequacy, and profitability. The Plan requires that the issuers of each contract have a minimum quality rating as of the contract effective date and that all underlying portfolio assets be rated investment grade at the time of purchase.

Separate account and security-backed guaranteed investment contracts generally are evergreen contracts that contain termination provisions, allowing the Plan or the contract issuer to terminate with notice, at any time at fair value, and providing for automatic termination of the contract if the contract value or the fair value of the underlying portfolio equals zero. The issuer is obligated to pay the excess contract value when the fair value of the underlying portfolio equals zero.

In addition, if the Plan defaults in its obligations under the contract (including the issuer’s determination that the agreement constitutes a nonexempt prohibited transaction as defined under ERISA), and such default is not corrected within the time permitted by the contract, then the contract may be terminated by the issuer and the Plan will receive the fair value as of the date of termination. Each contract recognizes certain “events of default” which can invalidate the contracts’ coverage. Among these are investments outside of the range of instruments which are permitted under the investment guidelines contained in the investment contract, fraudulent or other material misrepresentations made to the issuer, changes of control of the investment adviser not approved by the contract issuer, changes in certain key regulatory requirements, or failure of the Plan to be tax qualified.

The contracts also generally provide for withdrawals associated with certain events which are not in the ordinary course of Plan operations. These withdrawals are paid with a market value adjustment applied to the withdrawal as defined in the investment contract. Each contract issuer specifies the events which may trigger a market value adjustment; however, such events may include, but may not be limited to, the following:

|

|

|

|

•

|

material amendments to the Plan’s structure or administration;

|

|

|

|

|

•

|

complete or partial termination of the Plan, including a merger with another plan;

|

|

|

|

|

•

|

the failure of the Plan to qualify for exemption from federal income taxes or any required prohibited transaction exemption under ERISA;

|

|

|

|

|

•

|

the redemption of all or a portion of the interests in the Plan at the direction of the plan sponsor, including withdrawals due to the removal of a specifically identifiable group of employees from coverage under the plan (such as a group layoff or early retirement incentive program), the closing or sale of a subsidiary, employing unit, or affiliate, the bankruptcy or insolvency of the plan sponsor, the merger of the plan with another plan, or the plan sponsor’s establishment of another tax qualified defined contribution plan;

|

|

|

|

|

•

|

any change in law, regulation, ruling, administrative or judicial position, or accounting requirement, applicable to the Plan;

|

|

|

|

|

•

|

changes to competing investment options;

|

|

|

|

|

•

|

the delivery of any communication to plan participants designed to influence a participant not to invest in the stable value option.

|

5.

Transactions With Parties-in-Interest

Certain Plan investments are shares of collective trust funds managed by Comerica Bank (the Bank), a subsidiary of the Corporation. The Bank serves as trustee of the Plan. Transactions involving funds administered by the trustee qualify as exempt party-in-interest transactions. Participants direct how their contributions and matching contributions are invested within the Plan.

The Bank provides the Plan with certain accounting and administrative services for which no fees are charged.

On

December 31, 2018

and

2017

, the Plan held approximately

2 million

shares of Comerica Incorporated common stock with fair values of

$117 million

and

$162 million

, respectively. During the years ended

December 31, 2018

and

2017

, the Plan recorded dividend income from Comerica Incorporated common stock of

$3 million

and

$2 million

, respectively.

Comerica Incorporated Preferred Savings Plan

Notes to Financial Statements (continued)

6.

Tax Status

The Plan received a determination letter from the IRS dated December 15, 2017, stating that the Plan is qualified under Section 401(a) of the Internal Revenue Code (the Code) and, therefore, the related trust is exempt from taxation. Additionally, the Retirement Account Plan received a determination letter from the IRS dated January 30, 2018, stating that the Retirement Account Plan is qualified under Section 401(a) of the Code and, therefore, the related trust is exempt from taxation. Once qualified, the Plan is required to operate in conformity with the Code to maintain its qualification. The plan administrator believes the Plan is being operated in compliance with the applicable requirements of the Code and, therefore, believes the Plan is qualified and the related trust is tax exempt.

GAAP requires plan management to evaluate uncertain tax positions taken by the Plan. The financial statement effects of a tax position are recognized when the position is more likely than not, based on the technical merits, to be sustained upon examination by the IRS. The plan administrator has analyzed the tax positions taken by the Plan, and has concluded that as of

December 31, 2018

, there are no uncertain positions taken or expected to be taken. The Plan has recognized no interest or penalties related to uncertain tax positions. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress.

7.

Reconciliation of Financial Statements to Form 5500

The following is a reconciliation of total net assets available for benefits and the increase in net assets available for benefits per the financial statements to amounts reported on Form 5500 for the years ended

December 31, 2018

and

2017

.

|

|

|

|

|

|

|

|

|

|

|

|

(in millions)

|

|

|

|

|

December 31

|

2018

|

|

2017

|

|

Net assets available for benefits per financial statements

|

$

|

1,398

|

|

|

$

|

1,552

|

|

|

Adjustment from contract value to fair value for fully benefit-responsive investment contracts

|

(2

|

)

|

|

(1

|

)

|

|

Net assets per Form 5500

|

$

|

1,396

|

|

|

$

|

1,551

|

|

|

|

|

|

|

|

(Decrease) Increase in net assets per financial statements

|

$

|

(154

|

)

|

|

$

|

206

|

|

|

Net adjustment from contract value to fair value for fully benefit-responsive investment contracts

|

(1

|

)

|

|

(1

|

)

|

|

Net assets transferred from the Retirement Account Plan

|

—

|

|

|

(53

|

)

|

|

(Decrease) Increase in net assets per Form 5500

|

$

|

(155

|

)

|

|

$

|

152

|

|

The Retirement Account Plan transferred into the Plan effective January 1, 2017 and a final Form 5500 for the Retirement Account Plan was filed for the year ended December 31, 2016.

8.

Risks and Uncertainties

Plan participants invest in various investment securities. Investment securities are exposed to various risks such as interest rate, market and credit risks. Due to the level of risk associated with certain investment securities, it is reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants' account balances and the amounts reported in the Statements of Net Assets Available for Benefits.

SUPPLEMENTAL SCHEDULE

Comerica Incorporated Preferred Savings Plan

|

|

|

|

|

|

|

EIN: #38-1998421

|

|

Plan #002

|

Schedule H, Line 4i - Schedule of Assets (Held at End of Year)

December 31, 2018

|

|

|

|

|

|

|

|

|

|

|

(in millions)

|

|

|

|

|

|

Identity of Issue, Borrower, Lessor, or Similar Party

|

|

Description of Investment Including Maturity Date, Rate of Interest, Collateral, Par, or Maturity Value

|

|

Current Value

|

|

Mutual Funds

|

|

|

|

|

|

American Funds

|

|

The Growth Fund of America - 2,048,129 shares

|

|

$

|

88

|

|

|

|

|

Capital World Growth and Income Fund - 1,361,546 shares

|

|

58

|

|

|

|

|

|

|

|

|

Blackrock Funds

|

|

Blackrock Inflation Protected Bond Portfolio - 880,112 shares

|

|

9

|

|

|

|

|

|

|

|

|

Carillon Tower Advisers

|

|

Carillon Eagle Small Cap Growth Fund - 807,753 shares

|

|

37

|

|

|

|

|

|

|

|

|

Franklin/Templeton Investments

|

|

Franklin Rising Dividends Fund - 688,306 shares

|

|

38

|

|

|

|

|

Templeton Global Bond Fund - 817,063 shares

|

|

9

|

|

|

|

|

|

|

|

|

Invesco Funds

|

|

Invesco Equity and Income Fund - 3,626,852 shares

|

|

33

|

|

|

|

|

Invesco Treasury Portfolio Institutional Fund - 19,504,620 shares

|

|

20

|

|

|

|

|

Invesco Diversified Dividend Fund - 2,771,227 shares

|

|

48

|

|

|

|

|

|

|

|

|

Metropolitan West Funds

|

|

Metropolitan West Total Return Bond Plan - 2,588,883 shares

|

|

25

|

|

|

|

|

|

|

|

|

Neuberger Berman Funds

|

|

Neuberger Berman Genesis Fund - 1,073,706 shares

|

|

51

|

|

|

|

|

|

|

|

|

Oppenheimer Funds

|

|

Oppenheimer Developing Markets Fund - 450,788 shares

|

|

17

|

|

|

|

|

|

|

|

|

Putnam Funds

|

|

Putnam US Government Income Fund - 1,264,851 shares

|

|

15

|

|

|

|

|

|

|

|

|

Vanguard Funds

|

|

Vanguard Mid-Cap Index Fund - 1,551,516 shares

|

|

59

|

|

|

|

|

Vanguard Small-Cap Index Fund - 667,283 shares

|

|

42

|

|

|

|

|

Vanguard Total Bond Market Index Fund - 1,784,372 shares

|

|

19

|

|

|

|

|

|

|

|

|

Victory Capital

|

|

Victory Munder Mid-Cap Core Growth Fund - 1,449,984 shares

|

|

32

|

|

|

|

|

|

|

|

|

Wells Fargo

|

|

Wells Fargo Special Mid Cap Value Fund - 397,575 shares

|

|

13

|

|

|

|

|

|

|

|

|

William Blair Funds

|

|

William Blair International Growth Fund - 1,533,385 shares

|

|

36

|

|

|

|

|

|

|

|

|

Total Mutual Funds

|

|

|

|

649

|

|

|

|

|

|

|

|

|

Collective Trust Funds

|

|

|

|

|

|

Comerica Incorporated (a)

|

|

S&P 500 Index Fund - 6,598,137 shares

|

|

193

|

|

|

|

|

Destination Retirement Fund - 486,325 units

|

|

9

|

|

|

|

|

Destination 2015 Fund - 1,409,074 units

|

|

29

|

|

|

|

|

Destination 2025 Fund - 3,942,794 units

|

|

87

|

|

|

|

|

Destination 2035 Fund - 2,793,589 units

|

|

64

|

|

|

|

|

Destination 2045 Fund - 2,158,054 units

|

|

52

|

|

|

|

|

Destination 2055 Fund - 1,062,912 units

|

|

13

|

|

|

|

|

|

|

|

|

Wells Fargo/BlackRock

|

|

WF/BlackRock Short-Term Investment Fund S - 7,744,049 units

|

|

7

|

|

|

|

|

|

|

|

|

Total Collective Trust Funds

|

|

|

|

454

|

|

|

|

|

|

|

|

|

Comerica Incorporated (a)

|

|

Common Stock - 1,699,357 shares

|

|

117

|

|

|

|

|

|

|

|

|

Metropolitan Life Insurance Company

|

|

Separate Account Guaranteed Investment Contract, 2.43%

|

|

26

|

|

|

|

|

|

|

|

|

Security-Backed (Synthetic) Investment Contracts

|

|

|

|

|

|

Prudential Insurance Company

|

|

Security-Backed (Synthetic) Investment Contract, 2.63%

|

|

50

|

|

|

State Street Bank and Trust

|

|

Security-Backed (Synthetic) Investment Contract, 2.67%

|

|

34

|

|

|

Voya Retirement Insurance and Annuity Company

|

|

Security-Backed (Synthetic) Investment Contract, 2.71%

|

|

42

|

|

|

|

|

|

|

|

|

Total Security-Backed (Synthetic) Investment Contract

|

|

|

|

126

|

|

|

|

|

|

|

|

|

Total Investments

|

|

|

|

1,372

|

|

|

|

|

|

|

|

|

Participant Loans (a)

|

|

Interest rate range: 4.25% to 11.74%, with various maturity dates

|

|

25

|

|

|

|

|

|

|

|

|

Total Investments and Participant Loans

|

|

|

|

$

|

1,397

|

|

(a) Party-in-interest.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the Comerica Incorporated Preferred Savings Plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Comerica Incorporated Preferred Savings Plan

|

|

|

|

|

|

By: Comerica Bank, Trustee

|

|

|

|

|

|

/s/ John D. Buchanan

|

|

|

John D. Buchanan

|

|

|

Executive Vice President - Chief Legal Officer

|

Dated:

May 30, 2019

EXHIBIT INDEX

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

23.1

|

|

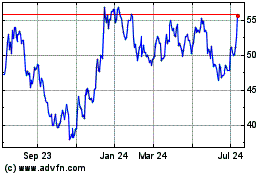

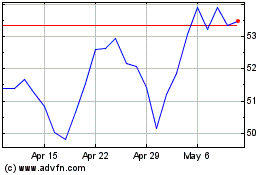

Comerica (NYSE:CMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Comerica (NYSE:CMA)

Historical Stock Chart

From Apr 2023 to Apr 2024