UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-A

FOR REGISTRATION OF CERTAIN CLASSES OF SECURITIES

PURSUANT TO SECTION 12(b) OR (g) OF

THE SECURITIES EXCHANGE ACT OF 1934

CLARIVATE PLC

(Exact name of registrant as specified in its charter)

| Jersey, Channel Islands |

Not Applicable |

(State or other jurisdiction

of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| |

|

|

70 St. Mary Axe

London, EC3A 8BE

United Kingdom |

Not Applicable

(Zip Code) |

| (Address of principal executive offices) |

|

Securities to be registered pursuant to Section 12(b) of

the Act:

|

Title of

each class to be so registered |

|

Name of each

exchange on which each class is to be registered |

| Series B Preferred Shares Purchase Rights |

|

New York Stock Exchange |

If this form relates to the registration

of a class of securities pursuant to Section 12(b) of the Exchange Act and is effective pursuant to General Instruction A.(c) or

(e), check the following box. x

If this form relates to the registration

of a class of securities pursuant to Section 12(g) of the Exchange Act and is effective pursuant to General Instruction A.(d) or

(e), check the following box. ¨

If this form relates to the registration

of a class of securities concurrently with a Regulation A offering, check the following box. ¨

Securities Act registration statement or Regulation A offering statement

file number to which this form relates: N/A.

Securities to be registered pursuant to Section 12(g) of

the Act:

None

| Item 1. |

Description of Registrant’s Securities to be Registered. |

Introduction

On

December 21, 2022, the Board of Directors of Clarivate Plc (the “Company”) declared a dividend of one preferred

share purchase right (a “Right”) for each outstanding ordinary share, no par value per share (the “Ordinary

Shares”), of the Company. The dividend is payable on January 1, 2023 (the “Record Date”) to holders

of record as of the close of business on that date. The description and terms of the Rights are set forth in a Tax Benefits Preservation

Plan (the “Tax Benefits Preservation Plan”) between the Company and Continental Stock Transfer & Trust Company,

as Rights Agent (the “Rights Agent”).

The

Board of Directors has adopted the Tax Benefits Preservation Plan to protect the availability of the Company’s U.S. net operating

loss carryforwards (“NOLs”) and certain other U.S. tax attributes, which can be utilized in certain circumstances to

offset future U.S. tax liabilities. The Company’s ability to use these NOLs and other tax attributes would be substantially limited

if it experienced an “ownership change” within the meaning of Section 382 of the Internal Revenue Code, which could occur

if “5% shareholders” (determined under Section 382) increased their ownership of the Company’s Ordinary Shares

by more than 50 percentage points over a rolling three-year period. The Tax Benefits Preservation Plan is intended to reduce the likelihood

of such an ownership change at the Company by deterring any person or group that would be treated as a 5% shareholder from acquiring beneficial

ownership, as determined for relevant tax purposes, of either (i) 4.9% or more of the outstanding Ordinary Shares of the Company

or (ii) 4.9% or more (by value) of the Company’s capital stock, and deterring existing shareholders who currently meet or exceed

this ownership threshold from acquiring additional Company stock. Acquisitions of the Company’s outstanding 5.25% Series A

mandatory convertible preferred shares are taken into account for purposes of these ownership thresholds, determined on an as-converted

basis in accordance with applicable U.S. securities laws or on the basis of the value of such shares, as applicable. Any such person or

group is an “Acquiring Person” within the meaning of the Tax Benefits Preservation Plan. The Tax Benefits Preservation

Plan should not interfere with any merger or other business combination approved by the Board of Directors. A summary of the terms of

the Tax Benefits Preservation Plan follows.

This

description is only a summary, and is not complete, and should be read together with the entire Tax Benefits Preservation Plan, which

has been filed as an exhibit to this Form 8-A. A copy of the Tax Benefits Preservation Plan is available free of charge from

the Company.

The Rights

Each outstanding Ordinary Share on the Record

Date will receive one Right. Ordinary Shares issued after the Record Date and prior to the Distribution Date (as defined below), will

be issued with a Right attached so that all Ordinary Shares outstanding prior to the Distribution Date will have Rights attached.

Prior to the Distribution Date, the Rights will

be evidenced by the certificates for and will be transferred with the Ordinary Shares, and the registered holders of the Ordinary Shares

will be deemed to be the registered holders of the Rights. After the Distribution Date, the Rights Agent will mail separate certificates

evidencing the Rights to each record holder of the Ordinary Shares as of the close of business on the Distribution Date, and thereafter

the Rights will be transferable separately from the Ordinary Shares. The “Distribution Date” generally means the earlier

of (i) the close of business on the 10th business day after the date of the first public announcement that a person (other than the

Company or any of its subsidiaries or any employee benefit plan of the Company or any such subsidiary) has become an Acquiring Person

and (ii) the close of business on the 10th business day (or such later day as may be designated by the Board of Directors before

any person has become an Acquiring Person) after the date of the commencement of a tender or exchange offer by any person which would

or could, if consummated, result in such person becoming an Acquiring Person.

Rights holders in their capacity as such have

no rights as a shareholder of the Company, including the right to vote and to receive dividends.

Exercisability

Prior

to the Distribution Date, the Rights will not be exercisable to purchase Series B Participating Cumulative Preferred Shares, no par

value per share (the “Preferred Shares”). After the Distribution Date, each Right will be exercisable to purchase,

for $42.00 (the “Purchase Price”), one one-thousandth of a Preferred Share (subject to adjustment). The terms and conditions

of the Rights are set forth in the Tax Benefits Preservation Plan, attached hereto as Exhibit 4.1.

At any time after any person has become an Acquiring

Person (but before the occurrence of any of the events described in the second succeeding paragraph), each Right (other than Rights beneficially

owned by the Acquiring Person, its affiliates and associates) will entitle the holder to purchase, for the Purchase Price, a number of

shares of Ordinary Shares having an aggregate market value of twice the Purchase Price. The Tax Benefit Preservation Plan contains an

exception from the definition of an Acquiring Person for persons or groups who, immediately prior to the date of this initial announcement,

are beneficial owners of 4.9% or more of the Ordinary Shares or of the Company’s stock (as measured for tax purposes) then outstanding

to the extent such persons or groups do not acquire additional Ordinary Shares or additional stock of the Company (as measured for tax

purposes). The Board of Directors has the discretion to exempt any person or group from the provisions of the Tax Benefits Preservation

Plan.

At any time after any person has become an Acquiring

Person (but before any person becomes the beneficial owner of 50% or more of the outstanding Ordinary Shares or the occurrence of any

of the events described in the next paragraph), the Board of Directors may exchange all or part of the Rights (other than Rights beneficially

owned by an Acquiring Person, its affiliates and associates) for Ordinary Shares at an exchange ratio of one Ordinary Share per Right.

If,

after any person has become an Acquiring Person, (1) the Company is involved in a merger or other business combination in which the

Company is not the surviving corporation or its Ordinary Shares is exchanged for other securities or assets or (2) the Company and/or

one or more of its subsidiaries sell or otherwise transfer assets or earning power aggregating more than 50% of the assets or earning

power of the Company and its subsidiaries, taken as a whole, then each Right (other than Rights beneficially owned by an Acquiring Person,

its affiliates and associates) will entitle the holder to purchase, for the Purchase Price, a number of ordinary shares of the other party

to such business combination or sale (or in certain circumstances, an affiliate) having a market value of twice the Purchase Price.

Preferred Shares

The value of one one-thousandth interest in a

Preferred Share should approximate the value of one Ordinary Share, subject to adjustment. Each one one-thousandth of a Preferred Share,

if issued:

| |

• |

will not be redeemable, |

| |

• |

will entitle holders to quarterly dividend payments of $0.01 per share, or an amount equal to the dividend paid on one Ordinary Share, whichever is greater, |

| |

• |

will entitle holders upon liquidation either to receive $1.00 per share or an amount equal to the payment made on one Ordinary Share, whichever is greater, |

| |

• |

will have the same voting power as one Ordinary Share, and |

| |

• |

if Ordinary Shares are exchanged via merger, consolidation, or a similar transaction, will entitle holders to a per share payment equal to the payment made on one Ordinary Share. |

Expiration

The Rights will expire on the close of business

of October 31, 2023, unless earlier exchanged or redeemed.

Redemption

The

Board of Directors may redeem all of the Rights at a price of $0.001 per Right at any time before any person has become an Acquiring

Person. If the Board of Directors redeems any Rights, it must redeem all of the Rights. Once the Rights are redeemed, the only right of

the holders of Rights will be to receive the redemption price per Right. The redemption price will be subject to adjustment.

Amendment

For so long as the Rights are redeemable, the

Tax Benefits Preservation Plan may be amended in any respect. At any time when the Rights are no longer redeemable, the Tax Benefits Preservation

Plan may be amended in any respect that does not adversely affect Rights holders (other than any Acquiring Person, its affiliates and

associates), to cure any ambiguity or to correct any inconsistent provision of the Tax Benefits Preservation Plan.

Antidilution

The Tax Benefits Preservation Plan includes antidilution

provisions designed to discourage efforts to diminish the effectiveness of the Rights.

A copy of the Tax Benefits Preservation Plan

is available free of charge from the Company. The foregoing description of the Tax Benefits Preservation Plan is qualified in its entirety

by reference to the full text of the Tax Benefits Preservation Plan, as amended from time to time, the complete terms of which are incorporated

herein by reference. A copy of the Tax Benefits Preservation Plan has been filed as Exhibit 1 to this Registration Statement.

SIGNATURE

Pursuant to the requirements of Section 12 of the Securities Exchange

Act of 1934, the registrant has duly caused this registration statement to be signed on its behalf by the undersigned, thereto duly authorized.

| |

|

CLARIVATE PLC |

| |

|

|

| Date: December 22, 2022 |

By: |

/s/ Jonathan Collins |

| |

Name: |

Jonathan Collins |

| |

Title: |

Executive Vice President & Chief Financial Officer |

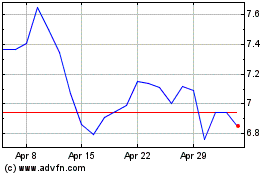

Clarivate (NYSE:CLVT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Clarivate (NYSE:CLVT)

Historical Stock Chart

From Apr 2023 to Apr 2024